Question: Objectives: This assignment has two primary objectives: 1) to illustrate the power of compounding over time, and 2) to utilize Excel as a decision-making construct.

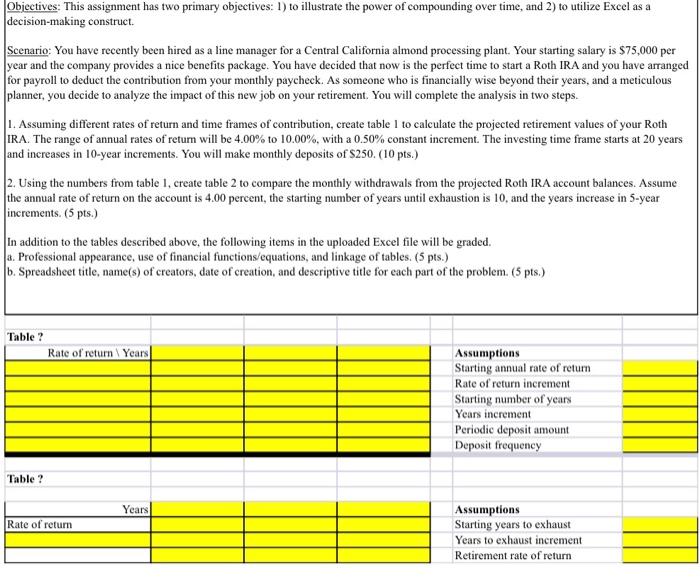

Objectives: This assignment has two primary objectives: 1) to illustrate the power of compounding over time, and 2) to utilize Excel as a decision-making construct. Scenario: You have recently been hired as a line manager for a Central California almond processing plant. Your starting salary is $75,000 per year and the company provides a nice benefits package. You have decided that now is the perfect time to start a Roth IRA and you have arranged for payroll to deduct the contribution from your monthly paycheck. As someone who is financially wise beyond their years, and a meticulous planner, you decide to analyze the impact of this new job on your retirement. You will complete the analysis in two steps. 1. Assuming different rates of return and time frames of contribution, create table I to calculate the projected retirement values of your Roth IRA. The range of annual rates of retum will be 4.00% to 10.00%, with a 0.50% constant increment. The investing time frame starts at 20 years and increases in 10-year increments. You will make monthly deposits of $250. (10 pts.) 2. Using the numbers from table 1, create table 2 to compare the monthly withdrawals from the projected Roth IRA account balances. Assume the annual rate of return on the account is 4.00 percent, the starting number of years until exhaustion is 10 , and the years increase in 5 -year increments. (5pts) In addition to the tables described above, the following items in the uploaded Excel file will be graded. a. Professional appearance, use of financial functions/equations, and linkage of tables. (5 pts.) b. Spreadsheet title, name(s) of creators, date of creation, and descriptive title for each part of the problem. ( 5 pts.) Objectives: This assignment has two primary objectives: 1) to illustrate the power of compounding over time, and 2) to utilize Excel as a decision-making construct. Scenario: You have recently been hired as a line manager for a Central California almond processing plant. Your starting salary is $75,000 per year and the company provides a nice benefits package. You have decided that now is the perfect time to start a Roth IRA and you have arranged for payroll to deduct the contribution from your monthly paycheck. As someone who is financially wise beyond their years, and a meticulous planner, you decide to analyze the impact of this new job on your retirement. You will complete the analysis in two steps. 1. Assuming different rates of return and time frames of contribution, create table I to calculate the projected retirement values of your Roth IRA. The range of annual rates of retum will be 4.00% to 10.00%, with a 0.50% constant increment. The investing time frame starts at 20 years and increases in 10-year increments. You will make monthly deposits of $250. (10 pts.) 2. Using the numbers from table 1, create table 2 to compare the monthly withdrawals from the projected Roth IRA account balances. Assume the annual rate of return on the account is 4.00 percent, the starting number of years until exhaustion is 10 , and the years increase in 5 -year increments. (5pts) In addition to the tables described above, the following items in the uploaded Excel file will be graded. a. Professional appearance, use of financial functions/equations, and linkage of tables. (5 pts.) b. Spreadsheet title, name(s) of creators, date of creation, and descriptive title for each part of the problem. ( 5 pts.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts