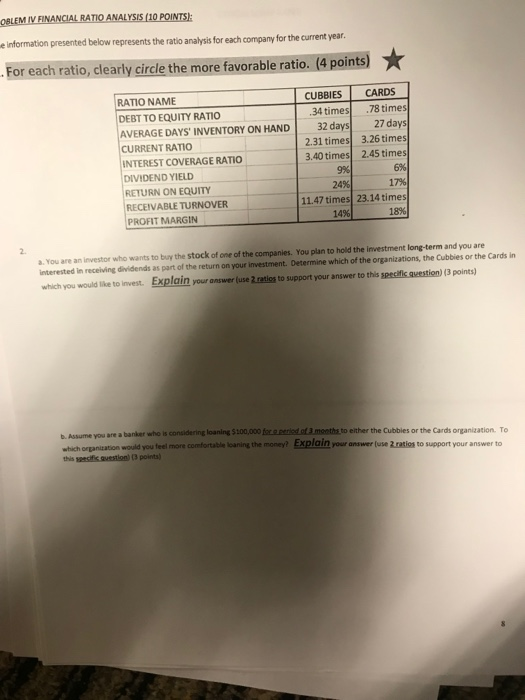

Question: OBLEM IV FINANCIAL RATIO ANALYSIS (10 POINTS e information presented below represents the ratio analysis for each company for the current year. For each ratio,

OBLEM IV FINANCIAL RATIO ANALYSIS (10 POINTS e information presented below represents the ratio analysis for each company for the current year. For each ratio, clearly circle the more favorable ratio. (4 points) RATIO NAME CUBBIES CARDS DEBT TO EQUITY RATIO AVERAGE DAYS' INVENTORY ON HAND CURRENT RATIO INTEREST COVERAGE RATIO DIVIDEND YIELD RETURN ON EQUITY RECEIVABLE TURNOVER PROFIT MARGIN 34 times 78 times 27 days 2.31 times 3.26 times 3.40 times 2.45 times 32 days 24% 17% 11.47 times 23.14 times 18% 14% 2. a. You are an investor who wants to buy the stock of one of the companies. You plan to hold the investment long-term and you are interested in receiving dividends as part of the return on your investment. Determine which of the organizations, the Cubbies or the Cards in which you would like to invest. Explain your answer (use 2 ratios to support your answer to this specific aestion) (3 points) b. Assume you which organization would you feel more comfortable loaning the money? this geesifis avestion) (3 points) are a banker who is considering loaning $100,000 for.e peried ot 3 months to either the Cubbles or the Cards organization. To Explain your answer (use 2 ratios to support your answer to

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts