Question: Observations from the financial forecast ? Comment on working capital EXHIBIT 11 Forecast Assumptions Ratio of Income tat/Profit before fax 30% Excise tax/Sales 15% This

Observations from the financial forecast ? Comment on working capital

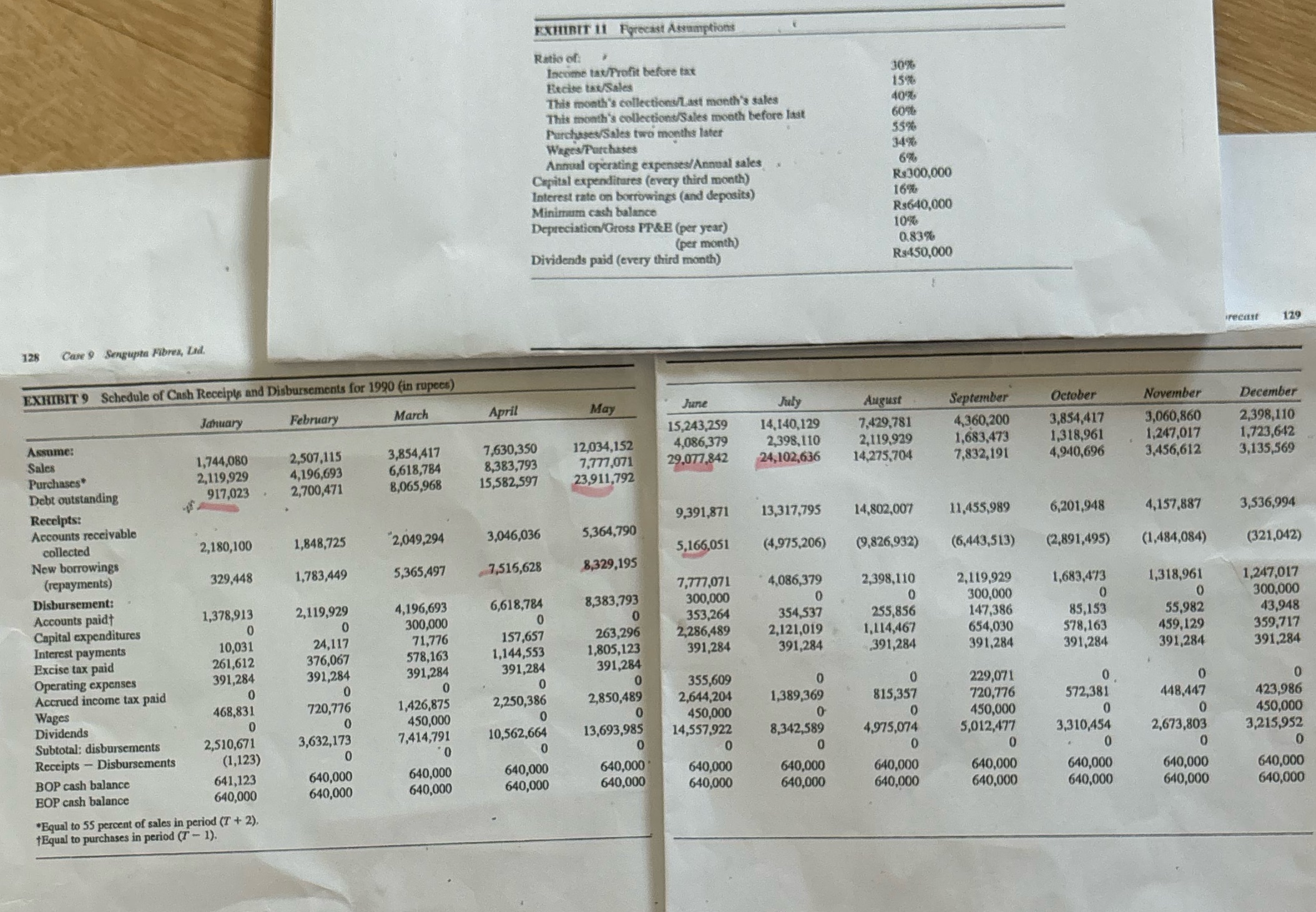

EXHIBIT 11 Forecast Assumptions Ratio of Income tat/Profit before fax 30% Excise tax/Sales 15% This month's collections/Last month's sales This month's collections/Sales month before last Purchases/Sales two months later 55% Wages/Purchases 34% Annual operating expenses/Annual sales 6% Capital expenditures (every third month) R 300,000 Interest rate on borrowings (and deposits) 16% Minimum cash balance Rs640,000 Depreciation/Gross PP&E (per year) 10% (per month) 0.83% Dividends paid (every third month) Rs450,000 recast 120 128 Case & Sengupta Fibres, Lid. EXHIBIT 9 Schedule of Cash Receipts and Disbursements for 1990 (in rupees) January February March April May June July August September October November December 15,243,259 14.140,129 7,429,781 4,360,200 3,854,417 3,060,860 Assume: 2,398,110 1,744,080 2,507,115 3,854,417 7,630,350 12,034,152 4,086,379 2,398,110 2,119,929 Sales 1,683,473 1,318,961 1,247.017 1,723,642 4,196,693 8,383,793 7,777,071 29,077,842 Purchases* 2,119,929 6,618,784 24,102,636 14,275,704 7,832,191 4,940,696 3,456,612 3,135,569 Debt outstanding 917,023 2,700,471 8,065,968 15,582,597 23,911,792 Receipts: 9,391,871 Accounts receivable 13,317,795 14,802,007 11,455,989 6,201,948 4,157.887 3,536,994 1,848,725 5,364,790 collected 2,180,100 2,049,294 3,046,036 New borrowings 5,166,051 (4,975,206) (9,826,932) (6,443,513) (2,891,495) (1,484,084) (321,042) 329.448 1,783,449 5,365,497 7,515,628 8,329,195 (repayments) Disbursement: 7,777,071 4,086,379 2,398,110 2,119,929 1,683,473 1,318,961 1,247,017 Accounts paid 1,378,913 2,119,929 4,196,693 6,618,784 8,383,793 300,000 300,000 300.000 Capital expenditures 300,000 0 353,264 354.537 255,856 147,386 85,153 55,982 43,948 10,031 24,117 71,776 157,657 263,296 Interest payment 2,286,489 2,121,019 1,114,467 654,030 578,163 459,129 359,717 Excise tax paid 261,612 376,067 578,163 1,144,553 1,805,123 391,284 391,284 391,284 391.284 391,284 391,284 391.284 Operating expenses 391,284 391,284 391,284 391,284 391,284 Accrued income tax paid 355,609 229,071 Wages 468,831 720,776 1,426,875 2,250,386 2,850,489 2,644,204 1,389,369 815,357 720,776 572,381 448,447 123.986 Dividends 450,000 450,000 450,000 450,000 Subtotal: disbursements 2,510,671 3,632,173 7,414,791 10,562,664 13,693,985 14,557,922 8,342,589 4.975,074 5,012,477 3,310,454 2,673,803 3,215,952 Receipts - Disbursements (1,123) 0 BOP cash balance 641,123 640,000 640,000 640,000 640,000 640,000 640,000 640,000 640,000 640,000 640,000 640,000 640,000 640,000 640,000 EOP cash balance 640,000 640,000 640,000 640,000 640,000 640,000 640,000 640,000 640,000 "Equal to 55 percent of sales in period (7 + 2), Equal to purchases in period (T - 1)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts