Ocean Fishers Ltd had a 22-foot fishing boat with an inboard motor that was purchased on...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

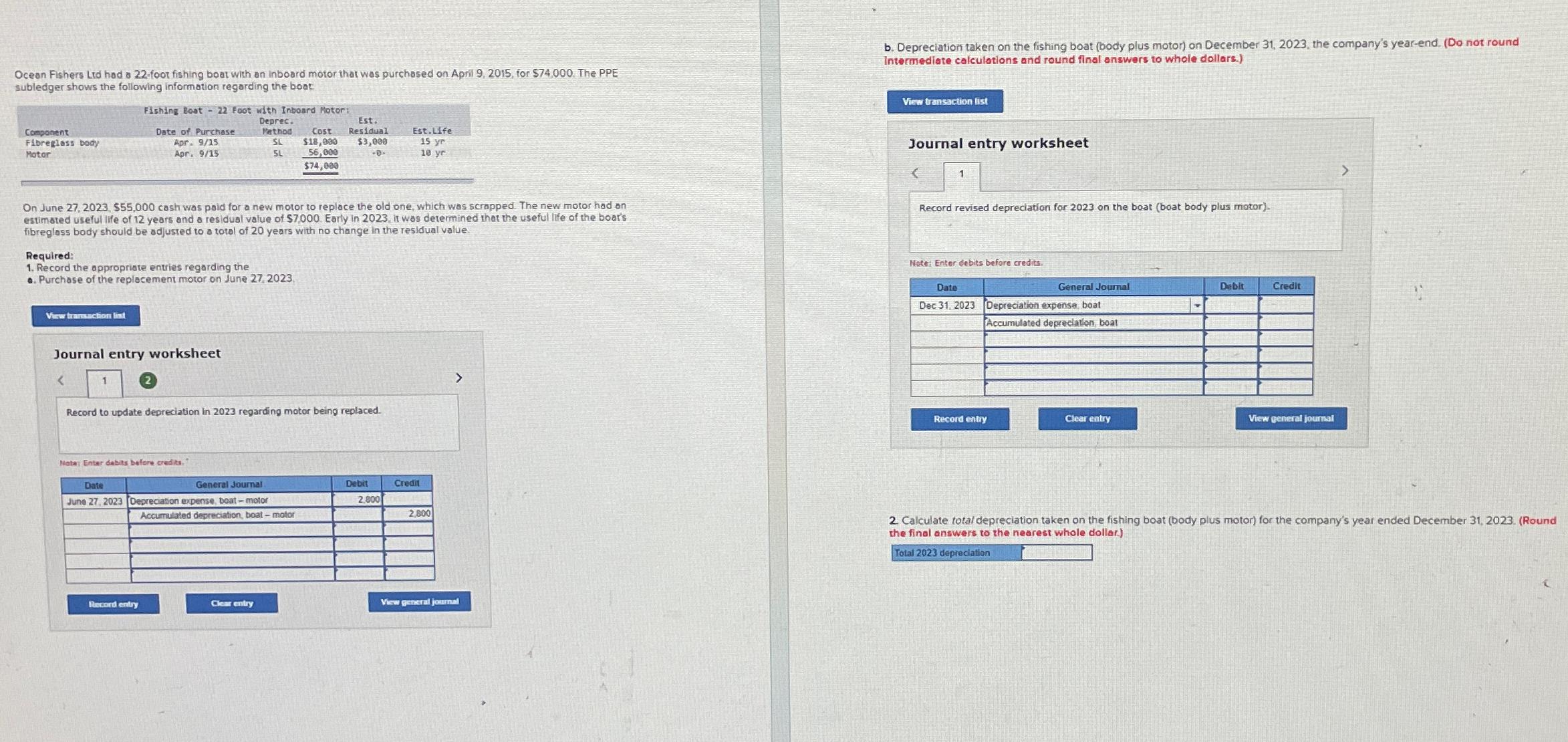

Ocean Fishers Ltd had a 22-foot fishing boat with an inboard motor that was purchased on April 9, 2015, for $74,000. The PPE subledger shows the following information regarding the boat b. Depreciation taken on the fishing boat (body plus motor) on December 31, 2023, the company's year-end. (Do not round Intermediate calculations and round final answers to whole dollars.) Fishing Boat -22 Foot with Inboard Motor: Component Fibreglass body Date of Purchase Apr. 9/15 Motor Apr. 9/15 Deprec. Pethod SL SL Cost $18,000 56,000 $74,000 Est. Residual $3,000 -0. Est.Life 15 yr 10 yr On June 27, 2023, $55,000 cash was paid for a new motor to replace the old one, which was scrapped. The new motor had an estimated useful life of 12 years and a residual value of $7,000. Early in 2023, it was determined that the useful life of the boat's fibreglass body should be adjusted to a total of 20 years with no change in the residual value. Required: 1. Record the appropriate entries regarding the e. Purchase of the replacement motor on June 27, 2023, View transaction list Journal entry worksheet 1 Record to update depreciation in 2023 regarding motor being replaced. Nota: Enter dabits before credits. Date General Journal June 27, 2023 [Depreciation expense, boat-motor Accumulated depreciation, boat - motor Debit Credit 2.800 2,800 > Record entry Clear entry View general journal View transaction list Journal entry worksheet < 1 Record revised depreciation for 2023 on the boat (boat body plus motor). Note: Enter debits before credits. Date General Journal Dec 31, 2023 Depreciation expense, boat Accumulated depreciation, boat Debit Credit Record entry Clear entry View general journal > 2. Calculate total depreciation taken on the fishing boat (body plus motor) for the company's year ended December 31, 2023. (Round the final answers to the nearest whole dollar.) Total 2023 depreciation Ocean Fishers Ltd had a 22-foot fishing boat with an inboard motor that was purchased on April 9, 2015, for $74,000. The PPE subledger shows the following information regarding the boat b. Depreciation taken on the fishing boat (body plus motor) on December 31, 2023, the company's year-end. (Do not round Intermediate calculations and round final answers to whole dollars.) Fishing Boat -22 Foot with Inboard Motor: Component Fibreglass body Date of Purchase Apr. 9/15 Motor Apr. 9/15 Deprec. Pethod SL SL Cost $18,000 56,000 $74,000 Est. Residual $3,000 -0. Est.Life 15 yr 10 yr On June 27, 2023, $55,000 cash was paid for a new motor to replace the old one, which was scrapped. The new motor had an estimated useful life of 12 years and a residual value of $7,000. Early in 2023, it was determined that the useful life of the boat's fibreglass body should be adjusted to a total of 20 years with no change in the residual value. Required: 1. Record the appropriate entries regarding the e. Purchase of the replacement motor on June 27, 2023, View transaction list Journal entry worksheet 1 Record to update depreciation in 2023 regarding motor being replaced. Nota: Enter dabits before credits. Date General Journal June 27, 2023 [Depreciation expense, boat-motor Accumulated depreciation, boat - motor Debit Credit 2.800 2,800 > Record entry Clear entry View general journal View transaction list Journal entry worksheet < 1 Record revised depreciation for 2023 on the boat (boat body plus motor). Note: Enter debits before credits. Date General Journal Dec 31, 2023 Depreciation expense, boat Accumulated depreciation, boat Debit Credit Record entry Clear entry View general journal > 2. Calculate total depreciation taken on the fishing boat (body plus motor) for the company's year ended December 31, 2023. (Round the final answers to the nearest whole dollar.) Total 2023 depreciation

Expert Answer:

Related Book For

Intermediate Algebra

ISBN: 9780134895987

13th Edition

Authors: Margaret Lial, John Hornsby, Terry McGinnis

Posted Date:

Students also viewed these accounting questions

-

Based on Exhibits 5 and 6, the value of the lower one-period forward rate is closest to: A. 3.5122%. B. 3.5400%. C. 4.8037%. Meredith Alvarez is a junior fixed-income analyst with Canzim Asset...

-

The Occupational Safety and Health Administration (OSHA) mandates certain regulations that have to be adopted by corporations. Prior to the implementation of the OSHA program, a company found that...

-

What unique personal holding company problems may confront a small personal service corporation?

-

Which of the following is not derived from the sun: (a) Biomass (b) Fossil fuels (c) Nuclear energy (d) Geothermal energy

-

Trusler Electronics Inc. produces and sells two models of pocket calculators, XQ-103 and XQ-104. The calculators sell for $12 and $25, respectively. Because of the intense competition Trusler faces,...

-

Damon Associates reported the following transactions during September 2017: Sept. 8 Sold $3,000 of merchandise to Bruce Company for cash. The cost of the merchandise was $1,250 10 Owner invested...

-

The following table gives the value of two functions, f and g, at various values of . 1 2 10 15 f(x) 10 15 55 80 g(x) 0 -3 -99 -224 1 -8 Use this table to evaluate each of the expressions below....

-

Brilliant, Inc. reported the following results from the sale of 31,000 units of IT-54: Sales $ 546,000 Variable manufacturing costs 310,000 Fixed manufacturing costs 124,000 Variable selling costs...

-

5. (10 pts) Show what is printed by the following program: /* problem 5 */ public class problem5 { public static void main(String[] args) { int j=0, k=0; for (i=3;j 0) { System.out.println (j + " " +...

-

prepare a two page paper on how these three principles apply in the supervision of others. Is one more important than the others? Define each term and analyze how each one effects the supervisory...

-

Can you think of any real-world examples where lapses in internal controls had a significant impact on a company's financial performance or reputation?

-

Discuss real-life ethical dilemmas. Explain the reasons for earnings management. Identify the costs of earnings management. Respond to potential earnings management fraud.

-

Select a finance topic or issue from the course or current events. If it is a topic (example, high frequency trading), you will conduct and discuss research (facts). If it is an issue (example,...

-

Why are stocks usually more risky than bonds?

-

Which of the following is least important as a reason for a written investment policy statement (IPS)? A. The IPS may be required by regulation. B. Having a written IPS is part of best practice for a...

-

Which of the following best describes the underlying rationale for a written investment policy statement (IPS)? A. A written IPS communicates a plan for trying to achieve investment success. B. A...

-

A written investment policy statement (IPS) is most likely to succeed if: A. Created by a software program to assure consistent quality. B. It is a collaborative effort of the client and the...

Study smarter with the SolutionInn App