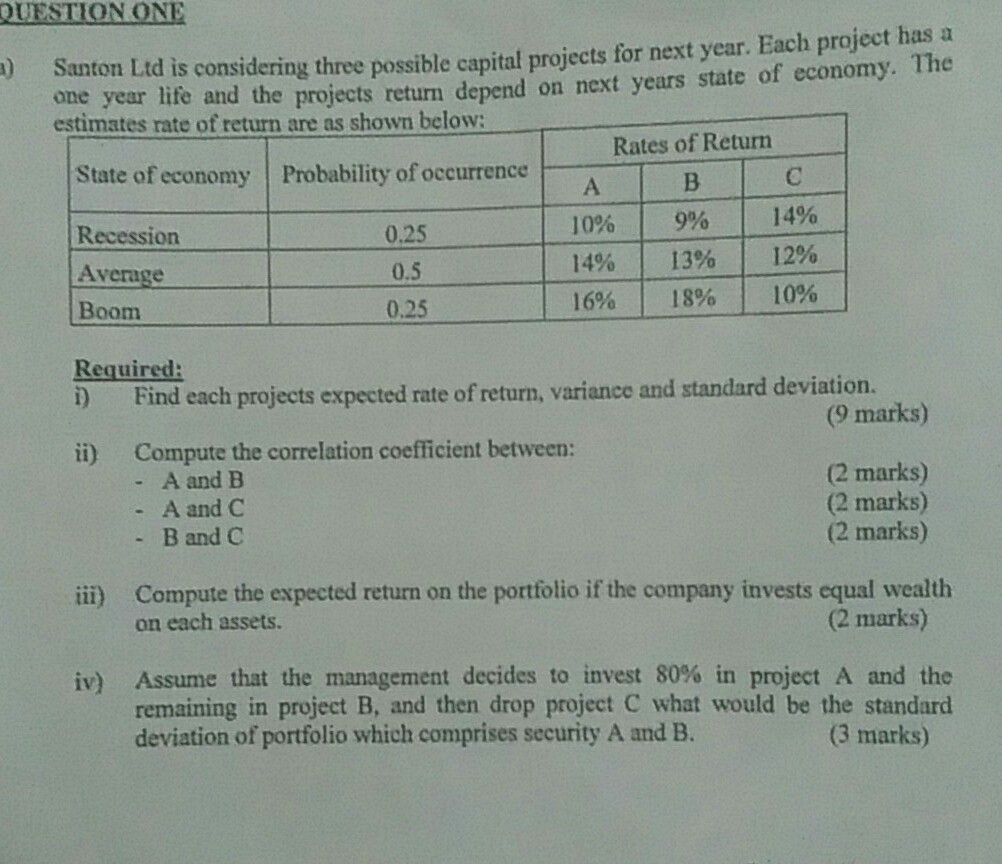

Question: OESTION one year life and the projects return depend on next years state of economy. The estimates rate of return are as shown below: )

OESTION one year life and the projects return depend on next years state of economy. The estimates rate of return are as shown below: ) Santon Ltd is considering three possible capital projects for next year. Each project has a State of economy Probability of occurrence Recession Average Boom 0.25 0.5 0.25 10% | 9% | 14% 14% | 13% | 12% 16% | 18% | 10% Required: ) Find each projects expected rate of return, variance and standard deviation. (9 marks) i) Compute the correlation coefficient between: - A and B A and C - B and C (2 marks) (2 marks) (2 marks) ii) Compute the expected return on the portfolio if the company invests equal wealth on each assets. (2 marks) iv) Assume that the management decides to invest 80% in project A and the remaining in project B, and then drop project C what would be the standard deviation of portfolio which comprises security A and B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts