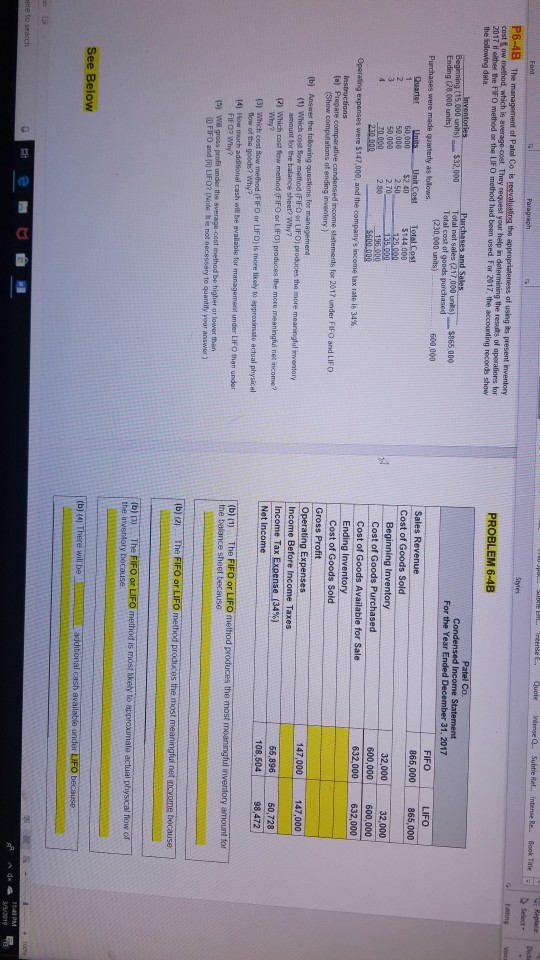

Question: of using its present inventory 2017 if either the FIFO method or the LIFO method had been used For 2017, the accounting records show Co.

of using its present inventory 2017 if either the FIFO method or the LIFO method had been used For 2017, the accounting records show Co. 31, 2017 Beginning (15.000 unins) Total cost of goods (230,000 units) FIFO LIFO S2.40 2 50 5144.000 50,000 50,000 2.80 s ot ending inveelory sheet? Why? (2) Which cost fhow method (FIFO or LiFO) produces the more meaningful net income? 50,728 98,472 108,504 Why? (3) Which cost How method (FIFO or LiFO) is more likely to apprasimate actual physicel method be higher ar lower than D FIFO and (il LIFO? (Note h is not necesssry to quantify your answer ) b) (3)The (b) (4) T e will be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts