Question: off from a long position in a forward contract on the settlement date is the dif- e between the spot price of the underlying asset

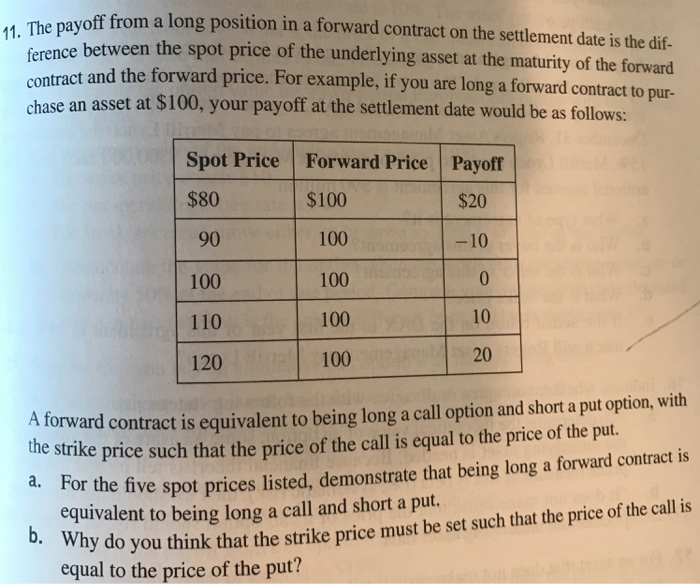

off from a long position in a forward contract on the settlement date is the dif- e between the spot price of the underlying asset at the maturity of the forward t and the forward price. For example, if you are long a forward contract to pur- 11. The pay e an asset at $100, your payoff at the settlement date would be as follows chas Spot Price Forward Price Payoff $80 $100 100 100 100 100 $20 90 100 110 120 -10 10 20 orward contract is equivalent to being long a call option and short a put option, with e strike price such that the price of the call is equal to the price of the put. A f or the five spot prices listed, demonstrate that being long a forward contract is equivalent to being long a call and short a put. a. F hy d equal to the price of the put? o you think that the strike price must be set such that the price of the call is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts