Question: OFF101 Use I = (P x (1 + R/N)NT) - P and A = (P x (1 + R/N)WI) to solve these compound interest problems.

OFF101

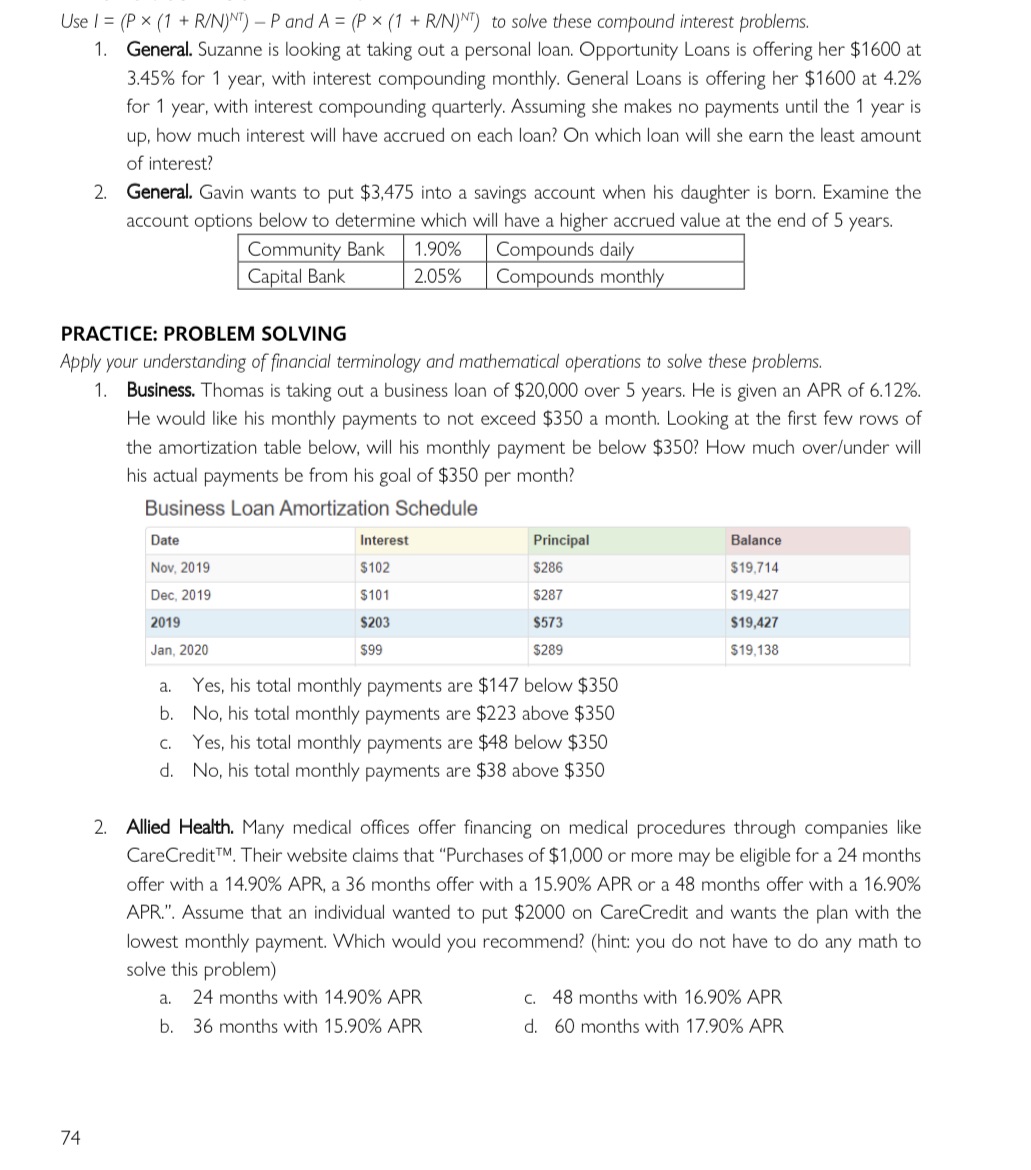

Use I = (P x (1 + R/N)NT) - P and A = (P x (1 + R/N)WI) to solve these compound interest problems. 1. General. Suzanne is looking at taking out a personal loan. Opportunity Loans is offering her $1600 at 3.45% for 1 year, with interest compounding monthly. General Loans is offering her $1600 at 4.2% for 1 year, with interest compounding quarterly. Assuming she makes no payments until the 1 year is up, how much interest will have accrued on each loan? On which loan will she earn the least amount of interest? 2. General. Gavin wants to put $3,475 into a savings account when his daughter is born. Examine the account options below to determine which will have a higher accrued value at the end of 5 years. Community Bank 1.90% Compounds daily Capital Bank 2.05% Compounds monthly PRACTICE: PROBLEM SOLVING Apply your understanding of financial terminology and mathematical operations to solve these problems. 1. Business. Thomas is taking out a business loan of $20,000 over 5 years. He is given an APR of 6.12%. He would like his monthly payments to not exceed $350 a month. Looking at the first few rows of the amortization table below, will his monthly payment be below $350? How much over/under will his actual payments be from his goal of $350 per month? Business Loan Amortization Schedule Date Interest Principal Balance Nov, 2019 $102 $286 $19,714 Dec, 2019 $101 $287 $19,427 2019 $203 $573 $19,427 Jan, 2020 $99 $289 $19,138 . Yes, his total monthly payments are $147 below $350 b. No, his total monthly payments are $223 above $350 C. Yes, his total monthly payments are $48 below $350 d. No, his total monthly payments are $38 above $350 2. Allied Health. Many medical offices offer financing on medical procedures through companies like CareCreditTM. Their website claims that "Purchases of $1,000 or more may be eligible for a 24 months offer with a 14.90% APR, a 36 months offer with a 15.90% APR or a 48 months offer with a 16.90% APR.". Assume that an individual wanted to put $2000 on CareCredit and wants the plan with the lowest monthly payment. Which would you recommend? (hint: you do not have to do any math to solve this problem) a. 24 months with 14.90% APR c. 48 months with 16.90% APR b. 36 months with 15.90% APR d. 60 months with 17.90% APR 74

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts