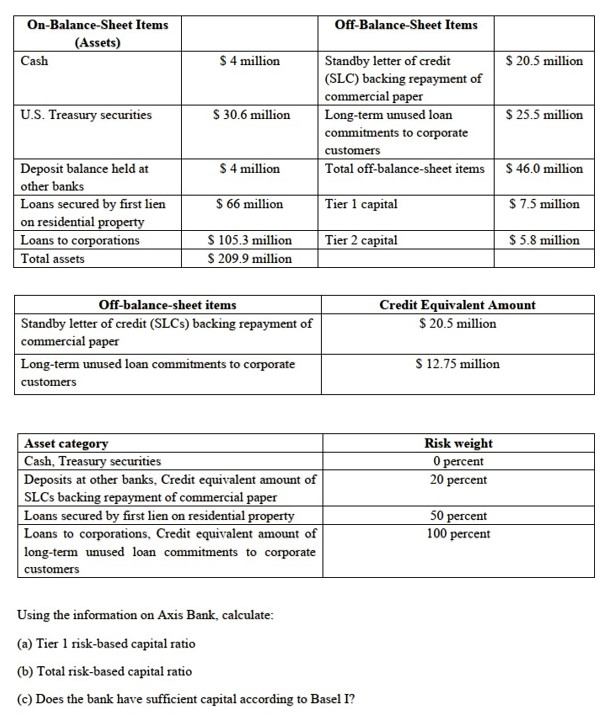

Question: Off-Balance Sheet Items On-Balance Sheet Items (Assets) Cash $ 4 million U.S. Treasury securities S 30.6 million Standby letter of credit $ 20.5 million (SLC)

Off-Balance Sheet Items On-Balance Sheet Items (Assets) Cash $ 4 million U.S. Treasury securities S 30.6 million Standby letter of credit $ 20.5 million (SLC) backing repayment of commercial paper Long-term unused loan $ 25.5 million commitments to corporate customers Total off-balance-sheet items S 46.0 million $ 4 million $ 66 million Tier 1 capital $ 7.5 million Deposit balance held at other banks Loans secured by first lien on residential property Loans to corporations Total assets Tier 2 capital $5.8 million $ 105.3 million $ 209.9 million Credit Equivalent Amount $ 20.5 million Off-balance-sheet items Standby letter of credit (SLCs) backing repayment of commercial paper Long-term unused loan commitments to corporate customers $ 12.75 million Risk weight O percent 20 percent Asset category Cash, Treasury securities Deposits at other banks, Credit equivalent amount of SLCs backing repayment of commercial paper Loans secured by first lien on residential property Loans to corporations, Credit equivalent amount of long-term unused loan commitments to corporate customers 50 percent 100 percent Using the information on Axis Bank, calculate: (a) Tier 1 risk-based capital ratio (b) Total risk-based capital ratio (c) Does the bank have sufficient capital according to Basel

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts