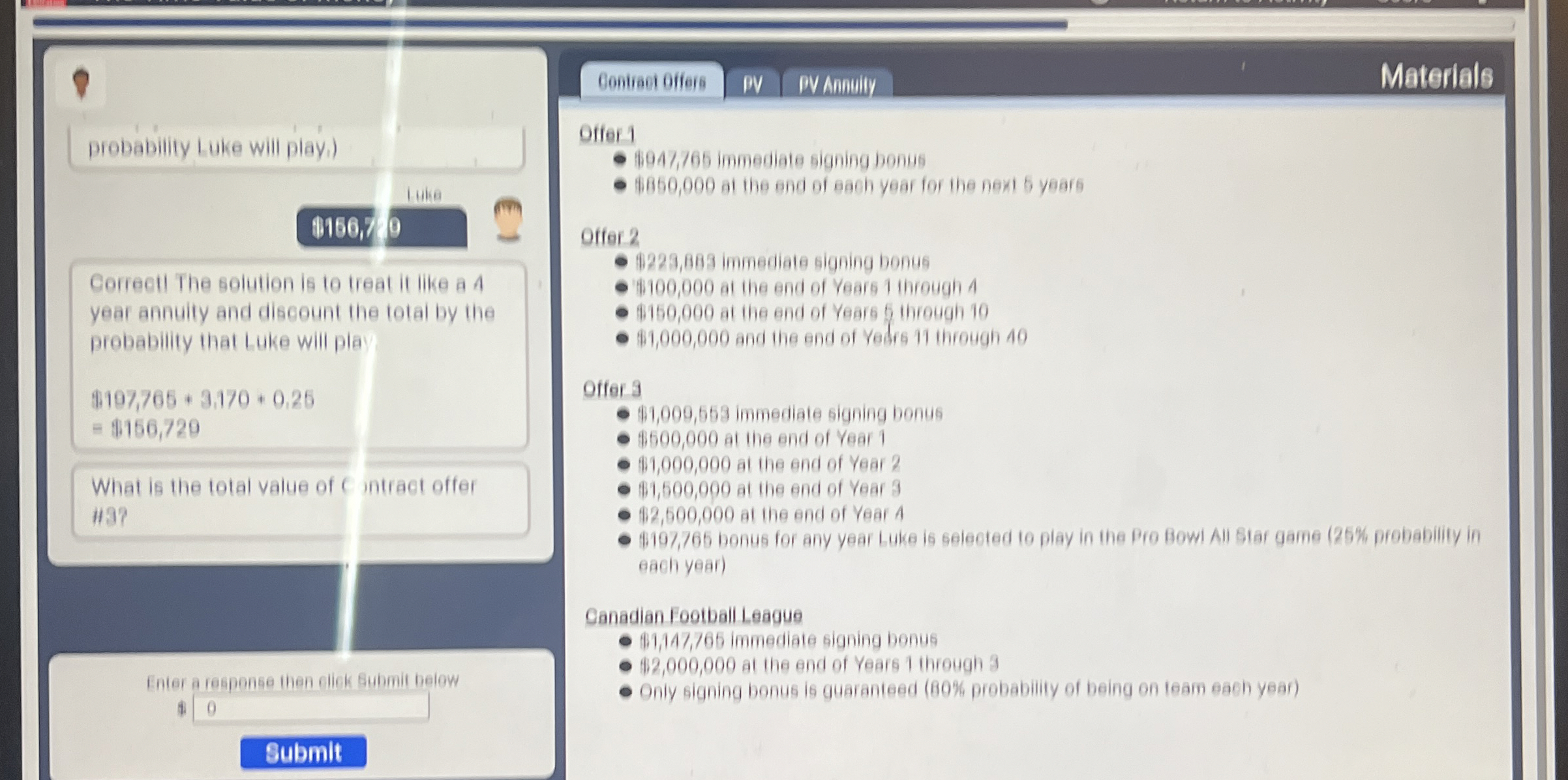

Question: Offer 1 $ 9 4 7 , 7 6 5 immediate signing bonys $ 4 6 5 0 , 0 0 0 at the end

Offer

$ immediate signing bonys

$ at the end of each year for the next years

Offor

$ immediate signing benus

$ at the end of Years ihrough a

$ at the end of Years through

$ and the end of Yedre ihrough

Correctl The solution is to treat it like a A

year annuity and discount the total by the

probability that Luke will play

$

What is the tetal value of intract effer

H

Offor

$ immediate signing benus

$ at the end of Year I

$ at the end of Year

$ at the end of Year

$ at the end of Year A

$ bonus for any year Luke is selected to play in the Pro Bowl All star game probability in

each year

Ganadian Football League

$ immediate signing benus

$ at the end of Years through

Only signing bonus is guaranteed probability of being on leam each year

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock