Question: Offer #3 3. The third offer/proposal that Alex is considering is the one that he and his friend worked on ogether. They both feel that

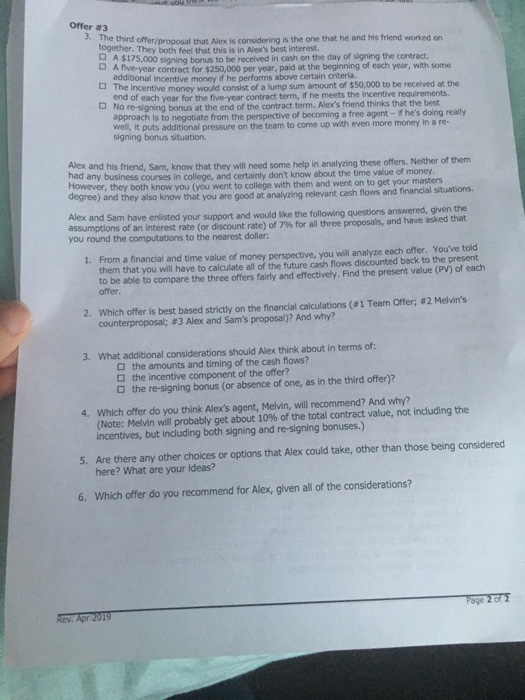

Offer #3 3. The third offer/proposal that Alex is considering is the one that he and his friend worked on ogether. They both feel that this is in Alex's best interest. A $175,000 signing bonus to be received in cash on the day of signing the contract. G A five-year contract for $250,000 per year, paid at the beginning of each year, with some additional incentive money if he performs above certain criteria. end of each year for the five-year contract term, if he meets the incentive requirements. D The incentive money would consist of a lump sum a No re-signing bonus at the end of the contract term. Alex's friend thinks that the best consist of a lump sum amount of $50,000 to be recelved at the approach is to negotiate from the perspective of becoming a free agent-if he's doing really well, it puts additional pressure on the team signing bonus situation. to come up with even more money in a re- Alex and his friend, Sam, know that they will need some help in analyzing these offers. Neither of them had any business courses in college, and certainly don't know about the time value of money However, they both know you (you went to college with them and went on to get your masters degree) and they also know that you are good at analyzing relevant cash flows and financial situations. Alex and assumptions of an interest rate (or you round the computations to the nearest dollar: Sam have enlisted your support and would like the following questions answered, given the discount rate) of 7% for all three proposals and have asked that 1. From a financial and time value of money perspective, you will analyze each offer. You've told them that you will have to calculate all of the future cash flows discounted back to the present to be able to compare the three offers fairly and effectively. Find the present value (PV) of each offer. Which offer is best based strictly on the financial calculations (#1 Team oner counterproposal; #3 Alex and Sam's proposa)? And why? 2 Melvin's 2. What additional considerations should Alex think about in terms of: 3. the amounts and timing of the cash flows? D the incentive component of the offer? D the re-signing bonus (or absence of one, as in the third offer)? 4. Which offer do you think Alex's agent, Melvin, will recommend? And why? (Note: Melvin will probably get about 10% of the total contract value, not including the incentives, but including both signing and re-signing bonuses.) here? What are your ideas? Which offer do you recommend for Alex, given all of the considerations? 5. Are there any other choices or options that Alex could take, other than those being considered 6. Offer #3 3. The third offer/proposal that Alex is considering is the one that he and his friend worked on ogether. They both feel that this is in Alex's best interest. A $175,000 signing bonus to be received in cash on the day of signing the contract. G A five-year contract for $250,000 per year, paid at the beginning of each year, with some additional incentive money if he performs above certain criteria. end of each year for the five-year contract term, if he meets the incentive requirements. D The incentive money would consist of a lump sum a No re-signing bonus at the end of the contract term. Alex's friend thinks that the best consist of a lump sum amount of $50,000 to be recelved at the approach is to negotiate from the perspective of becoming a free agent-if he's doing really well, it puts additional pressure on the team signing bonus situation. to come up with even more money in a re- Alex and his friend, Sam, know that they will need some help in analyzing these offers. Neither of them had any business courses in college, and certainly don't know about the time value of money However, they both know you (you went to college with them and went on to get your masters degree) and they also know that you are good at analyzing relevant cash flows and financial situations. Alex and assumptions of an interest rate (or you round the computations to the nearest dollar: Sam have enlisted your support and would like the following questions answered, given the discount rate) of 7% for all three proposals and have asked that 1. From a financial and time value of money perspective, you will analyze each offer. You've told them that you will have to calculate all of the future cash flows discounted back to the present to be able to compare the three offers fairly and effectively. Find the present value (PV) of each offer. Which offer is best based strictly on the financial calculations (#1 Team oner counterproposal; #3 Alex and Sam's proposa)? And why? 2 Melvin's 2. What additional considerations should Alex think about in terms of: 3. the amounts and timing of the cash flows? D the incentive component of the offer? D the re-signing bonus (or absence of one, as in the third offer)? 4. Which offer do you think Alex's agent, Melvin, will recommend? And why? (Note: Melvin will probably get about 10% of the total contract value, not including the incentives, but including both signing and re-signing bonuses.) here? What are your ideas? Which offer do you recommend for Alex, given all of the considerations? 5. Are there any other choices or options that Alex could take, other than those being considered 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts