Question: & Office Update To keep up-to-date with security updates, fixes, and improvements, choose C... CH 9. The two general ways of addressing the Principal-Agent problem

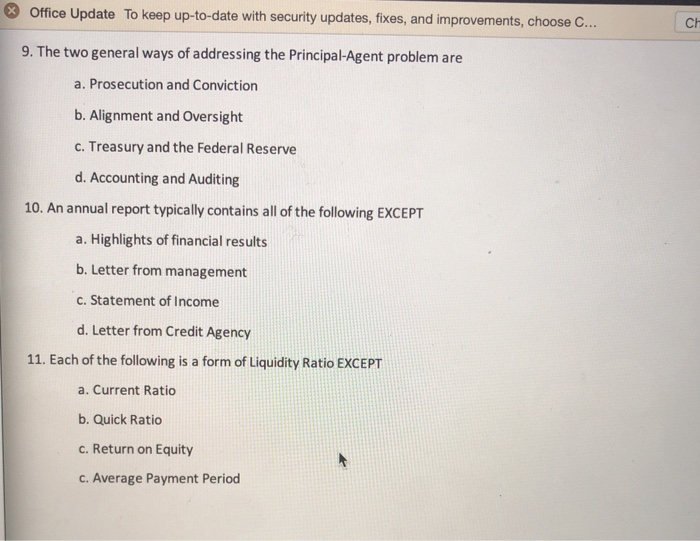

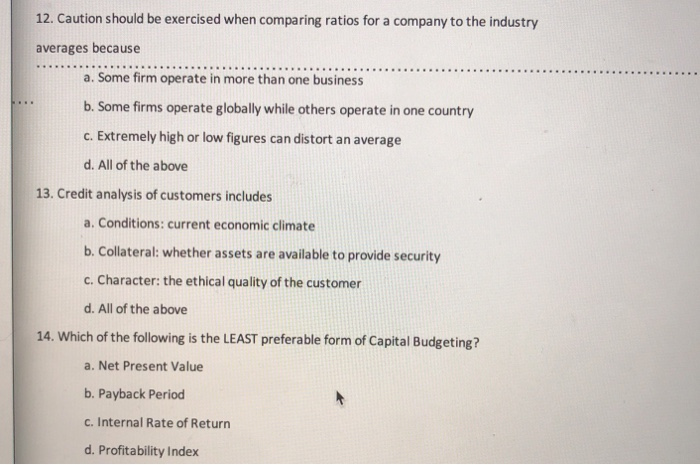

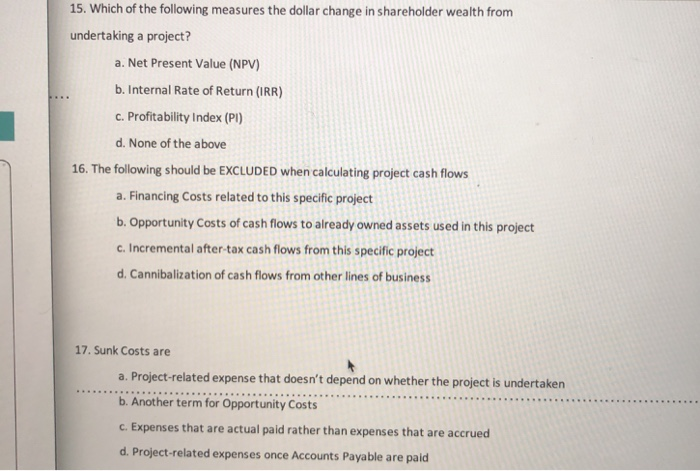

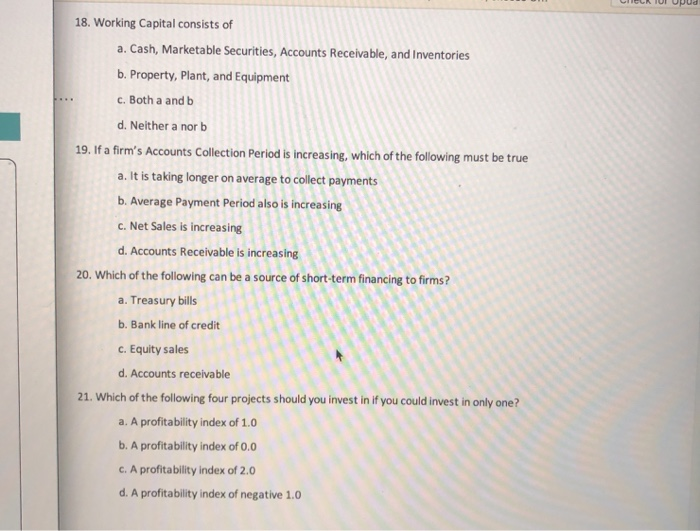

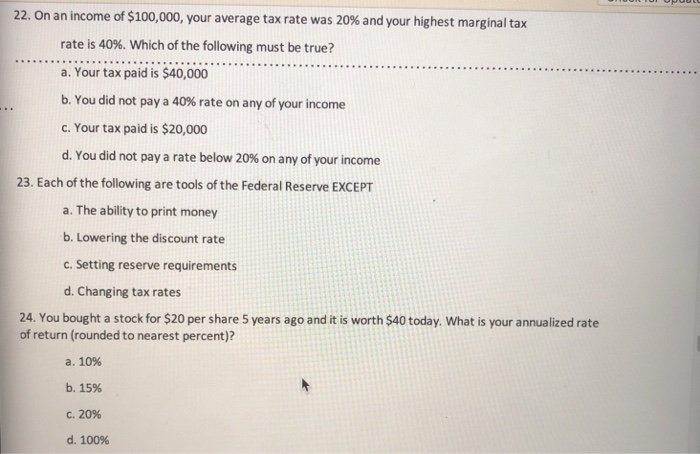

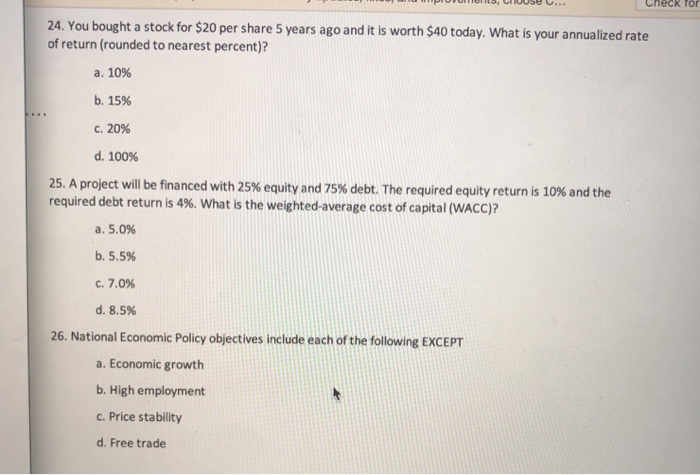

& Office Update To keep up-to-date with security updates, fixes, and improvements, choose C... CH 9. The two general ways of addressing the Principal-Agent problem are a. Prosecution and Conviction b. Alignment and Oversight C. Treasury and the Federal Reserve d. Accounting and Auditing 10. An annual report typically contains all of the following EXCEPT a. Highlights of financial results b. Letter from management c. Statement of Income d. Letter from Credit Agency 11. Each of the following is a form of Liquidity Ratio EXCEPT a. Current Ratio b. Quick Ratio c. Return on Equity C. Average Payment Period 12. Caution should be exercised when comparing ratios for a company to the industry averages because a. Some firm operate in more than one business b. Some firms operate globally while others operate in one country c. Extremely high or low figures can distort an average d. All of the above 13. Credit analysis of customers includes a. Conditions: current economic climate b. Collateral: whether assets are available to provide security c. Character: the ethical quality of the customer d. All of the above 14. Which of the following is the LEAST preferable form of Capital Budgeting? a. Net Present Value b. Payback Period c. Internal Rate of Return d. Profitability Index 15. Which of the following measures the dollar change in shareholder wealth from undertaking a project? a. Net Present Value (NPV) b. Internal Rate of Return (IRR) c. Profitability Index (PI) d. None of the above 16. The following should be EXCLUDED when calculating project cash flows a. Financing Costs related to this specific project b. Opportunity Costs of cash flows to already owned assets used in this project c. Incremental after-tax cash flows from this specific project d. Cannibalization of cash flows from other lines of business 17. Sunk Costs are a. Project-related expense that doesn't depend on whether the project is undertaken b. Another term for Opportunity Costs C. Expenses that are actual paid rather than expenses that are accrued d. Project-related expenses once Accounts Payable are paid CHECK IUI Upud 18. Working Capital consists of a. Cash, Marketable Securities, Accounts Receivable, and Inventories b. Property, Plant, and Equipment c. Both a and b d. Neither a norb 19. If a firm's Accounts Collection Period is increasing, which of the following must be true a. It is taking longer on average to collect payments b. Average Payment Period also is increasing c. Net Sales is increasing d. Accounts Receivable is increasing 20. Which of the following can be of short-term financing to firms? a. Treasury bills b. Bank line of credit C. Equity sales d. Accounts receivable 21. Which of the following four projects should you invest in if you could invest in only one? a. A profitability index of 1.0 b. A profitability index of 0.0 c. A profitability index of 2.0 d. A profitability index of negative 1.0 22. On an income of $100,000, your average tax rate was 20% and your highest marginal tax rate is 40%. Which of the following must be true? a. Your tax paid is $40,000 b. You did not pay a 40% rate on any of your income C. Your tax paid is $20,000 d. You did not pay a rate below 20% on any of your income 23. Each of the following are tools of the Federal Reserve EXCEPT a. The ability to print money b. Lowering the discount rate C. Setting reserve requirements d. Changing tax rates 24. You bought a stock for $20 per share 5 years ago and it is worth $40 today. What is your annualized rate of return (rounded to nearest percent)? a. 10% b. 15% C. 20% d. 100% 24. You bought a stock for $20 per share 5 years ago and it is worth $40 today. What is your annualized rate of return (rounded to nearest percent)? a. 10% b. 15% c. 20% d. 100% 25. A project will be financed with 25% equity and 75% debt. The required equity return is 10% and the required debt return is 4%. What is the weighted average cost of capital (WACC)? a. 5.0% b. 5.5% c. 7.0% d. 8.5% 26. National Economic Policy objectives include each of the following EXCEPT a. Economic growth b. High employment c. Price stability d. Free trade

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts