Question: Office Update To keep up-to-date with security updates, fixes, and improvements, choose Check for Updates. H189 A x fx J K 243 255 A B

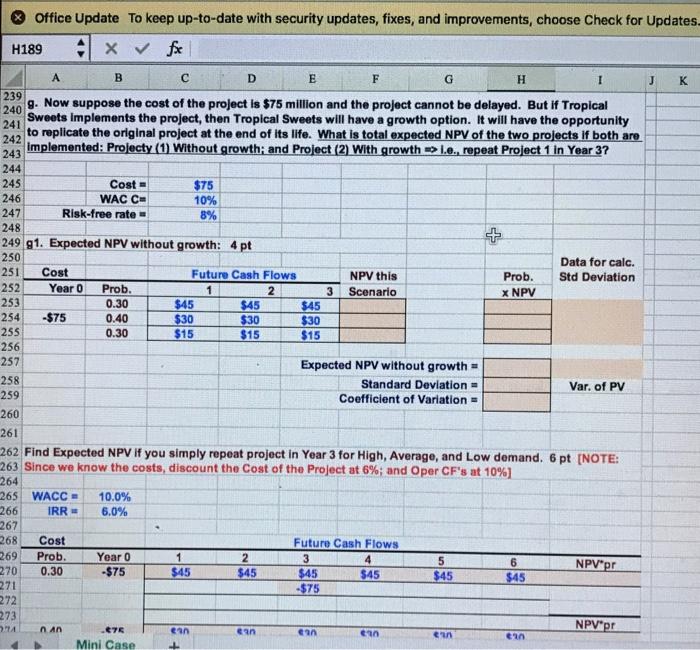

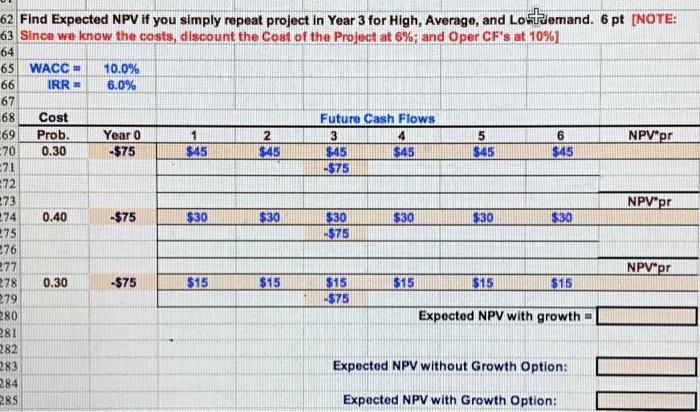

Office Update To keep up-to-date with security updates, fixes, and improvements, choose Check for Updates. H189 A x fx J K 243 255 A B D E F G H 239 g. Now suppose the cost of the project is $75 million and the project cannot be delayed. But if Tropical 240 Sweets Implements the project, then Tropical Sweets will have a growth option. It will have the opportunity 241 to replicate the original project at the end of its life. What is total expected NPV of the two projects If both are 242 implemented: Projecty (1) Without growth; and Project (2) With growth > I.e., repeat Project 1 In Year 3? 244 245 Cost - $75 246 WAC C- 10% 247 Risk-free rate 8% 248 249 91. Expected NPV without growth: 4 pt + 250 Data for calc. 251 Cost Future Cash Flows NPV this Prob. Std Deviation 252 Year 0 Prob. 1 2 3 Scenario x NPV 253 0.30 $45 $45 $45 254 -$75 0.40 $30 $30 $30 0.30 $15 $15 $15 256 257 Expected NPV without growth = 258 Standard Deviation - Var. of PV 259 Coefficient of Variation = 260 261 262 Find Expected NPV If you simply repeat project in Year 3 for High, Average, and Low demand. 6 pt [NOTE: 263 Since we know the costs, discount the cost of the Project at 6%; and Oper CF's at 10%) 264 265 WACC = 10.0% 266 IRR - 6.0% 267 268 Cost Future Cash Flows 269 Prob. Year 0 1 2 3 4 5 6 NPV pr 270 0.30 -$75 $45 $45 $45 $45 $45 $45 271 -$75 272 273 NPV pr en Mini Case .676 en ein enn ein eun 62 Find Expected NPV if you simply repeat project in Year 3 for High, Average, and Lortdemand. 6 pt [NOTE: 63 Since we know the costs, discount the Cost of the Project at 6%; and Oper CF's at 10%) 64 65 66 67 -68 WACC IRR 10.0% 6.0% Cost Future Cash Flows 3 Prob. 0.30 Year 0 -$75 1 $45 2 $45 5 $45 6 $45 NPV pr $45 $45 69 70 21 -72 273 -$75 NPV pr 274 0.40 -$75 $30 $30 $30 $30 $30 $30 -$75 275 276 NPV pr 0.30 -$75 $15 $15 $15 $15 $15 $15 -$75 Expected NPV with growth - 277 278 279 280 281 282 283 284 285 Expected NPV without Growth Option: Expected NPV with Growth Option: Office Update To keep up-to-date with security updates, fixes, and improvements, choose Check for Updates. H189 A x fx J K 243 255 A B D E F G H 239 g. Now suppose the cost of the project is $75 million and the project cannot be delayed. But if Tropical 240 Sweets Implements the project, then Tropical Sweets will have a growth option. It will have the opportunity 241 to replicate the original project at the end of its life. What is total expected NPV of the two projects If both are 242 implemented: Projecty (1) Without growth; and Project (2) With growth > I.e., repeat Project 1 In Year 3? 244 245 Cost - $75 246 WAC C- 10% 247 Risk-free rate 8% 248 249 91. Expected NPV without growth: 4 pt + 250 Data for calc. 251 Cost Future Cash Flows NPV this Prob. Std Deviation 252 Year 0 Prob. 1 2 3 Scenario x NPV 253 0.30 $45 $45 $45 254 -$75 0.40 $30 $30 $30 0.30 $15 $15 $15 256 257 Expected NPV without growth = 258 Standard Deviation - Var. of PV 259 Coefficient of Variation = 260 261 262 Find Expected NPV If you simply repeat project in Year 3 for High, Average, and Low demand. 6 pt [NOTE: 263 Since we know the costs, discount the cost of the Project at 6%; and Oper CF's at 10%) 264 265 WACC = 10.0% 266 IRR - 6.0% 267 268 Cost Future Cash Flows 269 Prob. Year 0 1 2 3 4 5 6 NPV pr 270 0.30 -$75 $45 $45 $45 $45 $45 $45 271 -$75 272 273 NPV pr en Mini Case .676 en ein enn ein eun 62 Find Expected NPV if you simply repeat project in Year 3 for High, Average, and Lortdemand. 6 pt [NOTE: 63 Since we know the costs, discount the Cost of the Project at 6%; and Oper CF's at 10%) 64 65 66 67 -68 WACC IRR 10.0% 6.0% Cost Future Cash Flows 3 Prob. 0.30 Year 0 -$75 1 $45 2 $45 5 $45 6 $45 NPV pr $45 $45 69 70 21 -72 273 -$75 NPV pr 274 0.40 -$75 $30 $30 $30 $30 $30 $30 -$75 275 276 NPV pr 0.30 -$75 $15 $15 $15 $15 $15 $15 -$75 Expected NPV with growth - 277 278 279 280 281 282 283 284 285 Expected NPV without Growth Option: Expected NPV with Growth Option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts