Question: oft Word - BUS 200 SEC X Microsoft Word - BUS 200 Sprin x Course Materials - 2020 Spring x B Second Odav/pid-46294305-dt-content-rid-375707747_1/courses/BMC01 ACC_122_0800_1202_1/SecondExamACC1229 Edits

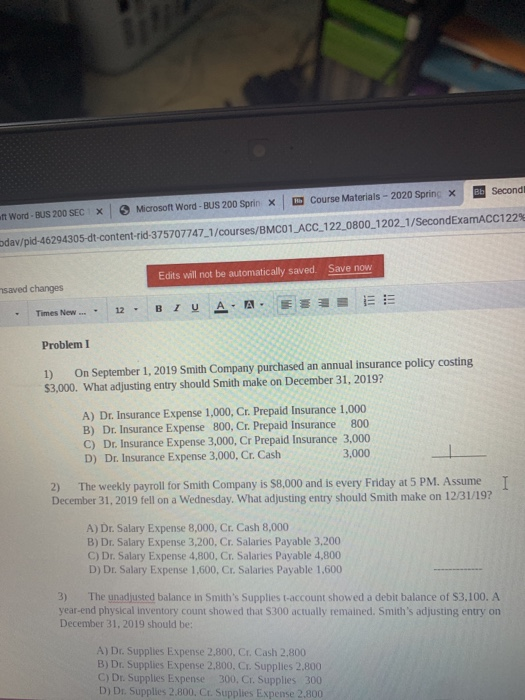

oft Word - BUS 200 SEC X Microsoft Word - BUS 200 Sprin x Course Materials - 2020 Spring x B Second Odav/pid-46294305-dt-content-rid-375707747_1/courses/BMC01 ACC_122_0800_1202_1/SecondExamACC1229 Edits will not be automatically saved. Save now saved changes Times New ... 12. BLU A. A. E EE Problem I 1) On September 1, 2019 Smith Company purchased an annual insurance policy costing $3,000. What adjusting entry should Smith make on December 31, 2019? A) Dr. Insurance Expense 1,000, Cr. Prepaid Insurance 1,000 B) Dr. Insurance Expense 800, Cr. Prepaid Insurance 800 C) Dr. Insurance Expense 3,000, Cr Prepaid Insurance 3,000 D) Dr. Insurance Expense 3,000, Cr. Cash 3,000 2) The weekly payroll for Smith Company is $8,000 and is every Friday at 5 PM. Assume December 31, 2019 fell on a Wednesday. What adjusting entry should Smith make on 12/31/19? A) Dr. Salary Expense 8,000. Cr. Cash 8,000 B) Dr. Salary Expense 3.200, Cr. Salaries Payable 3.200 C) Dr. Salary Expense 4,800, Cr. Salaries Payable 4.800 D) Dr. Salary Expense 1,600. Cr. Salaries Payable 1.600 3) The unadjusted balance in Smith's Supplies t-account showed a debit balance of S3,100. A year-end physical inventory count showed that $300 actually remained. Smith's adjusting entry on December 31, 2019 should be: A) Dr. Supplies Expense 2,800. Cr. Cash 2.800 B) Dr. Supplies Expense 2.800. C. Supplies 2.800 C) Dr. Supplies Expense 300, C1. Supplies 300 D) Dr. Supplies 2.800. C. Supplies Expense 2.800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts