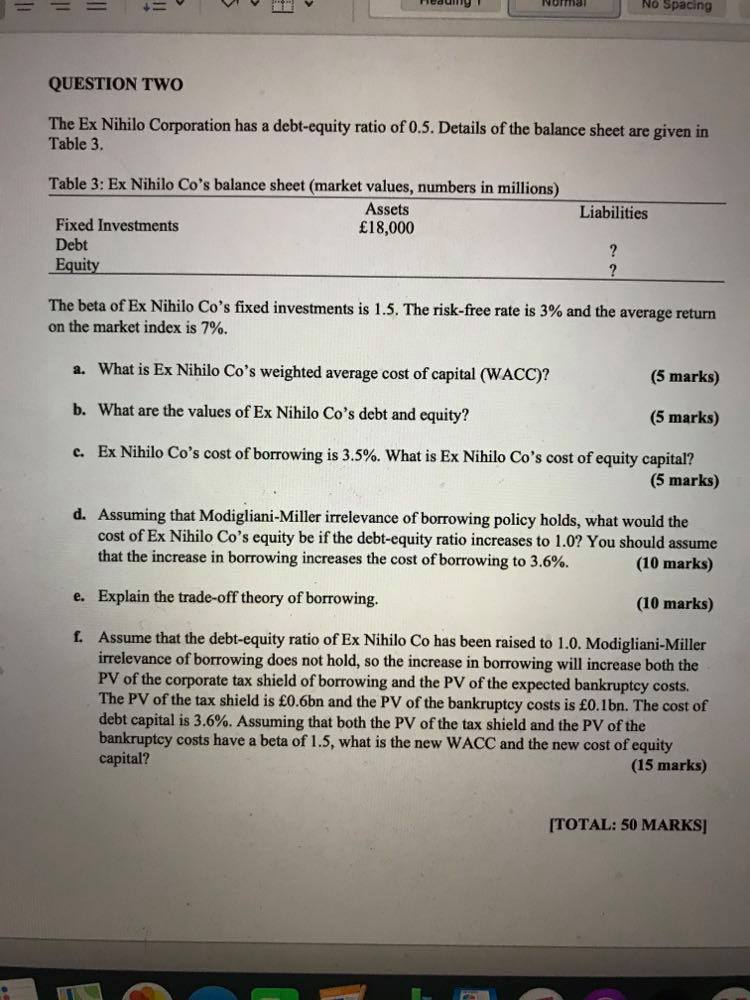

Question: og NU Spoliny QUESTION TWO The Ex Nihilo Corporation has a debt-equity ratio of 0.5. Details of the balance sheet are given in Table 3.

og NU Spoliny QUESTION TWO The Ex Nihilo Corporation has a debt-equity ratio of 0.5. Details of the balance sheet are given in Table 3. Liabilities Table 3: Ex Nihilo Co's balance sheet (market values, numbers in millions) Assets Fixed Investments 18,000 Debt Equity The beta of Ex Nihilo Co's fixed investments is 1.5. The risk-free rate is 3% and the average return on the market index is 7%. a. What is Ex Nihilo Co's weighted average cost of capital (WACC)? (5 marks) b. What are the values of Ex Nihilo Co's debt and equity? (5 marks) c. Ex Nihilo Co's cost of borrowing is 3.5%. What is Ex Nihilo Co's cost of equity capital? (5 marks) d. Assuming that Modigliani-Miller irrelevance of borrowing policy holds, what would the cost of Ex Nihilo Co's equity be if the debt-equity ratio increases to 1.0? You should assume that the increase in borrowing increases the cost of borrowing to 3.6%. (10 marks) e. Explain the trade-off theory of borrowing. (10 marks) f. Assume that the debt-equity ratio of Ex Nihilo Co has been raised to 1.0. Modigliani-Miller irrelevance of borrowing does not hold, so the increase in borrowing will increase both the PV of the corporate tax shield of borrowing and the PV of the expected bankruptcy costs. The PV of the tax shield is 0.6bn and the PV of the bankruptcy costs is 0.1bn. The cost of debt capital is 3.6%. Assuming that both the PV of the tax shield and the PV of the bankruptcy costs have a beta of 1.5, what is the new WACC and the new cost of equity capital? (15 marks) TOTAL: 50 MARKS]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts