Question: Ok Expert Community - Desperately need some help with this one. I was able to figure out the Common Stock answer, but for the life

Ok Expert Community - Desperately need some help with this one. I was able to figure out the Common Stock answer, but for the life of me cannot correctly compute the REs or Additional Paid-In Capital. Can someone please help by showing me what I'm doing wrong.

Thank you in advance!

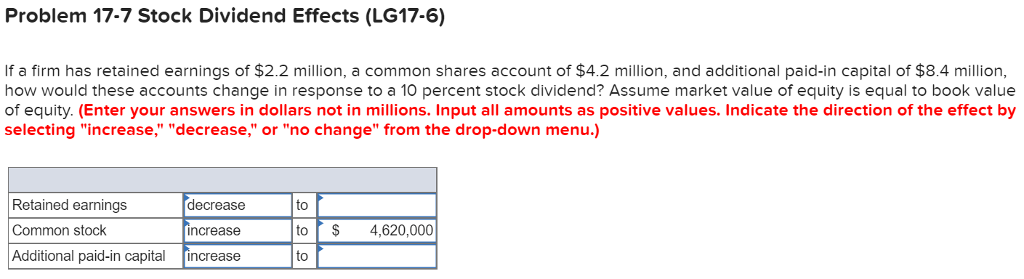

Problem 17-7 Stock Dividend Effects (LG17-6) If a firm has retained earnings of $2.2 million, a common shares account of $4.2 million, and additional paid-in capital of $8.4 million, how would these accounts change in response to a 10 percent stock dividend? Assume market value of equity is equal to book value of equity. (Enter your answers in dollars not in millions. Input all amounts as positive values. Indicate the direction of the effect by selecting "increase," "decrease," or "no change" from the drop-down menu.) Retained earnings Common stock Additional paid-in capital increa decrease increase aid-in capital increase to to4,620,000 to

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts