Question: okay, can you answer the first one? this question here Lacy Construction has a noncontributory, defined benefit pension plan. At December 31, 2021, Lacy received

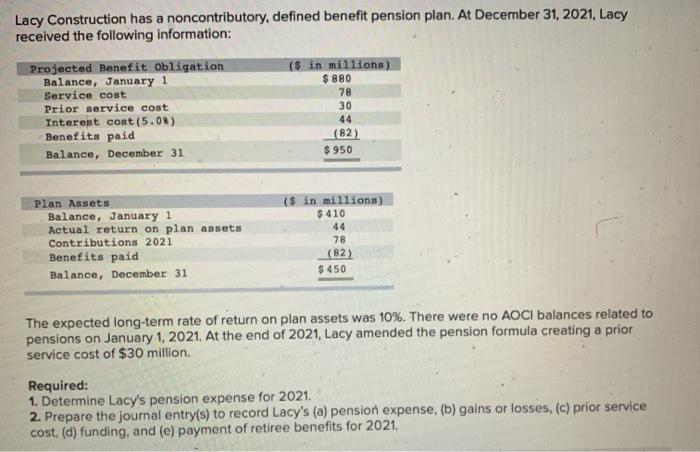

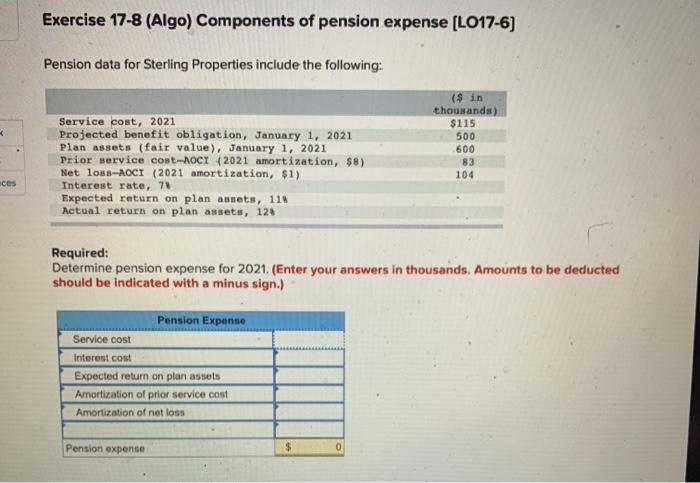

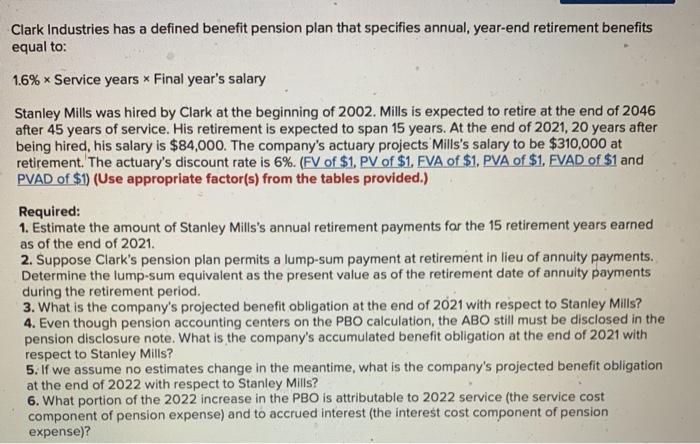

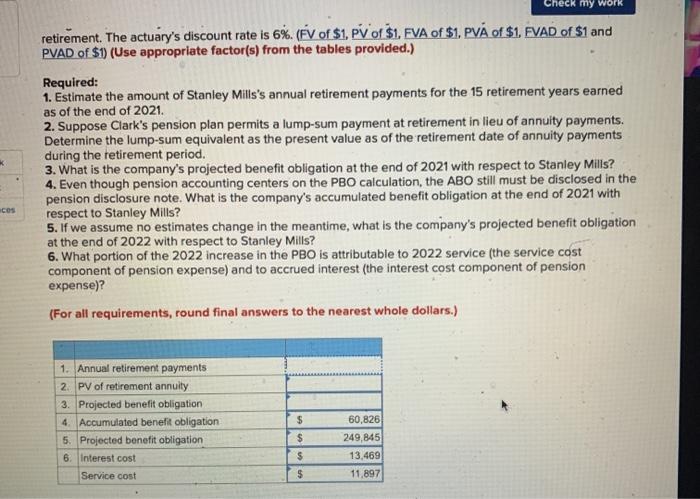

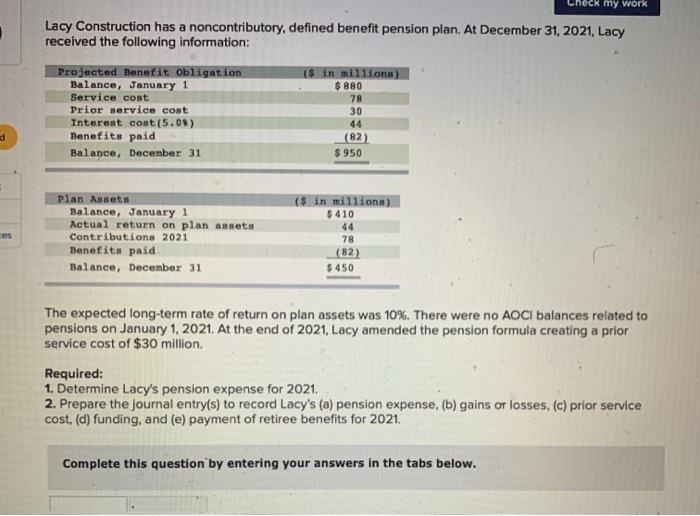

Lacy Construction has a noncontributory, defined benefit pension plan. At December 31, 2021, Lacy received the following information: (s in millions) $ 880 78 Projected Benefit obligation Balance, January 1 Service cost Prior service cost Interent cost (5.0) Benefits paid Balance, December 31 30 44 (82) $ 950 Plan Assets Balance, January 1 Actual return on plan assets Contributions 2021 Benefits paid Balance, December 31 ($ in millions) $ 410 44 78 (82) $ 450 The expected long-term rate of return on plan assets was 10%. There were no AOCI balances related to pensions on January 1, 2021. At the end of 2021, Lacy amended the pension formula creating a prior service cost of $30 million. Required: 1. Determine Lacy's pension expense for 2021. 2. Prepare the journal entry(s) to record Lacy's (a) pension expense, (b) gains or losses, (c) prior service cost. (d) funding, and (e) payment of retiree benefits for 2021. Exercise 17-8 (Algo) Components of pension expense (L017-6) Pension data for Sterling Properties include the following: Service cost, 2021 Projected benefit obligation, January 1, 2021 Plan assets (fair value), January 1, 2021 Prior service cost-AOCI (2021 amortization, $8) Net loss-AOCI (2021 amortization, $1) Interest rate, 71 Expected return on plan annets, 114 Actual return on plan assets, 126 ($ in thousands) $115 500 600 83 104 ces Required: Determine pension expense for 2021. (Enter your answers in thousands. Amounts to be deducted should be indicated with a minus sign.) Pension Expenso Service cost Interest cost Expected return on plan assets Amortization of prior service cost Amortization of not loss Pension expense $ 0 Clark Industries has a defined benefit pension plan that specifies annual year-end retirement benefits equal to: 1.6% * Service years * Final year's salary Stanley Mills was hired by Clark at the beginning of 2002. Mills is expected to retire at the end of 2046 after 45 years of service. His retirement is expected to span 15 years. At the end of 2021, 20 years after being hired, his salary is $84,000. The company's actuary projects Mills's salary to be $310,000 at retirement. The actuary's discount rate is 6%. (FV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Estimate the amount of Stanley Mills's annual retirement payments for the 15 retirement years earned as of the end of 2021. 2. Suppose Clark's pension plan permits a lump-sum payment at retirement in lieu of annuity payments. Determine the lump-sum equivalent as the present value as of the retirement date of annuity payments during the retirement period. 3. What is the company's projected benefit obligation at the end of 2021 with respect to Stanley Mills? 4. Even though pension accounting centers on the PBO calculation, the ABO still must be disclosed in the pension disclosure note. What is the company's accumulated benefit obligation at the end of 2021 with respect to Stanley Mills? 5. If we assume no estimates change in the meantime, what is the company's projected benefit obligation at the end of 2022 with respect to Stanley Mills? 6. What portion of the 2022 increase in the PBO is attributable to 2022 service (the service cost component of pension expense) and to accrued interest (the interest cost component of pension expense)? Check my work retirement. The actuary's discount rate is 6%. (FV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) * Required: 1. Estimate the amount of Stanley Mills's annual retirement payments for the 15 retirement years earned as of the end of 2021. 2. Suppose Clark's pension plan permits a lump-sum payment at retirement in lieu of annuity payments. Determine the lump-sum equivalent as the present value as of the retirement date of annuity payments during the retirement period. 3. What is the company's projected benefit obligation at the end of 2021 with respect to Stanley Mills? 4. Even though pension accounting centers on the PBO calculation, the ABO still must be disclosed in the pension disclosure note. What is the company's accumulated benefit obligation at the end of 2021 with respect to Stanley Mills? 5. If we assume no estimates change in the meantime, what is the company's projected benefit obligation at the end of 2022 with respect to Stanley Mills? 6. What portion of the 2022 increase in the PBO is attributable to 2022 service (the service cost component of pension expense) and to accrued interest (the interest cost component of pension expense)? (For all requirements, round final answers to the nearest whole dollars.) cos 1. Annual retirement payments 2. PV of retirement annuity 3. Projected benefit obligation 4. Accumulated benefit obligation 5. Projected benefit obligation 6. Interest cost Service cost $ $ 60,826 249,845 13,469 11,897 $ $ Check my work Lacy Construction has a noncontributory, defined benefit pension plan. At December 31, 2021, Lacy received the following information: Projected Benefit Obligation Balance, January 1 Service cost Prior service cost Interest cost(5.08) Benefits paid Balance, December 31 ($ in millions) $ 880 78 30 44 d (82) $950 Plan Assets Balance, January 1 Actual return on plan assets Contributions 2021 Benefits paid Balance, December 31 (s in millions) $ 410 44 78 (82) $450 The expected long-term rate of return on plan assets was 10%. There were no AOCI balances related to pensions on January 1, 2021. At the end of 2021, Lacy amended the pension formula creating a prior service cost of $30 million. Required: 1. Determine Lacy's pension expense for 2021. 2. Prepare the journal entry(s) to record Lacy's (a) pension expense, (b) gains or losses. (c) prior service cost, (d) funding, and (e) payment of retiree benefits for 2021. Complete this question by entering your answers in the tabs below

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts