Question: okmarks People Tab Window Help Defining Surplus Spending Unit x + urses/_258191_1/cl/outline w Timer astion Completion Status: Problem 5 (5 pts) As a personal financial

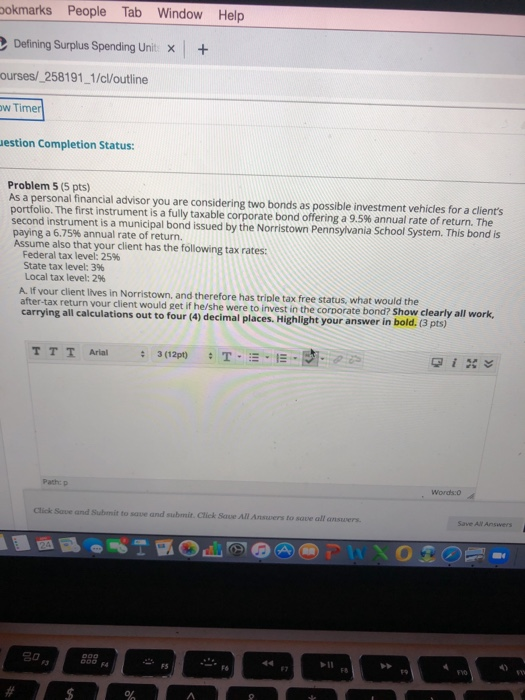

okmarks People Tab Window Help Defining Surplus Spending Unit x + urses/_258191_1/cl/outline w Timer astion Completion Status: Problem 5 (5 pts) As a personal financial advisor you are considering two bonds as possible investment vehicles for a client's portfolio. The first instrument is a fully taxable corporate bond offering a 9.5% annual rate of return. The second instrument is a municipal bond issued by the Norristown Pennsylvania School System. This bond is paying a 6.75% annual rate of return. Assume also that your client has the following tax rates: Federal tax level: 25% State tax level: 3% Local tax level: 2% A If your client lives in Norristown, and therefore has triple tax free status, what would the after-tax return your client would get if he/she were to invest in the corporate bond? Show clearly all work, carrying all calculations out to four (4) decimal places. Highlight your answer in bold. (3 pts) TTT Arial 3(12pt) T.E - E Path Words Click Save and Sutonit to save and submit. Click Save All Answers to save all answers Save Al Answers okmarks People Tab Window Help Defining Surplus Spending Unit x + urses/_258191_1/cl/outline w Timer astion Completion Status: Problem 5 (5 pts) As a personal financial advisor you are considering two bonds as possible investment vehicles for a client's portfolio. The first instrument is a fully taxable corporate bond offering a 9.5% annual rate of return. The second instrument is a municipal bond issued by the Norristown Pennsylvania School System. This bond is paying a 6.75% annual rate of return. Assume also that your client has the following tax rates: Federal tax level: 25% State tax level: 3% Local tax level: 2% A If your client lives in Norristown, and therefore has triple tax free status, what would the after-tax return your client would get if he/she were to invest in the corporate bond? Show clearly all work, carrying all calculations out to four (4) decimal places. Highlight your answer in bold. (3 pts) TTT Arial 3(12pt) T.E - E Path Words Click Save and Sutonit to save and submit. Click Save All Answers to save all answers Save Al Answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts