Question: Old MathJax webview 1st image 2nd image 3rd image 4th image 5th image 6th image 7th image 8th image 9th image Hello, I need help

Old MathJax webview

1st image

2nd image

3rd image

4th image

5th image

6th image

7th image

8th image

9th image

Hello,

I need help with this question. I couldn't take the whole picture at once, I had to take 9 screenshots to fit the Chegg image dimension. The deadline is in an hour from now..

Thank you.

Here is the complete "unadjusted trial balance."

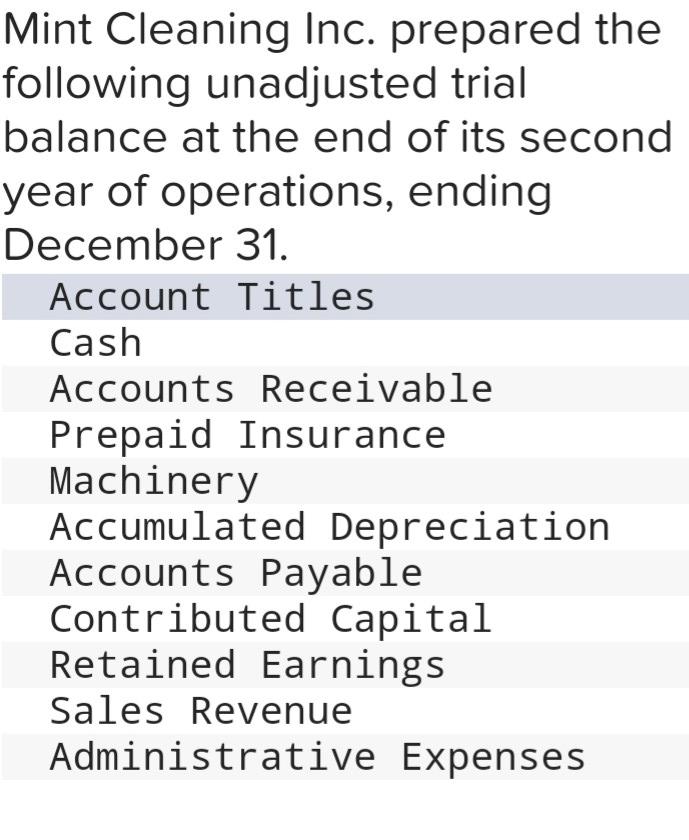

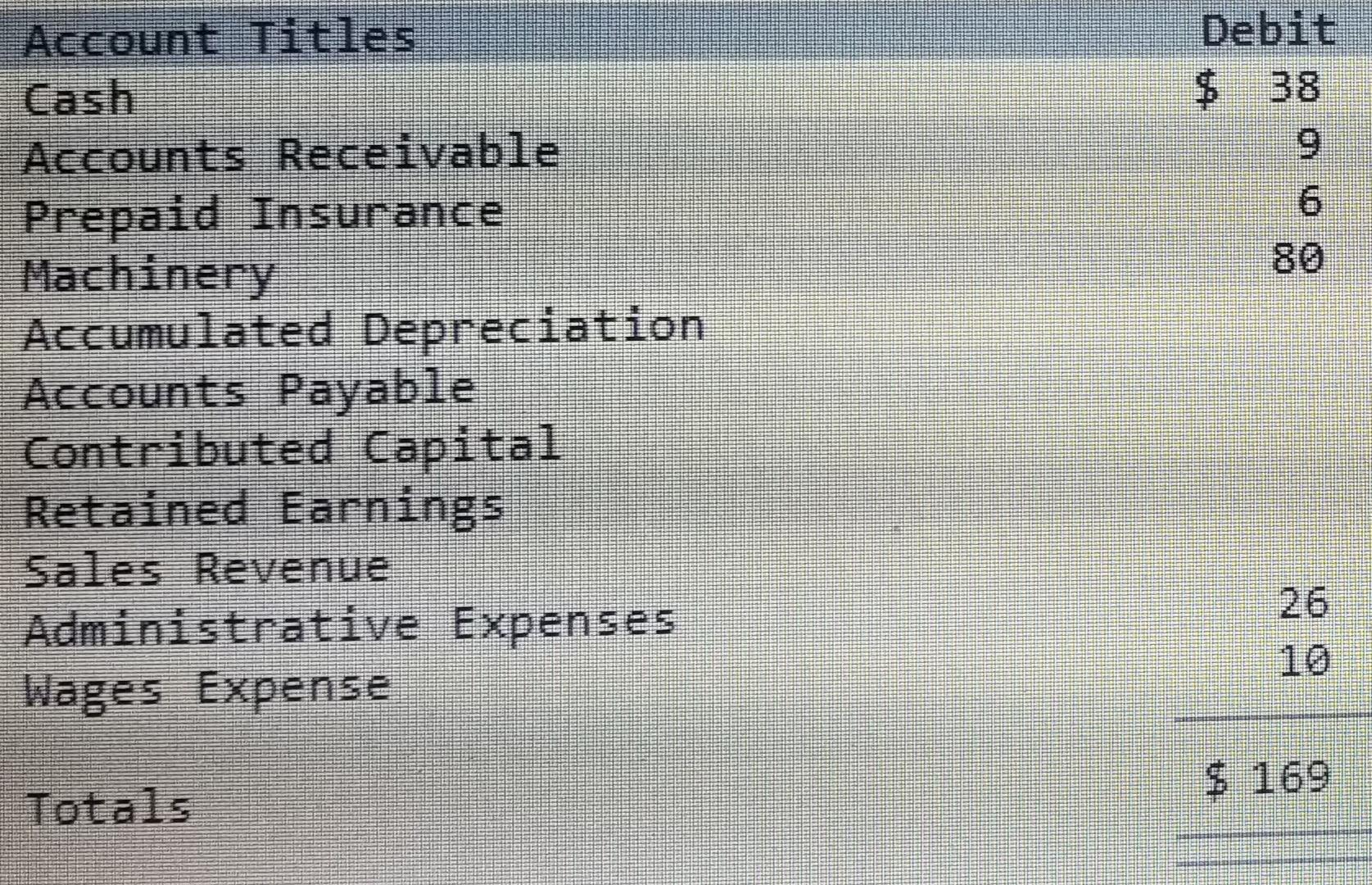

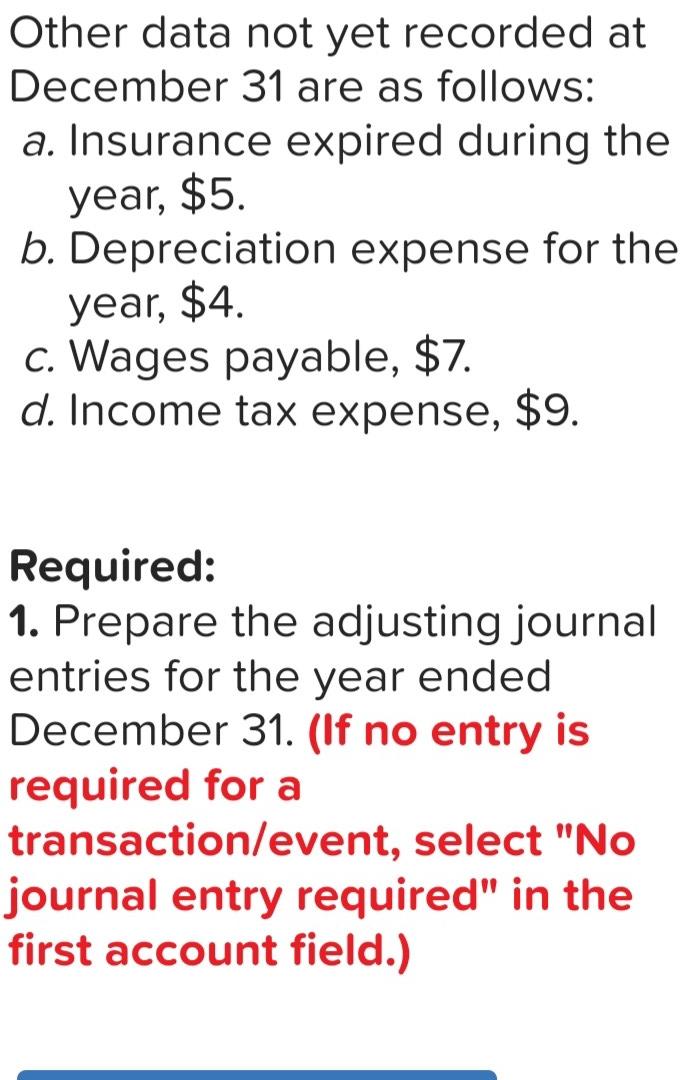

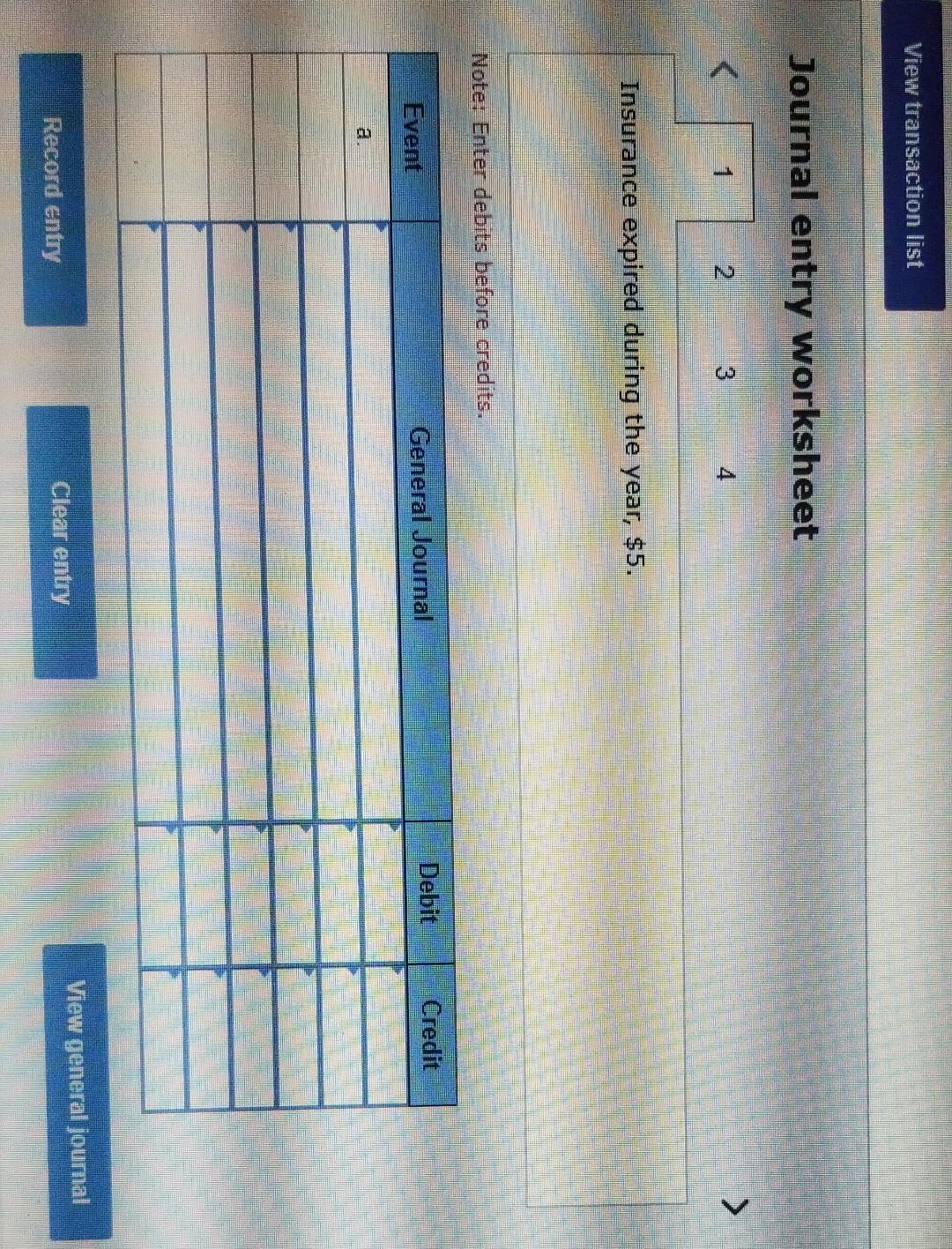

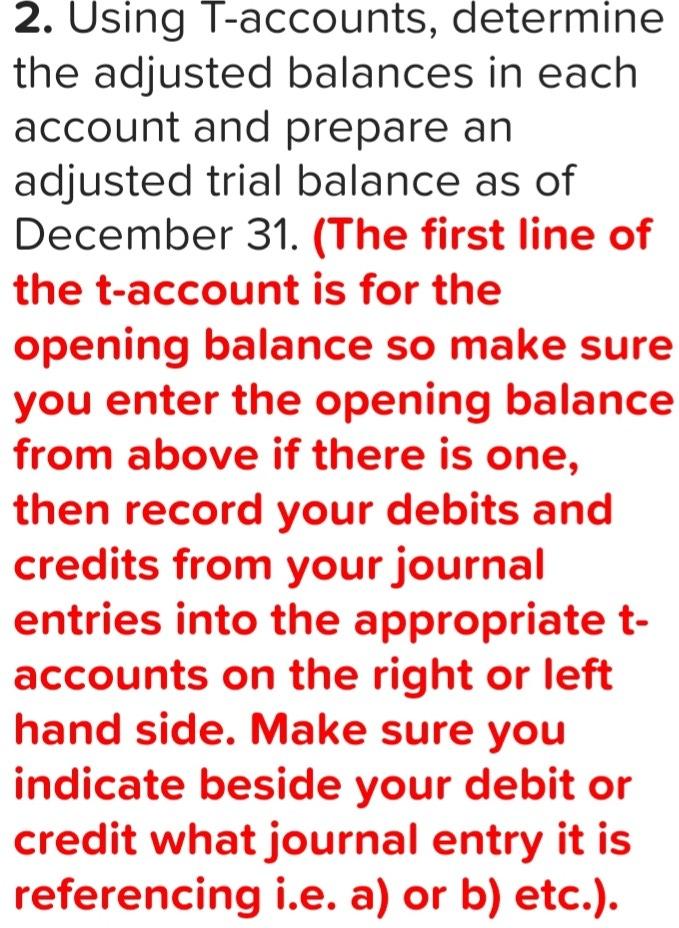

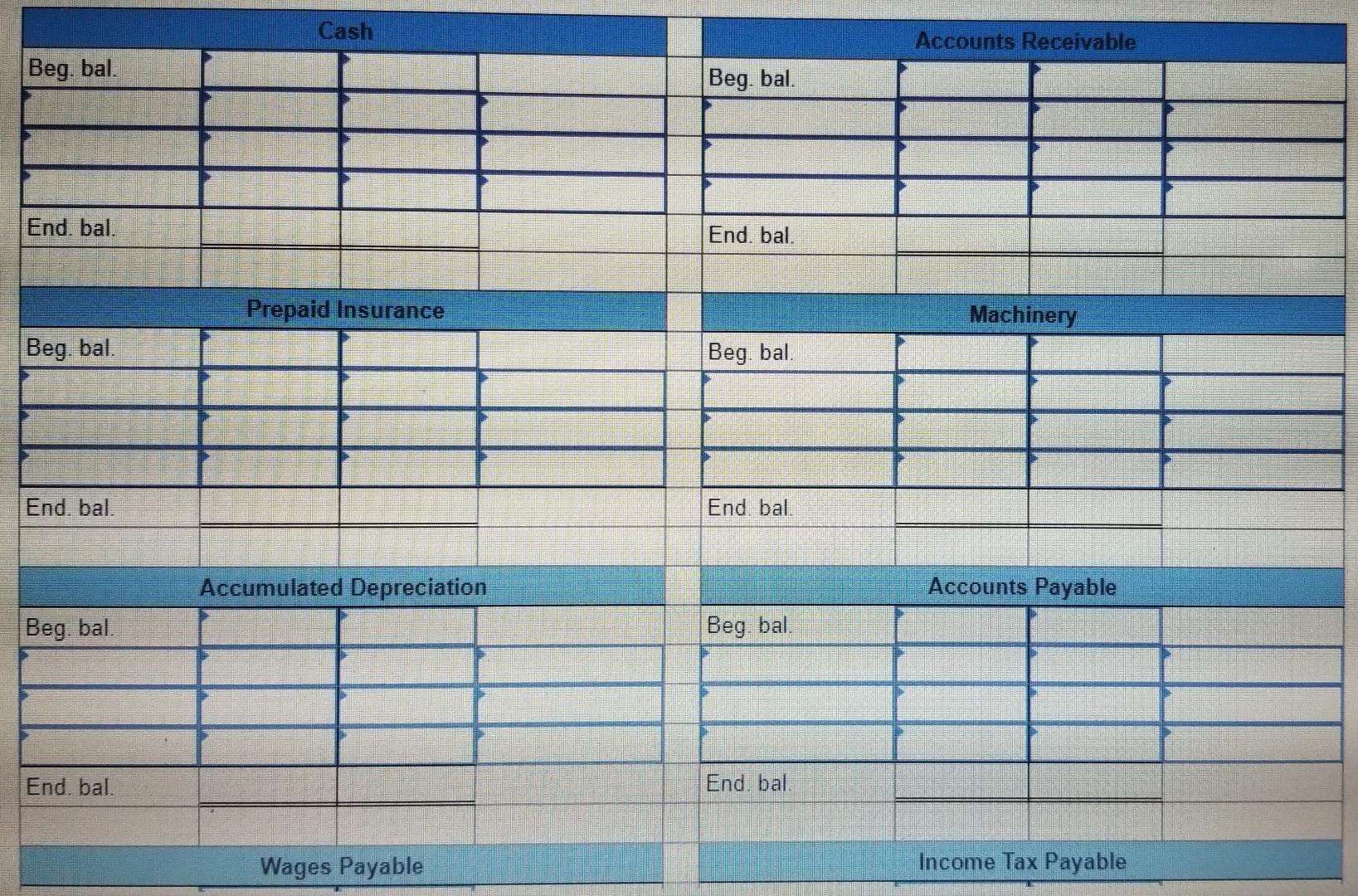

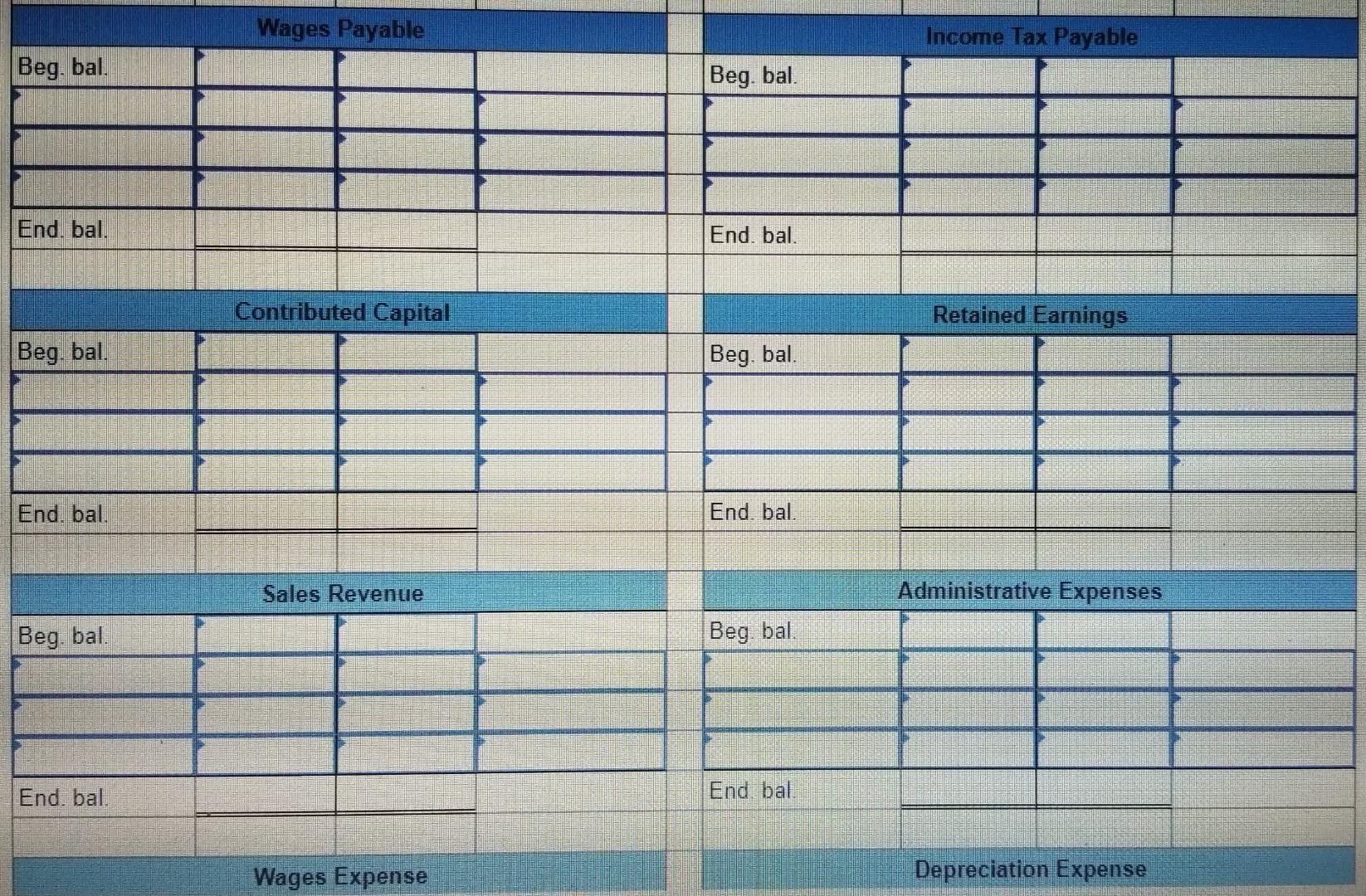

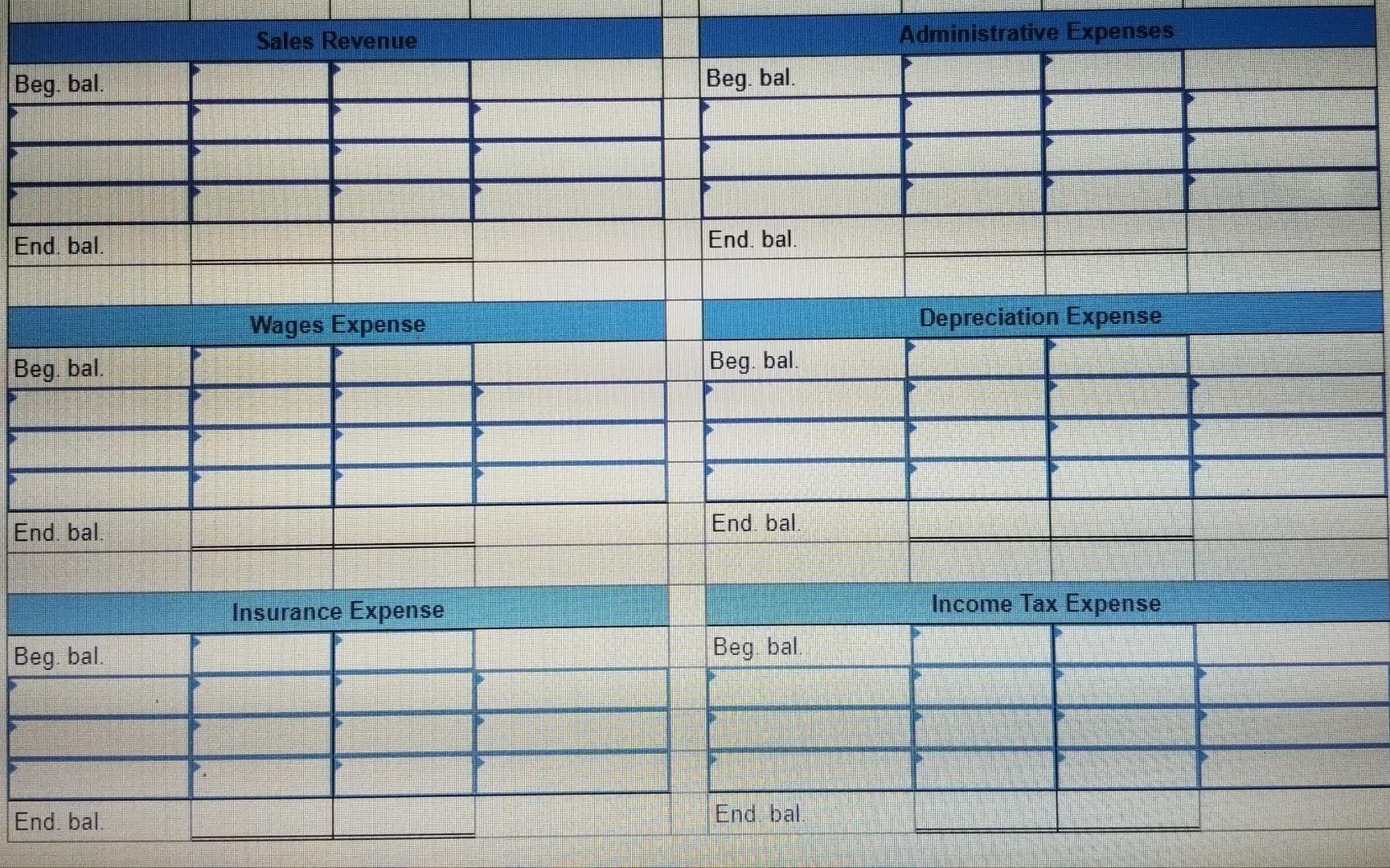

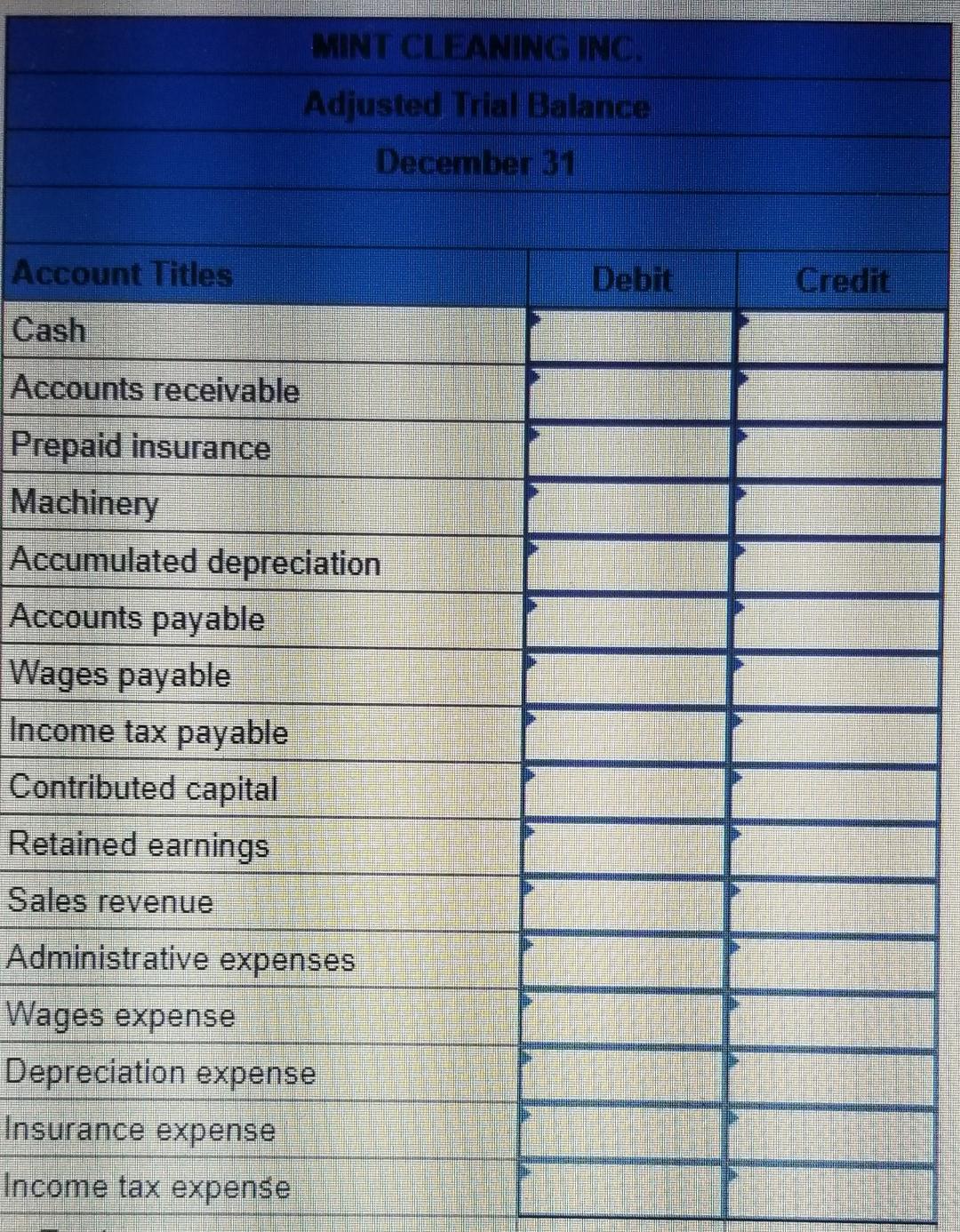

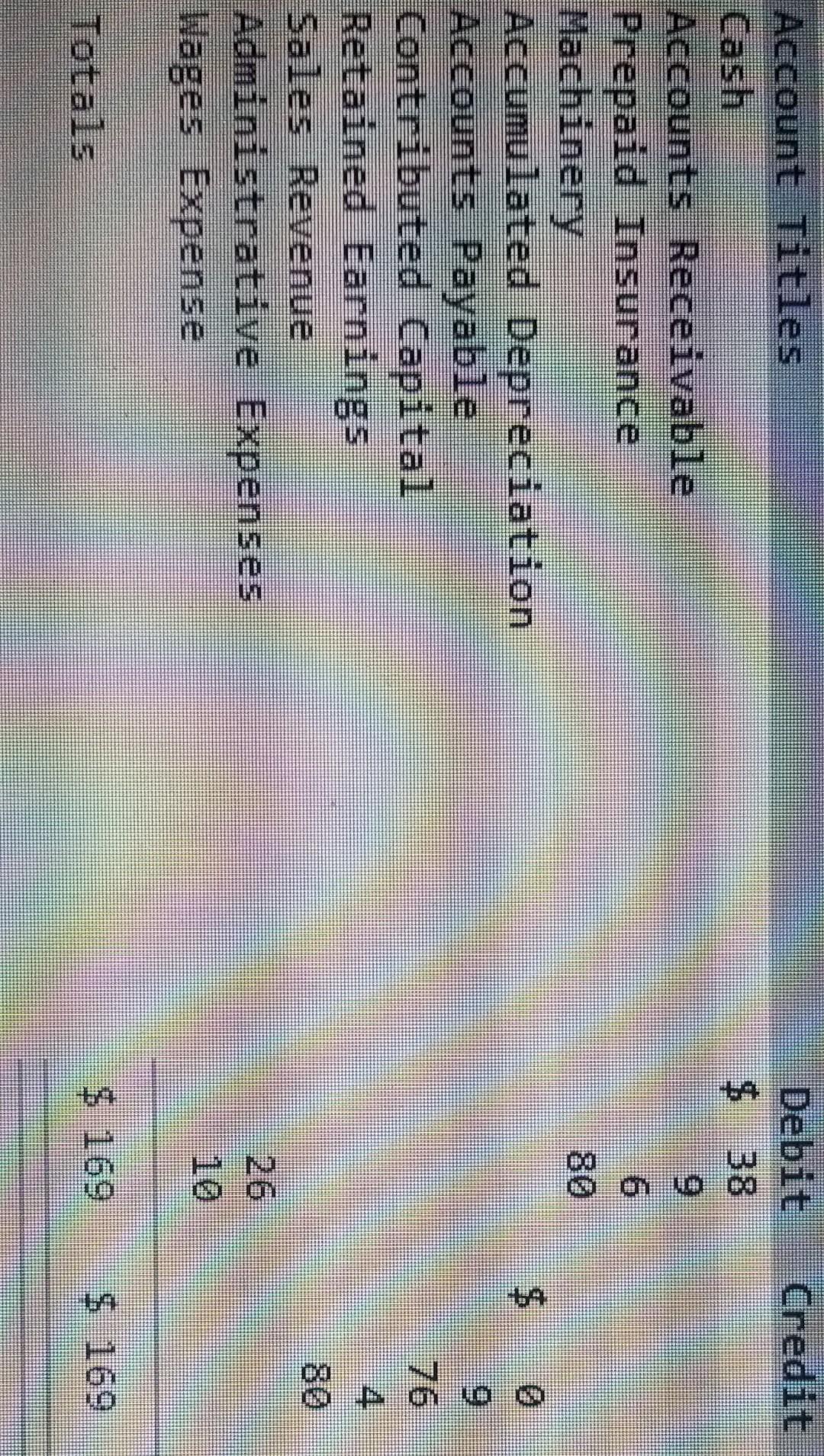

Mint Cleaning Inc. prepared the following unadjusted trial balance at the end of its second year of operations, ending December 31. Account Titles Cash Accounts Receivable Prepaid Insurance Machinery Accumulated Depreciation Accounts Payable Contributed Capital Retained Earnings Sales Revenue Administrative Expenses Debit $ 38 9 6 Account Titles Cash Accounts Receivable Prepaid Insurance Machinery Accumulated Depreciation Accounts Payable Contributed Capital Retained Earnings Sales Revenue Administrative Expenses Wages Expense 10 $ 169 Totals Other data not yet recorded at December 31 are as follows: a. Insurance expired during the year, $5. b. Depreciation expense for the year, $4. c. Wages payable, $7. d. Income tax expense, $9. Required: 1. Prepare the adjusting journal entries for the year ended December 31. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 2 3 4 Insurance expired during the year, $5. Note: Enter debits before credits. Credit Debit Event General Journal View general joumal Record entry Clear entry 2. Using T-accounts, determine the adjusted balances in each account and prepare an adjusted trial balance as of December 31. (The first line of the t-account is for the opening balance so make sure you enter the opening balance from above if there is one, then record your debits and credits from your journal entries into the appropriate t- accounts on the right or left hand side. Make sure you indicate beside your debit or credit what journal entry it is referencing i.e. a) or b) etc.). Cash Accounts Receivable Beg. bal. Beg. bal. End, bal. End. bal. Prepaid Insurance Machinery Beg. bal. Beg. bal. End, bal. End bal. Accumulated Depreciation Accounts Payable Beg. bal. Beg bal. End, bal. End, bal Wages Payable Income Tax Payable Wages Payable Income Tax Payable Beg. bal. Beg. bal. End. bal. End. bal. Contributed Capital Retained Earnings Beg. bal. Beg. bal. End, bal. End, bal Sales Revenue Administrative Expenses Beg. bal. Beg bal. End. bal. End bal Wages Expense Depreciation Expense Sales Revenue Administrative Expenses Beg. bal. Beg. bal. End. bal. End, bal. Wages Expense Depreciation Expense Beg. bal. Beg. bal. End. bal. End. bal. Insurance Expense Income Tax Expense Beg. bal. Beg bal. End, bal. End bal. MINT CLEANING INC Adjusted Trial Balance December 31 Account Titles Debit Credit Cash Accounts receivable Prepaid insurance Machinery Accumulated depreciation Accounts payable Wages payable Income tax payable Contributed capital Retained earnings Sales revenue Administrative expenses Wages expense Depreciation expense Insurance expense Income tax expense Credit Debit $ 38 6 6 80 $ Account Titles Cash Accounts Receivable Prepaid Insurance Machinery Accumulated Depreciation Accounts Payable Contributed Capital Retained Earnings Sales Revenue Administrative Expenses Wages Expense oo 76 4 80 Totals $ 169 $ 169

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts