Question: Old MathJax webview 2009 2010 A. (20 points) Calculate the financial ratios of Kmart in 2010. Financial Ratio Formula 4.12 1. Return on Equity (ROE)

Old MathJax webview

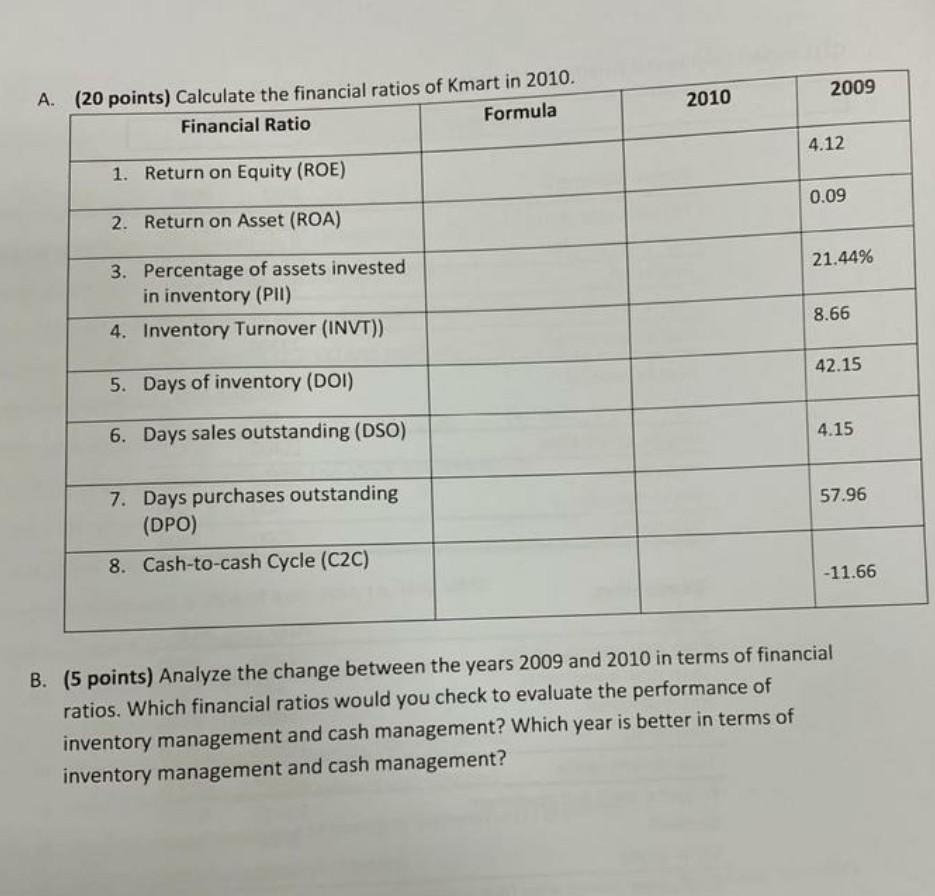

2009 2010 A. (20 points) Calculate the financial ratios of Kmart in 2010. Financial Ratio Formula 4.12 1. Return on Equity (ROE) 0.09 2. Return on Asset (ROA) 21.44% 3. Percentage of assets invested in inventory (PII) 4. Inventory Turnover (INVT)) 8.66 42.15 5. Days of inventory (DOI) 6. Days sales outstanding (DSO) 4.15 57.96 7. Days purchases outstanding (DPO) 8. Cash-to-cash Cycle (C2C) -11.66 B. (5 points) Analyze the change between the years 2009 and 2010 in terms of financial ratios. Which financial ratios would you check to evaluate the performance of inventory management and cash management? Which year is better in terms of inventory management and cash management

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock