Question: Old MathJax webview bb need right answer I will vote you According to your ans.thank you WS 3/159 acquisition Income UH other soure els 562)

Old MathJax webview

bb

need right answer I will vote you According to your ans.thank you

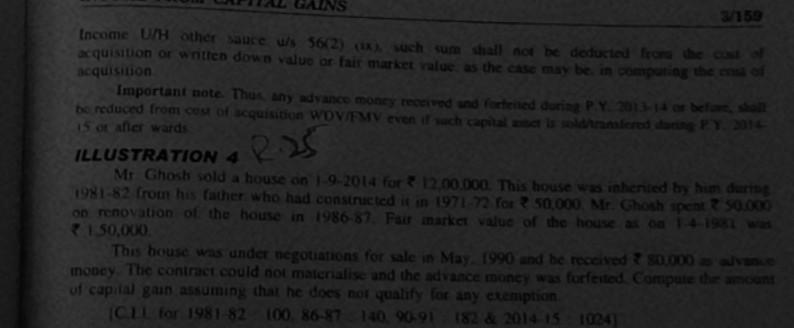

WS 3/159 acquisition Income UH other soure els 562) **) such sum shall not be deducted from the cost acquisition or written down value or fair market value as the case may be in comparing the on Important note that any advance money received and fortened duris PY21.1 or belasan be reduced from cou of acquisition WOVPV even if each cama allero de 15 of afler wards ILLUSTRATION Mi Ghosh sold a house on 1-9-2014 for 12.00.000. This house was inhented by hunderts 1981-82 from his father who had constructed in 1971-72 for 250.000. Mr. Choch spent 250.000 on renovation of the house in 1986-87 Fainarket value of the house as on 1-4-1941 150,000 This house was under negotiations for sale in May1990 and he received ? 30.000 = wale money. The contract could not materialise and the advance money was forfeited Compute the amount of capital gain assuming that he does not quality for any exemption CIL for 1981-82 100.86-87140.90.91 182 & 2014-15 104) VaR25Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts