Question: Old MathJax webview *************HOW TO SOLVE PART B************* You are a manager at Percolated Fiber, which is considering expanding its operations in synthetic fiber manufacturing.

Old MathJax webview

*************HOW TO SOLVE PART B*************

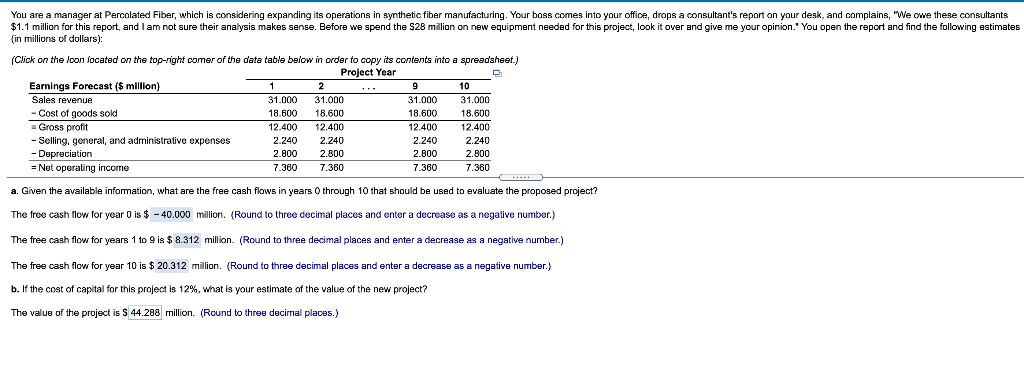

You are a manager at Percolated Fiber, which is considering expanding its operations in synthetic fiber manufacturing. Your boss comes into your office drops a consultant's report on your desk, and complains, "We owe these consultants $1.1 million for this report, and I am not sure their analysis makes sense. Before we spend the S28 million on new equipment needed for this project, look it over and give me your opinion. You open the report and find the following estimates in millions of dollars): (Click on the loon located on the top-night comer of the data table below in order to copy its contents into a spreadsheet.) Project Year D Earnings Forecast ($ million) 1 2 9 10 Sales revenue 31.000 31.000 31.000 31.000 - Cost of goods sold 18.600 18.600 18.600 18.600 Gross profit 12.400 12.400 12.400 12.400 -Selling, general, and administrative expenses 2.240 2.240 2.240 2.240 - Depreciation 2.800 2.800 2.800 2.800 = Net operating income 7.360 7.360 7.360 7.380 a. Given the available information, what are the free cash flows in years through 10 that should be used to evaluate the proposed project? The free cash flow for year 0 is $ - 40.000 million. (Round to three decimal places and enter a decrease as a negative number.) The free cash flow for years 1 to 9 is $ 8.312 million. (Round to three decimal places and enter a decrease as a negative number.) The free cash flow for year 10 is $ 20.312 million. (Round to three decimal places and enter a decrease as a negative number.) b. If the cost of capital for this project is 12%, what is your estimate of the value of the new project? The value of the project is $ 44.288 million. (Round to three decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts