Question: Old MathJax webview Imesimerr old road spring 2001 - Word mohamed mohsen 0 Hom. Insert Design Layout Ricerences Mailings Review View Heip Time what you

Old MathJax webview

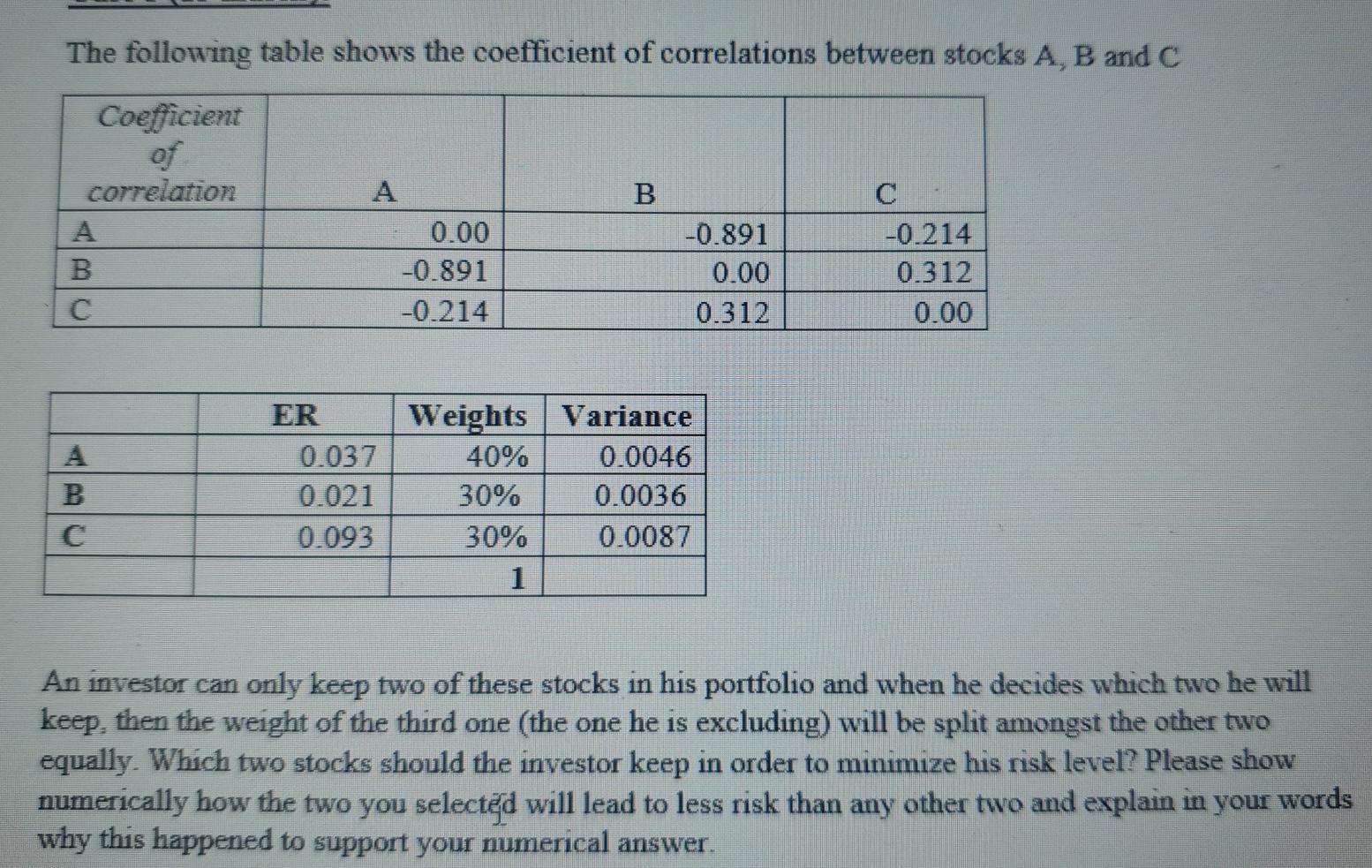

Imesimerr old road spring 2001 - Word mohamed mohsen 0 Hom. Insert Design Layout Ricerences Mailings Review View Heip Time what you want to do A Share El Rele Uralt One Page W CE Mubple Pages Paga Width Gridir Navigation Pane Bend Prin Web Side by Side Schronous scrolling Window Position Wind verticale Lo sie Zoom Switch Micros Properties Mu Laul Layout New Arrange Spit Wind. Al Page Movement Show 2oom Window Nacres SharePoint Case 5 (13 marks: The following table shows the coefficient of comelations hetween stocks A Rand Coefficient of correlarion A B 0.891 0.214 0.00 -0.891 B 0.00 0.312 0.00 C 0.214 0.312 ER A B 0.037 0.021 Weights Variance 0.0016 30% 0.0036 30% 0.0087 1 0.093 An investor can caly keep two of these stocks an has poattolio and when he decades winch two he will keep, then the weight of the third one (the one he is excluding) will be split amongst the other two quelly Winch two stocks should the mesto keep in order to minimize his siek tevet? Please show mumerically how the two you selected will lead to less risk than any other two and explain in your words why this happened to support your numerical manner Rest of luck Reyes als 902 wurde D English (United States ALISE 100% 2:27 PM Type here to search YU'S 4 ENG 6/10/2001 The following table shows the coefficient of correlations between stocks A, B and C Coefficient of correlation B C 0.00 -0.891 -0.214 B -0.891 0.00 0.312 C -0.214 0.312 0.00 ER 0.037 Weights Variance 40% 0.0046 30% 0.0036 B 0.021 0.093 30% 0.0087 1 An investor can only keep two of these stocks in his portfolio and when he decides which two he will keep, then the weight of the third one (the one he is excluding) will be split amongst the other two equally. Which two stocks should the investor keep in order to minimize his risk level? Please show numerically how the two you selected will lead to less risk than any other two and explain in your words why this happened to support your numerical

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts