Question: Old MathJax webview make financial plann!! CASE STUDY 1 -TOM AND VIV ELIOT 0 Background Tom and Viv Eliot met with you on April 1,

Old MathJax webview

make financial plann!!

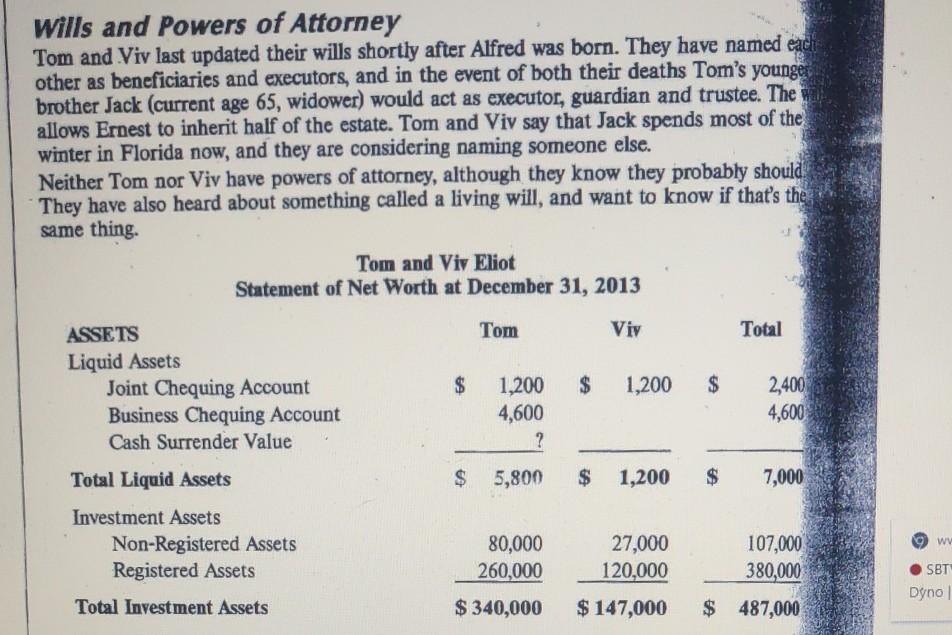

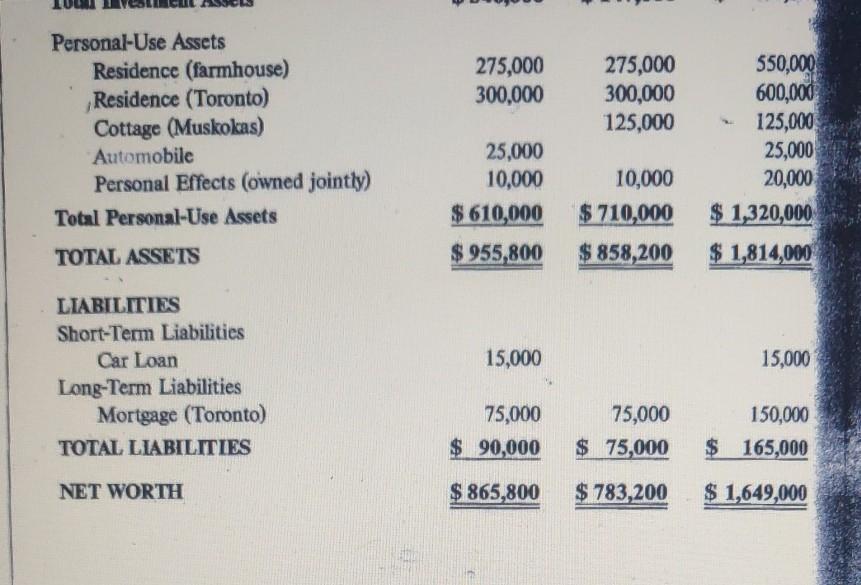

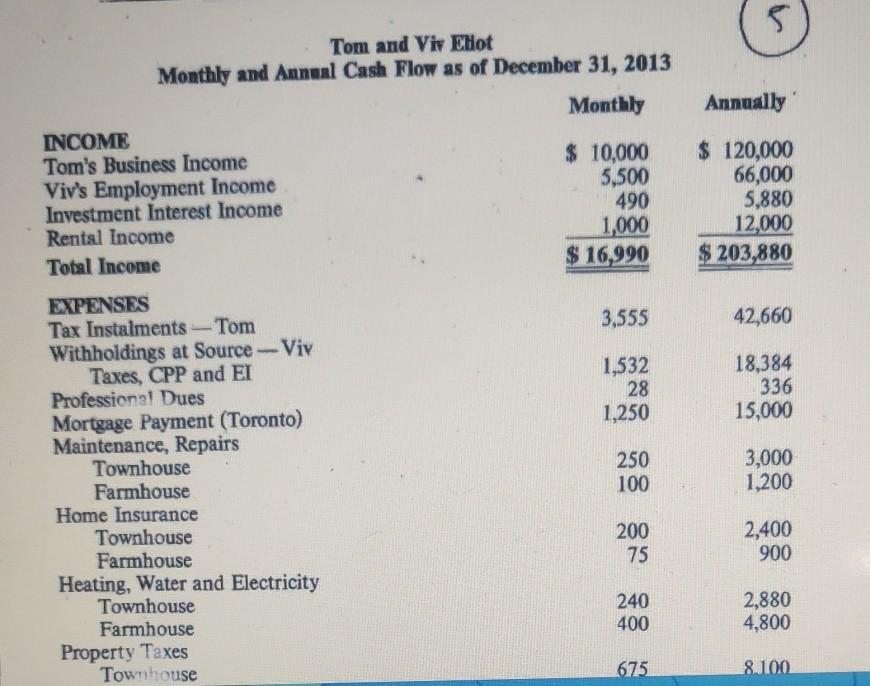

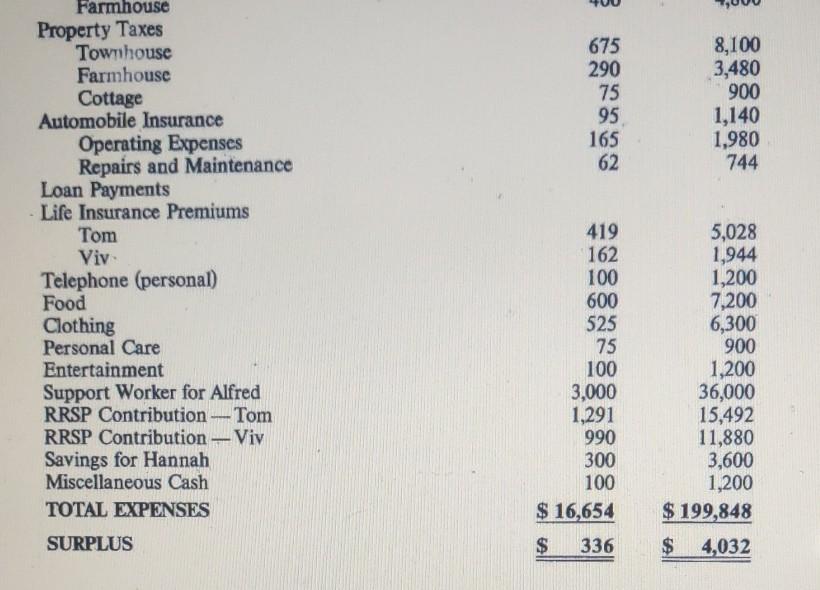

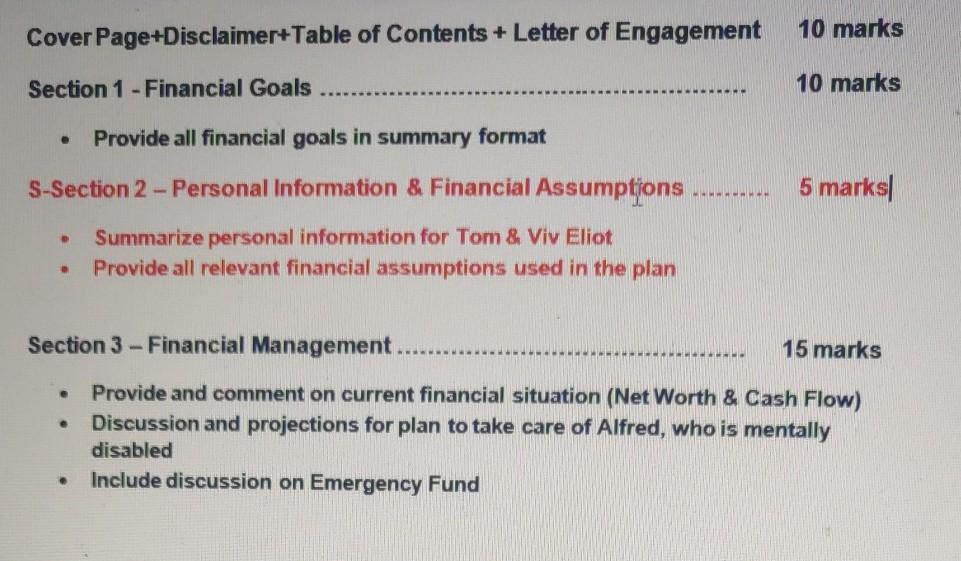

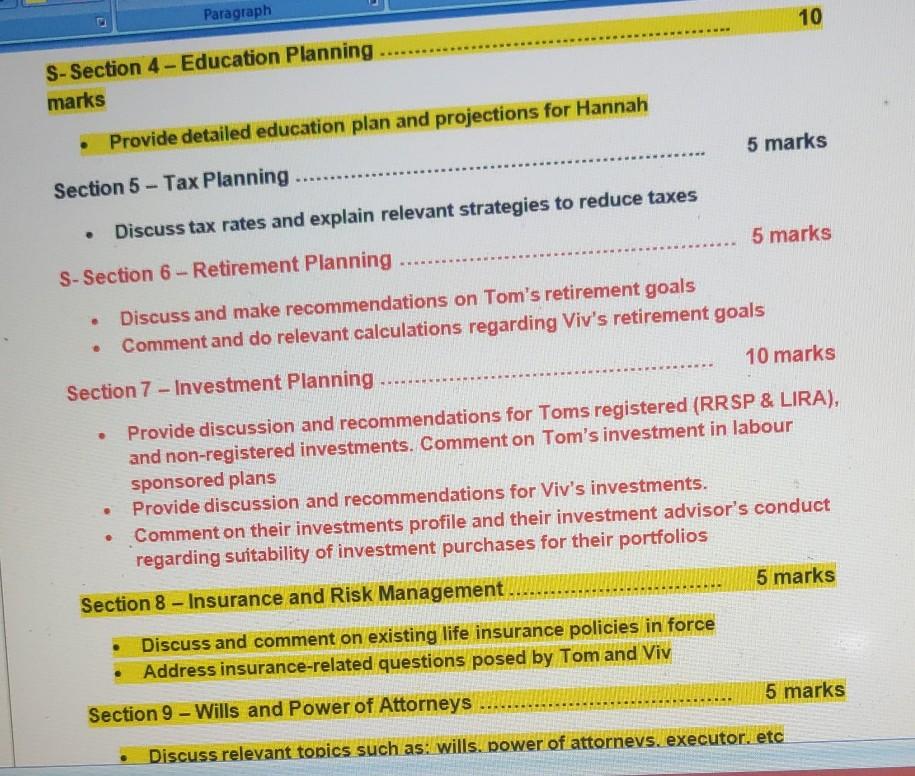

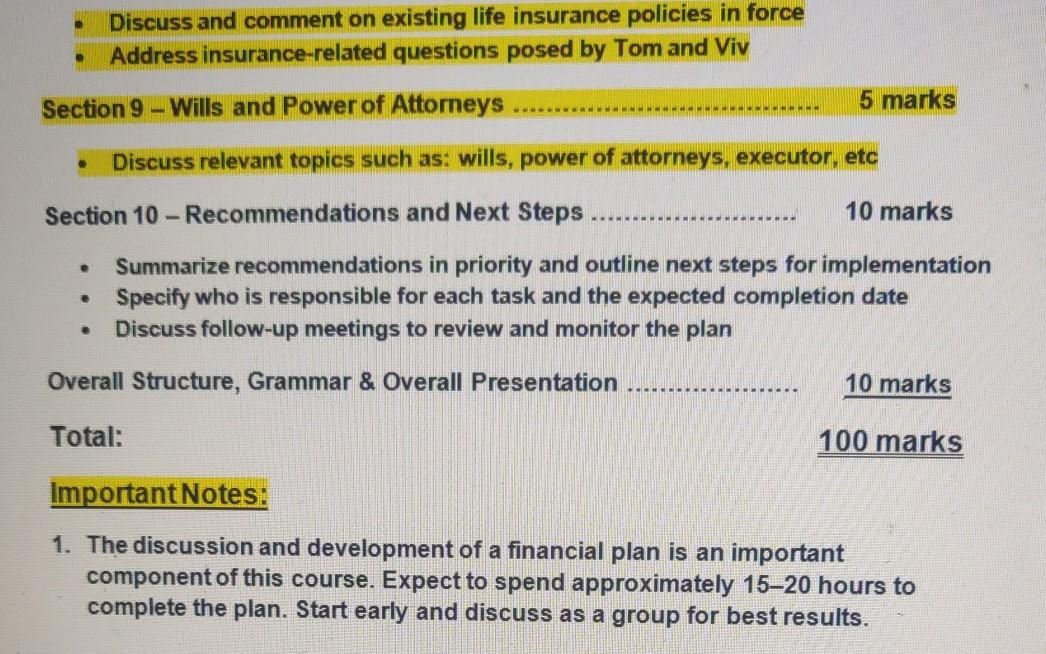

CASE STUDY 1 -TOM AND VIV ELIOT 0 Background Tom and Viv Eliot met with you on April 1, 2014 in order to get a second opinion on their financial situation. They say that they are unhappy with their current CFP professional, who they feel has sometimes pressured them into purchasing investment and insurance products they did not completely understand. They are particularly concerned about the taxes they pay on their non-registered portfolios, and they are also worried they may not be able to leave enough money to their son Alfred, who is mentally disabled. They tell you that theyve never really had anyone prepare a complete financial plan for them in the past, but Viv has prepared net worth and cash flow statements to give you a better idea of their situation (see Tables). Personal Information Tom Eliot (age 70) and Viv Eliot (age 58) live in a small town outside of Ottawa, Ontario. They have been married for 33 years. Both live a very healthy lifestyle. They exercise regularly, eat a balanced diet, and are both non-smokers. They have two children - Ernest (age 31) and Alfred (age 17). Ernest has just finished his Ph.D. in English literature and is working as an associate professor at a university in British Columbia. He is married to Mary (age 30), who is also a university professor, and they have a seven-year-old daughter named Hannah. Tom and Viv say that they were happy to help Ernest financially when he went to school, and they are prepared to do the same for his daughter. They would like to set aside $3,600 every year for her education. The Eliots' other son, Alfred, was born with Down syndrome. He is able to attend special- ized classes at the local high school, but Tom and Viv say that he relies on them com- The Eliots' other son, Alfred, was born with Down syndrome. He is able to attend special- ized classes at the local high school, but Tom and Viv say that he relies on them com- pletely. They have retained the services of a part-time support worker to help them look after Alfred, and they worry about whether he will be able to manage financially after thei- deaths. Employment Information Details of Tom's Business Tom is the sole proprietor of a small media company, Eliot Publishing, which he runs from an office in his home. He has no employees, but he does contract the services of several freelance editors to help him edit manuscripts and co-ordinate the printing of the books ha publishes. Tom has few expenses besides production costs, such as a cellphone and a sepatate business phone line and fax line, and usually takes home about $120,000 before taxes. He is considering incorporating the business, Tom says he has no plans to retire, and hopes to keep working for at least another 10 years One of the freelance editors has expressed an interest in investing in the company and becoming a partner, but Tom says that he isn't prepared to give up control just yet. Details of Viv's Employment Viv works as an in-house translator at Big Time Translations, an independent agency in Ottawa. She earns $66,000 a year and has worked at Big Time since 1993. Big Time has lost several important contracts over the last few years, and her boss has just offered her a $35,000 severance package. She will be leaving the company at Christmas. Viv says that she plans to start her own business and will work as a part-time freelance translator next year. She says she won't miss commuting, and her employer did not provide health, dental, or retirement benefits anyway. She is wondering if it would be worthwhile renovating an extra bedroom that she could use as her own office at home, or whether she should just share the room Tom already uses as his office. 2) Financial Position Real Estate Tom and Viv purchased their home 31 years ago for $40,000 and paid off the mortgage quite a few years ago. It is an old Victorian farmhouse, and they own it jointly. After all the improvements the Eliots have made, its value has grown significantly. It has 10 bedrooms and was recently appraised at $550,000. mprovements and was recently appraised at $550,000. They also own a 1,600 square foot townhouse in a fashionable part of Toronto, which feu purchased in 1997 for $180,000. They own it jointly as well. A friend of theirs who is a real estate agent recently told them that the property is now worth $600,000. They currently rent out the bottom floor and keep the small apartment (about 700 square feet) at the cos of the house for personal use. The Eliots spend at least one weekend a month there, as as a good part of their summer holidays. Viv also owns half of a cottage in the Muskokas with her sister, Susan. They are tenants in common. When they inherited it from her mother 10 years ago, the cottage was valued a $50,000. It is now worth $250,000. Neither Susan nor Viv spend much time there, especials now that Susan lives in Newfoundland. However, Susan's daughter, Samantha, spends thos! of the summer there and often has Alfred up to stay for several weeks to give Tom and 1. a bit of time to themselves - Samantha does not pay any rent for the cottages but Viv say she is happy to have someone so reliable looking after the place for them. She says it means a great deal to Alfred to be able to spend time there with Samantha. Tom's Investments, Registered: Tom's RRSP portfolio cosists of the following investments: $28,000 GrowGreat Canadian Precious Metals Fund $27,000 GrowGreat American Small Cap Fund $48,000 GrowGreat Canadian Aggressive Growth Fund $20,000 GrowGreat S&P/TSX 60 Index Fund $18,000 GrowGreat Telecommunications Fund $15,000 GrowGreat Labour-Sponsored Fund On the advice of their current adviser, Tom has put $5,000 into the GrowGreat Labour Sponsored Fund every year, for a total investment of $30,000. He received a 30% tax credit in total each year from the federal and provincial governments. The market value of the On the advice of their current adviser, Tom has put $5,000 into the Grow Great Labour Sponsored Fund every year, for a total investment of $30,000. He received a 30% tax er in total each year from the federal and provincial governments. The market value of li investment has declined to $15,000. Tom says he is very unhappy with the way most funds have performed, especially the Labour-Sponsored Fund. Tom also has $89,000 in a locked-in retirement account. The money is in a money mai fund and the account is held by the same company that managed his former employers pension plan. Tom wants to know what, if anything, he can do with these funds. Tom's Investments, Non-Registered Tom says that, in an attempt to make up for all the money he was losing in his RRSP opened up an account at a discount brokerage. Based on information he read in the new paper, he decided to invest a total of $60,000 in the ABC Bond Fund. The market value the fund is now $80,000. Tom says he's happy to earn the extra money, currently about 3 a year, but hates having to pay tax on this interest income. He says he has already max: mized his RRSP, or he would transfer the money there. Viv's Investments, Registered Like Tom, Viv has invested most of her registered funds in very aggressive GrowGreat Funds: $8,000 GrowGreat Canadian Precious Metals Fund $12,000 GrowGreat Japan Small Cap Fund $37,000 GrowGreat Canadian Aggressive Growth Fund $18,000 GrowGreat Canadian Telecommunications Fund 3 $15,000 GrowGreat Labour-Sponsored Fund She is as displeased as Tom with the performance of her investments, and says that she has lost sleep worrying about her investments. She also invested $30,000 in the Labour Spon- sored Fund, and her other investments have a book value of $100,000. She says she would prefer a more conservative portfolio. Viv's Investments, Non-Registered Viv has always purchased Canada Savings Bonds (CSBs), and currently holds $27,000 in various series, with earnings averaging 4% annually. While she likes the regular interest income the CSBs generate, she would like to find a way to reduce the taxes she pays. She wishes she could transfer them to her RRSP but she has no more contribution room available. Liabilities Tom and Viv pay their entire credit card bill each month, and do not have any outstanding personal loans except for a small car loan of $15,000 at 4%. They still have a $150,000 mortgage at 6.9% on their Toronto property, and the rate is locked in for the next two years. They are paying $1,250 every month in principal and interest. Viv says that she will have to either purchase or lease a computer when she starts working from home. The computer she is looking at retails for $3,500. Insurance Information Tom has a T-100 life insurance policy with a face value of $300,000, and Viv has a $280,000 five-year term life insurance coverage thmush her university alumni nlan Tom Insurance Information Tom has a T-100 life insurance policy with a face value of $300,000, and Viv has a $280,000 five-year term life insurance coverage through her university alumni plan. Tom was unable to find his last statement from the insurance company, but the policy is more than 10 years old and he thinks it may have a cash surrender value. Viv is worried about what will happen when her term insurance policy expires. They have named each other as beneficiaries on their policies. Neither Tom nor Viv have disability insurance, Children They want to make sure that Alfred is provided with a decent and reliable level of income for the rest of his life. They love their son Ernest very much, but they say that he is not at all good with money. They say that he is a terrible spendthrift, and they are worried he would spend any money they give to him. They would like whatever money that is left after Alfred dies to go to their granddaughter, Hannah Risk Profile Both Tom and Vit describe themselves as extremely conservative investors who cannot tolerate short-term volatility. They say that they would rather earn a lower rate of return than face the ups and downs of the stock market. They say that they told their adviser this, but that he later telephoned and pushed them into buying growth investment funds anyway. They have shown you copies of their original investment applications, and they have pointed to where they checked off boxes indicating they had "little or no" tolerance for risk. They say their adviser often makes "adjustments" to their investment mix, and only informs them of changes after the fact. They do not remember ever signing a form to authorize him to do this, and wonder if it is a common practice. Goals and objectives Tom and Viv say that their number one priority is to make sure that Alfred is able to live comfortably after their deaths. They have heard that if they leave money in a trust for Alfred, he might not be able to receive his disability benefits. They want to know if there is any way to deal with this problem, 19 Tom says he doesn't want to retire. He enjoys his job and wants to keep working as long as he is physically able. He's deferred CPP income as long as possible, and he hasn't converted his RRSPURRIF yet, but now that he's approaching 71 he knows he'll have to act soon! He wants to receive as little income as possible, and wants to minimize his income taxes. Viv says she'd like to stop working at age 60 and spend more time with Alfred, and perhap help Tom with his business. She says that her needs are quite modest; she'd like to have a retirement income of about $30,000 before taxes. Wills and Powers of Attorney Tom and Viv last updated their wills shortly after Alfred was born. They have named each other as beneficiaries and executors, and in the event of both their deaths Tom's younger brother Jack (current age 65, widower) would act as executor, guardian and trustee. The allows Ernest to inherit half of the estate. Tom and Viv say that Jack spends most of the winter in Florida now, and they are considering naming someone else. Neither Tom nor Viv have powers of attorney, although they know they probably should They have also heard about something called a living will, and want to know if that's the same thing Tom and Viv Eliot Statement of Net Worth at December 31, 2013 Tom Viv Total ASSETS Liquid Assets Joint Chequing Account Business Chequing Account Cash Surrender Value $ $ 1,200 $ 1,200 4,600 ? 2,400 4,600 $ 5,800 $ 1,200 $ 7,000 Total Liquid Assets Investment Assets Non-Registered Assets Registered Assets WY 80,000 260,000 27,000 120,000 107,000 380,000 SBT Dyno Total Investment Assets $ 340,000 $ 147,000 $ 487,000 275,000 300,000 Personal-Use Assets Residence (farmhouse) Residence (Toronto) Cottage (Muskokas) Automobile Personal Effects (owned jointly) Total Personal-Use Assets 275,000 300,000 125,000 25,000 10,000 $ 610,000 550,000 600,000 125,000 25,000 20,000 $ 1,320,000 $ 1,814,000 10,000 $ 710,000 TOTAL ASSETS $ 955,800 $ 858,200 15,000 15,000 LIABILITIES Short-Term Liabilities Car Loan Long-Term Liabilities Mortgage (Toronto) TOTAL LIABILITIES 75,000 $ 90,000 75,000 $ 75,000 150,000 $ 165,000 NET WORTH $ 865,800 $ 783,200 $ 1,649,000 Annually $ 120,000 66,000 5,880 12,000 $ 203,880 42,660 Tom and Vir Elliot Monthly and Annual Cash Flow as of December 31, 2013 Monthly INCOME Tom's Business Income $ 10,000 Viv's Employment Income 5,500 Investment Interest Income 490 Rental Income 1,000 Total Income $ 16,990 EXPENSES Tax Instalments - Tom 3,555 Withholdings at Source - Viv Taxes, CPP and EI 1,532 Professional Dues 28 Mortgage Payment (Toronto) 1,250 Maintenance, Repairs Townhouse 250 Farmhouse 100 Home Insurance Townhouse 200 Farmhouse 75 Heating, Water and Electricity Townhouse 240 Farmhouse 400 Property Taxes Townhouse 675 18,384 336 15,000 3,000 1,200 2,400 900 2,880 4,800 8.100 675 290 75 95 165 62 8,100 3,480 900 1,140 1,980 744 Farmhouse Property Taxes Townhouse Farmhouse Cottage Automobile Insurance Operating Expenses Repairs and Maintenance Loan Payments Life Insurance Premiums Tom Viv Telephone (personal) Food Clothing Personal Care Entertainment Support Worker for Alfred RRSP Contribution - Tom RRSP Cont ition - Viv Savings for Hannah Miscellaneous Cash TOTAL EXPENSES 419 162 100 600 525 75 100 3,000 1,291 990 300 100 $ 16,654 5,028 1,944 1,200 7,200 6,300 900 1,200 36,000 15,492 11,880 3,600 1,200 $ 199,848 $ 4,032 SURPLUS $ 336 Cover Page+Disclaimer+Table of Contents + Letter of Engagement 10 marks Section 1 - Financial Goals 10 marks . Provide all financial goals in summary format S-Section 2 - Personal Information & Financial Assumptions 5 marks Summarize personal information for Tom & Viv Eliot Provide all relevant financial assumptions used in the plan Section 3 - Financial Management 15 marks Provide and comment on current financial situation (Net Worth & Cash Flow) Discussion and projections for plan to take care of Alfred, who is mentally disabled Include discussion on Emergency Fund . Paragraph 10 S-Section 4 - Education Planning marks Provide detailed education plan and projections for Hannah 5 marks Section 5 - Tax Planning Discuss tax rates and explain relevant strategies to reduce taxes 5 marks S-Section 6 - Retirement Planning Discuss and make recommendations on Tom's retirement goals Comment and do relevant calculations regarding Viv's retirement goals Section 7 - Investment Planning 10 marks Provide discussion and recommendations for Toms registered (RRSP & LIRA), and non-registered investments. Comment on Tom's investment in labour sponsored plans Provide discussion and recommendations for Viv's investments. Comment on their investments profile and their investment advisor's conduct regarding suitability of investment purchases for their portfolios . . 5 marks Section 8 - Insurance and Risk Management Discuss and comment on existing life insurance policies in force Address insurance-related questions posed by Tom and Viv 5 marks Section 9 - Wills and Power of Attorneys Discuss relevant topics such as: wills, power of attorneys, executor, etc Discuss and comment on existing life insurance policies in force Address insurance-related questions posed by Tom and Viv Section 9 - Wills and Power of Attorneys 5 marks WWW . Discuss relevant topics such as: wills, power of attorneys, executor, etc Section 10 - Recommendations and Next Steps 10 marks Summarize recommendations in priority and outline next steps for implementation Specify who is responsible for each task and the expected completion date Discuss follow-up meetings to review and monitor the plan . Overall Structure, Grammar & Overall Presentation 10 marks Total: 100 marks Important Notes: 1. The discussion and development of a financial plan is an important component of this course. Expect to spend approximately 1520 hours to complete the plan. Start early and discuss as a group for best results. CASE STUDY 1 -TOM AND VIV ELIOT 0 Background Tom and Viv Eliot met with you on April 1, 2014 in order to get a second opinion on their financial situation. They say that they are unhappy with their current CFP professional, who they feel has sometimes pressured them into purchasing investment and insurance products they did not completely understand. They are particularly concerned about the taxes they pay on their non-registered portfolios, and they are also worried they may not be able to leave enough money to their son Alfred, who is mentally disabled. They tell you that theyve never really had anyone prepare a complete financial plan for them in the past, but Viv has prepared net worth and cash flow statements to give you a better idea of their situation (see Tables). Personal Information Tom Eliot (age 70) and Viv Eliot (age 58) live in a small town outside of Ottawa, Ontario. They have been married for 33 years. Both live a very healthy lifestyle. They exercise regularly, eat a balanced diet, and are both non-smokers. They have two children - Ernest (age 31) and Alfred (age 17). Ernest has just finished his Ph.D. in English literature and is working as an associate professor at a university in British Columbia. He is married to Mary (age 30), who is also a university professor, and they have a seven-year-old daughter named Hannah. Tom and Viv say that they were happy to help Ernest financially when he went to school, and they are prepared to do the same for his daughter. They would like to set aside $3,600 every year for her education. The Eliots' other son, Alfred, was born with Down syndrome. He is able to attend special- ized classes at the local high school, but Tom and Viv say that he relies on them com- The Eliots' other son, Alfred, was born with Down syndrome. He is able to attend special- ized classes at the local high school, but Tom and Viv say that he relies on them com- pletely. They have retained the services of a part-time support worker to help them look after Alfred, and they worry about whether he will be able to manage financially after thei- deaths. Employment Information Details of Tom's Business Tom is the sole proprietor of a small media company, Eliot Publishing, which he runs from an office in his home. He has no employees, but he does contract the services of several freelance editors to help him edit manuscripts and co-ordinate the printing of the books ha publishes. Tom has few expenses besides production costs, such as a cellphone and a sepatate business phone line and fax line, and usually takes home about $120,000 before taxes. He is considering incorporating the business, Tom says he has no plans to retire, and hopes to keep working for at least another 10 years One of the freelance editors has expressed an interest in investing in the company and becoming a partner, but Tom says that he isn't prepared to give up control just yet. Details of Viv's Employment Viv works as an in-house translator at Big Time Translations, an independent agency in Ottawa. She earns $66,000 a year and has worked at Big Time since 1993. Big Time has lost several important contracts over the last few years, and her boss has just offered her a $35,000 severance package. She will be leaving the company at Christmas. Viv says that she plans to start her own business and will work as a part-time freelance translator next year. She says she won't miss commuting, and her employer did not provide health, dental, or retirement benefits anyway. She is wondering if it would be worthwhile renovating an extra bedroom that she could use as her own office at home, or whether she should just share the room Tom already uses as his office. 2) Financial Position Real Estate Tom and Viv purchased their home 31 years ago for $40,000 and paid off the mortgage quite a few years ago. It is an old Victorian farmhouse, and they own it jointly. After all the improvements the Eliots have made, its value has grown significantly. It has 10 bedrooms and was recently appraised at $550,000. mprovements and was recently appraised at $550,000. They also own a 1,600 square foot townhouse in a fashionable part of Toronto, which feu purchased in 1997 for $180,000. They own it jointly as well. A friend of theirs who is a real estate agent recently told them that the property is now worth $600,000. They currently rent out the bottom floor and keep the small apartment (about 700 square feet) at the cos of the house for personal use. The Eliots spend at least one weekend a month there, as as a good part of their summer holidays. Viv also owns half of a cottage in the Muskokas with her sister, Susan. They are tenants in common. When they inherited it from her mother 10 years ago, the cottage was valued a $50,000. It is now worth $250,000. Neither Susan nor Viv spend much time there, especials now that Susan lives in Newfoundland. However, Susan's daughter, Samantha, spends thos! of the summer there and often has Alfred up to stay for several weeks to give Tom and 1. a bit of time to themselves - Samantha does not pay any rent for the cottages but Viv say she is happy to have someone so reliable looking after the place for them. She says it means a great deal to Alfred to be able to spend time there with Samantha. Tom's Investments, Registered: Tom's RRSP portfolio cosists of the following investments: $28,000 GrowGreat Canadian Precious Metals Fund $27,000 GrowGreat American Small Cap Fund $48,000 GrowGreat Canadian Aggressive Growth Fund $20,000 GrowGreat S&P/TSX 60 Index Fund $18,000 GrowGreat Telecommunications Fund $15,000 GrowGreat Labour-Sponsored Fund On the advice of their current adviser, Tom has put $5,000 into the GrowGreat Labour Sponsored Fund every year, for a total investment of $30,000. He received a 30% tax credit in total each year from the federal and provincial governments. The market value of the On the advice of their current adviser, Tom has put $5,000 into the Grow Great Labour Sponsored Fund every year, for a total investment of $30,000. He received a 30% tax er in total each year from the federal and provincial governments. The market value of li investment has declined to $15,000. Tom says he is very unhappy with the way most funds have performed, especially the Labour-Sponsored Fund. Tom also has $89,000 in a locked-in retirement account. The money is in a money mai fund and the account is held by the same company that managed his former employers pension plan. Tom wants to know what, if anything, he can do with these funds. Tom's Investments, Non-Registered Tom says that, in an attempt to make up for all the money he was losing in his RRSP opened up an account at a discount brokerage. Based on information he read in the new paper, he decided to invest a total of $60,000 in the ABC Bond Fund. The market value the fund is now $80,000. Tom says he's happy to earn the extra money, currently about 3 a year, but hates having to pay tax on this interest income. He says he has already max: mized his RRSP, or he would transfer the money there. Viv's Investments, Registered Like Tom, Viv has invested most of her registered funds in very aggressive GrowGreat Funds: $8,000 GrowGreat Canadian Precious Metals Fund $12,000 GrowGreat Japan Small Cap Fund $37,000 GrowGreat Canadian Aggressive Growth Fund $18,000 GrowGreat Canadian Telecommunications Fund 3 $15,000 GrowGreat Labour-Sponsored Fund She is as displeased as Tom with the performance of her investments, and says that she has lost sleep worrying about her investments. She also invested $30,000 in the Labour Spon- sored Fund, and her other investments have a book value of $100,000. She says she would prefer a more conservative portfolio. Viv's Investments, Non-Registered Viv has always purchased Canada Savings Bonds (CSBs), and currently holds $27,000 in various series, with earnings averaging 4% annually. While she likes the regular interest income the CSBs generate, she would like to find a way to reduce the taxes she pays. She wishes she could transfer them to her RRSP but she has no more contribution room available. Liabilities Tom and Viv pay their entire credit card bill each month, and do not have any outstanding personal loans except for a small car loan of $15,000 at 4%. They still have a $150,000 mortgage at 6.9% on their Toronto property, and the rate is locked in for the next two years. They are paying $1,250 every month in principal and interest. Viv says that she will have to either purchase or lease a computer when she starts working from home. The computer she is looking at retails for $3,500. Insurance Information Tom has a T-100 life insurance policy with a face value of $300,000, and Viv has a $280,000 five-year term life insurance coverage thmush her university alumni nlan Tom Insurance Information Tom has a T-100 life insurance policy with a face value of $300,000, and Viv has a $280,000 five-year term life insurance coverage through her university alumni plan. Tom was unable to find his last statement from the insurance company, but the policy is more than 10 years old and he thinks it may have a cash surrender value. Viv is worried about what will happen when her term insurance policy expires. They have named each other as beneficiaries on their policies. Neither Tom nor Viv have disability insurance, Children They want to make sure that Alfred is provided with a decent and reliable level of income for the rest of his life. They love their son Ernest very much, but they say that he is not at all good with money. They say that he is a terrible spendthrift, and they are worried he would spend any money they give to him. They would like whatever money that is left after Alfred dies to go to their granddaughter, Hannah Risk Profile Both Tom and Vit describe themselves as extremely conservative investors who cannot tolerate short-term volatility. They say that they would rather earn a lower rate of return than face the ups and downs of the stock market. They say that they told their adviser this, but that he later telephoned and pushed them into buying growth investment funds anyway. They have shown you copies of their original investment applications, and they have pointed to where they checked off boxes indicating they had "little or no" tolerance for risk. They say their adviser often makes "adjustments" to their investment mix, and only informs them of changes after the fact. They do not remember ever signing a form to authorize him to do this, and wonder if it is a common practice. Goals and objectives Tom and Viv say that their number one priority is to make sure that Alfred is able to live comfortably after their deaths. They have heard that if they leave money in a trust for Alfred, he might not be able to receive his disability benefits. They want to know if there is any way to deal with this problem, 19 Tom says he doesn't want to retire. He enjoys his job and wants to keep working as long as he is physically able. He's deferred CPP income as long as possible, and he hasn't converted his RRSPURRIF yet, but now that he's approaching 71 he knows he'll have to act soon! He wants to receive as little income as possible, and wants to minimize his income taxes. Viv says she'd like to stop working at age 60 and spend more time with Alfred, and perhap help Tom with his business. She says that her needs are quite modest; she'd like to have a retirement income of about $30,000 before taxes. Wills and Powers of Attorney Tom and Viv last updated their wills shortly after Alfred was born. They have named each other as beneficiaries and executors, and in the event of both their deaths Tom's younger brother Jack (current age 65, widower) would act as executor, guardian and trustee. The allows Ernest to inherit half of the estate. Tom and Viv say that Jack spends most of the winter in Florida now, and they are considering naming someone else. Neither Tom nor Viv have powers of attorney, although they know they probably should They have also heard about something called a living will, and want to know if that's the same thing Tom and Viv Eliot Statement of Net Worth at December 31, 2013 Tom Viv Total ASSETS Liquid Assets Joint Chequing Account Business Chequing Account Cash Surrender Value $ $ 1,200 $ 1,200 4,600 ? 2,400 4,600 $ 5,800 $ 1,200 $ 7,000 Total Liquid Assets Investment Assets Non-Registered Assets Registered Assets WY 80,000 260,000 27,000 120,000 107,000 380,000 SBT Dyno Total Investment Assets $ 340,000 $ 147,000 $ 487,000 275,000 300,000 Personal-Use Assets Residence (farmhouse) Residence (Toronto) Cottage (Muskokas) Automobile Personal Effects (owned jointly) Total Personal-Use Assets 275,000 300,000 125,000 25,000 10,000 $ 610,000 550,000 600,000 125,000 25,000 20,000 $ 1,320,000 $ 1,814,000 10,000 $ 710,000 TOTAL ASSETS $ 955,800 $ 858,200 15,000 15,000 LIABILITIES Short-Term Liabilities Car Loan Long-Term Liabilities Mortgage (Toronto) TOTAL LIABILITIES 75,000 $ 90,000 75,000 $ 75,000 150,000 $ 165,000 NET WORTH $ 865,800 $ 783,200 $ 1,649,000 Annually $ 120,000 66,000 5,880 12,000 $ 203,880 42,660 Tom and Vir Elliot Monthly and Annual Cash Flow as of December 31, 2013 Monthly INCOME Tom's Business Income $ 10,000 Viv's Employment Income 5,500 Investment Interest Income 490 Rental Income 1,000 Total Income $ 16,990 EXPENSES Tax Instalments - Tom 3,555 Withholdings at Source - Viv Taxes, CPP and EI 1,532 Professional Dues 28 Mortgage Payment (Toronto) 1,250 Maintenance, Repairs Townhouse 250 Farmhouse 100 Home Insurance Townhouse 200 Farmhouse 75 Heating, Water and Electricity Townhouse 240 Farmhouse 400 Property Taxes Townhouse 675 18,384 336 15,000 3,000 1,200 2,400 900 2,880 4,800 8.100 675 290 75 95 165 62 8,100 3,480 900 1,140 1,980 744 Farmhouse Property Taxes Townhouse Farmhouse Cottage Automobile Insurance Operating Expenses Repairs and Maintenance Loan Payments Life Insurance Premiums Tom Viv Telephone (personal) Food Clothing Personal Care Entertainment Support Worker for Alfred RRSP Contribution - Tom RRSP Cont ition - Viv Savings for Hannah Miscellaneous Cash TOTAL EXPENSES 419 162 100 600 525 75 100 3,000 1,291 990 300 100 $ 16,654 5,028 1,944 1,200 7,200 6,300 900 1,200 36,000 15,492 11,880 3,600 1,200 $ 199,848 $ 4,032 SURPLUS $ 336 Cover Page+Disclaimer+Table of Contents + Letter of Engagement 10 marks Section 1 - Financial Goals 10 marks . Provide all financial goals in summary format S-Section 2 - Personal Information & Financial Assumptions 5 marks Summarize personal information for Tom & Viv Eliot Provide all relevant financial assumptions used in the plan Section 3 - Financial Management 15 marks Provide and comment on current financial situation (Net Worth & Cash Flow) Discussion and projections for plan to take care of Alfred, who is mentally disabled Include discussion on Emergency Fund . Paragraph 10 S-Section 4 - Education Planning marks Provide detailed education plan and projections for Hannah 5 marks Section 5 - Tax Planning Discuss tax rates and explain relevant strategies to reduce taxes 5 marks S-Section 6 - Retirement Planning Discuss and make recommendations on Tom's retirement goals Comment and do relevant calculations regarding Viv's retirement goals Section 7 - Investment Planning 10 marks Provide discussion and recommendations for Toms registered (RRSP & LIRA), and non-registered investments. Comment on Tom's investment in labour sponsored plans Provide discussion and recommendations for Viv's investments. Comment on their investments profile and their investment advisor's conduct regarding suitability of investment purchases for their portfolios . . 5 marks Section 8 - Insurance and Risk Management Discuss and comment on existing life insurance policies in force Address insurance-related questions posed by Tom and Viv 5 marks Section 9 - Wills and Power of Attorneys Discuss relevant topics such as: wills, power of attorneys, executor, etc Discuss and comment on existing life insurance policies in force Address insurance-related questions posed by Tom and Viv Section 9 - Wills and Power of Attorneys 5 marks WWW . Discuss relevant topics such as: wills, power of attorneys, executor, etc Section 10 - Recommendations and Next Steps 10 marks Summarize recommendations in priority and outline next steps for implementation Specify who is responsible for each task and the expected completion date Discuss follow-up meetings to review and monitor the plan . Overall Structure, Grammar & Overall Presentation 10 marks Total: 100 marks Important Notes: 1. The discussion and development of a financial plan is an important component of this course. Expect to spend approximately 1520 hours to complete the plan. Start early and discuss as a group for best results

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts