Question: Old MathJax webview need the ratios too this is full question STATEMENTS OF FINANCIAL POSITION AS AT 30 JUNE 2020 The Group The Company 2020

Old MathJax webview

need the ratios too

this is full question

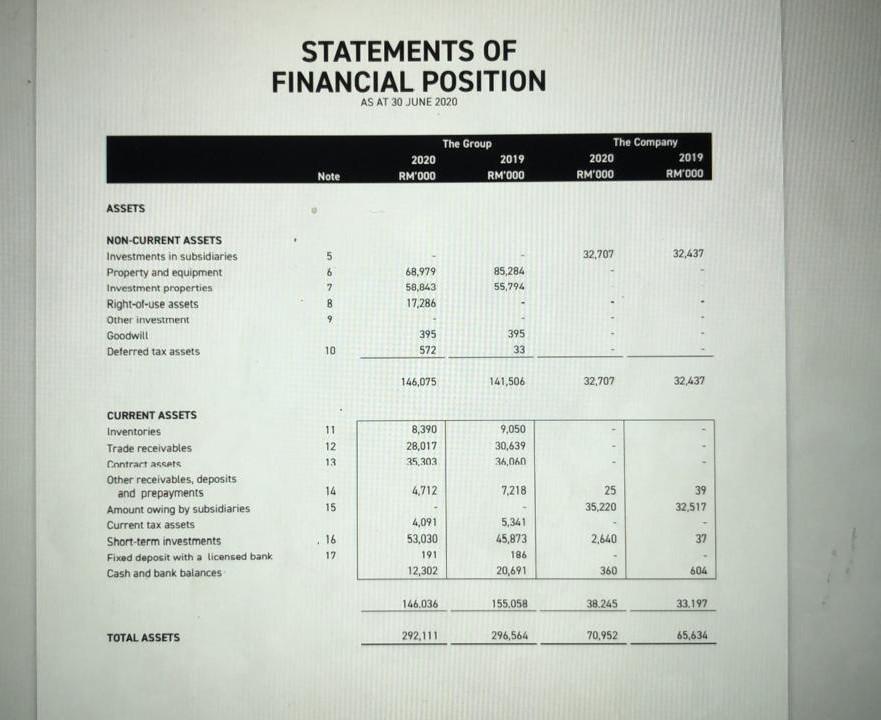

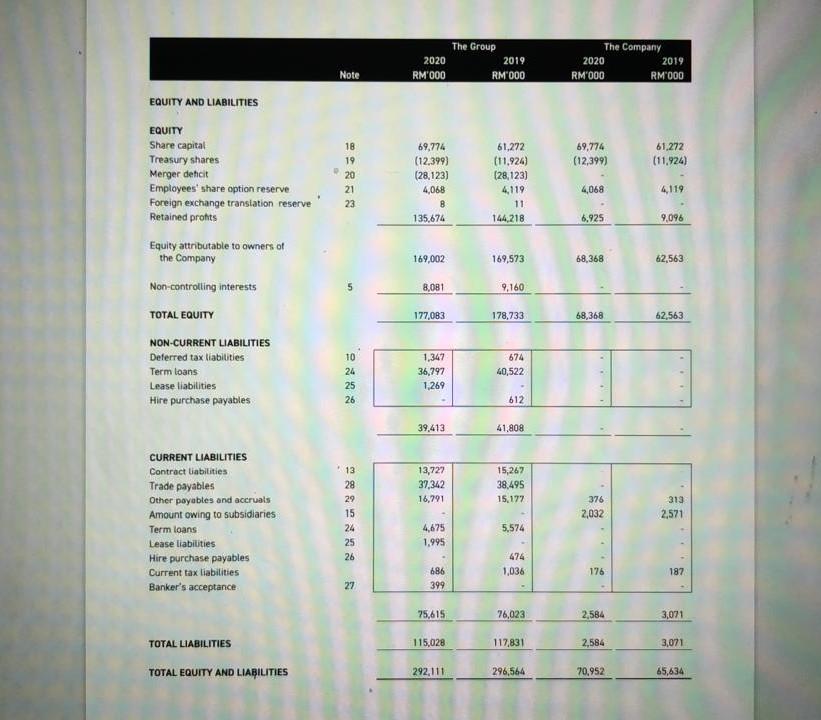

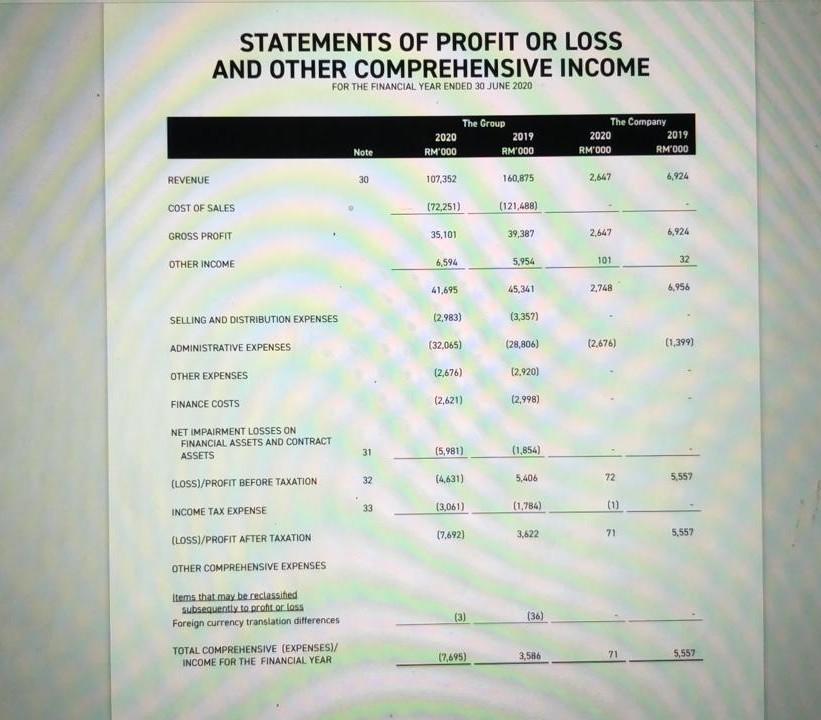

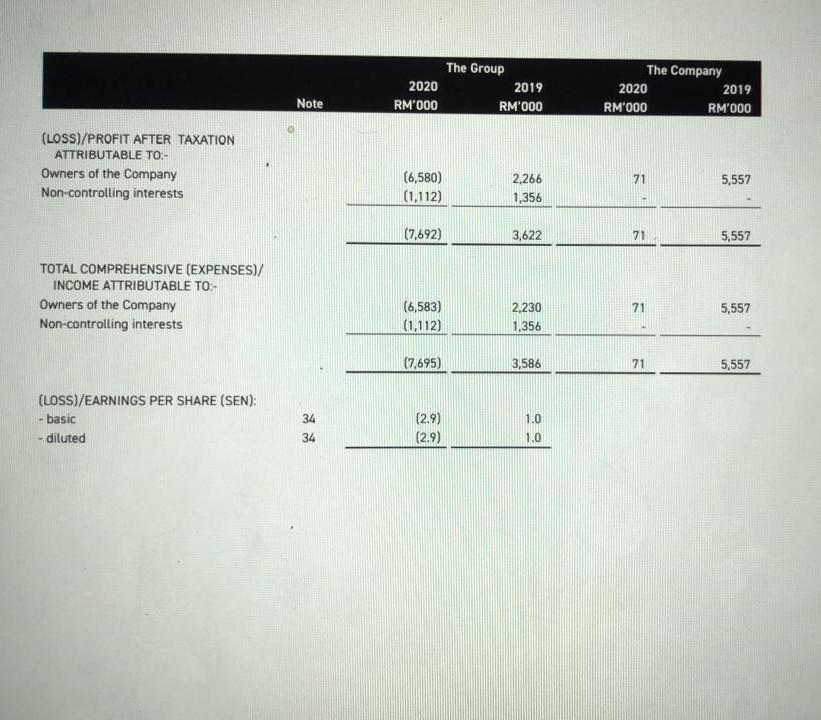

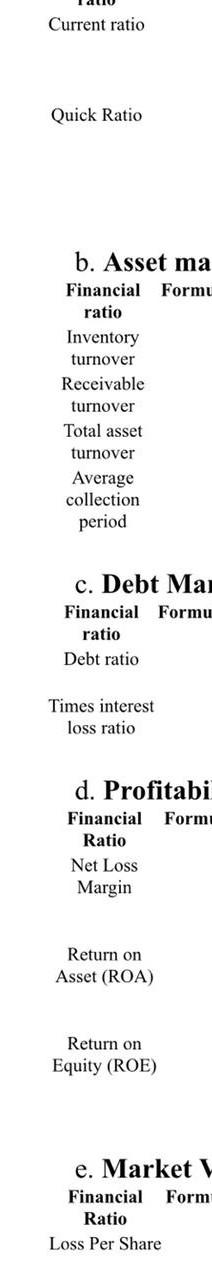

STATEMENTS OF FINANCIAL POSITION AS AT 30 JUNE 2020 The Group The Company 2020 2019 2020 2019 Note RM'000 RM'000 RM'000 RM'000 ASSETS NON-CURRENT ASSETS Investments in subsidiaries 5 32,707 32,437 6 85,284 55,794 2 Property and equipment Investment properties Right-of-use assets Other investment Goodwill 68,979 58,843 17,286 B 9 395 395 Deferred tax assets 10 572 33 146,075 141,506 32,707 32,437 CURRENT ASSETS Inventories 11 9,050 8,390 28,017 Trade receivables 12 30,639 36,00 Contract assets 13 35,303 14 4,712 7,218 25 39 Other receivables, deposits and prepayments Amount owing by subsidiaries Current tax assets 15 35,220 32,517 4,091 53,030 5,341 45,873 Short-term investments 16 2.640 37 17 191 186 Fixed deposit with a licensed bank Cash and bank balances 12,302 20,691 360 604 146.036 155.058 38.245 33.197 TOTAL ASSETS 292,111 296,564 70.952 65,634 The Group The Company 2020 2019 2020 2019 Note RM'000 RM"000 RM'000 RM000 EQUITY AND LIABILITIES EQUITY 18 69.774 (12.399) (28,123) 69,774 (12,399) 61.272 (11.924) 19 20 Share capital Treasury shares Merger decit Employees' share option reserve Foreign exchange translation reserve Retained prots 61,272 (11.924) (28,123) 4,119 11 21 4,068 4,068 4,119 23 8 135,674 144,218 6,925 9,096 Equity attributable to owners of the Company 169,002 169,573 68,368 62,563 Non-controlling interests 8,081 9,160 TOTAL EQUITY 177,083 178,733 68,368 62,563 NON-CURRENT LIABILITIES 10 1,347 674 24 36,797 40,522 Deferred tax liabilities Term loans Lease liabilities Hire purchase payables 25 1.269 26 612 39,413 41.808 13 13,727 37,342 28 CURRENT LIABILITIES Contract liabilities Trade payables Other payables and accruals Amount owing to subsidiaries Term loans 15,267 38,495 15.177 29 16,791 376 313 2,571 15 2,032 24 4,675 5,574 Lease liabilities 25 1.995 26 474 Hire purchase payables Current tax liabilities 686 1,036 176 187 Banker's acceptance 27 399 75,615 76,023 2,584 3,071 TOTAL LIABILITIES 115,028 117,831 2,584 3,071 TOTAL EQUITY AND LIABILITIES 292,111 296,564 70,952 65,634 STATEMENTS OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR THE FINANCIAL YEAR ENDED 30 JUNE 2020 The Group The Company 2019 2020 2019 2020 Note RM 000 RM 000 RM 000 RM'000 REVENUE 30 107,352 160,875 2,642 6,924 COST OF SALES (72,251) (121,488) GROSS PROFIT 35,101 39,387 2,647 6,924 6,594 5.954 OTHER INCOME 101 32 41,695 45,341 2,748 4,956 SELLING AND DISTRIBUTION EXPENSES (2,983) (3,357) (32.065) (28,806) (2,676) ADMINISTRATIVE EXPENSES (1,3991 OTHER EXPENSES (2,676) 12.920) FINANCE COSTS (2,621) (2,998) NET IMPAIRMENT LOSSES ON FINANCIAL ASSETS AND CONTRACT ASSETS 31 (5,981) (1,854) 32 (4,631) 5,406 72 (LOSS)/PROFIT BEFORE TAXATION 5.552 33 (3,061) (1,784) (1) INCOME TAX EXPENSE 17.692) 3,622 71 5.557 (LOSSI/PROFIT AFTER TAXATION OTHER COMPREHENSIVE EXPENSES Items that may be reclassified subsequently to profit or loss Foreign currency translation differences (3) (36) TOTAL COMPREHENSIVE (EXPENSES/ INCOME FOR THE FINANCIAL YEAR 19,695) 3,566 71 5,557 The Group The Company 2020 2019 2020 2019 Note RM'000 RM'000 RM'000 RM'000 (LOSS)/PROFIT AFTER TAXATION ATTRIBUTABLE TO:- Owners of the Company Non-controlling interests 2,266 71 5,557 (6,580) (1.112) 1,356 (7.692) 3,622 71 5,557 TOTAL COMPREHENSIVE (EXPENSES)/ INCOME ATTRIBUTABLE TO Owners of the Company Non-controlling interests 2,230 71 5,557 (6,583) (1.112) 1.356 (7,695) 3,586 71 5,557 (LOSS)/EARNINGS PER SHARE (SEN): - basic 34 1.0 (2.9) (2.9) - diluted 34 1.0 Current ratio Quick Ratio b. Asset ma Financial Formu ratio Inventory turnover Receivable turnover Total asset turnover Average collection period c. Debt Mai Financial Formu ratio Debt ratio Times interest loss ratio d. Profitabi Financial Form Ratio Net Loss Margin Return on Asset (ROA) Return on Equity (ROE) e. Market Form Financial Ratio Loss Per Share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts