Question: Old MathJax webview Next, the cash flows forecast for the future of an investment project are presented, an economic analysis is required that allows decision-making,

Old MathJax webview

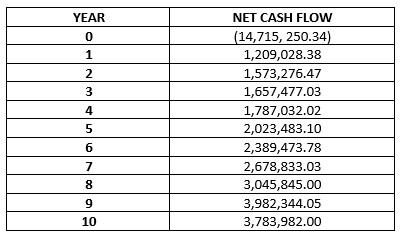

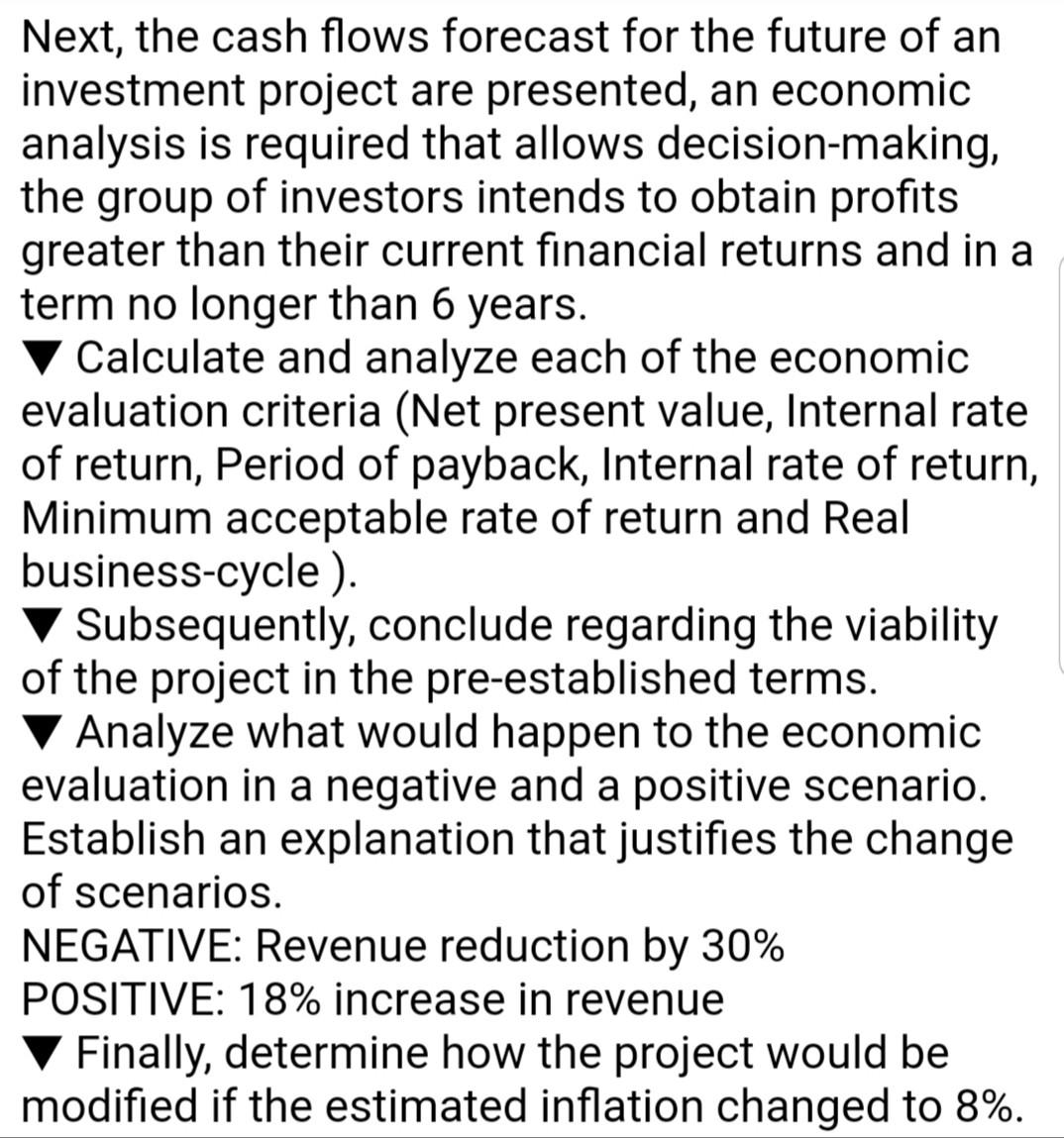

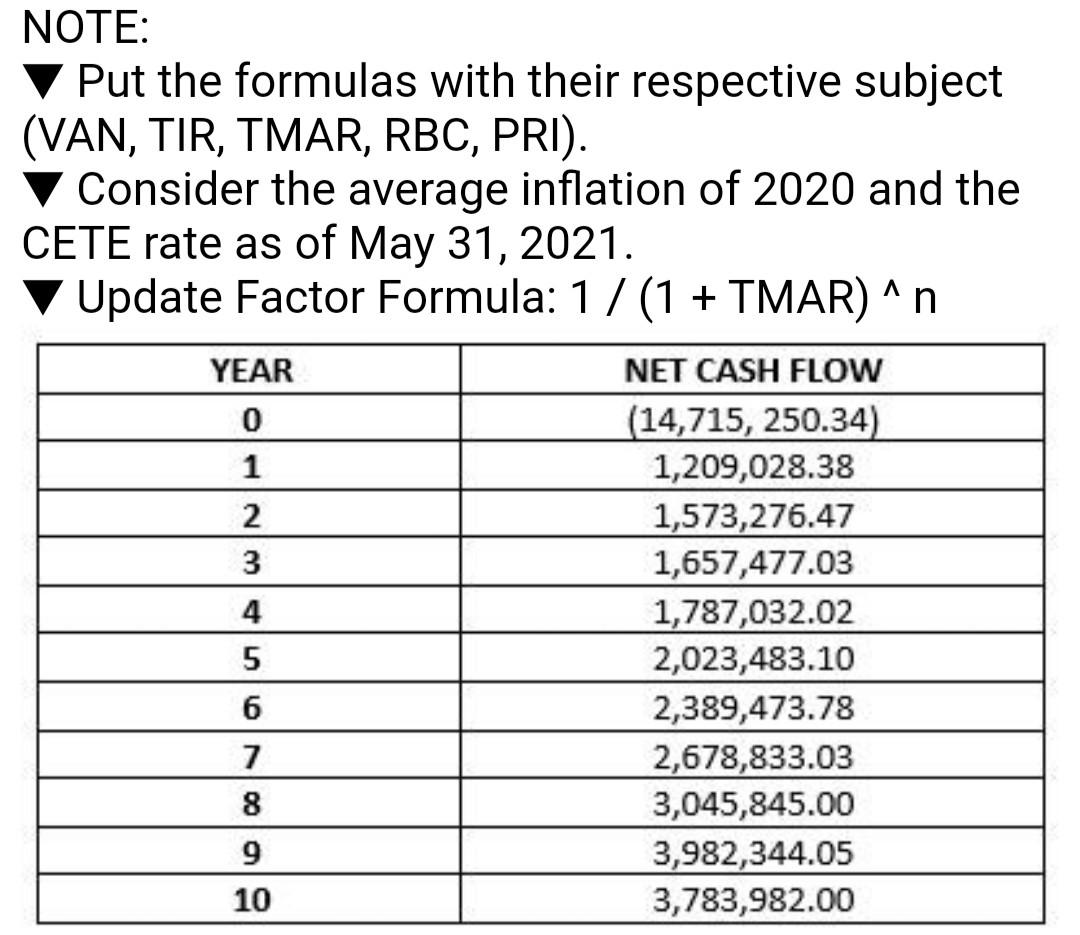

Next, the cash flows forecast for the future of an investment project are presented, an economic analysis is required that allows decision-making, the group of investors intends to obtain profits greater than their current financial returns and in a term no longer than 6 years.

Calculate and analyze each of the economic evaluation criteria (Net present value, Internal rate of return, Period of payback, Internal rate of return, Minimum acceptable rate of return and Real business-cycle ).

Subsequently, conclude regarding the viability of the project in the pre-established terms.

Analyze what would happen to the economic evaluation in a negative and a positive scenario. Establish an explanation that justifies the change of scenarios.

NEGATIVE: Revenue reduction by 30%

POSITIVE: 18% increase in revenue

Finally, determine how the project would be modified if the estimated inflation changed to 8%.

NOTE:

Put the formulas with their respective subject (VAN, TIR, TMAR, RBC, PRI).

Consider the average inflation of 2020 and the CETE rate as of May 31, 2021.

Update Factor Formula: 1 / (1 + TMAR) ^ n

Economic evaluation

YEAR NET CASH FLOW 0 1 2 3 4 (14,715, 250.34) 1,209,028.38 1,573,276.47 1,657,477.03 1,787,032.02 2,023,483.10 2,389,473.78 2,678,833.03 3,045,845.00 5 6 7 8 9 3,982,344.05 10 3,783,982.00 Next, the cash flows forecast for the future of an investment project are presented, an economic analysis is required that allows decision-making, the group of investors intends to obtain profits greater than their current financial returns and in a term no longer than 6 years. V Calculate and analyze each of the economic evaluation criteria (Net present value, Internal rate of return, Period of payback, Internal rate of return, Minimum acceptable rate of return and Real business-cycle ). V Subsequently, conclude regarding the viability of the project in the pre-established terms. Analyze what would happen to the economic evaluation in a negative and a positive scenario. Establish an explanation that justifies the change of scenarios. NEGATIVE: Revenue reduction by 30% POSITIVE: 18% increase in revenue Finally, determine how the project would be modified if the estimated inflation changed to 8%. NOTE: Put the formulas with their respective subject (VAN, TIR, TMAR, RBC, PRI). V Consider the average inflation of 2020 and the CETE rate as of May 31, 2021. Update Factor Formula: 1 / (1 + TMAR)^n YEAR NET CASH FLOW 0 1 Nimo (14,715, 250.34) 1,209,028.38 1,573,276.47 1,657,477.03 1,787,032.02 2,023,483.10 2,389,473.78 2,678,833.03 3,045,845.00 3,982,344.05 3,783,982.00 7 8 9 10 YEAR NET CASH FLOW 0 1 2 3 4 (14,715, 250.34) 1,209,028.38 1,573,276.47 1,657,477.03 1,787,032.02 2,023,483.10 2,389,473.78 2,678,833.03 3,045,845.00 5 6 7 8 9 3,982,344.05 10 3,783,982.00 Next, the cash flows forecast for the future of an investment project are presented, an economic analysis is required that allows decision-making, the group of investors intends to obtain profits greater than their current financial returns and in a term no longer than 6 years. V Calculate and analyze each of the economic evaluation criteria (Net present value, Internal rate of return, Period of payback, Internal rate of return, Minimum acceptable rate of return and Real business-cycle ). V Subsequently, conclude regarding the viability of the project in the pre-established terms. Analyze what would happen to the economic evaluation in a negative and a positive scenario. Establish an explanation that justifies the change of scenarios. NEGATIVE: Revenue reduction by 30% POSITIVE: 18% increase in revenue Finally, determine how the project would be modified if the estimated inflation changed to 8%. NOTE: Put the formulas with their respective subject (VAN, TIR, TMAR, RBC, PRI). V Consider the average inflation of 2020 and the CETE rate as of May 31, 2021. Update Factor Formula: 1 / (1 + TMAR)^n YEAR NET CASH FLOW 0 1 Nimo (14,715, 250.34) 1,209,028.38 1,573,276.47 1,657,477.03 1,787,032.02 2,023,483.10 2,389,473.78 2,678,833.03 3,045,845.00 3,982,344.05 3,783,982.00 7 8 9 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts