Question: Old MathJax webview Old MathJax webview A 3-months forward contract is an agreement where: O One side has the right to buy an asset for

Old MathJax webview

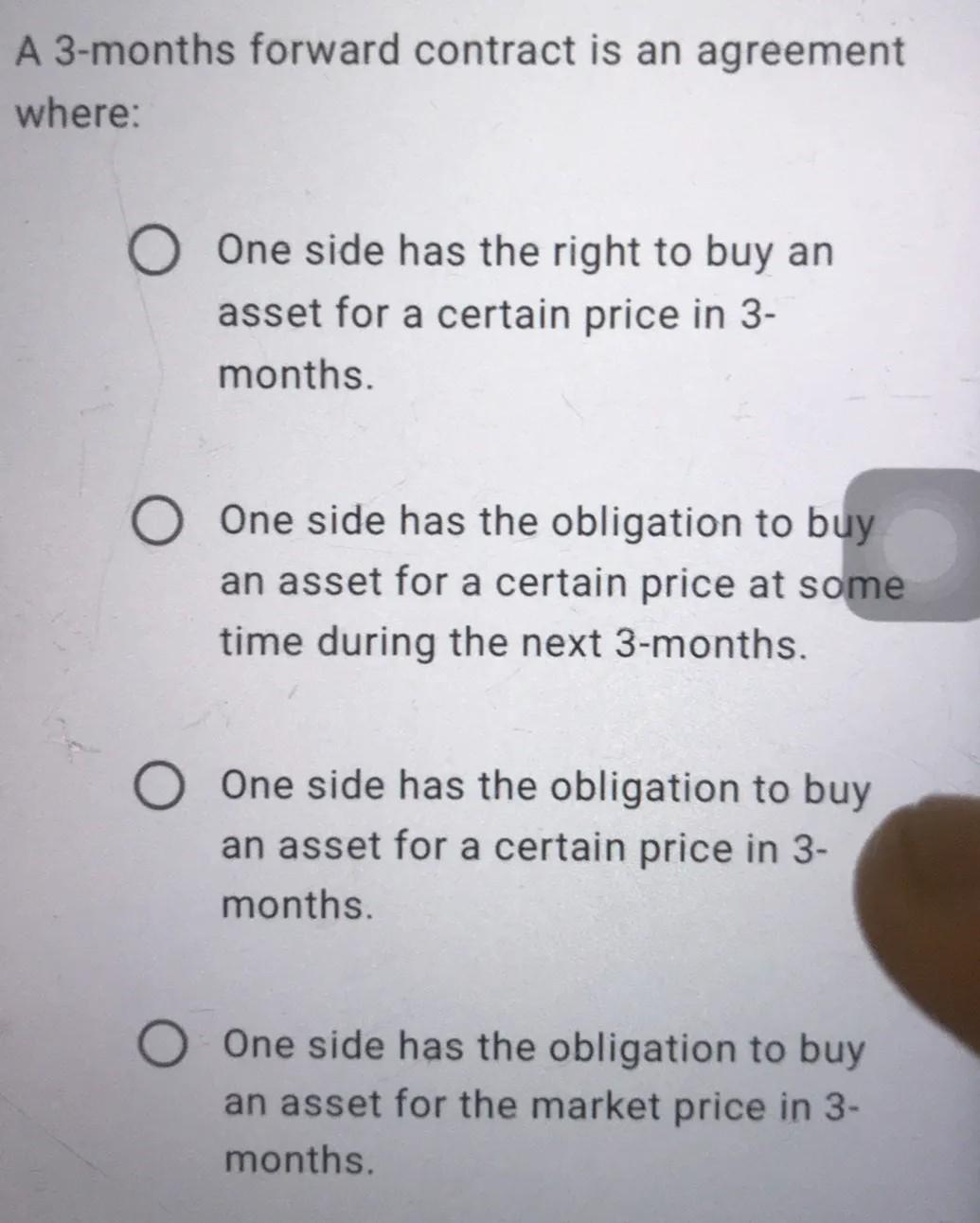

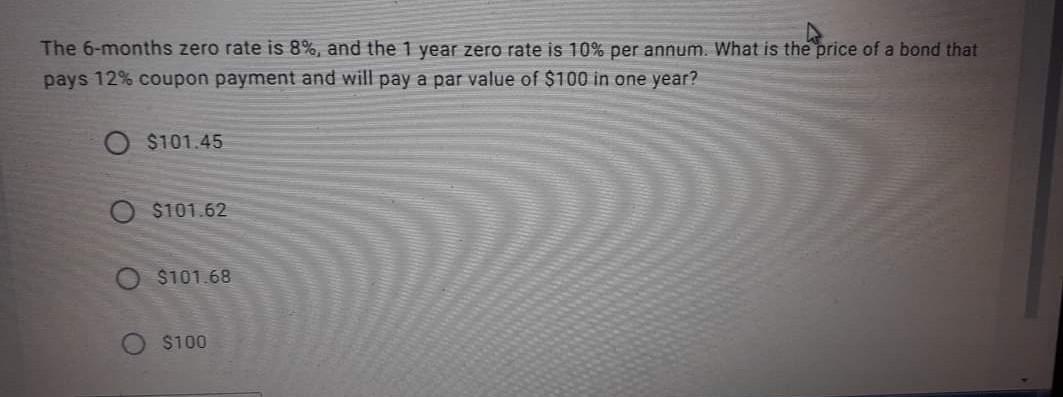

A 3-months forward contract is an agreement where: O One side has the right to buy an asset for a certain price in 3- months. One side has the obligation to buy an asset for a certain price at some time during the next 3-months. O One side has the obligation to buy an asset for a certain price in 3- months. One side has the obligation to buy an asset for the market price in 3- months. The 6-months zero rate is 8%, and the 1 year zero rate is 10% per annum. What is the price of a bond that pays 12% coupon payment and will pay a par value of $100 in one year? O $101.45 $101.62 $101.68 $100 A 3-months forward contract is an agreement where: O One side has the right to buy an asset for a certain price in 3- months. One side has the obligation to buy an asset for a certain price at some time during the next 3-months. O One side has the obligation to buy an asset for a certain price in 3- months. One side has the obligation to buy an asset for the market price in 3- months. The 6-months zero rate is 8%, and the 1 year zero rate is 10% per annum. What is the price of a bond that pays 12% coupon payment and will pay a par value of $100 in one year? O $101.45 $101.62 $101.68 $100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts