Question: Old MathJax webview Old MathJax webview A. What is the appropriate discount rate for NPV decisions in its computer division? Assume Risk free rate =3%

Old MathJax webview

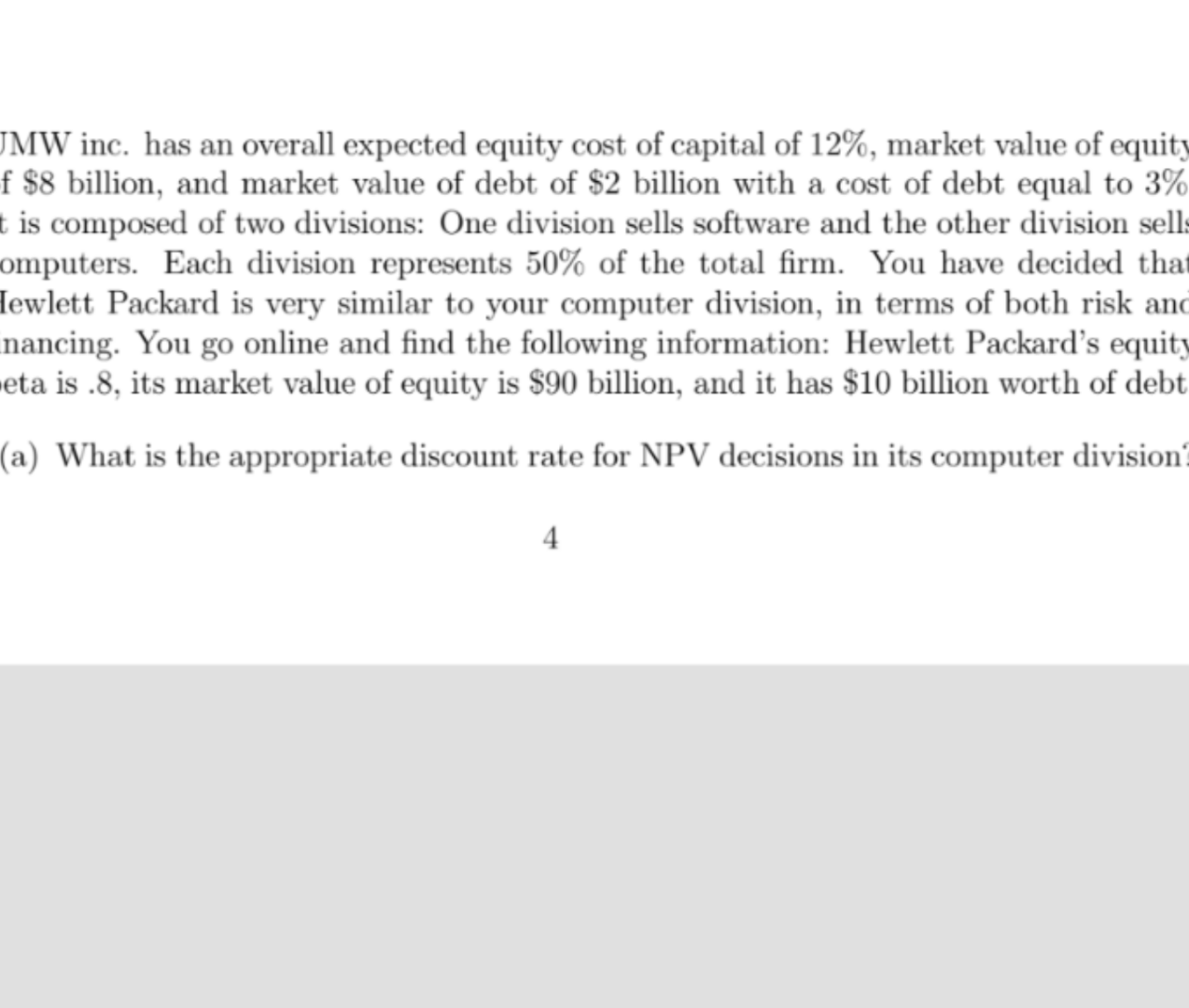

A. What is the appropriate discount rate for NPV decisions in its computer division?

Assume

Risk free rate =3% Equity market premium =7% Tax rate =21%

Assume Risk free rate = 3% Equity market premium = 7 % Tax rate =21%

JMW inc. has an overall expected equity cost of capital of 12%, market value of equity f $8 billion, and market value of debt of $2 billion with a cost of debt equal to 3% t is composed of two divisions: One division sells software and the other division sell: omputers. Each division represents 50% of the total firm. You have decided that Iewlett Packard is very similar to your computer division, in terms of both risk and nancing. You go online and find the following information: Hewlett Packard's equity eta is .8, its market value of equity is $90 billion, and it has $10 billion worth of debt (a) What is the appropriate discount rate for NPV decisions in its computer division 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts