Question: Old MathJax webview Old MathJax webview Chuck, a single taxpayer, earns $76,700 in taxable income and $11,900 in interest from an investment in City of

Old MathJax webview

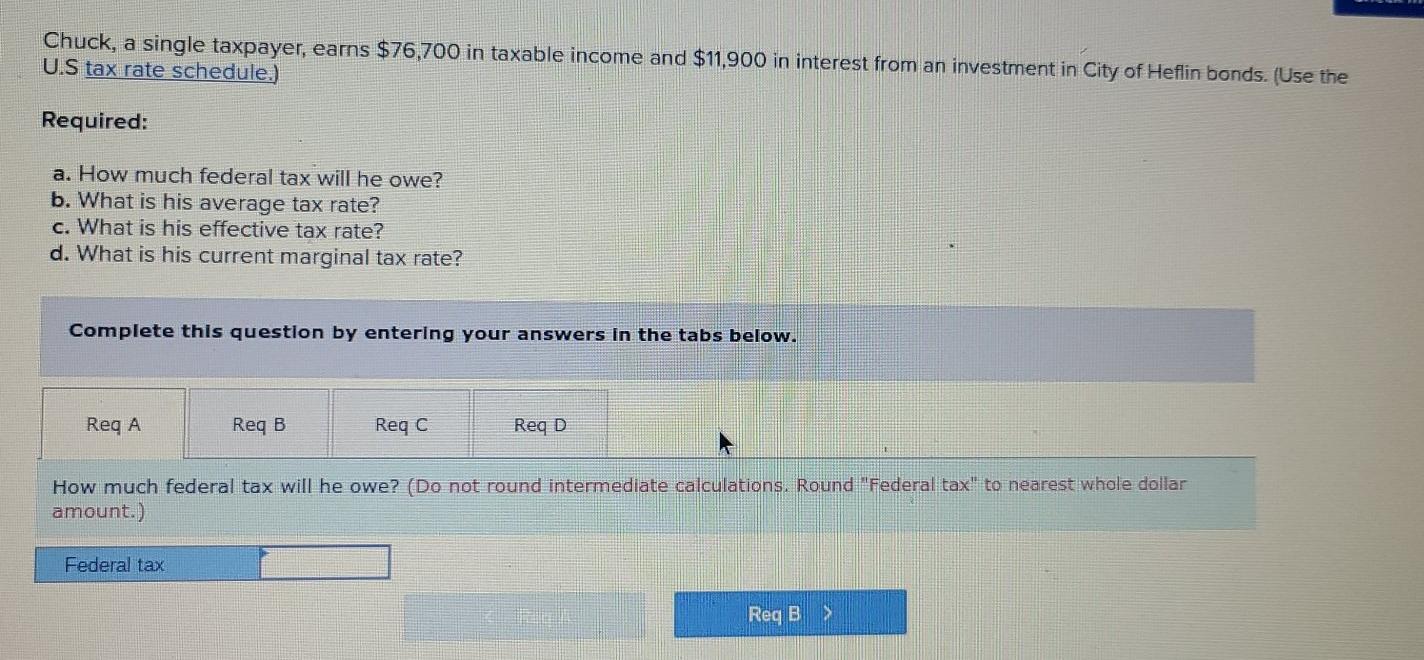

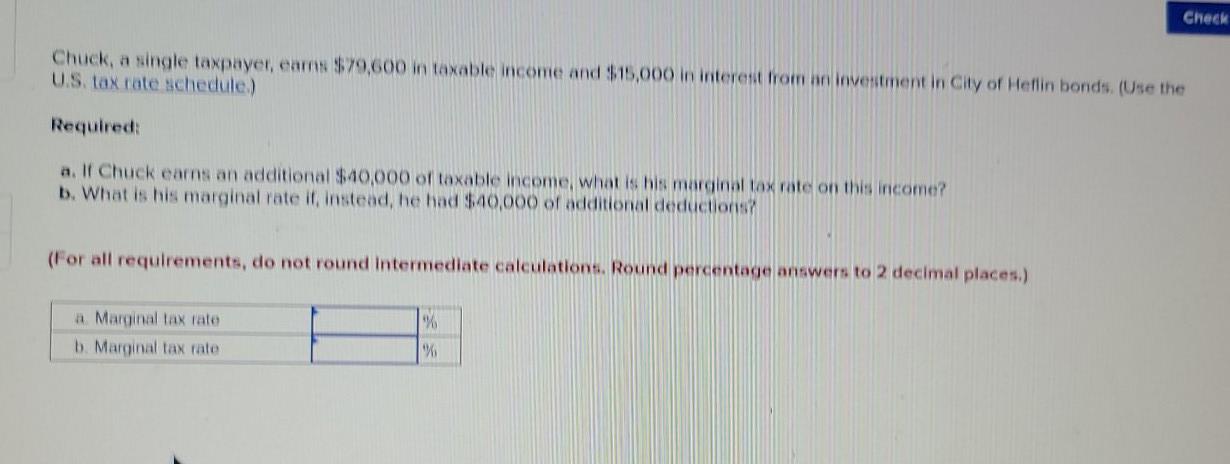

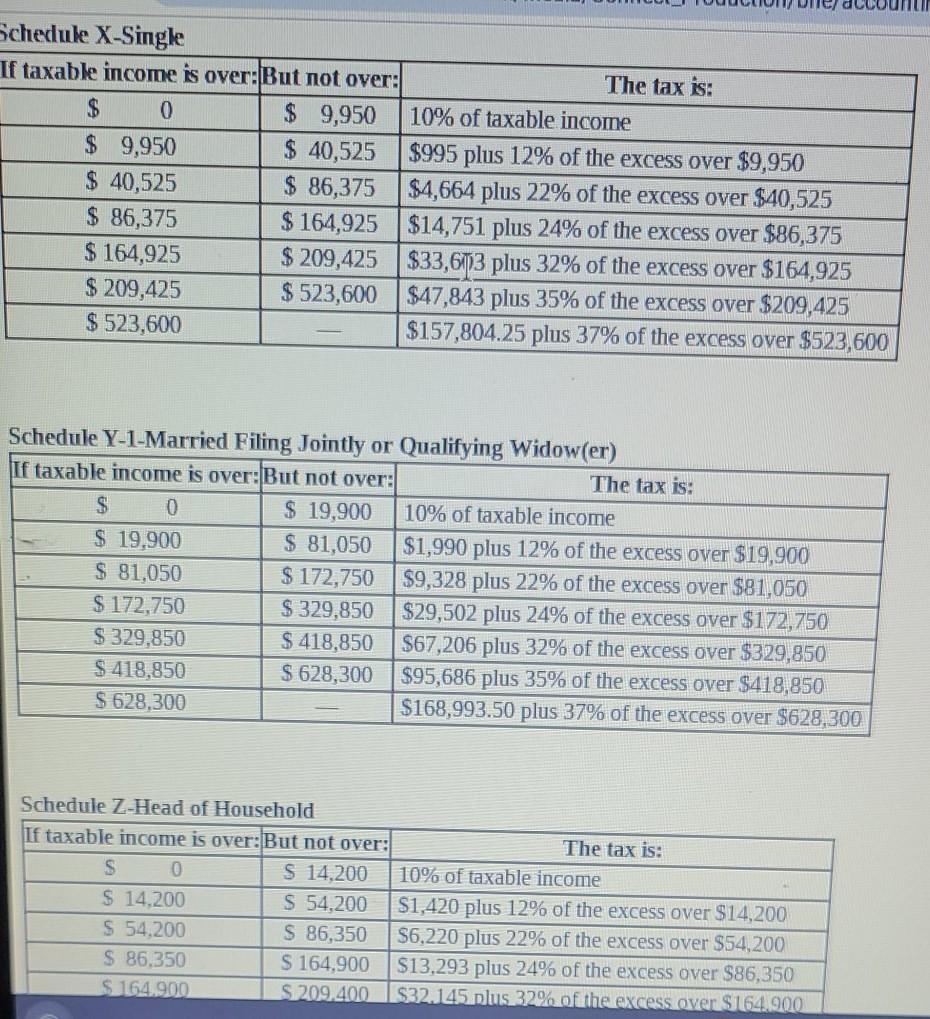

Chuck, a single taxpayer, earns $76,700 in taxable income and $11,900 in interest from an investment in City of Heflin bonds. (Use the U.S tax rate schedule.) Required: a. How much federal tax will he owe? b. What is his average tax rate? c. What is his effective tax rate? d. What is his current marginal tax rate? Complete this question by entering your answers in the tabs below. Req A Req B Reqc Req D How much federal tax will he owe? (Do not round intermediate calculations. Round "Federal tax" to nearest whole dollar amount.) Federal tax Reg BS Check Chuck, a single taxpayer, earns $79,600 in taxable income and $15,000 in interest from an investment in City of Hellin bonds (Use the U.S. tax rate schedule.) Required: a. If Chuck earns an additional $40,000 of taxable income, what is his marginal tax rate on this income? b. What is his marginal rate it, Instead, he had $40,000 of additional deductions (For all requirements, do not round Intermediate calculations, Round percentage answers to 2 decimal places.) % a Marginal tax rate b. Marginal tax rate Schedule X-Single If taxable income is over: But not over: The tax is: $ 0 $ 9,950 10% of taxable income $ 9,950 $ 40,525 $995 plus 12% of the excess over $9,950 $ 40,525 $ 86,375 $4,664 plus 22% of the excess over $40,525 $ 86,375 $164,925 $14,751 plus 24% of the excess over $86,375 $164,925 $ 209,425 $33,603 plus 32% of the excess over $164,925 $ 209,425 $ 523,600 $47,843 plus 35% of the excess over $209,425 $ 523,600 $157,804.25 plus 37% of the excess over $523,600 Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) If taxable income is over:But not over: The tax is: $ 0 $ 19,900 10% of taxable income $ 19,900 $ 81,050 $1,990 plus 12% of the excess over $19,900 $ 81,050 $ 172,750 $9,328 plus 22% of the excess over $81,050 $ 172,750 $ 329,850 $29,502 plus 24% of the excess over $172,750 $ 329,850 $ 418,850 $67,206 plus 32% of the excess over $329,850 $ 418,850 $ 628,300 $95,686 plus 35% of the excess over $418,850 $ 628,300 $168,993.50 plus 37% of the excess over $628,300 Schedule Z-Head of Household If taxable income is over:But not over: The tax is: S 0 S 14,200 10% of taxable income $ 14,200 S 54,200 $1,420 plus 12% of the excess over $14,200 $ 54,200 S 86,350 $6,220 plus 22% of the excess over $54,200 $ 86,350 S 164,900 $13,293 plus 24% of the excess over $86,350 $164.900 $ 209,400 $32.145 plus 32% of the excess over $164.900

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts