Question: Old MathJax webview Old MathJax webview I need solution for this problem with details DEPRECIATION - ACCELERATED DEPRECIATION METHOD Depreciation: Tax law allows firms to

Old MathJax webview

I need solution for this problem with details

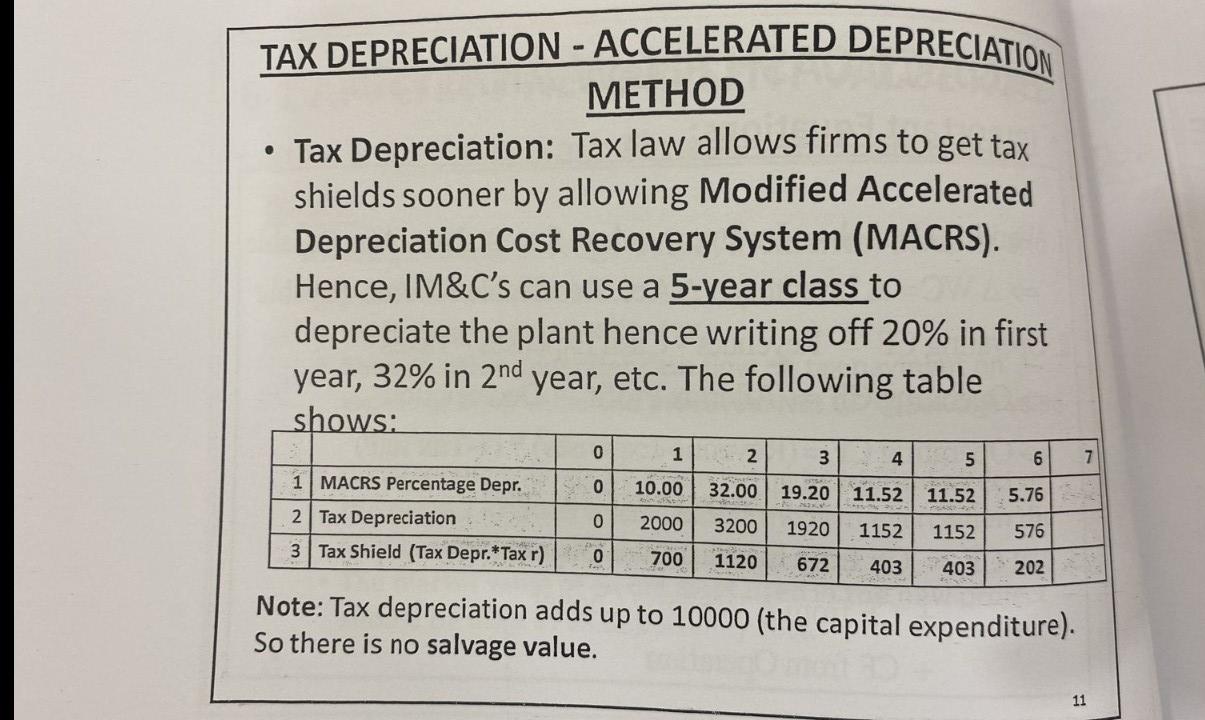

DEPRECIATION - ACCELERATED DEPRECIATION METHOD Depreciation: Tax law allows firms to get tax elds sooner by allowing Modified Accelerated preciation Cost Recovery System (MACRS). nce, IM&C's can use a 5-year class to preciate the plant hence writing off 20% in first r, 32% in 2nd year, etc. The following table WS: 0 1 2 3 3 4 5 6 0 10.00 32.00 19.20 11.52 11.52 5.76 CRS Percentage Depr.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts