Question: Old MathJax webview Old MathJax webview need first 4 question be helpful. PHASE I: THE TASK Based on a detailed analysis of the case including

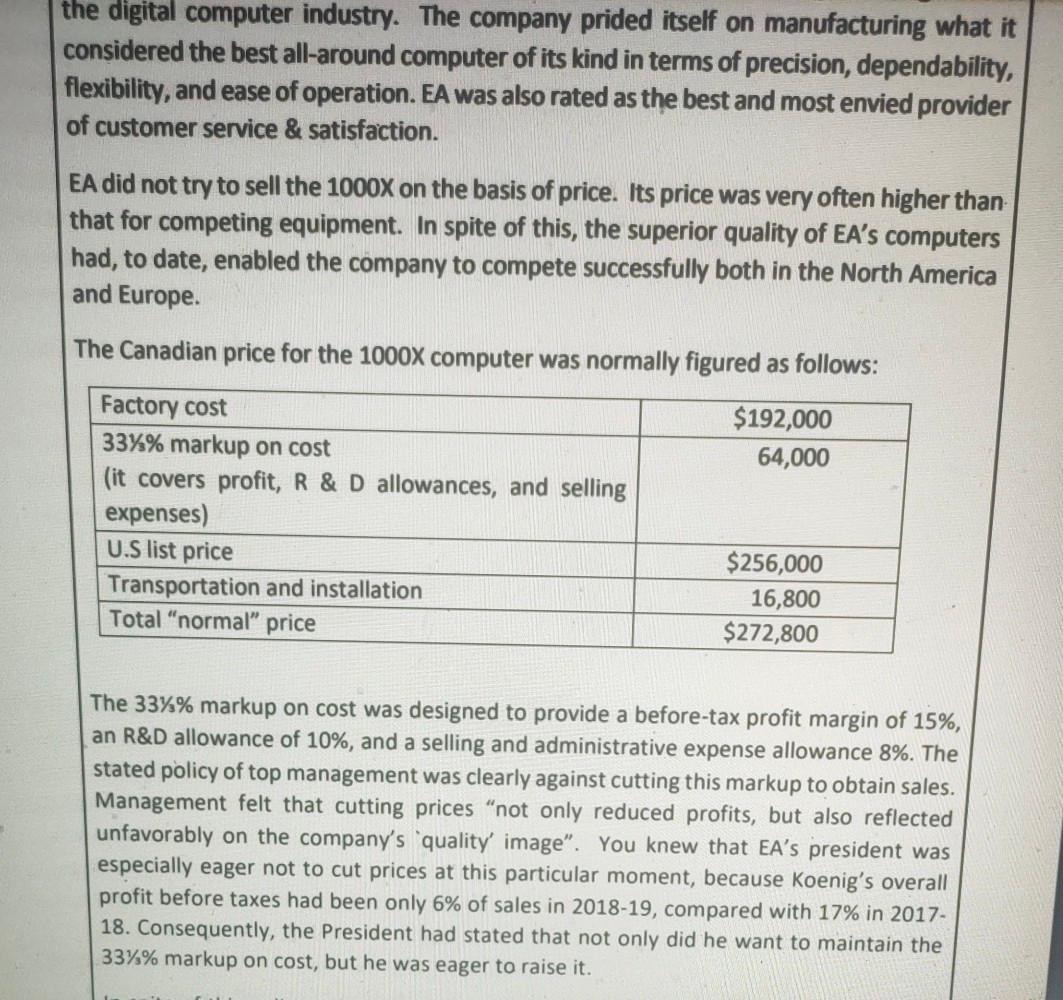

Old MathJax webview

Old MathJax webview

need first 4 question

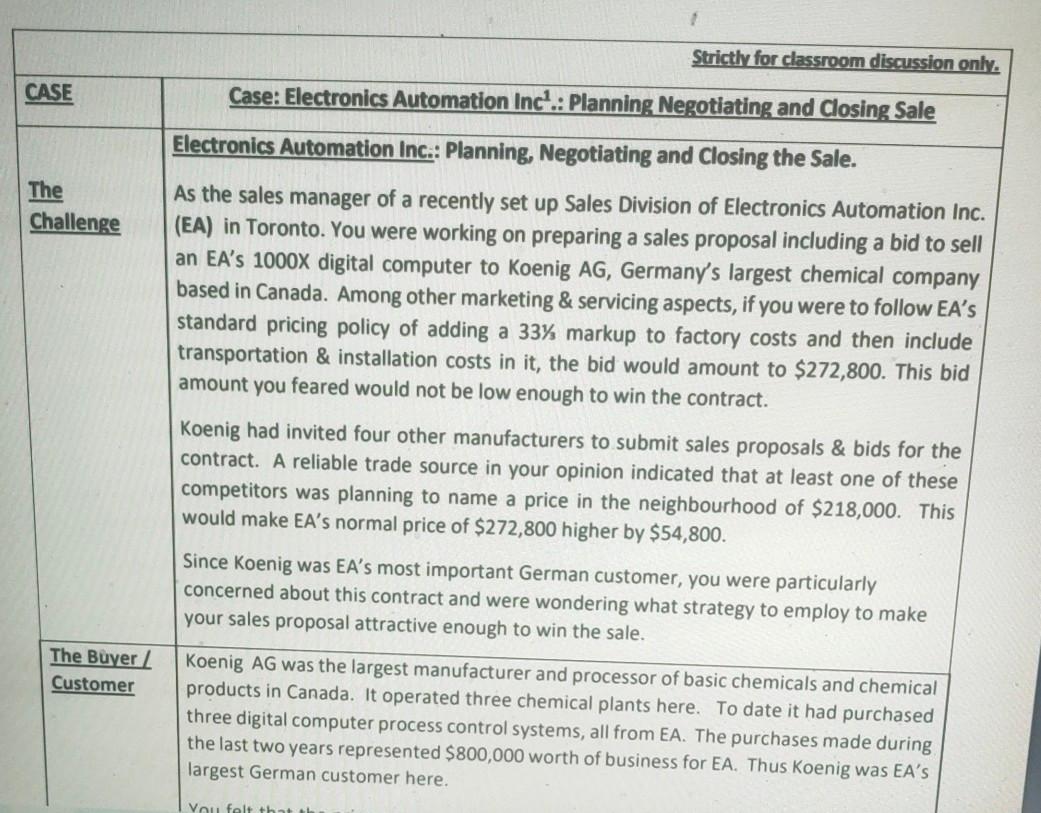

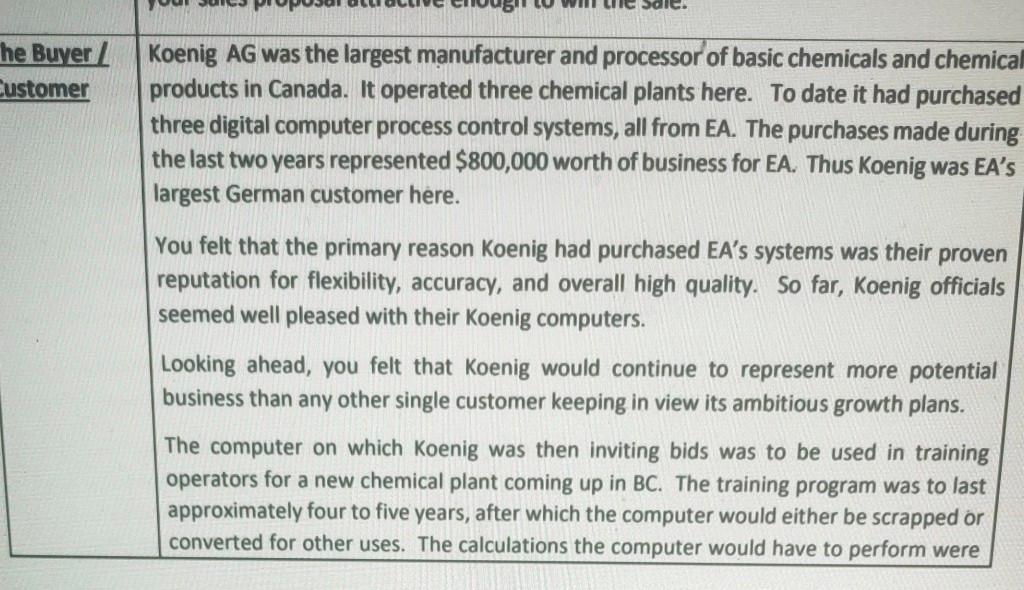

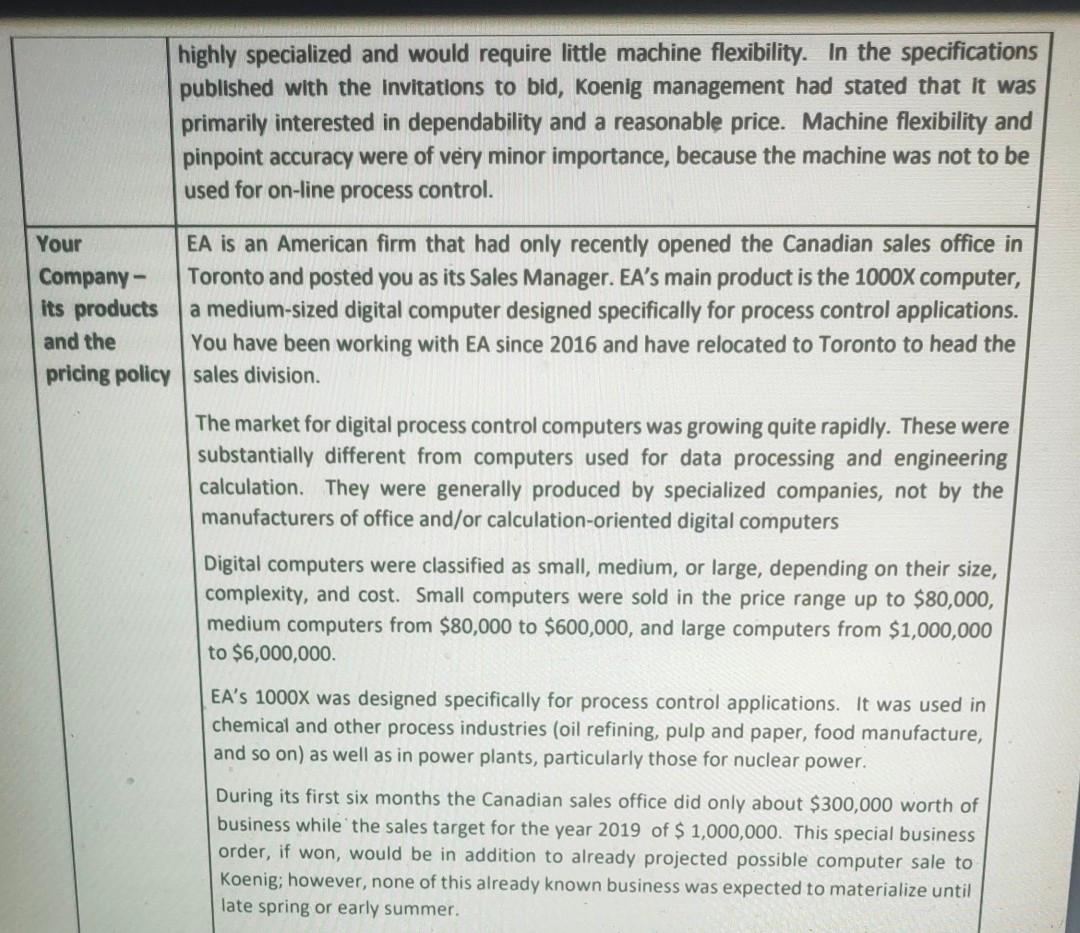

be helpful. PHASE I: THE TASK Based on a detailed analysis of the case including an analysis of the customer need requirements, and market & competition dynamics, answer the following Nine questions. 1. What is Unique in this (digital computer /process control systems) industry? 2. How do firms compete in this industry to keep their customers with them as well as to attract new customers? 3. What is a typical market behavior of a Hi-tech company? 4. Where does EA fit in your answers to the first three questions above? Based on your perception you may rate EA on a 5-point scale (where 1= Very weak, 2-Weak, 3 = neither weak nor strong, 4=strong, and 5 = very strong). 5. How are such products purchased (i.e., what criteria and buying process is typically followed) 6. What would be your winning bid amount? 7. What could be your Five specific reasons to support the bid amount? 8. Why must your bid be considered as a Winning Bid? (Three reasons in support) 9. What could be the worst outcome, if your bid is not accepted? (Three worst outcomes) Strictly for classroom discussion only. CASE Case: Electronics Automation Inc.: Planning Negotiating and Closing Sale The Challenge Electronics Automation Inc.: Planning, Negotiating and Closing the Sale. As the sales manager of a recently set up Sales Division of Electronics Automation Inc. (EA) in Toronto. You were working on preparing a sales proposal including a bid to sell an EA's 1000x digital computer to Koenig AG, Germany's largest chemical company based in Canada. Among other marketing & servicing aspects, if you were to follow EA's standard pricing policy of adding a 33% markup to factory costs and then include transportation & installation costs in it, the bid would amount to $272,800. This bid amount you feared would not be low enough to win the contract. Koenig had invited four other manufacturers to submit sales proposals & bids for the contract. A reliable trade source in your opinion indicated that at least one of these competitors was planning to name a price in the neighbourhood of $218,000. This would make EA's normal price of $272,800 higher by $54,800. The Buyer Customer Since Koenig was EA's most important German customer, you were particularly concerned about this contract and were wondering what strategy to employ to make your sales proposal attractive enough to win the sale. Koenig AG was the largest manufacturer and processor of basic chemicals and chemical products in Canada. It operated three chemical plants here. To date it had purchased three digital computer process control systems, all from EA. The purchases made during the last two years represented $800,000 worth of business for EA. Thus Koenig was EA's largest German customer here. Vou felt that Csaic he Buyer Customer Koenig AG was the largest manufacturer and processor of basic chemicals and chemical products in Canada. It operated three chemical plants here. To date it had purchased three digital computer process control systems, all from EA. The purchases made during the last two years represented $800,000 worth of business for EA. Thus Koenig was EA's largest German customer here. You felt that the primary reason Koenig had purchased EA's systems was their proven reputation for flexibility, accuracy, and overall high quality. So far, Koenig officials seemed well pleased with their Koenig computers. Looking ahead, you felt that Koenig would continue to represent more potential business than any other single customer keeping in view its ambitious growth plans. The computer on which Koenig was then inviting bids was to be used in training operators for a new chemical plant coming up in BC. The training program was to last approximately four to five years, after which the computer would either be scrapped or converted for other uses. The calculations the computer would have to perform were highly specialized and would require little machine flexibility. In the specifications published with the Invitations to bid, Koenig management had stated that it was primarily interested in dependability and a reasonable price. Machine flexibility and pinpoint accuracy were of very minor importance, because the machine was not to be used for on-line process control. Your EA is an American firm that had only recently opened the Canadian sales office in Company - Toronto and posted you as its Sales Manager. EA's main product is the 1000X computer, its products a medium-sized digital computer designed specifically for process control applications. and the You have been working with EA since 2016 and have relocated to Toronto to head the pricing policy sales division. The market for digital process control computers was growing quite rapidly. These were substantially different from computers used for data processing and engineering calculation. They were generally produced by specialized companies, not by the manufacturers of office and/or calculation-oriented digital computers Digital computers were classified as small, medium, or large, depending on their size, complexity, and cost. Small computers were sold in the price range up to $80,000, medium computers from $80,000 to $600,000, and large computers from $1,000,000 to $6,000,000. EA's 1000X was designed specifically for process control applications. It was used in chemical and other process industries (oil refining, pulp and paper, food manufacture, and so on) as well as in power plants, particularly those for nuclear power. During its first six months the Canadian sales office did only about $300,000 worth of business while the sales target for the year 2019 of $ 1,000,000. This special business order, if won, would be in addition to already projected possible computer sale to Koenig; however, none of this already known business was expected to materialize until late spring or early summer. EA's computers sold to Canadian customers were manufactured and assembled in the United States and shipped to Canada for installation. Looking at the vast potential for growth in the Canadian market, EA had already initiated steps to construct a plant in Ontario. This besides providing employment to Canadians would also help it to reduce its costs. You were also concerned about the possibility that the new plant might have to sit idle unless EA could win the Koenig contract. Company Pricing Policy EA had always concentrated on being the quality, blue-chip Company in its segment of the digital computer industry. The company prided itself on manufacturing what it considered the best all-around computer of its kind in terms of precision, dependability, flexibility, and ease of operation. EA was also rated as the best and most envied provider of customer service & satisfaction. EA did not try to sell the 1000X on the basis of price. Its price was very often higher than that for competing equipment. In spite of this, the superior quality of EA's computers had, to date, enabled the company to compete successfully both in the North America and Europe. The Canadian price for the 1000x computer was normally figured or follo the digital computer industry. The company prided itself on manufacturing what it considered the best all-around computer of its kind in terms of precision, dependability, flexibility, and ease of operation. EA was also rated as the best and most envied provider of customer service & satisfaction. EA did not try to sell the 1000X on the basis of price. Its price was very often higher than that for competing equipment. In spite of this, the superior quality of EA's computers had, to date, enabled the company to compete successfully both in the North America and Europe. The Canadian price for the 1000X computer was normally figured as follows: Factory cost $192,000 33%% markup on cost 64,000 (it covers profit, R & D allowances, and selling expenses) U.S list price $256,000 Transportation and installation 16,800 Total "normal" price $272,800 The 33%% markup on cost was designed to provide a before-tax profit margin of 15%, an R&D allowance of 10%, and a selling and administrative expense allowance 8%. The stated policy of top management was clearly against cutting this markup to obtain sales. Management felt that cutting prices "not only reduced profits, but also reflected unfavorably on the company's quality image". You knew that EA's president was especially eager not to cut prices at this particular moment, because Koenig's overall profit before taxes had been only 6% of sales in 2018-19, compared with 17% in 2017- 18. Consequently, the President had stated that not only did he want to maintain the 33%% markup on cost, but he was eager to raise it. instances when the markup had been dropped to the neighborhood of 25% to obtain important orders in the United States. In fact, you were aware of one instance when the markup had been cut to 20%. In the Canadian market, however, EA had never yet deviated from a 33%% markup on cost. Competition and Competitors There were about nine companies competing with EA in the sale of medium-priced digital process control computers. Four companies accounted for 80% of sales. (See Table below). You were primarily concerned with competition from the following companies: RAM SYSTEMS is a very aggressive German company which has been trying hard to expand its share of the market. It sold a medium-quality, general-purpose digital computer at a price roughly 22Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock