Question: Old MathJax webview Old MathJax webview Old MathJax webview please i need a long ans professional answers beacuse iam a master degree student ,, i

Old MathJax webview

please i need a long ans professional answers beacuse iam a master degree student ,, i need an answers for both questions .thanks

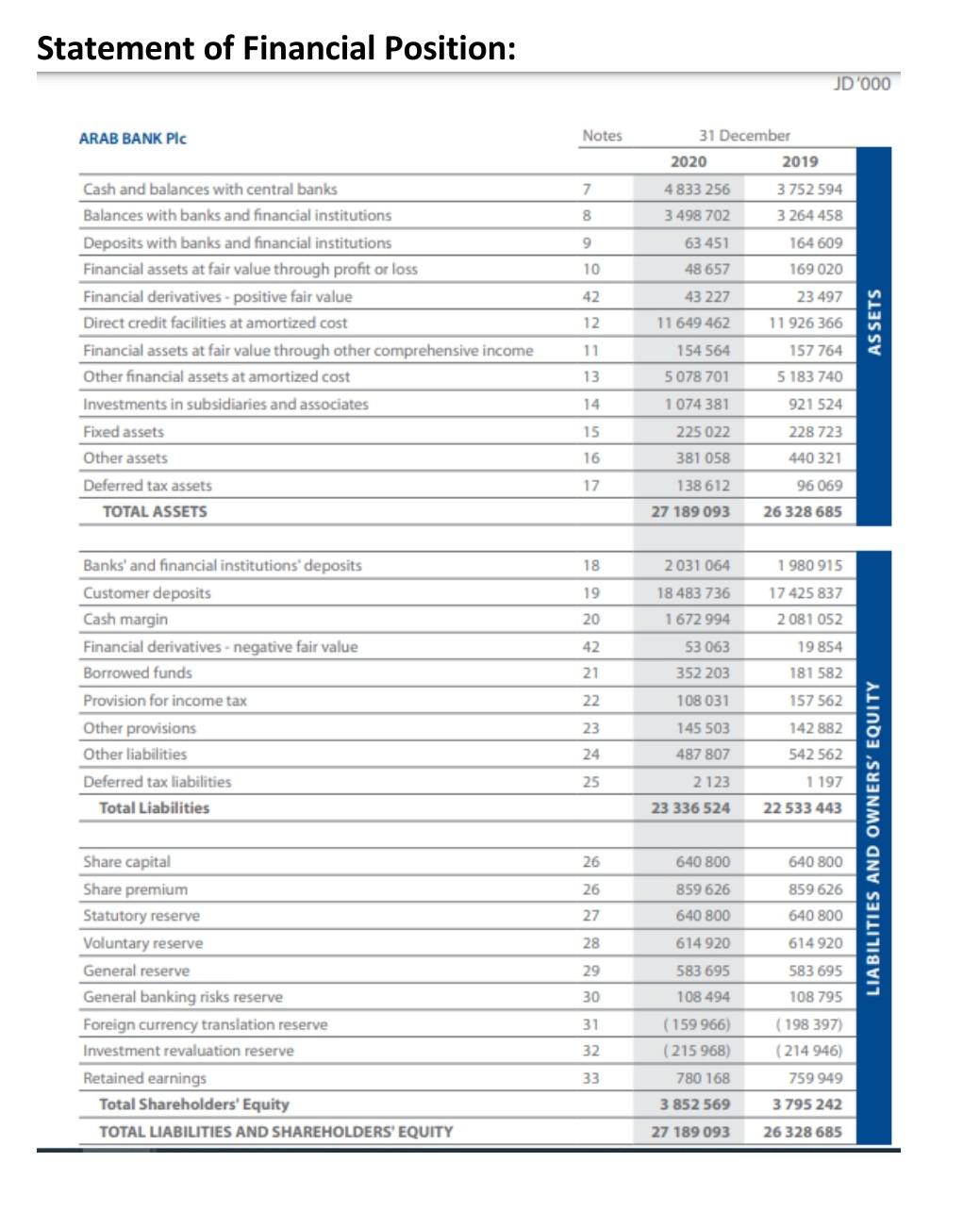

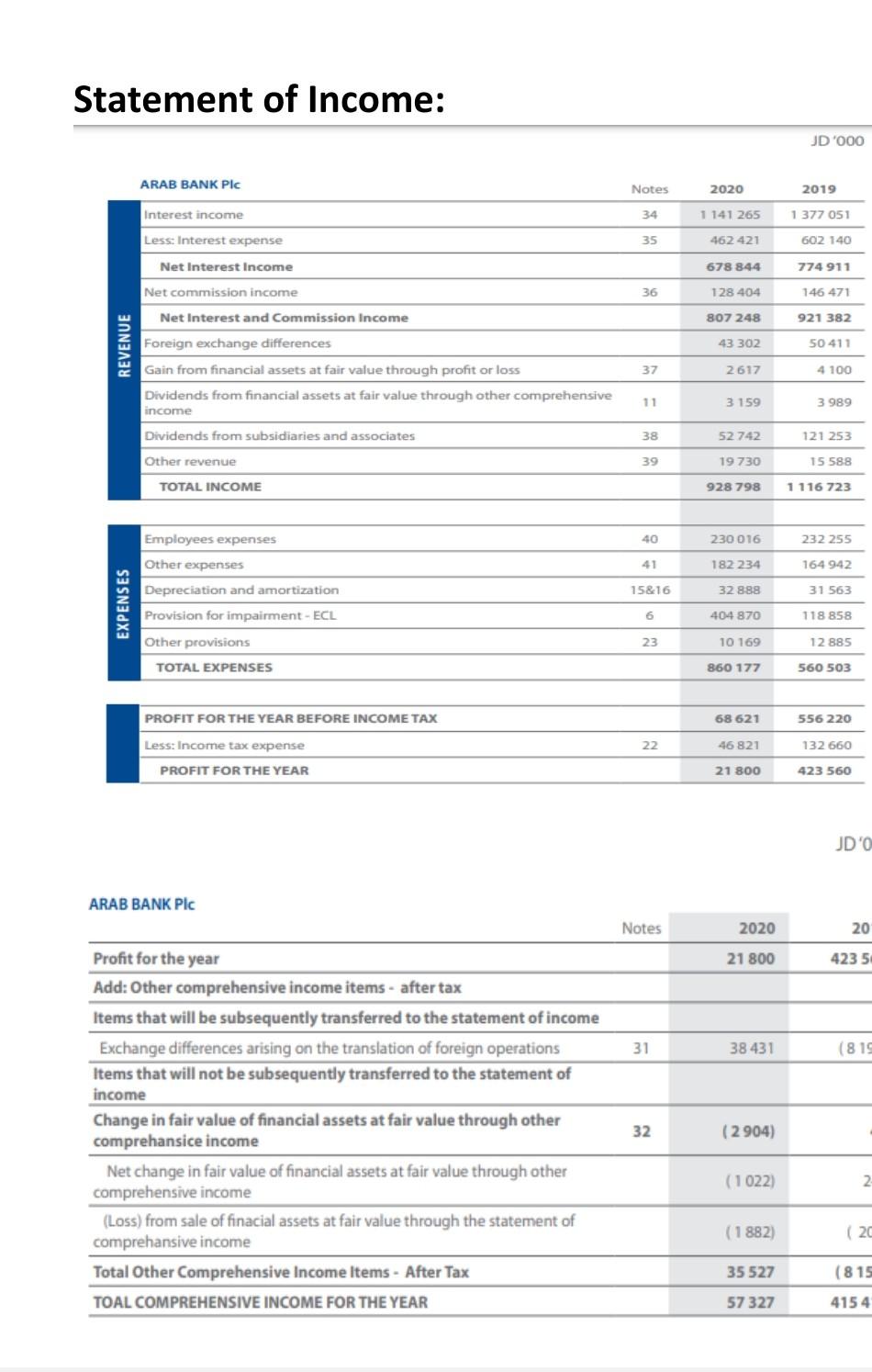

Analyze the financial performance of Arab Bank PLC?? then give comments about the performance??

using banking ratios : net interest margin roa wacc efficiency ratio operating leverage liquidity cover ratio leverage ratio : tier capital total assets debt to equity ratio CET 1 ratio provision for credit losses ratio

please i need a good explanation for the ratios , whats the meaning behind each one , this is what the doctor wants in this question

Statement of Financial Position: JD'000 ARAB BANK PLC Notes 7 8 9 10 42 Cash and balances with central banks Balances with banks and financial institutions Deposits with banks and financial institutions Financial assets at fair value through profit or loss Financial derivatives - positive fair value Direct credit facilities at amortized cost Financial assets at fair value through other comprehensive income Other financial assets at amortized cost Investments in subsidiaries and associates Fixed assets Other assets Deferred tax assets TOTAL ASSETS 31 December 2020 2019 4833 256 3752 594 3498 702 3 264 458 63 451 164 609 48 657 169 020 43 227 23 497 11 649 462 11 926 366 154 564 157 764 5078 701 5 183 740 1 074 381 921 524 225 022 228 723 381 058 440 321 ASSETS UWEN 16 17 96 069 138 612 27 189 093 26 328 685 18 2031 064 1 980 915 19 Banks' and financial institutions deposits Customer deposits Cash margin Financial derivatives - negative fair value Borrowed funds 18 483 736 1 672 994 17425837 2 081 052 20 42 53 063 352 203 19854 181 582 21 22 108 031 157 562 23 Provision for income tax Other provisions Other liabilities Deferred tax liabilities Total Liabilities 145 503 487 807 142 882 542 562 24 25 2 123 1 197 23 336 524 22 533 443 LIABILITIES AND OWNERS' EQUITY 26 640 800 640 800 859 626 859626 26 27 640 800 640 800 28 614 920 614 920 Share capital Share premium Statutory reserve Voluntary reserve General reserve General banking risks reserve Foreign currency translation reserve Investment revaluation reserve Retained earnings Total Shareholders' Equity TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY 29 30 583 695 108 494 583 695 108 795 (198 397) (214 946) 31 32 ( 159 966) (215 968) 780 168 33 759 949 3 852 569 3795 242 27 189 093 26 328 685 Statement of Income: JD '000 ARAB BANK PIC Notes 2020 2019 Interest income 34 1 141 265 1 377 051 Less: Interest expense 35 462 421 602 140 Net Interest Income 678 844 774 911 36 128 404 146 471 Net commission income Net Interest and Commission Income 807 248 921 382 REVENUE Foreign exchange differences 43 302 50 411 37 2617 4 100 Gain from financial assets at fair value through profit or loss Dividends from financial assets at fair value through other comprehensive income 11 3159 3 989 Dividends from subsidiaries and associates 38 52 742 121 253 Other revenue 39 19730 15 588 TOTAL INCOME 928 798 1 116 723 Employees expenses 40 230 016 232 255 Other expenses 41 182 234 164 942 15&16 32 888 31 563 EXPENSES 6 404 870 118 858 Depreciation and amortization Provision for impairment - ECL Other provisions TOTAL EXPENSES 23 10 169 12 885 860 177 560 503 PROFIT FOR THE YEAR BEFORE INCOME TAX 68 621 556 220 22 46 821 132660 Less: Income tax expense PROFIT FOR THE YEAR 21 800 423 560 JDO ARAB BANK PLC Notes 2020 20 21 800 423 5 31 38 431 (815 Profit for the year Add: Other comprehensive income items after tax Items that will be subsequently transferred to the statement of income Exchange differences arising on the translation of foreign operations Items that will not be subsequently transferred to the statement of income Change in fair value of financial assets at fair value through other comprehansice income Net change in fair value of financial assets at fair value through other comprehensive income (Loss) from sale of finacial assets at fair value through the statement of comprehansive income Total Other Comprehensive Income Items - After Tax TOAL COMPREHENSIVE INCOME FOR THE YEAR 32 (2 904) (1022) (1 882) (20 35 527 (815 57 327 4154 Statement of Financial Position: JD'000 ARAB BANK PLC Notes 7 8 9 10 42 Cash and balances with central banks Balances with banks and financial institutions Deposits with banks and financial institutions Financial assets at fair value through profit or loss Financial derivatives - positive fair value Direct credit facilities at amortized cost Financial assets at fair value through other comprehensive income Other financial assets at amortized cost Investments in subsidiaries and associates Fixed assets Other assets Deferred tax assets TOTAL ASSETS 31 December 2020 2019 4833 256 3752 594 3498 702 3 264 458 63 451 164 609 48 657 169 020 43 227 23 497 11 649 462 11 926 366 154 564 157 764 5078 701 5 183 740 1 074 381 921 524 225 022 228 723 381 058 440 321 ASSETS UWEN 16 17 96 069 138 612 27 189 093 26 328 685 18 2031 064 1 980 915 19 Banks' and financial institutions deposits Customer deposits Cash margin Financial derivatives - negative fair value Borrowed funds 18 483 736 1 672 994 17425837 2 081 052 20 42 53 063 352 203 19854 181 582 21 22 108 031 157 562 23 Provision for income tax Other provisions Other liabilities Deferred tax liabilities Total Liabilities 145 503 487 807 142 882 542 562 24 25 2 123 1 197 23 336 524 22 533 443 LIABILITIES AND OWNERS' EQUITY 26 640 800 640 800 859 626 859626 26 27 640 800 640 800 28 614 920 614 920 Share capital Share premium Statutory reserve Voluntary reserve General reserve General banking risks reserve Foreign currency translation reserve Investment revaluation reserve Retained earnings Total Shareholders' Equity TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY 29 30 583 695 108 494 583 695 108 795 (198 397) (214 946) 31 32 ( 159 966) (215 968) 780 168 33 759 949 3 852 569 3795 242 27 189 093 26 328 685 Statement of Income: JD '000 ARAB BANK PIC Notes 2020 2019 Interest income 34 1 141 265 1 377 051 Less: Interest expense 35 462 421 602 140 Net Interest Income 678 844 774 911 36 128 404 146 471 Net commission income Net Interest and Commission Income 807 248 921 382 REVENUE Foreign exchange differences 43 302 50 411 37 2617 4 100 Gain from financial assets at fair value through profit or loss Dividends from financial assets at fair value through other comprehensive income 11 3159 3 989 Dividends from subsidiaries and associates 38 52 742 121 253 Other revenue 39 19730 15 588 TOTAL INCOME 928 798 1 116 723 Employees expenses 40 230 016 232 255 Other expenses 41 182 234 164 942 15&16 32 888 31 563 EXPENSES 6 404 870 118 858 Depreciation and amortization Provision for impairment - ECL Other provisions TOTAL EXPENSES 23 10 169 12 885 860 177 560 503 PROFIT FOR THE YEAR BEFORE INCOME TAX 68 621 556 220 22 46 821 132660 Less: Income tax expense PROFIT FOR THE YEAR 21 800 423 560 JDO ARAB BANK PLC Notes 2020 20 21 800 423 5 31 38 431 (815 Profit for the year Add: Other comprehensive income items after tax Items that will be subsequently transferred to the statement of income Exchange differences arising on the translation of foreign operations Items that will not be subsequently transferred to the statement of income Change in fair value of financial assets at fair value through other comprehansice income Net change in fair value of financial assets at fair value through other comprehensive income (Loss) from sale of finacial assets at fair value through the statement of comprehansive income Total Other Comprehensive Income Items - After Tax TOAL COMPREHENSIVE INCOME FOR THE YEAR 32 (2 904) (1022) (1 882) (20 35 527 (815 57 327 4154

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts