Question: Old MathJax webview Old MathJax webview Options question 116% today is September 26, and you are considering buying one call option expiring or 26. You

Old MathJax webview

Options question

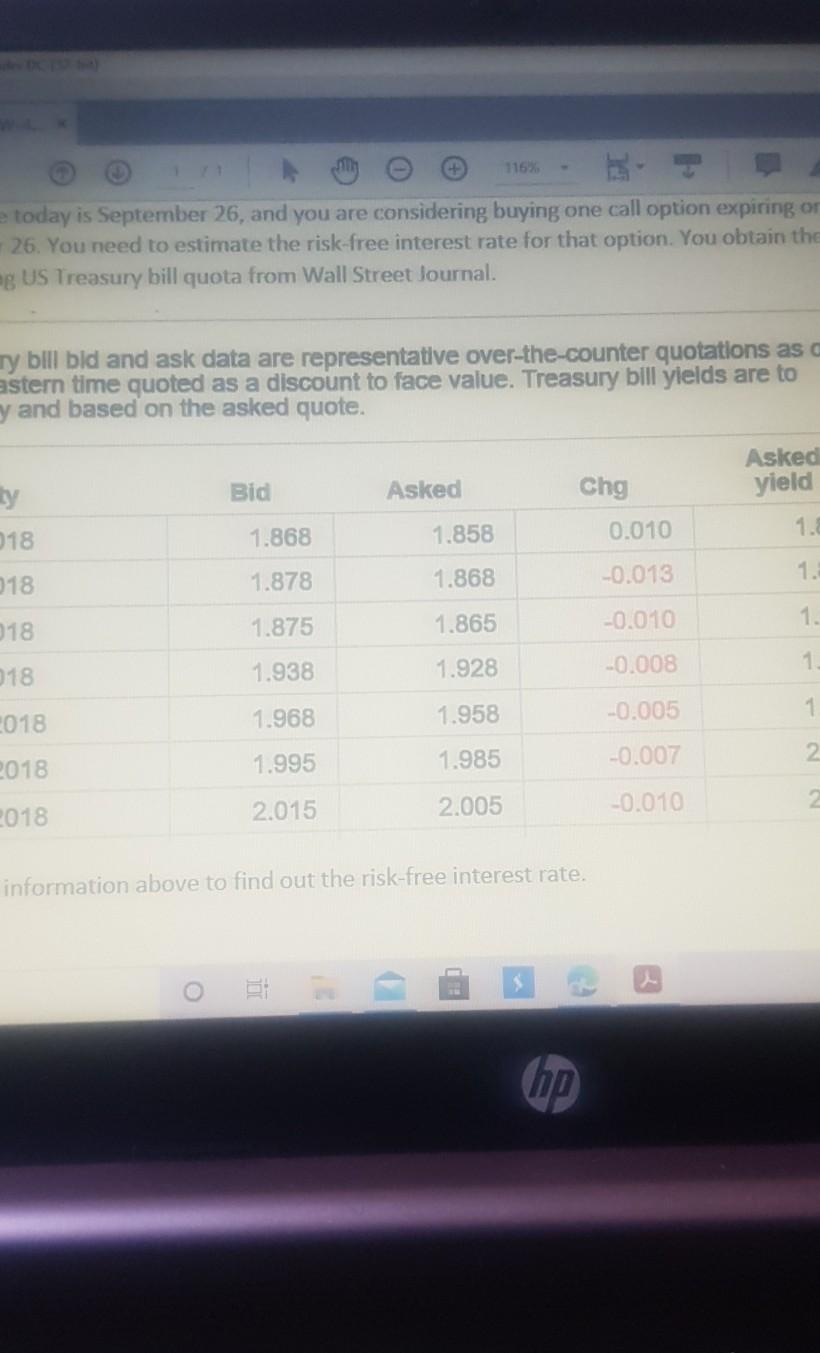

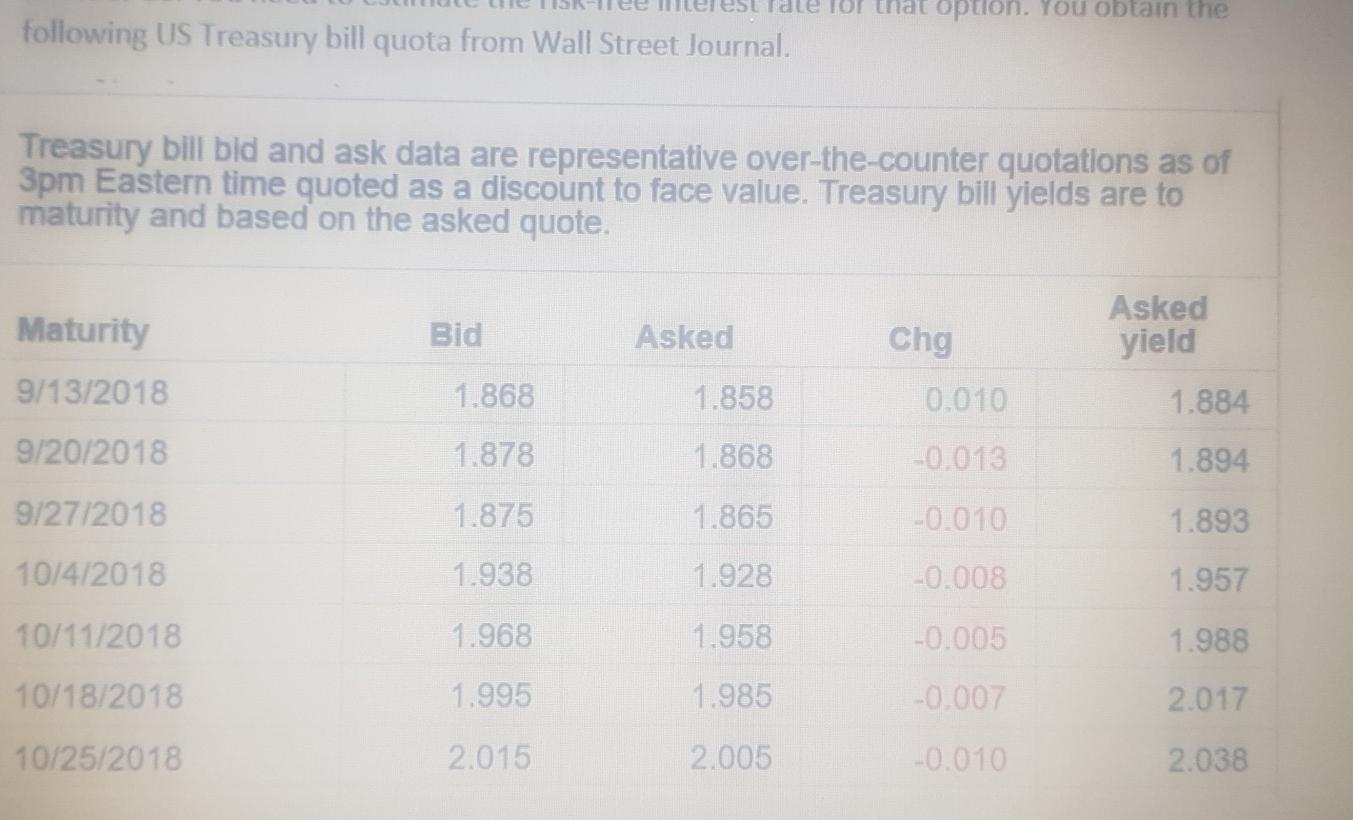

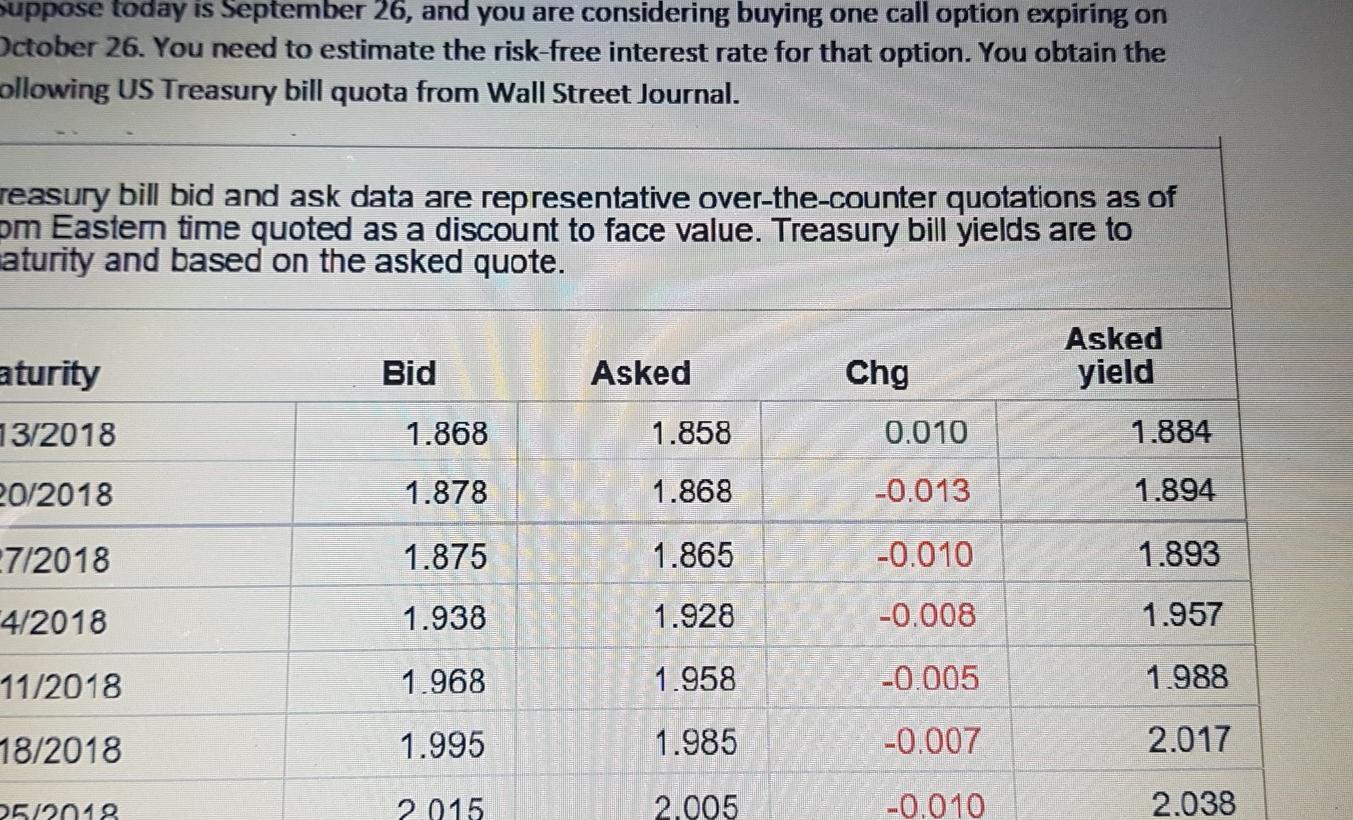

116% today is September 26, and you are considering buying one call option expiring or 26. You need to estimate the risk-free interest rate for that option. You obtain the eg US Treasury bill quota from Wall Street Journal. ty bill bld and ask data are representative over-the-counter quotations as c astern time quoted as a discount to face value. Treasury bill yields are to y and based on the asked quote. Asked yield Bid Asked Chg ty 018 1.868 1.858 1. 0.010 018 1.878 1.868 -0.013 1. 018 1.875 1.865 -0.010 1 1.938 1.928 -0.008 1 1.968 1.958 -0.005 18 2018 2018 2018 1.995 1.985 -0.007 2.015 2.005 -0.010 information above to find out the risk-free interest rate. 0 hp idle rol option. You obtain the following US Treasury bill quota from Wall Street Journal. Treasury bill bid and ask data are representative over-the-counter quotations as of 3pm Eastern time quoted as a discount to face value. Treasury bill yields are to maturity and based on the asked quote. Maturity Bid Asked Chg Asked yield 9/13/2018 1.868 1.858 0.010 1.884 9/20/2018 1.878 1.868 -0.013 1.894 9/27/2018 1.875 1.865 -0.0110 1.893 10/4/2018 1.938 1.928 -0.008 1.957 10/11/2018 1.968 1.958 -0.005 1.988 10/18/2018 1.995 1.985 -0.007 2.017 10/25/2018 2.015 2.005 -0.010 2.038 Suppose today is September 26, and you are considering buying one call option expiring on October 26. You need to estimate the risk-free interest rate for that option. You obtain the ollowing US Treasury bill quota from Wall Street Journal. reasury bill bid and ask data are representative over-the-counter quotations as of om Eastern time quoted as a discount to face value. Treasury bill yields are to maturity and based on the asked quote. aturity Bid Asked Chg Asked yield 13/2018 1.868 1.858 0.010 1.884 20/2018 1.878 1.868 -0.013 1.894 7/2018 1.875 1.865 -0.010 1.893 4/2018 1.938 1.928 -0.008 1.957 11/2018 1.968 1.958 -0.005 1.988 18/2018 1.995 1.985 -0.007 2.017 25/2018 2015 2.005 -0.010 2.038 116% today is September 26, and you are considering buying one call option expiring or 26. You need to estimate the risk-free interest rate for that option. You obtain the eg US Treasury bill quota from Wall Street Journal. ty bill bld and ask data are representative over-the-counter quotations as c astern time quoted as a discount to face value. Treasury bill yields are to y and based on the asked quote. Asked yield Bid Asked Chg ty 018 1.868 1.858 1. 0.010 018 1.878 1.868 -0.013 1. 018 1.875 1.865 -0.010 1 1.938 1.928 -0.008 1 1.968 1.958 -0.005 18 2018 2018 2018 1.995 1.985 -0.007 2.015 2.005 -0.010 information above to find out the risk-free interest rate. 0 hp idle rol option. You obtain the following US Treasury bill quota from Wall Street Journal. Treasury bill bid and ask data are representative over-the-counter quotations as of 3pm Eastern time quoted as a discount to face value. Treasury bill yields are to maturity and based on the asked quote. Maturity Bid Asked Chg Asked yield 9/13/2018 1.868 1.858 0.010 1.884 9/20/2018 1.878 1.868 -0.013 1.894 9/27/2018 1.875 1.865 -0.0110 1.893 10/4/2018 1.938 1.928 -0.008 1.957 10/11/2018 1.968 1.958 -0.005 1.988 10/18/2018 1.995 1.985 -0.007 2.017 10/25/2018 2.015 2.005 -0.010 2.038 Suppose today is September 26, and you are considering buying one call option expiring on October 26. You need to estimate the risk-free interest rate for that option. You obtain the ollowing US Treasury bill quota from Wall Street Journal. reasury bill bid and ask data are representative over-the-counter quotations as of om Eastern time quoted as a discount to face value. Treasury bill yields are to maturity and based on the asked quote. aturity Bid Asked Chg Asked yield 13/2018 1.868 1.858 0.010 1.884 20/2018 1.878 1.868 -0.013 1.894 7/2018 1.875 1.865 -0.010 1.893 4/2018 1.938 1.928 -0.008 1.957 11/2018 1.968 1.958 -0.005 1.988 18/2018 1.995 1.985 -0.007 2.017 25/2018 2015 2.005 -0.010 2.038

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts