Question: Old MathJax webview Old MathJax webview Tirolet LCHI Questa 13 Nuit mo tive alternatives (Corey are compare the present worth irwantoma o coturnix) value for

Old MathJax webview

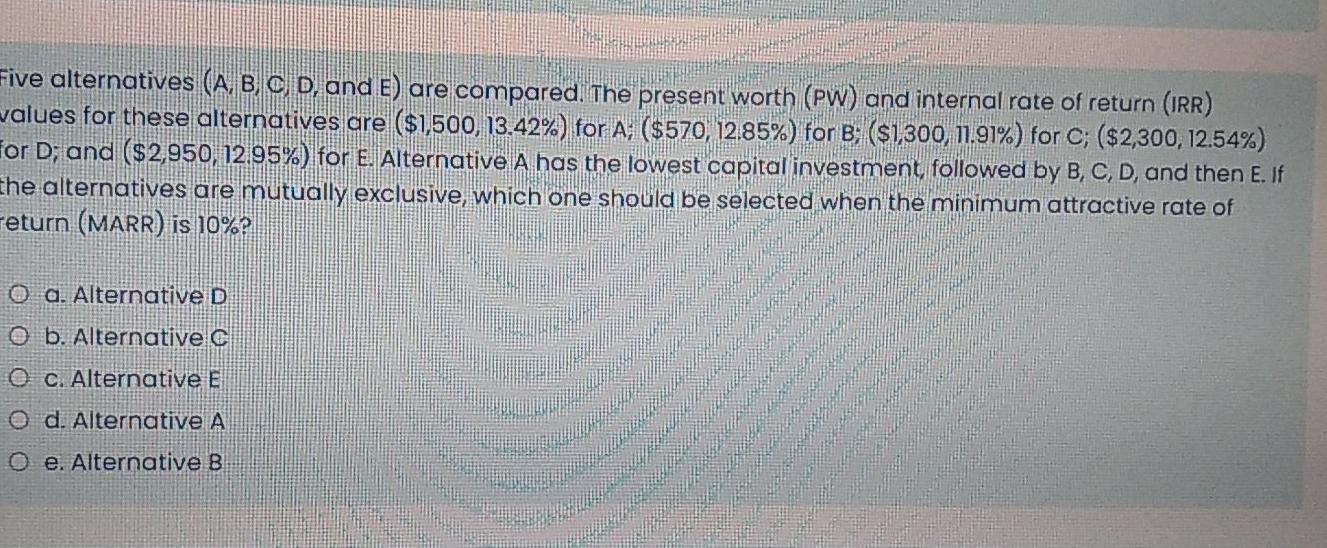

Tirolet LCHI Questa 13 Nuit mo tive alternatives (Corey are compare the present worth irwantoma o coturnix) value for these alternatives eras,500,12 4231 for $570 12.4 to $300, 1.to (12.09.1964) fero; and (32 860,12 95%) for Merriative has the loads. capital investment to be one than the alternativas e mutually esclusi ora should be selectes when the narration rate of return (MARR 18 10% Merit 2:50 FOR question u. Alternative Obternative QC Alternative d. Alterave DRATarnative Five alternatives (A, B, C, D, and E) are compared. The present worth (PW) and internal rate of return (IRR) values for these alternatives are ($1,500, 13.42%) for A; ($570, 12,85%) for B; ($1,300, 11.91%) for C; ($2,300, 12.54%) for D; and ($2,950. 12.95%) for E. Alternative A has the lowest capital investment followed by B, C, D, and then E. if the alternatives are mutually exclusive, which one should be selected when the minimum attractive rate of return (MARR) is 10%? O a. Alternative D O b. Alternative c O C. Alternative E O d. Alternative A O e. Alternative B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts