Question: Old MathJax webview please answer as soon as possible Question 2 (10 marks) (Show all working clearly. Round off answers to 2d.p.) Ben's Trading Ltd.

Old MathJax webview

please answer as soon as possible

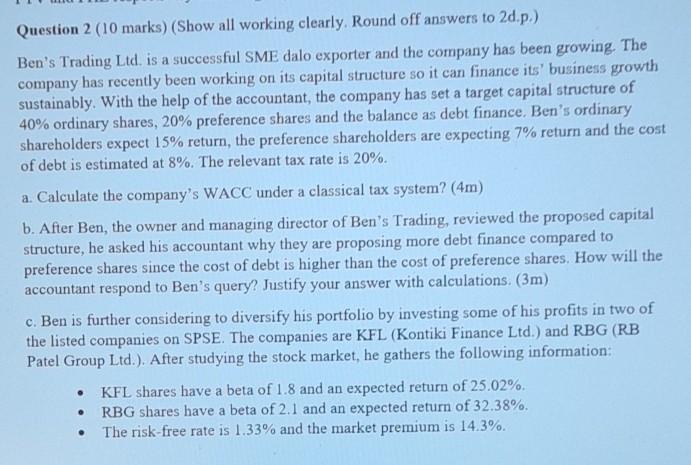

Question 2 (10 marks) (Show all working clearly. Round off answers to 2d.p.) Ben's Trading Ltd. is a successful SME dalo exporter and the company has been growing. The company has recently been working on its capital structure so it can finance its' business growth sustainably. With the help of the accountant, the company has set a target capital structure of 40% ordinary shares, 20% preference shares and the balance as debt finance. Ben's ordinary shareholders expect 15% return, the preference shareholders are expecting 7% return and the cost of debt is estimated at 8%. The relevant tax rate is 20%. a. Calculate the company's WACC under a classical tax system? (4m) b. After Ben, the owner and managing director of Ben's Trading, reviewed the proposed capital structure, he asked his accountant why they are proposing more debt finance compared to preference shares since the cost of debt is higher than the cost of preference shares. How will the accountant respond to Ben's query? Justify your answer with calculations. (3m) c. Ben is further considering to diversify his portfolio by investing some of his profits in two of the listed companies on SPSE. The companies are KFL (Kontiki Finance Ltd.) and RBG (RB Patel Group Ltd.). After studying the stock market, he gathers the following information: KFL shares have a beta of 1.8 and an expected return of 25.02%. RBG shares have a beta of 2.1 and an expected return of 32.38%. The risk-free rate is 1.33% and the market premium is 14.3%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts