Question: Old MathJax webview PLEASE SHOW ALL METHODS CLEARLY...explaining every step...thanks:) and dont use excel. 2. Suppose the company have three exclusive mutually investments as given

Old MathJax webview

PLEASE SHOW ALL METHODS CLEARLY...explaining every step...thanks:) and dont use excel.

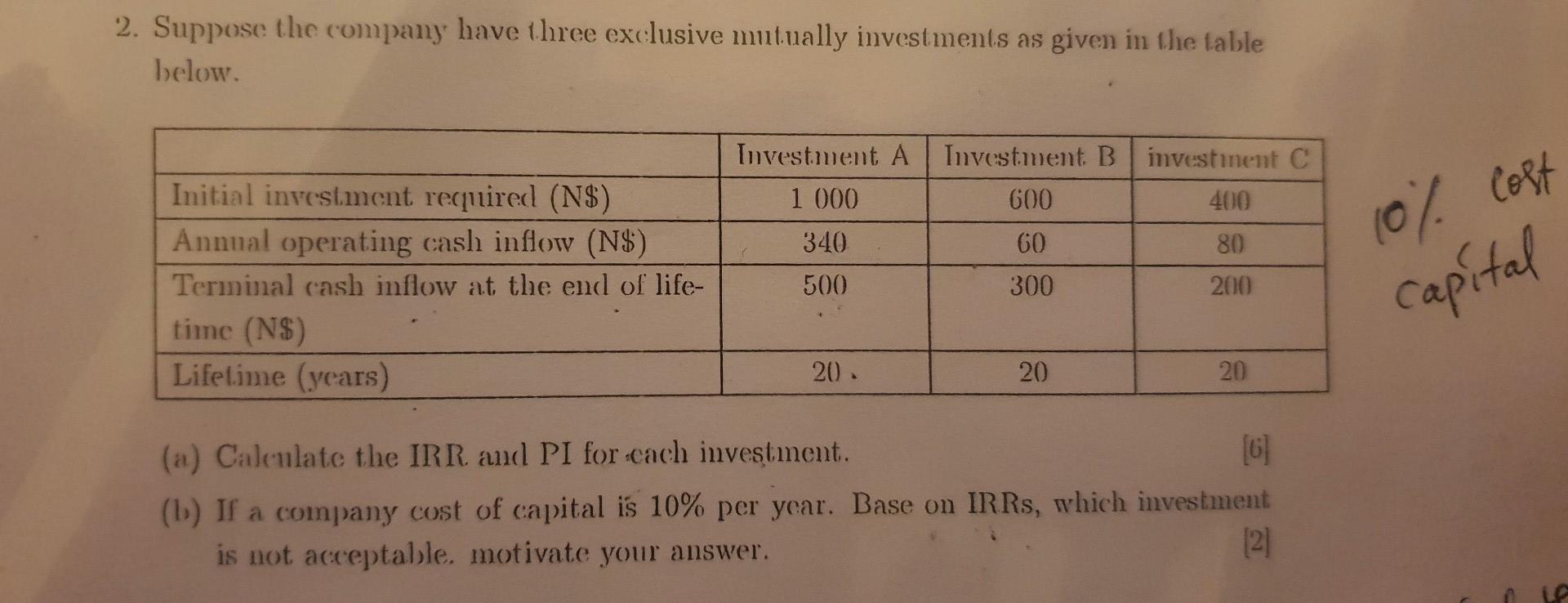

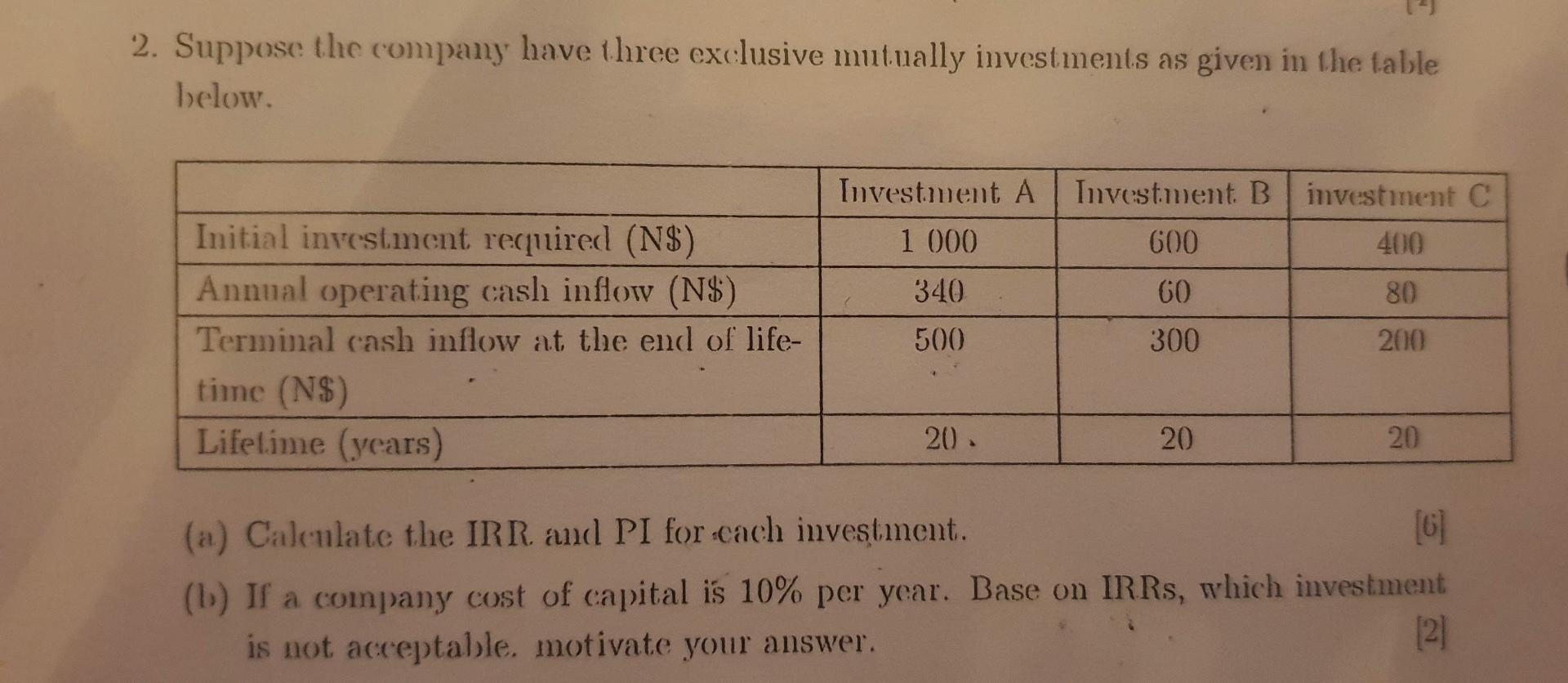

2. Suppose the company have three exclusive mutually investments as given in the table below. Investment A Investment B 600 investinent C 400 1 000 340 60 80 Initial investment required (N$) Annual operating cash inflow (N$) Terminal cash inflow at the end of life- time (N$) Lifetime (years) 10% cost capital 500 300 200 20. 20 20 (a) Calenlate the IRR and PI for.cach investment. [6] (b) If a company cost of capital is 10% per year. Base on IRRs, which investment is not acceptable, motivate your answer. [2] 2. Suppose the company have three exclusive mutually investments as given in the table below. Investment A Investment B investinent C 400 1 000 600 340 60 80 Initial investment required (N$) Annual operating cash inflow (N$) Terminal cash inflow at the end of life- time (N$) Lifetime (years) 500 300 200 20. 20 20 (a) Caleulate the IRR and PI for cach investment. [6] (b) If a company cost of capital is 10% per year. Base on IRRs, which investment is not acceptable, motivate your answer. [2]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts