Question: Old MathJax webview Plez solve it UK TAX Question 2: During the tax year 2020/21, Sona has Rental income of 50,000, Employment income of 120,000,

Old MathJax webview

Plez solve it

UK TAX

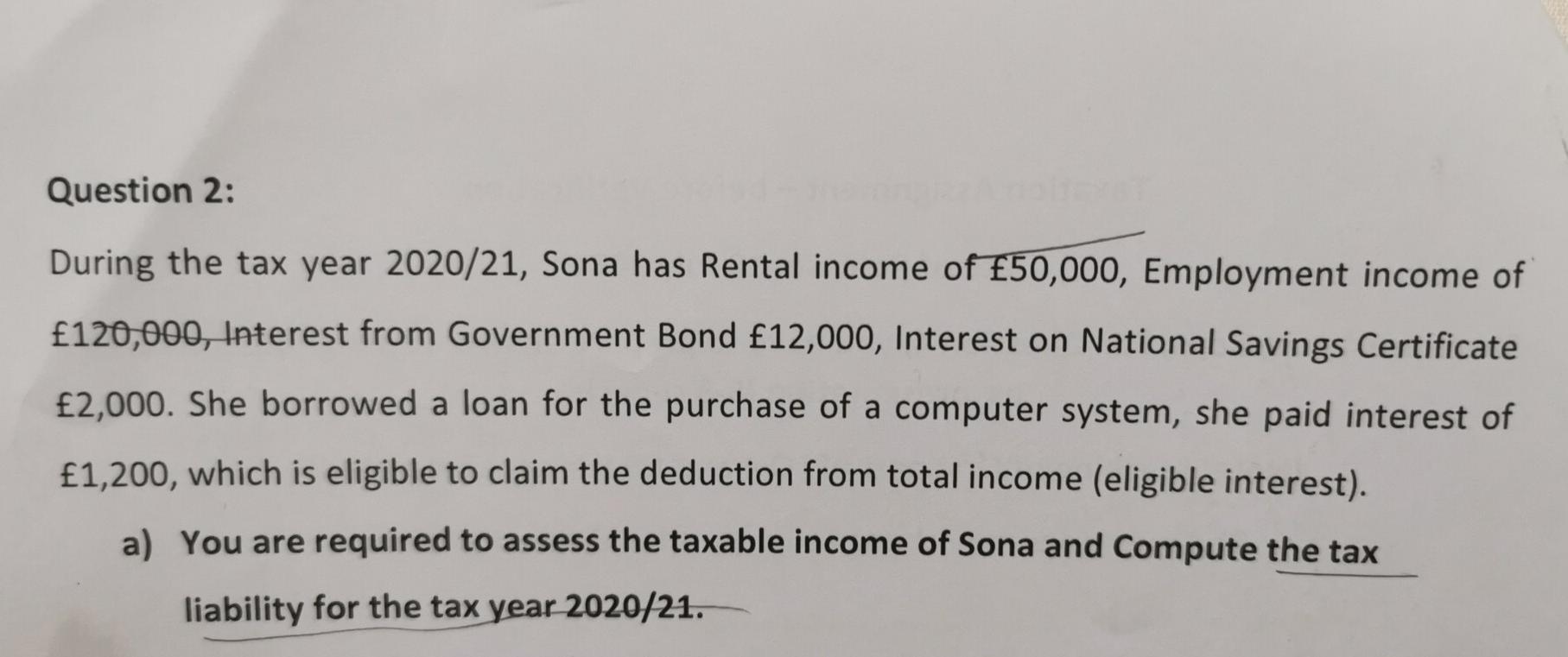

Question 2: During the tax year 2020/21, Sona has Rental income of 50,000, Employment income of 120,000, Interest from Government Bond 12,000, Interest on National Savings Certificate 2,000. She borrowed a loan for the purchase of a computer system, she paid interest of 1,200, which is eligible to claim the deduction from total income (eligible interest). a) You are required to assess the taxable income of Sona and Compute the tax liability for the tax year 2020/21. Question 2: During the tax year 2020/21, Sona has Rental income of 50,000, Employment income of 120,000, Interest from Government Bond 12,000, Interest on National Savings Certificate 2,000. She borrowed a loan for the purchase of a computer system, she paid interest of 1,200, which is eligible to claim the deduction from total income (eligible interest). a) You are required to assess the taxable income of Sona and Compute the tax liability for the tax year 2020/21

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts