Question: Old MathJax webview pls answer asap Spread the numbers for the following two mutually exclusive projects: Both projects have an investment cost of $10,000,000 Project

Old MathJax webview

pls answer asap

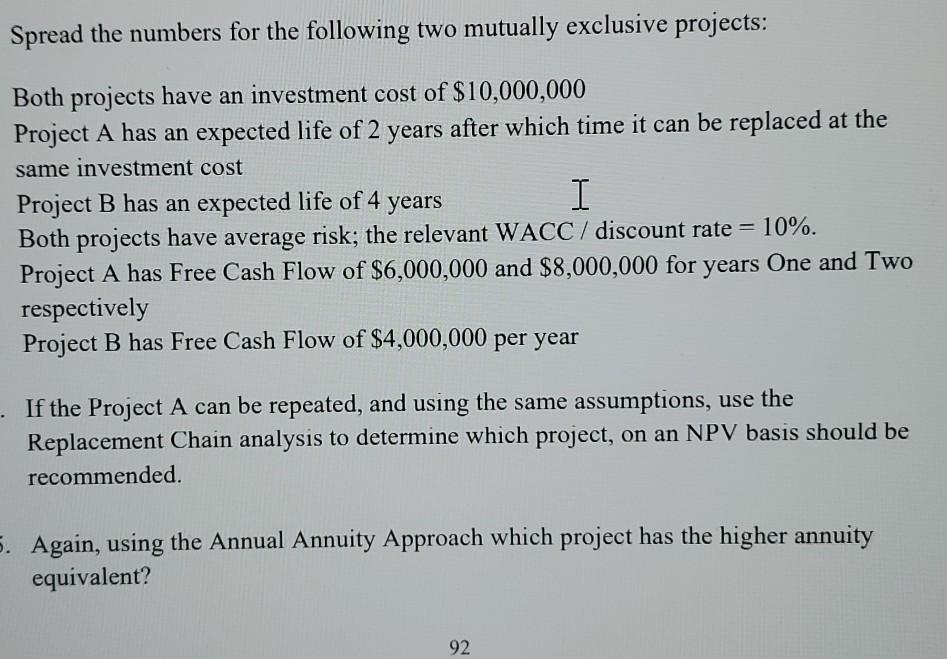

Spread the numbers for the following two mutually exclusive projects: Both projects have an investment cost of $10,000,000 Project A has an expected life of 2 years after which time it can be replaced at the same investment cost Project B has an expected life of 4 years I Both projects have average risk; the relevant WACC / discount rate = 10%. Project A has Free Cash Flow of $6,000,000 and $8,000,000 for years One and Two respectively Project B has Free Cash Flow of $4,000,000 per year If the Project A can be repeated, and using the same assumptions, use the Replacement Chain analysis to determine which project, on an NPV basis should be recommended. 5. Again, using the Annual Annuity Approach which project has the higher annuity equivalent? 92

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts