Question: Old MathJax webview Portfolio Urgent solution 1. This is a comprehensive project which will be completed by individual students. PLAGARISM if found will be allocated

Old MathJax webview

Portfolio Urgent solution

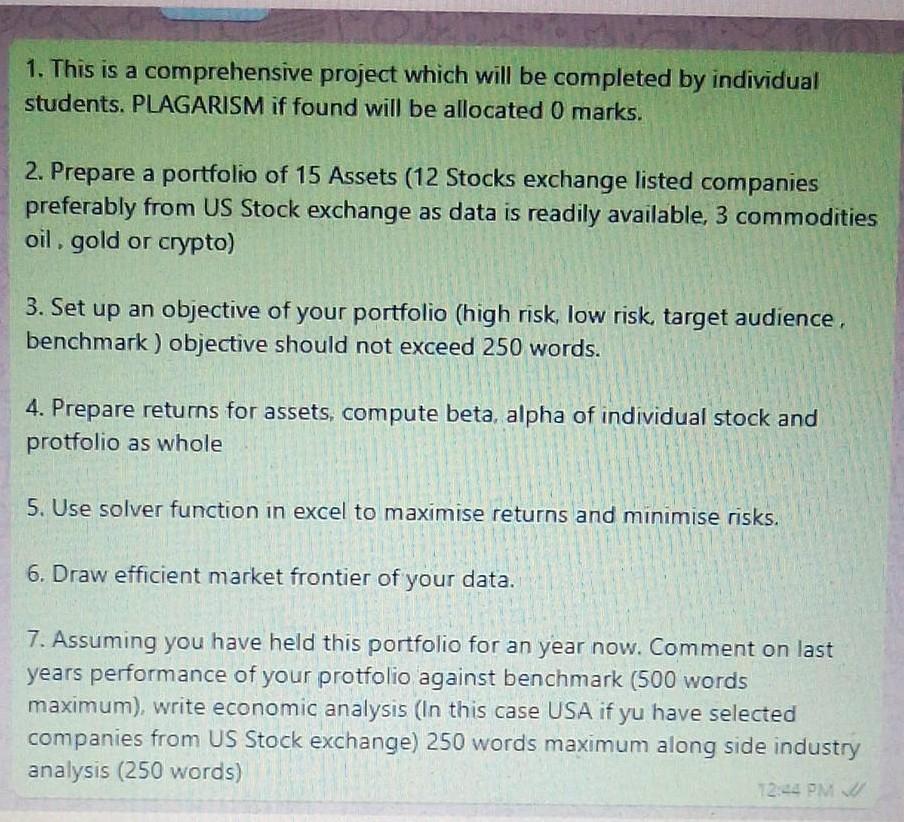

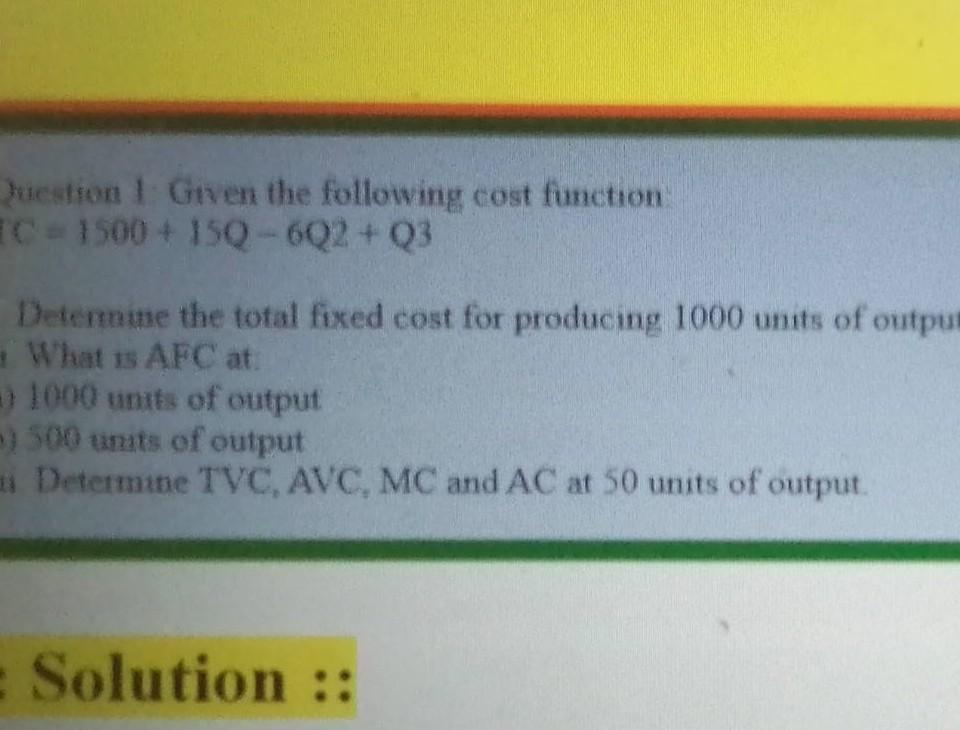

1. This is a comprehensive project which will be completed by individual students. PLAGARISM if found will be allocated 0 marks. 2. Prepare a portfolio of 15 Assets (12 Stocks exchange listed companies preferably from US Stock exchange as data is readily available, 3 commodities oil, gold or crypto) 3. Set up an objective of your portfolio (high risk, low risk, target audience, benchmark) objective should not exceed 250 words. 4. Prepare returns for assets, compute beta, alpha of individual stock and protfolio as whole 5. Use solver function in excel to maximise returns and minimise risks. 6. Draw efficient market frontier of your data. 7. Assuming you have held this portfolio for an year now. Comment on last years performance of your protfolio against benchmark (500 words maximum), write economic analysis (In this case USA if yu have selected companies from US Stock exchange) 250 words maximum along side industry analysis (250 words) 12:44 PM Juestion ! Given the following cost function C = 1500 + 150-6Q2+Q3 Determine the total fixed cost for producing 1000 units of output What is AFC at => 1000 units of output 500 units of output Determine TVC, AVC, MC and AC at 50 units of output. Solution :: 1. This is a comprehensive project which will be completed by individual students. PLAGARISM if found will be allocated 0 marks. 2. Prepare a portfolio of 15 Assets (12 Stocks exchange listed companies preferably from US Stock exchange as data is readily available, 3 commodities oil, gold or crypto) 3. Set up an objective of your portfolio (high risk, low risk, target audience, benchmark) objective should not exceed 250 words. 4. Prepare returns for assets, compute beta, alpha of individual stock and protfolio as whole 5. Use solver function in excel to maximise returns and minimise risks. 6. Draw efficient market frontier of your data. 7. Assuming you have held this portfolio for an year now. Comment on last years performance of your protfolio against benchmark (500 words maximum), write economic analysis (In this case USA if yu have selected companies from US Stock exchange) 250 words maximum along side industry analysis (250 words) 12:44 PM Juestion ! Given the following cost function C = 1500 + 150-6Q2+Q3 Determine the total fixed cost for producing 1000 units of output What is AFC at => 1000 units of output 500 units of output Determine TVC, AVC, MC and AC at 50 units of output. Solution

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts