Question: Old MathJax webview Prepare a 2017 T1 Return given the following information: Complete the T1 Income Tax Return and any relevant Schedules. Name: Mr. Henry

Old MathJax webview

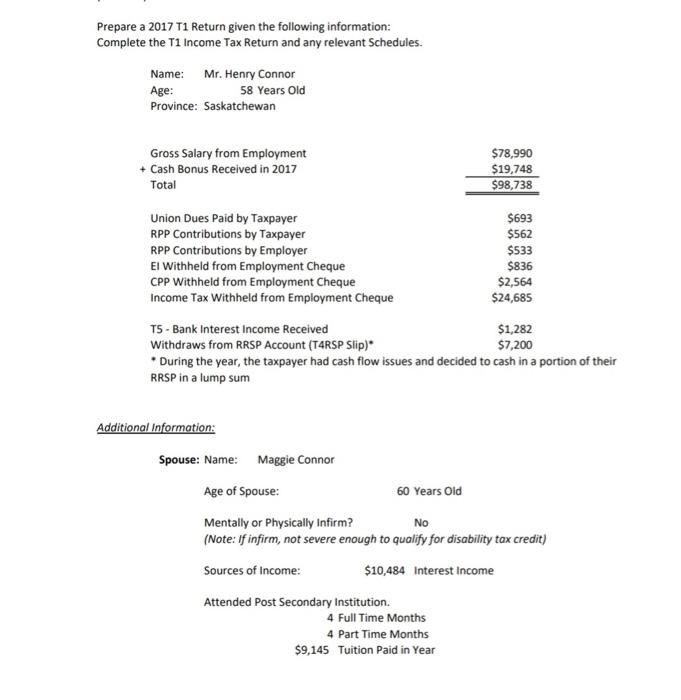

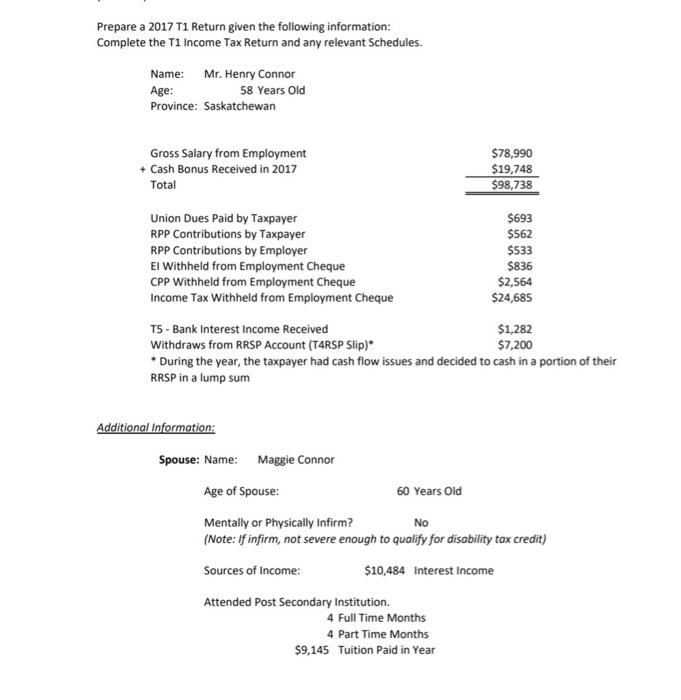

Prepare a 2017 T1 Return given the following information: Complete the T1 Income Tax Return and any relevant Schedules. Name: Mr. Henry Connor Age: 58 Years Old Province: Saskatchewan Gross Salary from Employment + Cash Bonus Received in 2017 $78,990 $19,748 $98,738 Total Union Dues Paid by Taxpayer $693 RPP Contributions by Taxpayer $562 RPP Contributions by Employer $533 El Withheld from Employment Cheque $836 CPP Withheld from Employment Cheque $2,564 Income Tax Withheld from Employment Cheque $24,685 T5 - Bank Interest Income Received $1,282 Withdraws from RRSP Account (T4RSP Slip) $7,200 During the year, the taxpayer had cash flow issues and decided to cash in a portion of their RRSP in a lump sum Additional Information: Spouse: Name: Maggie Connor Age of Spouse: 60 Years Old Mentally or Physically Infirm? No (Note: If infirm, not severe enough to qualify for disability tax credit) Sources of Income: $10,484 Interest Income Attended Post Secondary Institution. 4 Full Time Months 4 Part Time Months $9,145 Tuition Paid in Year Prepare a 2017 T1 Return given the following information: Complete the T1 Income Tax Return and any relevant Schedules. Name: Mr. Henry Connor Age: 58 Years Old Province: Saskatchewan Gross Salary from Employment + Cash Bonus Received in 2017 Total $78,990 $19,748 $98,738 Union Dues Paid by Taxpayer $693 RPP Contributions by Taxpayer $562 RPP Contributions by Employer $533 El Withheld from Employment Cheque $836 CPP Withheld from Employment Cheque $2,564 Income Tax Withheld from Employment Cheque $24,685 T5 - Bank Interest Income Received $1,282 Withdraws from RRSP Account (T4RSP Slip) $7,200 * During the year, the taxpayer had cash flow issues and decided to cash in a portion of their RRSP in a lump sum Additional Information: Spouse: Name: Maggie Connor Age of Spouse: 60 Years Old Mentally or Physically Infirm? No (Note: If infirm, not severe enough to qualify for disability tax credit) Sources of Income: $10,484 Interest Income Attended Post Secondary Institution. 4 Full Time Months 4 Part Time Months $9,145 Tuition Paid in Year Prepare a 2017 T1 Return given the following information: Complete the T1 Income Tax Return and any relevant Schedules. Name: Mr. Henry Connor Age: 58 Years Old Province: Saskatchewan Gross Salary from Employment + Cash Bonus Received in 2017 $78,990 $19,748 $98,738 Total Union Dues Paid by Taxpayer $693 RPP Contributions by Taxpayer $562 RPP Contributions by Employer $533 El Withheld from Employment Cheque $836 CPP Withheld from Employment Cheque $2,564 Income Tax Withheld from Employment Cheque $24,685 T5 - Bank Interest Income Received $1,282 Withdraws from RRSP Account (T4RSP Slip) $7,200 During the year, the taxpayer had cash flow issues and decided to cash in a portion of their RRSP in a lump sum Additional Information: Spouse: Name: Maggie Connor Age of Spouse: 60 Years Old Mentally or Physically Infirm? No (Note: If infirm, not severe enough to qualify for disability tax credit) Sources of Income: $10,484 Interest Income Attended Post Secondary Institution. 4 Full Time Months 4 Part Time Months $9,145 Tuition Paid in Year Prepare a 2017 T1 Return given the following information: Complete the T1 Income Tax Return and any relevant Schedules. Name: Mr. Henry Connor Age: 58 Years Old Province: Saskatchewan Gross Salary from Employment + Cash Bonus Received in 2017 Total $78,990 $19,748 $98,738 Union Dues Paid by Taxpayer $693 RPP Contributions by Taxpayer $562 RPP Contributions by Employer $533 El Withheld from Employment Cheque $836 CPP Withheld from Employment Cheque $2,564 Income Tax Withheld from Employment Cheque $24,685 T5 - Bank Interest Income Received $1,282 Withdraws from RRSP Account (T4RSP Slip) $7,200 * During the year, the taxpayer had cash flow issues and decided to cash in a portion of their RRSP in a lump sum Additional Information: Spouse: Name: Maggie Connor Age of Spouse: 60 Years Old Mentally or Physically Infirm? No (Note: If infirm, not severe enough to qualify for disability tax credit) Sources of Income: $10,484 Interest Income Attended Post Secondary Institution. 4 Full Time Months 4 Part Time Months $9,145 Tuition Paid in Year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts