Question: Old MathJax webview Put your answers in bold please, and thanks in advance. 13 2 question 12 and sorry A 20-year annuity of forty $6,000

Old MathJax webview

Put your answers in bold please, and thanks in advance. 13

2

question 12 and sorry

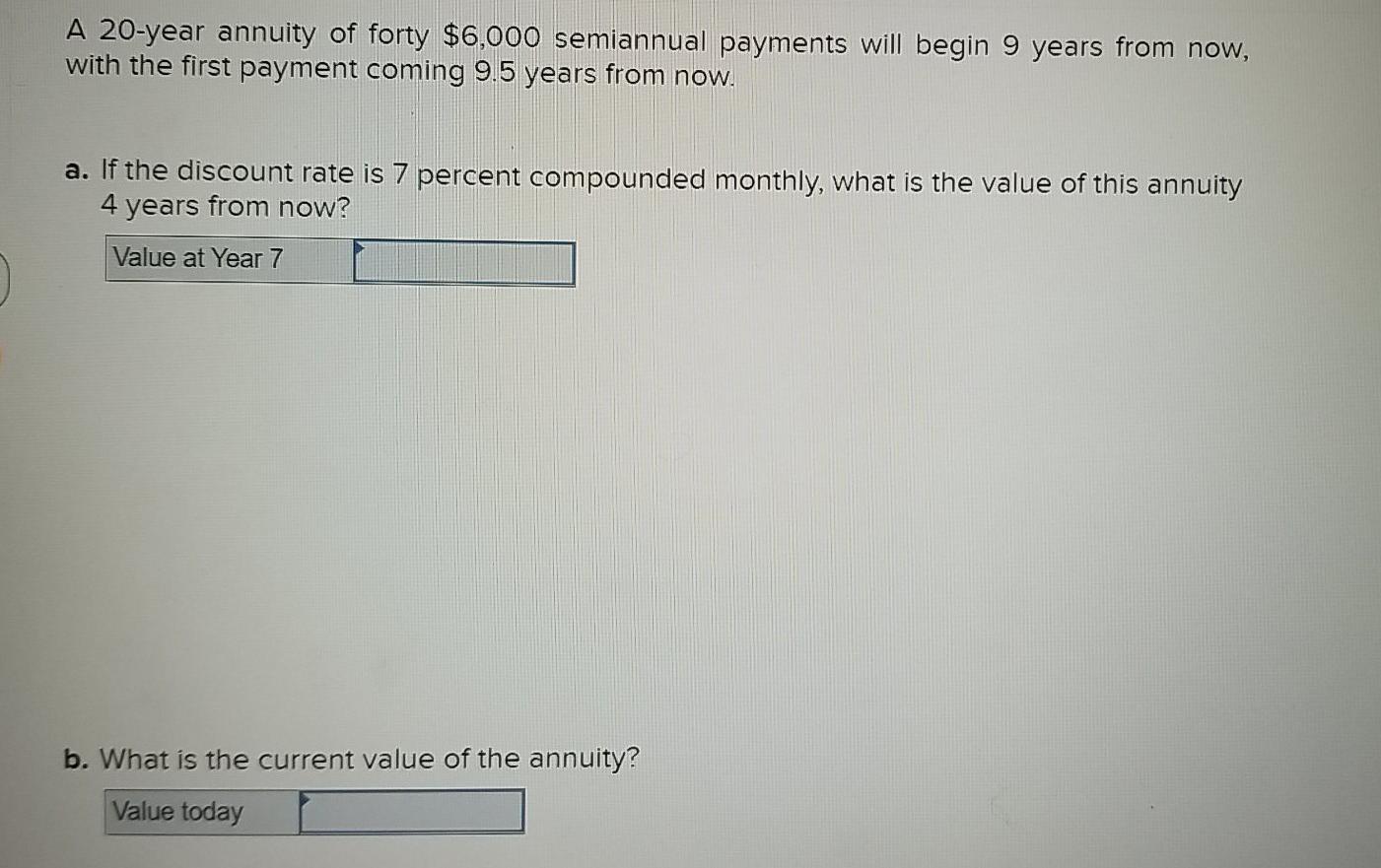

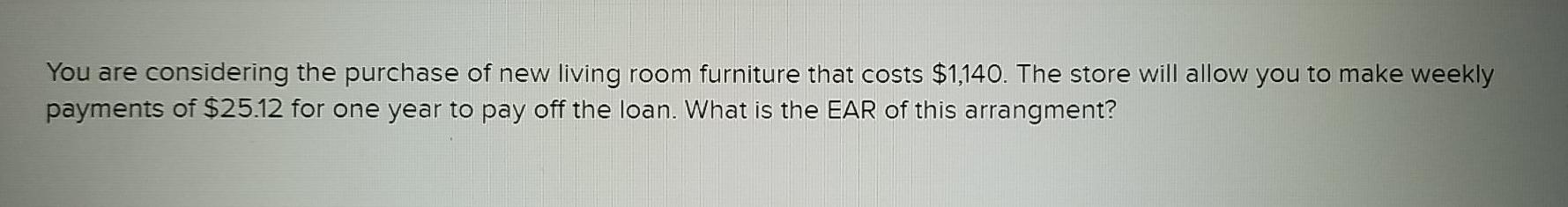

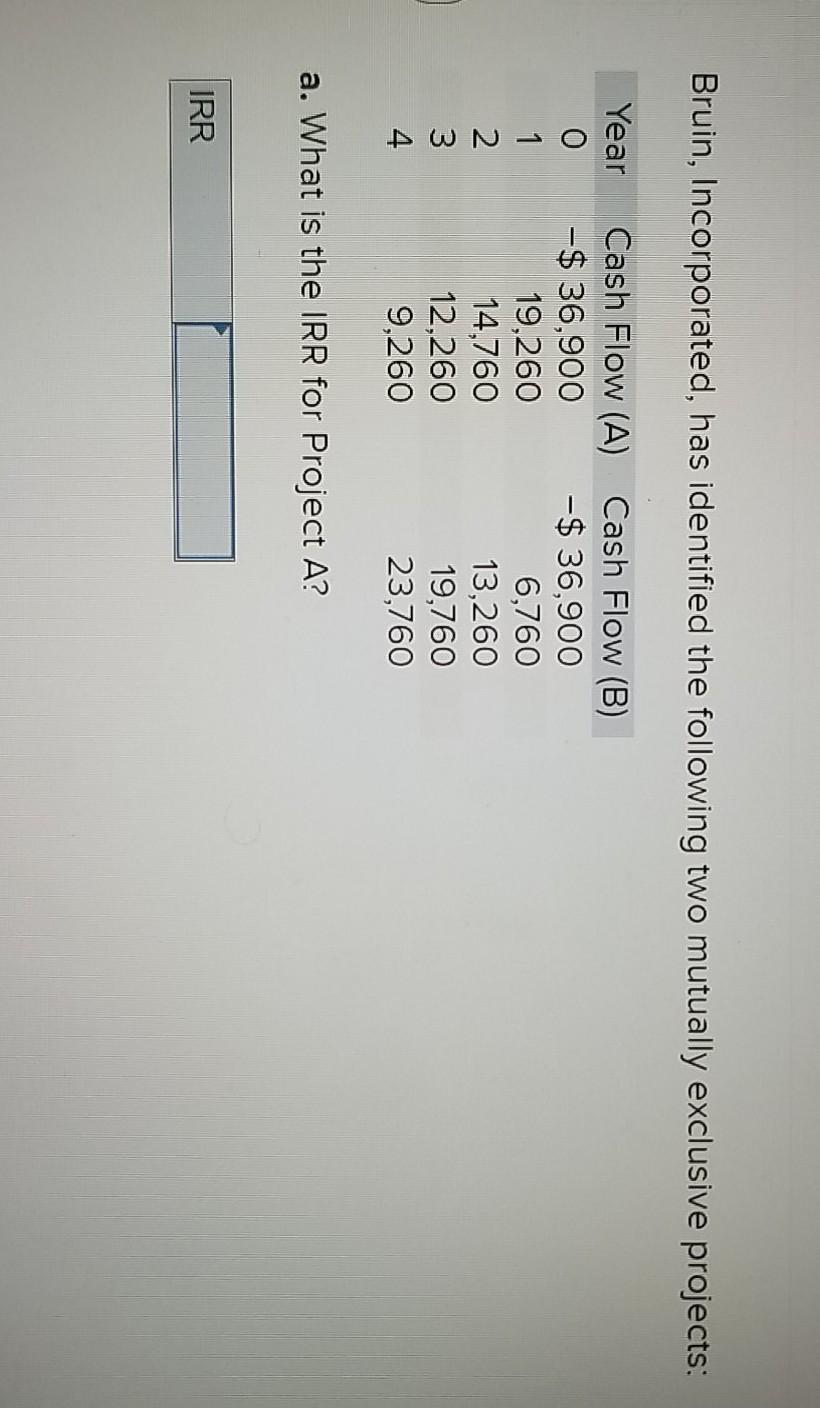

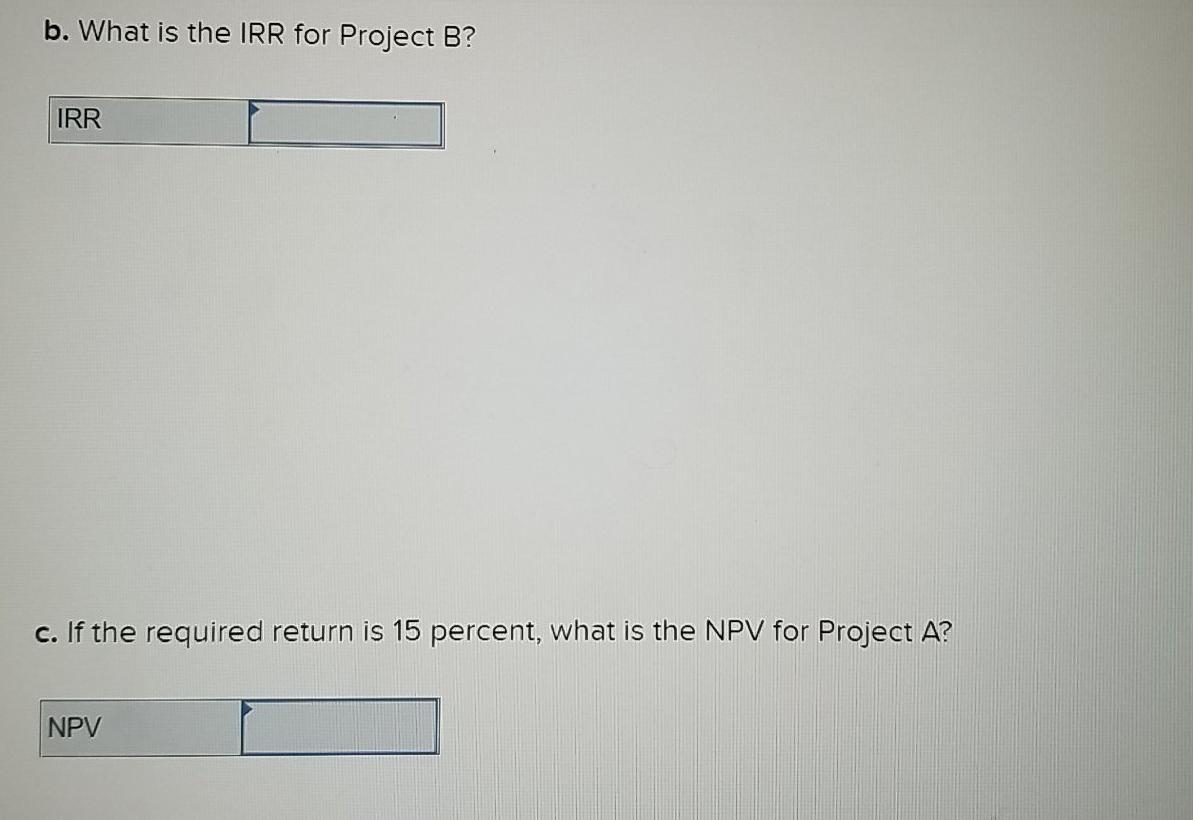

A 20-year annuity of forty $6,000 semiannual payments will begin 9 years from now, with the first payment coming 9.5 years from now. a. If the discount rate is 7 percent compounded monthly, what is the value of this annuity 4 years from now? Value at Year 7 b. What is the current value of the annuity? Value today You are considering the purchase of new living room furniture that costs $1,140. The store will allow you to make weekly payments of $25.12 for one year to pay off the loan. What is the EAR of this arrangment? Bruin, Incorporated, has identified the following two mutually exclusive projects: Year 0 1 2 3 4 Cash Flow (A) Cash Flow (B) -$ 36,900 -$ 36,900 19,260 6,760 14,760 13,260 12,260 19,760 9,260 23,760 a. What is the IRR for Project A? IRR b. What is the IRR for Project B? IRR c. If the required return is 15 percent, what is the NPV for Project A? NPV d. If the required return is 15 percent, what is the NPV for Project B? NPV e. At what discount rate would the company be indifferent between these two projects? Discount rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts