Question: Old MathJax webview Q1 . One of the problems in achieving acquisition success is that the firm will face integration difficulties . Explain this problem

Old MathJax webview

Q1 . One of the problems in achieving acquisition success is that the firm will face integration difficulties . Explain this problem and discuss how it can be solved . ( 35 pts ) .

subject strategic management

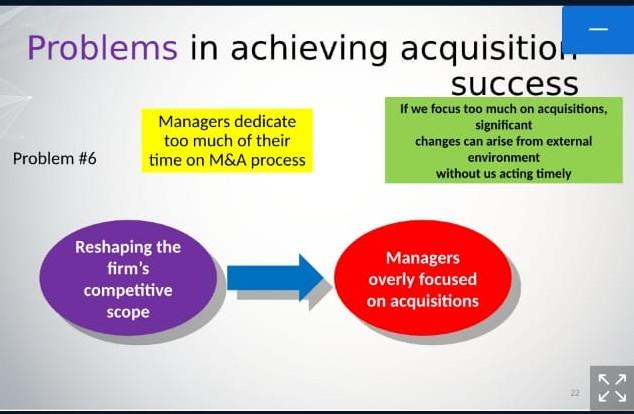

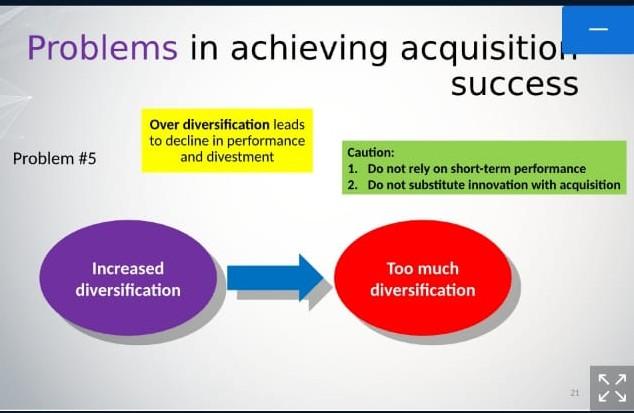

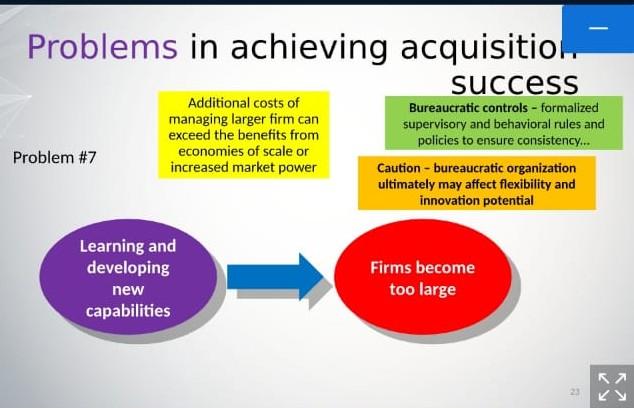

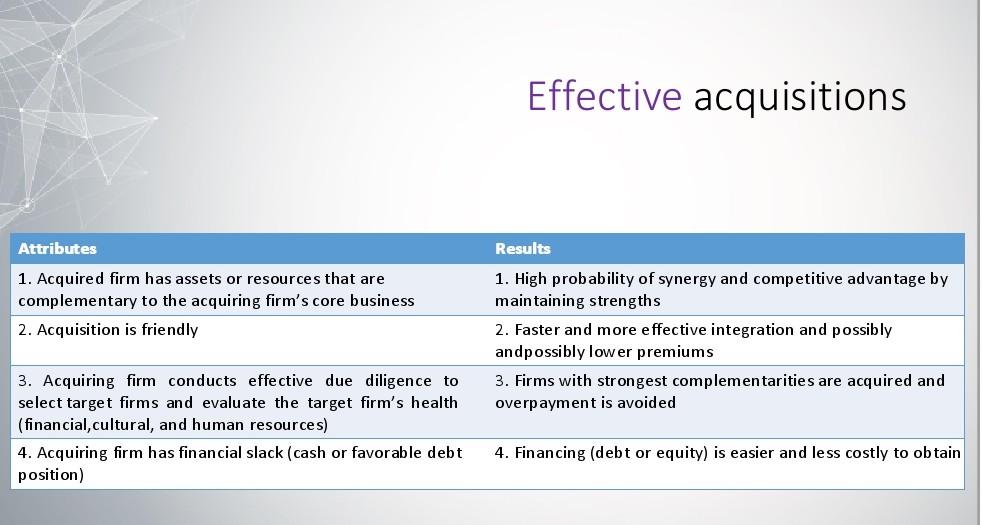

Problems in achieving acquisitio. success Problem #4 Private synergy - created when combining resources of two companies yields capabilities and core competencies that cannot be achieved if combined with other companies Lower risk compared to developing new products Inability to achieve synergy Acquisition costs Direct - legal fees & charges from investment banks Indirect -target evaluation, negotiations, loss of key people Problems in achieving acquisitio.. success Managers dedicate too much of their time on M&A process If we focus too much on acquisitions, significant changes can arise from external environment without us acting timely Problem #6 Reshaping the firm's competitive scope Managers overly focused on acquisitions 2 Problems in achieving acquisition success Over diversification leads to decline in performance and divestment Problem #5 Caution: 1. Do not rely on short-term performance 2. Do not substitute innovation with acquisition Increased diversification Too much diversification 21 S Problems in achieving acquisitio.. success Additional costs of managing larger firm can exceed the benefits from economies of scale or increased market power Problem #7 Bureaucratic controls - formalized supervisory and behavioral rules and policies to ensure consistency... Caution - bureaucratic organization ultimately may affect flexibility and innovation potential Learning and developing new capabilities Firms become too large 2 Reasons for acquisitions REASON #5 - INCREASED DIVERSIFICATION Firms usually diversify their product lines for market segments they know Cisco (expertise in network hardware and software) acquired IronPort Systems to go into security software for networks Acquisitions can be used for related and unrelated diversification The more related the acquired firm is to the acquiring firm, the chances of success are higher! Reasons for acquisitions REASON #2 - OVERCOMING ENTRY BARRIERS What are the barriers to entry? . Maybe it is better to acquire a well-established competitor than being a new entrant? Immediate access to market - especially important for entering international markets Cross-border acquisitions - Tata (India) acquired Jaguar and Land Rover (UK) Reasons for acquisitions REASON #6 - RESHAPING THE FIRM'S COMPETITIVE SCOPE Competitive rivalry affects firm's profitability . By entering other markets through acquisitions, acquiring firms lower the competitive pressure in main industry P&G acquired Gillette and turned more to men target group, thus reshaped its competitive scope Reasons for acquisitions REASON #3 - COST OF NEW PRODUCT DEVELOPMENT AND INCREASED SPEED TO MARKET Internal product development is risky 88% of innovations fail to achieve adequate returns 60% of innovations are copied within first four years . Therefore, large firms acquire smaller, innovative firms 3 12 Reasons for acquisitions REASON #4 - LOWER RISK COMPARED TO DEVELOPING NEW PRODUCTS As mentioned earlier, sometimes it is less risky to buy new product than to develop it yourself The danger exists when companies use acquisitions as a substitute for innovation! RISE The popularity of M&A strategies WhatsApp 10 Miliarde Mergers, acquisitions and takeovers: what are the differences? ACQUISITION - one firm buys a controlling or 100% interest in another firm, with the intent of making the acquired firm a subsidiary business within its portfolio Acquisitions can be friendly and unfriendly 2 Miliares f 1 M Reasons for acquisitions REASON #1 - INCREASED MARKET POWER What is market power? Facebook acquiring of WhatsApp and Instagram? Acer buying Gateway and Packard Bell, aiming for Lenovo? Types of acquisitions for increasing market power Horizontal acquisition - a bank acquires a bank Vertical acquisition - McDonald's acquiring of beef producer Related acquisition - Apple acquiring Beats . The popularity of M&A strategies IM SUNE LOWONG FORARD TO MEETING 16 NEW MANAGEMENT. TAKEOVER - special type of acquisition strategy wherein the target firm does not solicit the acquiring firm's bid B 2001 BOARD ROOM mees "I think it's what they call a hostile takeover." Effective acquisitions Attributes 1. Acquired firm has assets or resources that are complementary to the acquiring firm's core business 2. Acquisition is friendly Results 1. High probability of synergy and competitive advantage by maintaining strengths 2. Faster and more effective integration and possibly andpossibly lower premiums 3. Firms with strongest complementarities are acquired and overpayment is avoided 3. Acquiring firm conducts effective due diligence to select target firms and evaluate the target firm's health (financial,cultural, and human resources) 4. Acquiring firm has financial slack (cash or favorable debt position) 4. Financing (debt or equity) is easier and less costly to obtain Problems in achieving acquisitio. success Problem #4 Private synergy - created when combining resources of two companies yields capabilities and core competencies that cannot be achieved if combined with other companies Lower risk compared to developing new products Inability to achieve synergy Acquisition costs Direct - legal fees & charges from investment banks Indirect -target evaluation, negotiations, loss of key people Problems in achieving acquisitio.. success Managers dedicate too much of their time on M&A process If we focus too much on acquisitions, significant changes can arise from external environment without us acting timely Problem #6 Reshaping the firm's competitive scope Managers overly focused on acquisitions 2 Problems in achieving acquisition success Over diversification leads to decline in performance and divestment Problem #5 Caution: 1. Do not rely on short-term performance 2. Do not substitute innovation with acquisition Increased diversification Too much diversification 21 S Problems in achieving acquisitio.. success Additional costs of managing larger firm can exceed the benefits from economies of scale or increased market power Problem #7 Bureaucratic controls - formalized supervisory and behavioral rules and policies to ensure consistency... Caution - bureaucratic organization ultimately may affect flexibility and innovation potential Learning and developing new capabilities Firms become too large 2 Reasons for acquisitions REASON #5 - INCREASED DIVERSIFICATION Firms usually diversify their product lines for market segments they know Cisco (expertise in network hardware and software) acquired IronPort Systems to go into security software for networks Acquisitions can be used for related and unrelated diversification The more related the acquired firm is to the acquiring firm, the chances of success are higher! Reasons for acquisitions REASON #2 - OVERCOMING ENTRY BARRIERS What are the barriers to entry? . Maybe it is better to acquire a well-established competitor than being a new entrant? Immediate access to market - especially important for entering international markets Cross-border acquisitions - Tata (India) acquired Jaguar and Land Rover (UK) Reasons for acquisitions REASON #6 - RESHAPING THE FIRM'S COMPETITIVE SCOPE Competitive rivalry affects firm's profitability . By entering other markets through acquisitions, acquiring firms lower the competitive pressure in main industry P&G acquired Gillette and turned more to men target group, thus reshaped its competitive scope Reasons for acquisitions REASON #3 - COST OF NEW PRODUCT DEVELOPMENT AND INCREASED SPEED TO MARKET Internal product development is risky 88% of innovations fail to achieve adequate returns 60% of innovations are copied within first four years . Therefore, large firms acquire smaller, innovative firms 3 12 Reasons for acquisitions REASON #4 - LOWER RISK COMPARED TO DEVELOPING NEW PRODUCTS As mentioned earlier, sometimes it is less risky to buy new product than to develop it yourself The danger exists when companies use acquisitions as a substitute for innovation! RISE The popularity of M&A strategies WhatsApp 10 Miliarde Mergers, acquisitions and takeovers: what are the differences? ACQUISITION - one firm buys a controlling or 100% interest in another firm, with the intent of making the acquired firm a subsidiary business within its portfolio Acquisitions can be friendly and unfriendly 2 Miliares f 1 M Reasons for acquisitions REASON #1 - INCREASED MARKET POWER What is market power? Facebook acquiring of WhatsApp and Instagram? Acer buying Gateway and Packard Bell, aiming for Lenovo? Types of acquisitions for increasing market power Horizontal acquisition - a bank acquires a bank Vertical acquisition - McDonald's acquiring of beef producer Related acquisition - Apple acquiring Beats . The popularity of M&A strategies IM SUNE LOWONG FORARD TO MEETING 16 NEW MANAGEMENT. TAKEOVER - special type of acquisition strategy wherein the target firm does not solicit the acquiring firm's bid B 2001 BOARD ROOM mees "I think it's what they call a hostile takeover." Effective acquisitions Attributes 1. Acquired firm has assets or resources that are complementary to the acquiring firm's core business 2. Acquisition is friendly Results 1. High probability of synergy and competitive advantage by maintaining strengths 2. Faster and more effective integration and possibly andpossibly lower premiums 3. Firms with strongest complementarities are acquired and overpayment is avoided 3. Acquiring firm conducts effective due diligence to select target firms and evaluate the target firm's health (financial,cultural, and human resources) 4. Acquiring firm has financial slack (cash or favorable debt position) 4. Financing (debt or equity) is easier and less costly to obtain

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock