Question: Old MathJax webview q11, q12 where are u? QUESTION 11 General Motors has current assets $5000, non-current assets $3000, plant and equipment $1500, notes payable

Old MathJax webview

q11,q12

where are u?

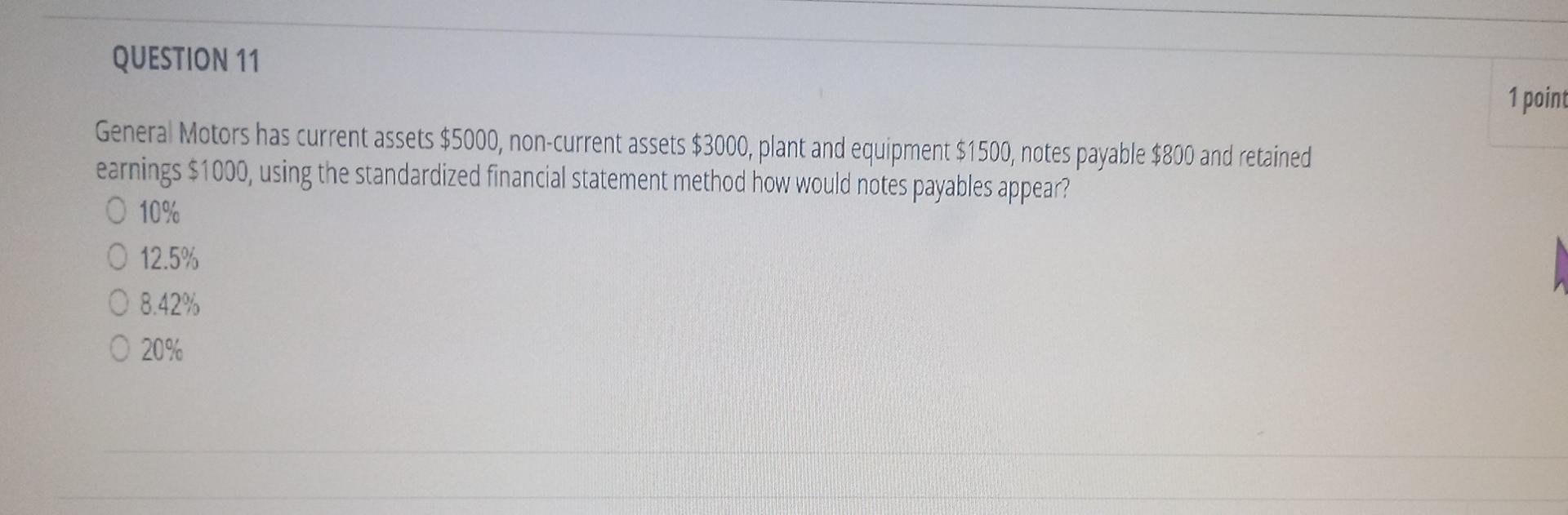

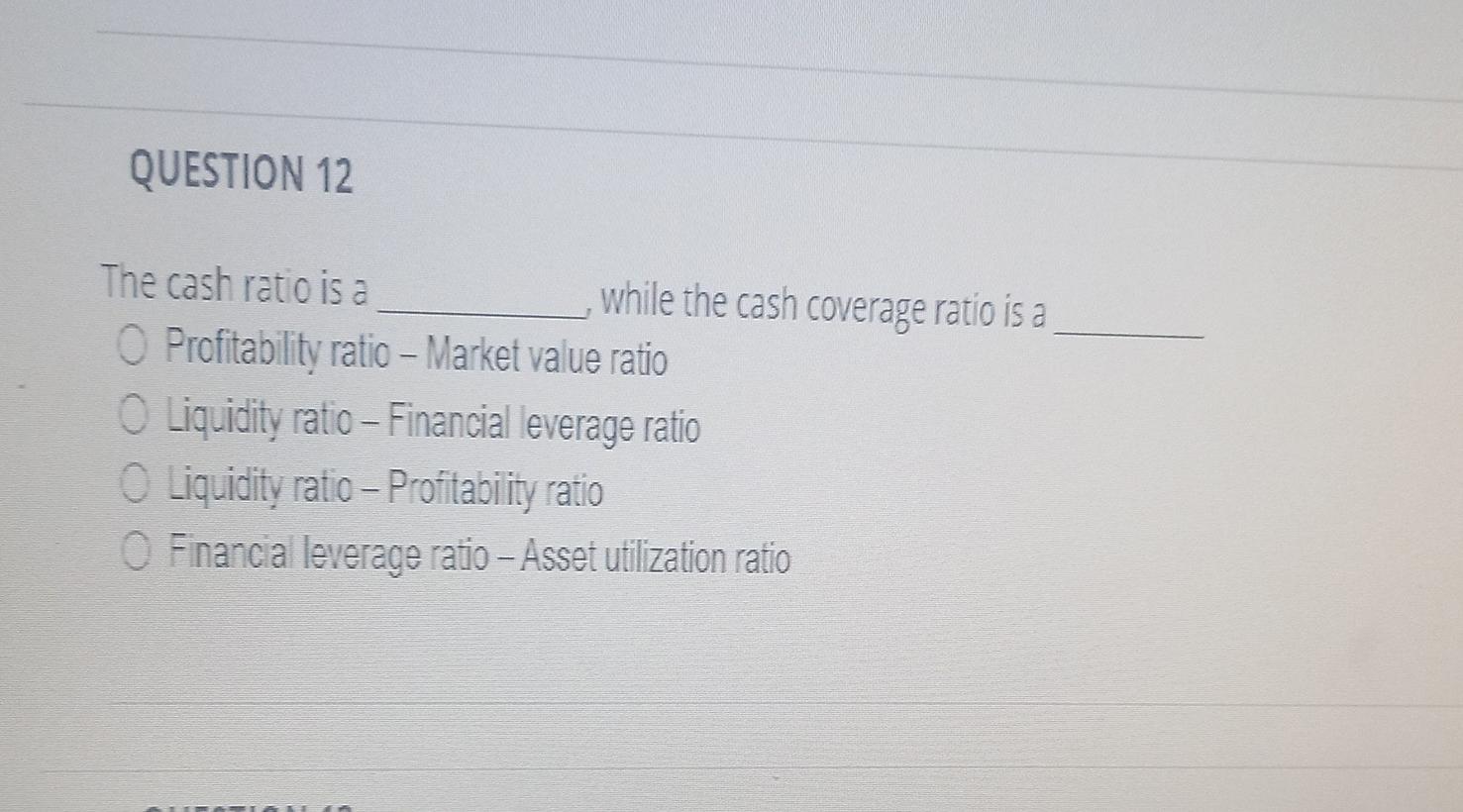

QUESTION 11 General Motors has current assets $5000, non-current assets $3000, plant and equipment $1500, notes payable $800 and retained earnings $1000, using the standardized financial statement method how would notes payables appear? O 10% O 12.5% O 8.42% O 20% 1 point QUESTION 12 The cash ratio is a O Profitability ratio-Market value ratio O Liquidity ratio-Financial leverage ratio O Liquidity ratio - Profitability ratio O Financial leverage ratio-Asset utilization ratio SIAA while the cash coverage ratio is a

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock