Question: Old MathJax webview REPLY FAST I HAVE LESS TIME Now its ckear please do ASAP QUESTION 1 The stock of Lead Zeppelin a metal manufacturer,

Old MathJax webview

REPLY FAST I HAVE LESS TIME

Now its ckear please do ASAP

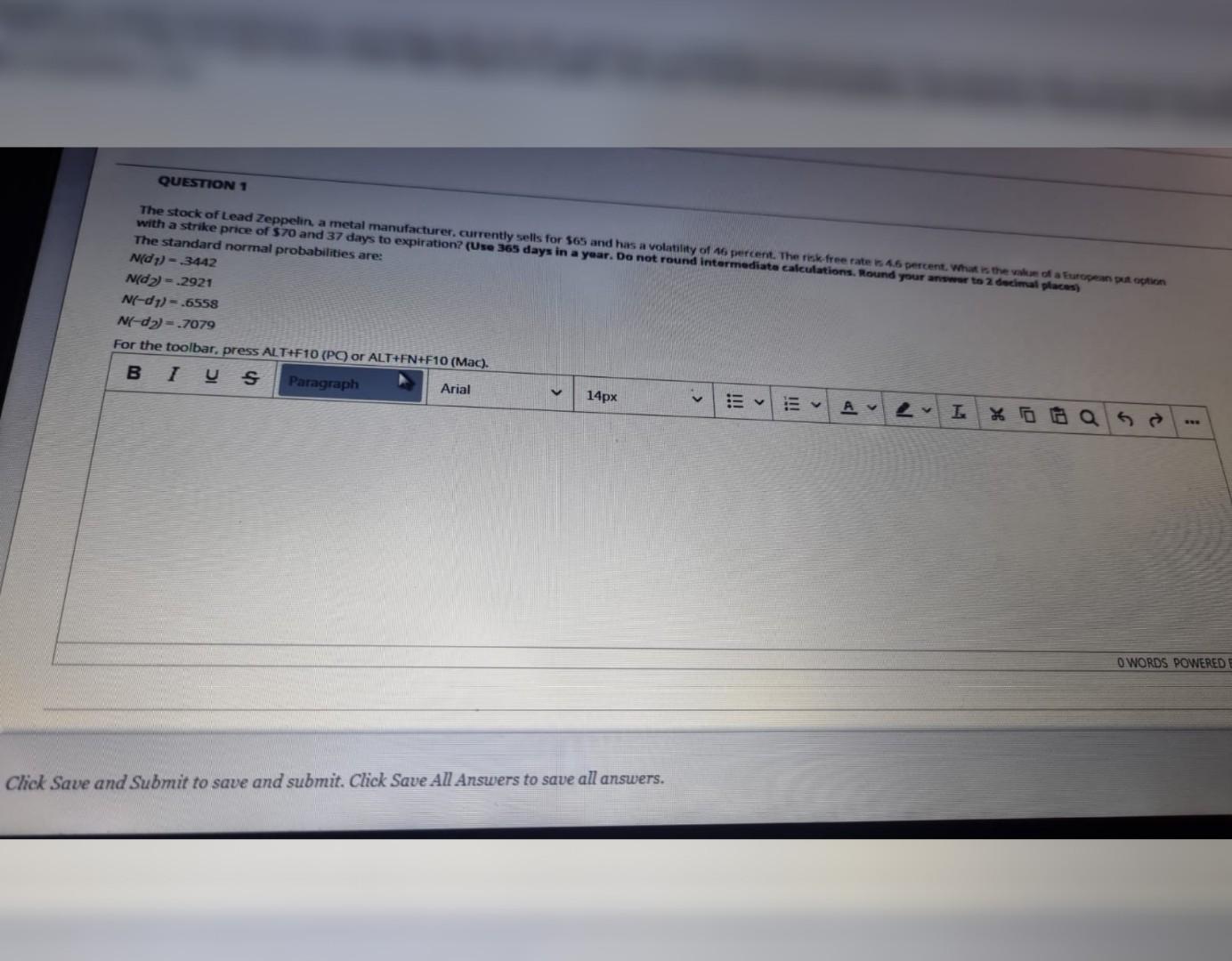

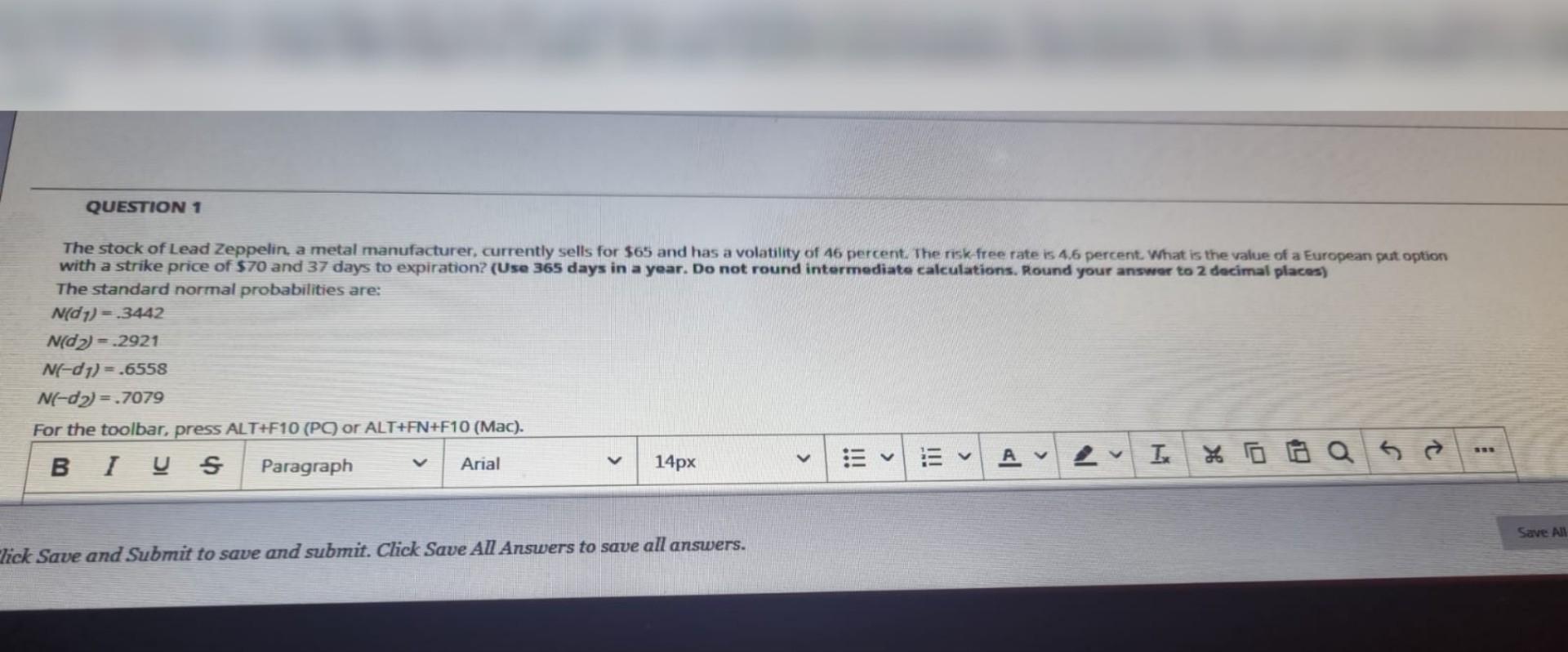

QUESTION 1 The stock of Lead Zeppelin a metal manufacturer, currently sells for $65 and has a volatility of 15 percent. The risk free rate : 45 percent. What is the worden option with a strike price of $70 and 37 days to expiration? (Use 365 days in a year. Do not round intermediate calculations. Round your ato 2 decimal places) The standard normal probabilities are: N/dy) - 3442 Nda) - .2921 NC-d1) = .6558 NX-dy)-.7079 For the toolbar, press ALT+F10 (POor ALT+FN+F10 (Mac). B I y Paragraph Arial 14px AL I O WORDS POWERED Click Save and submit to save and submit. Click Save All Answers to save all answers. QUESTION 1 The stock of Lead Zeppelin, a metal manufacturer, currently sells for $65 and has a volatility of 46 percent. The risk-free rate is 4.6 percent. What is the value of a European put option with a strike price of 570 and 37 days to expiration? (Use 365 days in a year. Do not round intermediate calculations. Round your answer to 2 decimal places) The standard normal probabilities are: Nd1) 3442 Nda) = .2921 N-d1) = .6558 N-dy) = .7079 For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). I B I US * oo Q A Paragraph Arial 14px Save A Click Save and Submit to save and submit. Click Save All Answers to save all answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts