Question: Old MathJax webview Scenario 04 - Lynn Independence is often considered as the cornerstone of auditing' and recognised as the most important characteristic of an

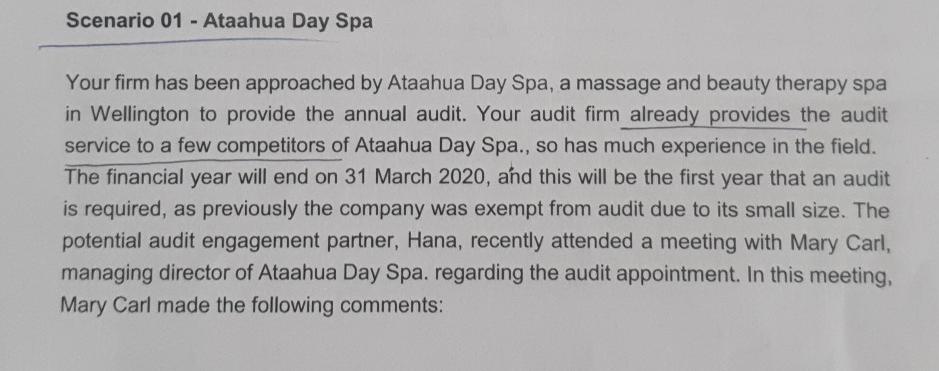

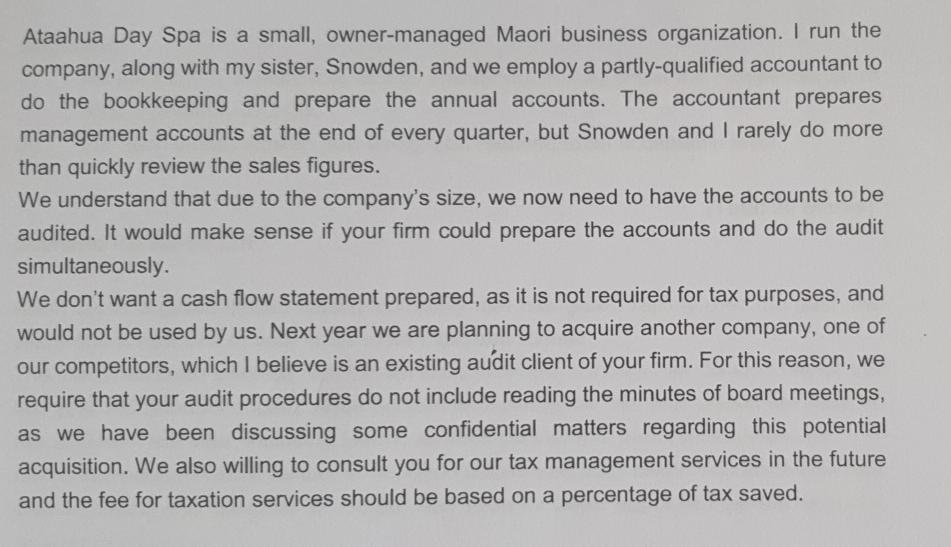

Old MathJax webview

Scenario 04 - Lynn Independence is often considered as the cornerstone of auditing' and recognised as the most important characteristic of an auditor. The independence requirements set out in the Code of Ethics for Assurance Practitioners (PES 1) (Revised) apply to all entities and all assurance practitioners. Assume you are an audit partner in Lynn & Co., a firm of Chartered Accountants. You are preparing the engagement letter for the audit of Brien Ltd for the year ending 31st December 2019. Brien Ltd is one of your firm's most important clients. Brien Ltd has been an audit client for ten years, and Lynn & Co has provided audit, taxation and management consultancy advice during this time. Brien Ltd is one of your firm's most important clients who produce 30% of the revenue of Lynn & Co. Ataahua Day Spa is a small, owner-managed Maori business organization. I run the company, along with my sister, Snowden, and we employ a partly-qualified accountant to do the bookkeeping and prepare the annual accounts. The accountant prepares management accounts at the end of every quarter, but Snowden and I rarely do more than quickly review the sales figures. We understand that due to the company's size, we now need to have the accounts to be audited. It would make sense if your firm could prepare the accounts and do the audit simultaneously. We don't want a cash flow statement prepared, as it is not required for tax purposes, and would not be used by us. Next year we are planning to acquire another company, one of our competitors, which I believe is an existing audit client of your firm. For this reason, we require that your audit procedures do not include reading the minutes of board meetings, as we have been discussing some confidential matters regarding this potential acquisition. We also willing to consult you for our tax management services in the future and the fee for taxation services should be based on a percentage of tax saved. ith reference to international code of ethics for assurance practitioners (PES scuss four ethical principles that will be potentially breached, if you ccepted the audit of Ataahua Day Spa iscuss possible safeguard/s for each of the identified ethical principles in abou (i) Required; With reference to international code of ethics for assurance practitioners (PES 1), discuss four ethical principles that will be potentially breached, if you accepted the audit of Ataahua Day Spa Discuss possible safeguard/s for each of the identified ethical principles in above Scenario 01 - Ataahua Day Spa Your firm has been approached by Ataahua Day Spa, a massage and beauty therapy spa in Wellington to provide the annual audit. Your audit firm already provides the audit service to a few competitors of Ataahua Day Spa., so has much experience in the field. The financial year will end on 31 March 2020, and this will be the first year that an audit is required, as previously the company was exempt from audit due to its small size. The potential audit engagement partner, Hana, recently attended a meeting with Mary Carl, managing director of Ataahua Day Spa, regarding the audit appointment. In this meeting, Mary Carl made the following comments: Ataahua Day Spa is a small, owner-managed Maori business organization. I run the company, along with my sister, Snowden, and we employ a partly-qualified accountant to do the bookkeeping and prepare the annual accounts. The accountant prepares management accounts at the end of every quarter, but Snowden and I rarely do more than quickly review the sales figures. We understand that due to the company's size, we now need to have the accounts to be audited. It would make sense if your firm could prepare the accounts and do the audit simultaneously. We don't want a cash flow statement prepared, as it is not required for tax purposes, and would not be used by us. Next year we are planning to acquire another company, one of our competitors, which I believe is an existing audit client of your firm. For this reason, we require that your audit procedures do not include reading the minutes of board meetings, as we have been discussing some confidential matters regarding this potential acquisition. We also willing to consult you for our tax management services in the future and the fee for taxation services should be based on a percentage of tax saved. Required; (i) With reference to international code of ethics for assurance practitioners (PES 1), discuss four ethical principles that will be potentially breached, if you accepted the audit of Ataahua Day Spa Discuss possible safeguard/s for each of the identified ethical principles in above (Total 20 marks) Scenario 04 - Lynn Independence is often considered as the cornerstone of auditing' and recognised as the most important characteristic of an auditor. The independence requirements set out in the Code of Ethics for Assurance Practitioners (PES 1) (Revised) apply to all entities and all assurance practitioners. Assume you are an audit partner in Lynn & Co., a firm of Chartered Accountants. You are preparing the engagement letter for the audit of Brien Ltd for the year ending 31st December 2019. Brien Ltd is one of your firm's most important clients. Brien Ltd has been an audit client for ten years, and Lynn & Co has provided audit, taxation and management consultancy advice during this time. Brien Ltd is one of your firm's most important clients who produce 30% of the revenue of Lynn & Co. Ataahua Day Spa is a small, owner-managed Maori business organization. I run the company, along with my sister, Snowden, and we employ a partly-qualified accountant to do the bookkeeping and prepare the annual accounts. The accountant prepares management accounts at the end of every quarter, but Snowden and I rarely do more than quickly review the sales figures. We understand that due to the company's size, we now need to have the accounts to be audited. It would make sense if your firm could prepare the accounts and do the audit simultaneously. We don't want a cash flow statement prepared, as it is not required for tax purposes, and would not be used by us. Next year we are planning to acquire another company, one of our competitors, which I believe is an existing audit client of your firm. For this reason, we require that your audit procedures do not include reading the minutes of board meetings, as we have been discussing some confidential matters regarding this potential acquisition. We also willing to consult you for our tax management services in the future and the fee for taxation services should be based on a percentage of tax saved. ith reference to international code of ethics for assurance practitioners (PES scuss four ethical principles that will be potentially breached, if you ccepted the audit of Ataahua Day Spa iscuss possible safeguard/s for each of the identified ethical principles in abou (i) Required; With reference to international code of ethics for assurance practitioners (PES 1), discuss four ethical principles that will be potentially breached, if you accepted the audit of Ataahua Day Spa Discuss possible safeguard/s for each of the identified ethical principles in above Scenario 01 - Ataahua Day Spa Your firm has been approached by Ataahua Day Spa, a massage and beauty therapy spa in Wellington to provide the annual audit. Your audit firm already provides the audit service to a few competitors of Ataahua Day Spa., so has much experience in the field. The financial year will end on 31 March 2020, and this will be the first year that an audit is required, as previously the company was exempt from audit due to its small size. The potential audit engagement partner, Hana, recently attended a meeting with Mary Carl, managing director of Ataahua Day Spa, regarding the audit appointment. In this meeting, Mary Carl made the following comments: Ataahua Day Spa is a small, owner-managed Maori business organization. I run the company, along with my sister, Snowden, and we employ a partly-qualified accountant to do the bookkeeping and prepare the annual accounts. The accountant prepares management accounts at the end of every quarter, but Snowden and I rarely do more than quickly review the sales figures. We understand that due to the company's size, we now need to have the accounts to be audited. It would make sense if your firm could prepare the accounts and do the audit simultaneously. We don't want a cash flow statement prepared, as it is not required for tax purposes, and would not be used by us. Next year we are planning to acquire another company, one of our competitors, which I believe is an existing audit client of your firm. For this reason, we require that your audit procedures do not include reading the minutes of board meetings, as we have been discussing some confidential matters regarding this potential acquisition. We also willing to consult you for our tax management services in the future and the fee for taxation services should be based on a percentage of tax saved. Required; (i) With reference to international code of ethics for assurance practitioners (PES 1), discuss four ethical principles that will be potentially breached, if you accepted the audit of Ataahua Day Spa Discuss possible safeguard/s for each of the identified ethical principles in above (Total 20 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts