Question: Old MathJax webview sorry, how to do question C? great thanks! Question 4 (14 marks) Lisbon is indifferent between investing all her wealth (which is

Old MathJax webview

sorry, how to do question C? great thanks!

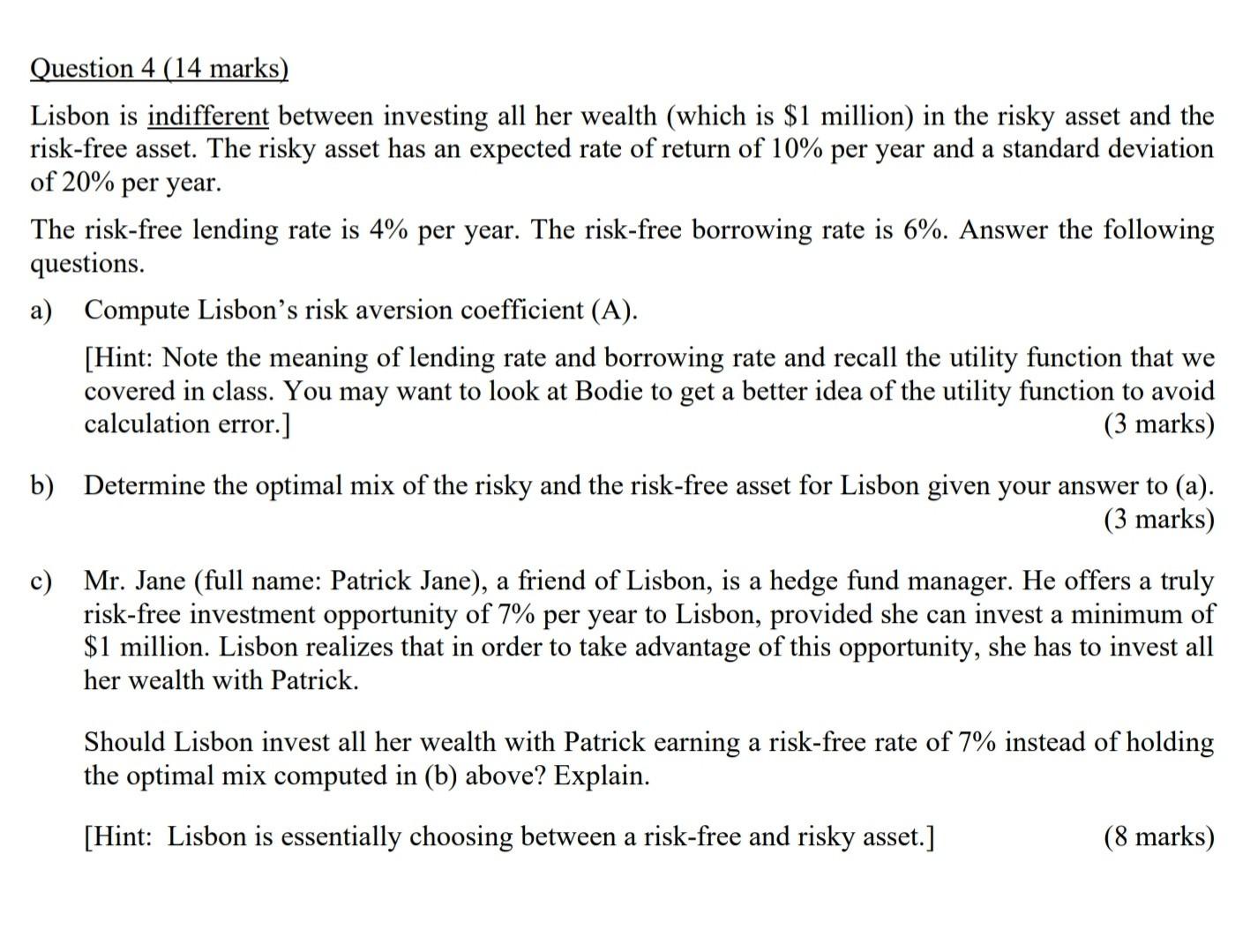

Question 4 (14 marks) Lisbon is indifferent between investing all her wealth (which is $1 million) in the risky asset and the risk-free asset. The risky asset has an expected rate of return of 10% per year and a standard deviation of 20% per year. The risk-free lending rate is 4% per year. The risk-free borrowing rate is 6%. Answer the following questions. a) Compute Lisbon's risk aversion coefficient (A). [Hint: Note the meaning of lending rate and borrowing rate and recall the utility function that we covered in class. You may want to look at Bodie to get a better idea of the utility function to avoid calculation error.] (3 marks) b) Determine the optimal mix of the risky and the risk-free asset for Lisbon given your answer to (a). (3 marks) c) Mr. Jane (full name: Patrick Jane), a friend of Lisbon, is a hedge fund manager. He offers a truly risk-free investment opportunity of 7% per year to Lisbon, provided she can invest a minimum of $1 million. Lisbon realizes that in order to take advantage of this opportunity, she has to invest all her wealth with Patrick. Should Lisbon invest all her wealth with Patrick earning a risk-free rate of 7% instead of holding the optimal mix computed in (b) above? Explain. [Hint: Lisbon is essentially choosing between a risk-free and risky asset.] (8 marks) Question 4 (14 marks) Lisbon is indifferent between investing all her wealth (which is $1 million) in the risky asset and the risk-free asset. The risky asset has an expected rate of return of 10% per year and a standard deviation of 20% per year. The risk-free lending rate is 4% per year. The risk-free borrowing rate is 6%. Answer the following questions. a) Compute Lisbon's risk aversion coefficient (A). [Hint: Note the meaning of lending rate and borrowing rate and recall the utility function that we covered in class. You may want to look at Bodie to get a better idea of the utility function to avoid calculation error.] (3 marks) b) Determine the optimal mix of the risky and the risk-free asset for Lisbon given your answer to (a). (3 marks) c) Mr. Jane (full name: Patrick Jane), a friend of Lisbon, is a hedge fund manager. He offers a truly risk-free investment opportunity of 7% per year to Lisbon, provided she can invest a minimum of $1 million. Lisbon realizes that in order to take advantage of this opportunity, she has to invest all her wealth with Patrick. Should Lisbon invest all her wealth with Patrick earning a risk-free rate of 7% instead of holding the optimal mix computed in (b) above? Explain. [Hint: Lisbon is essentially choosing between a risk-free and risky asset.] (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts