Question: Old MathJax webview W hat numbers will yield the best results for each of these areas in this third round of COMP-XM. I greatly appreciate

Old MathJax webview

What numbers will yield the best results for each of these areas in this third round of COMP-XM. I greatly appreciate your help with this. Will be sure to UPVOTE for any help provided. Thanks

please help me in answering these questions instead. I really appreciate it and will make sure to UPVOTE for your help. Best regards

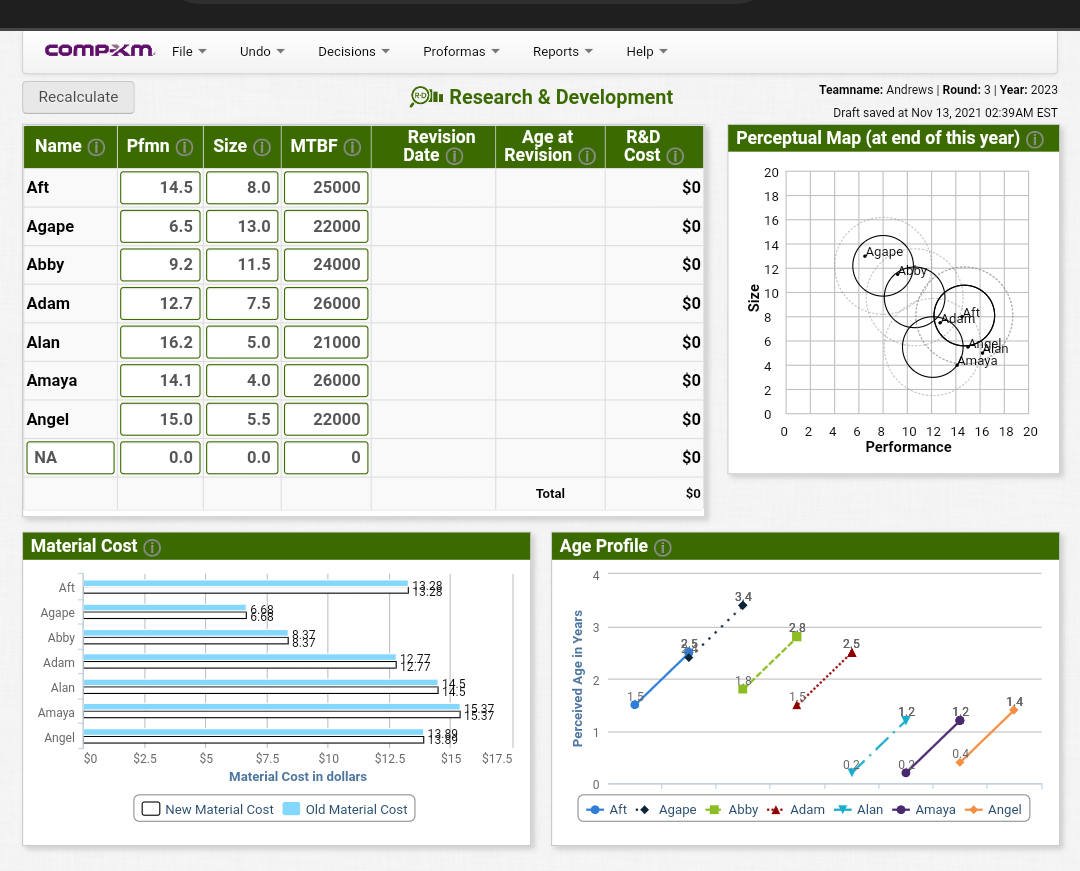

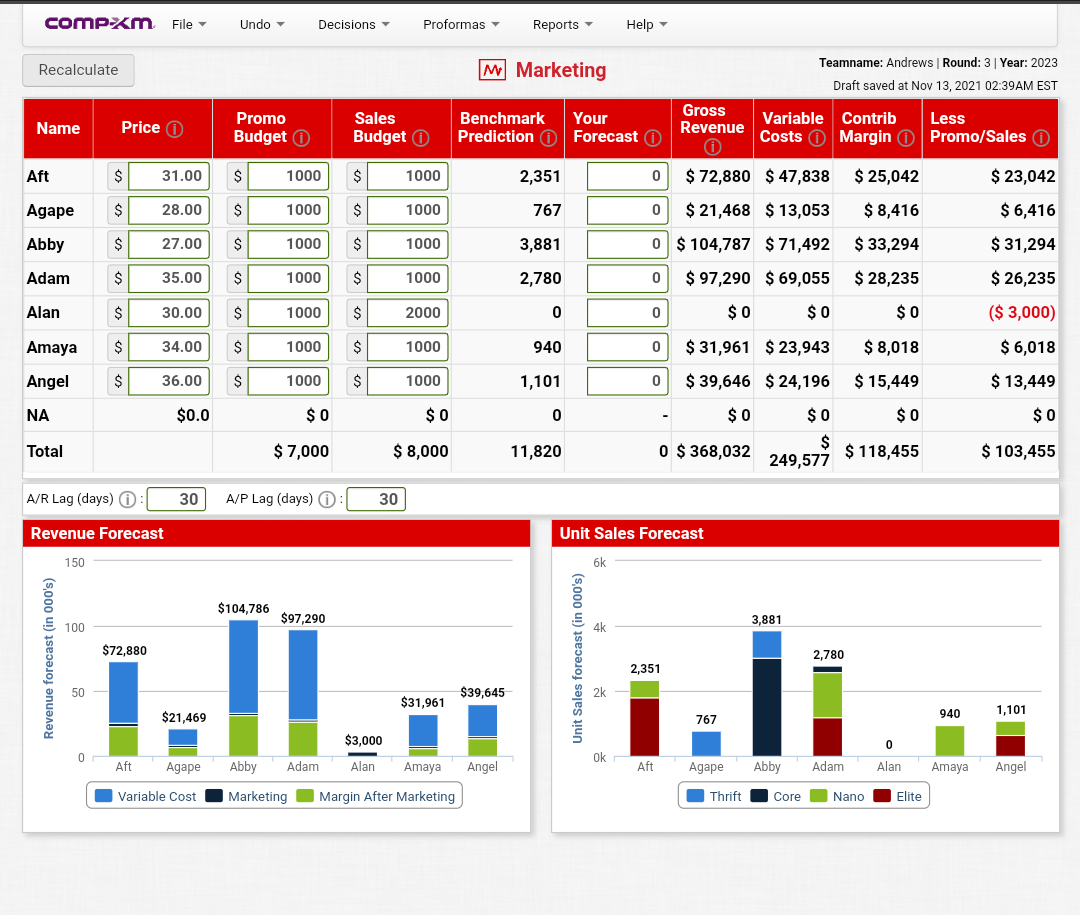

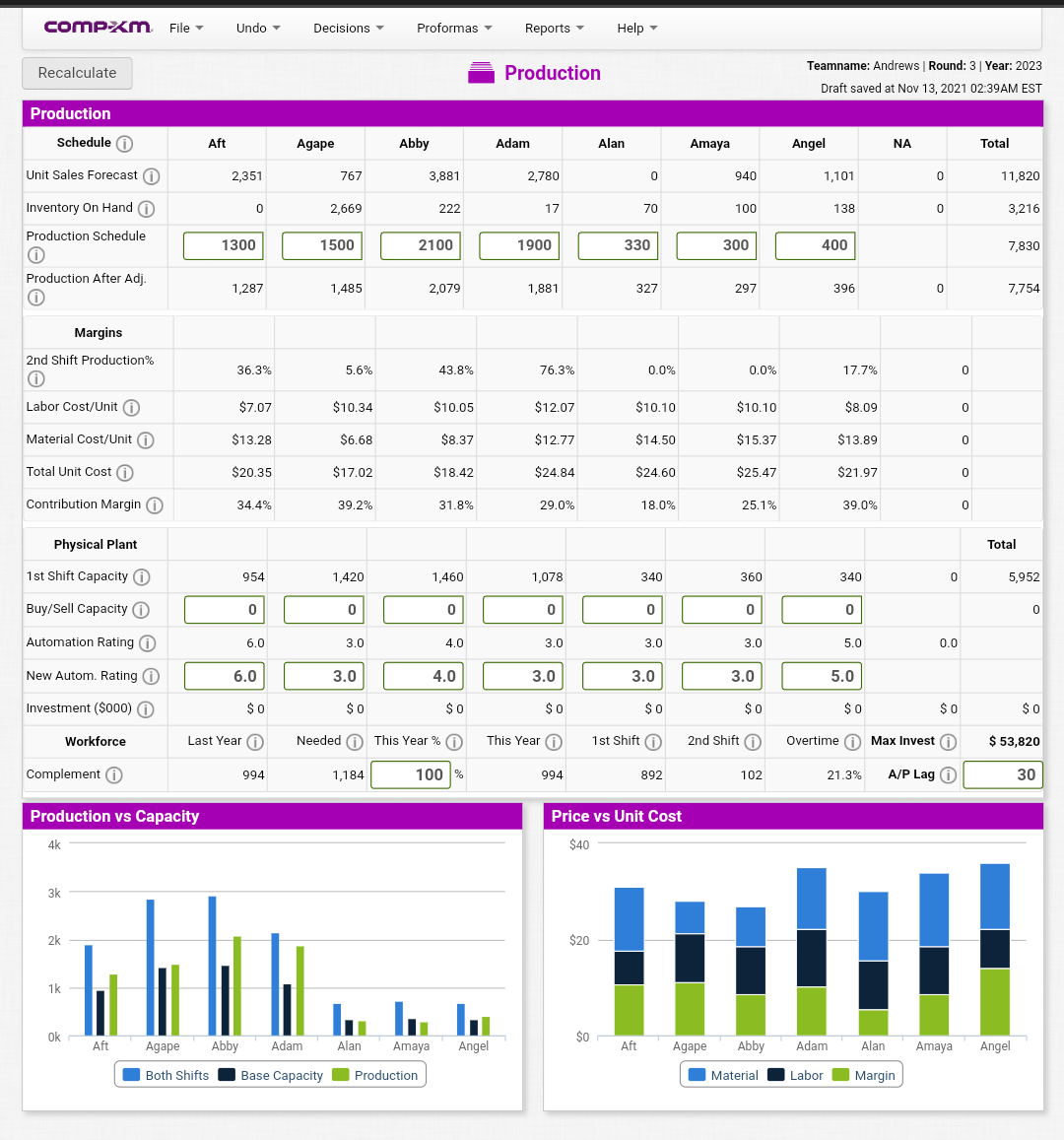

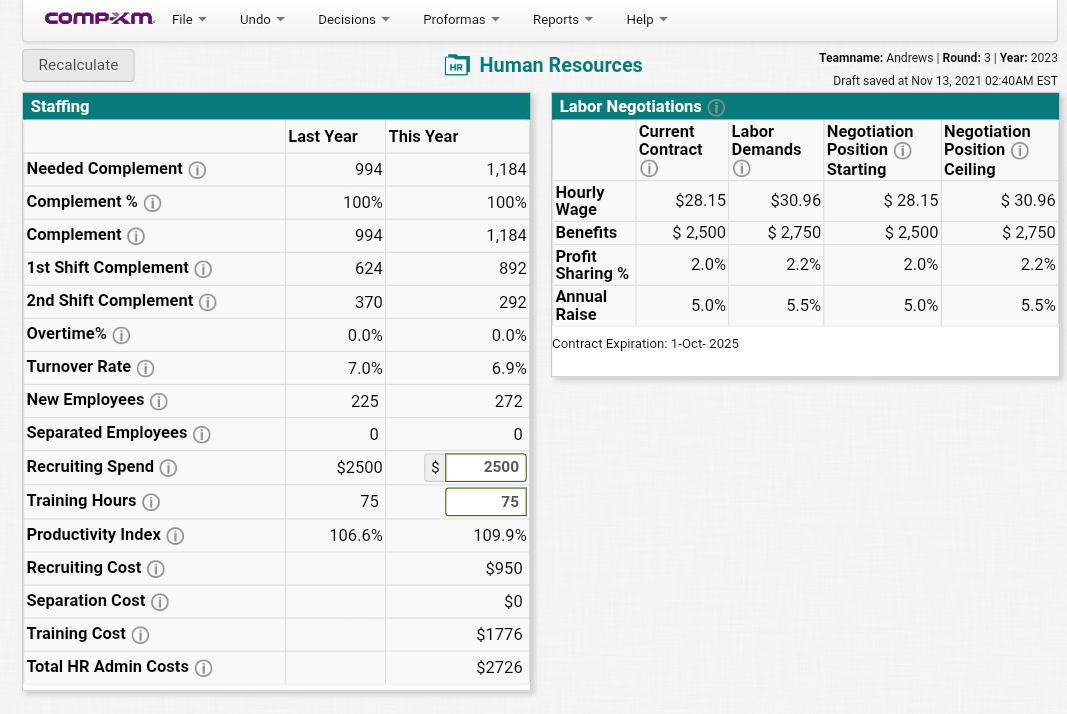

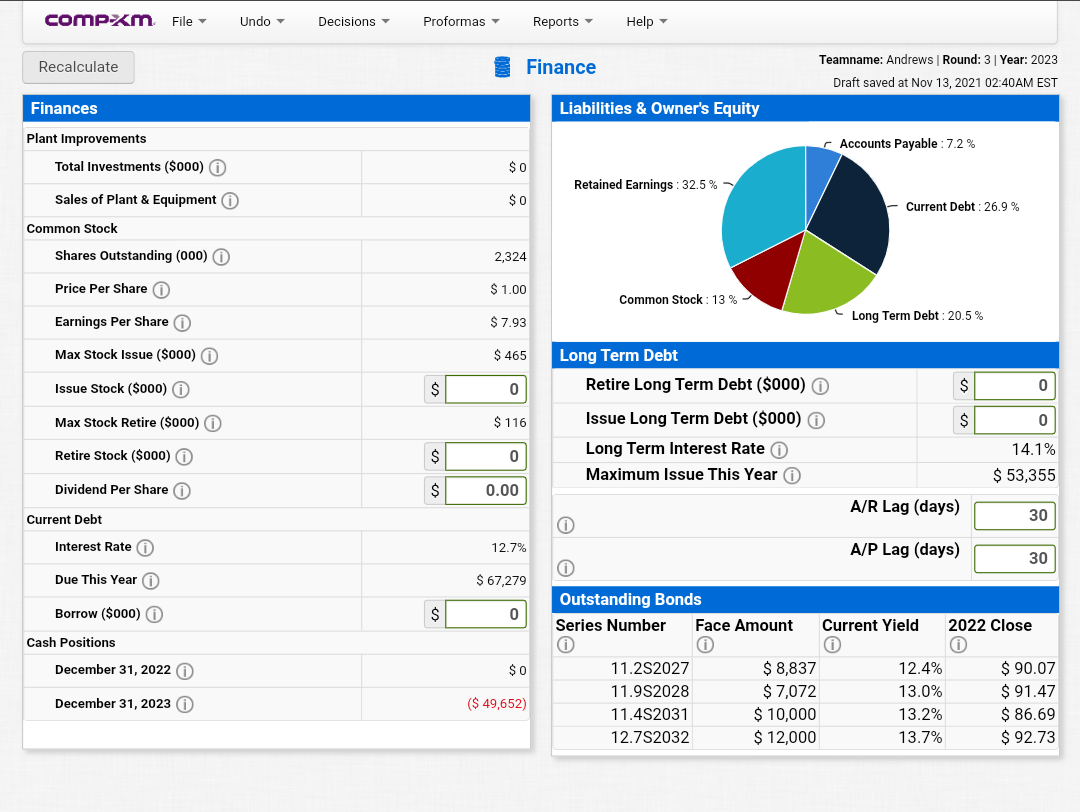

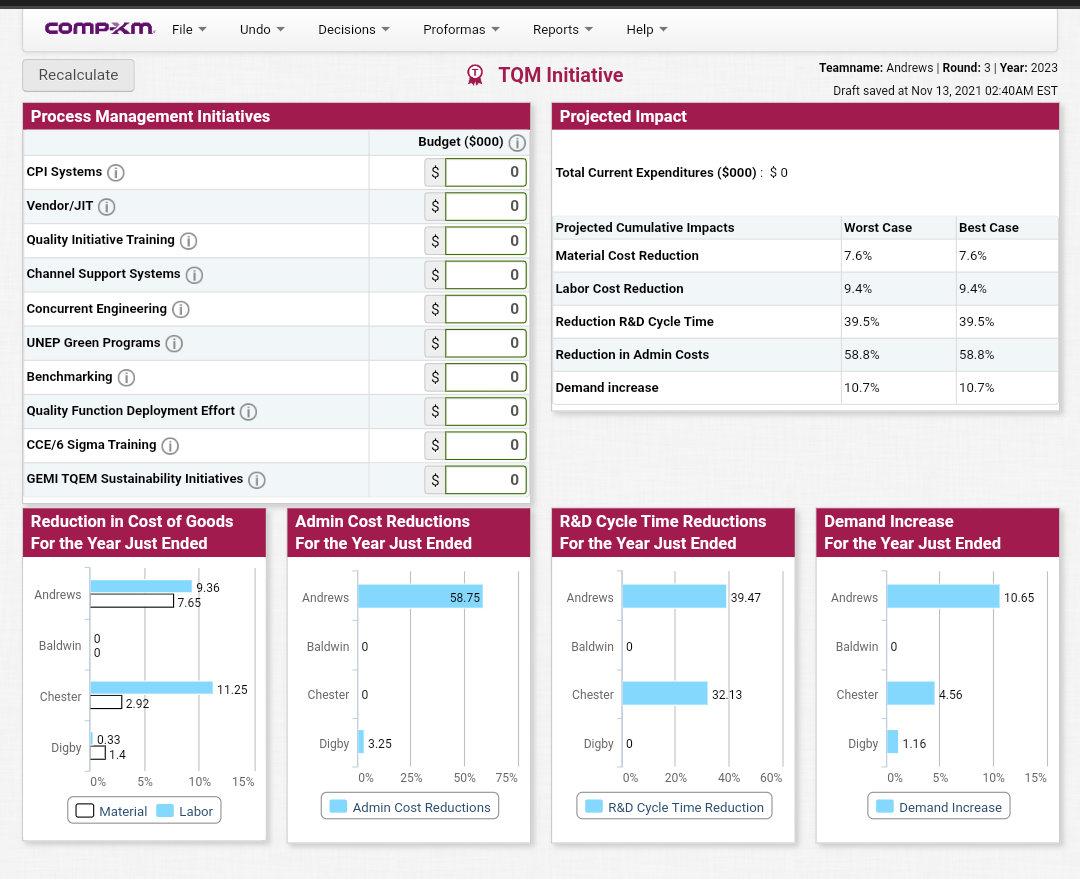

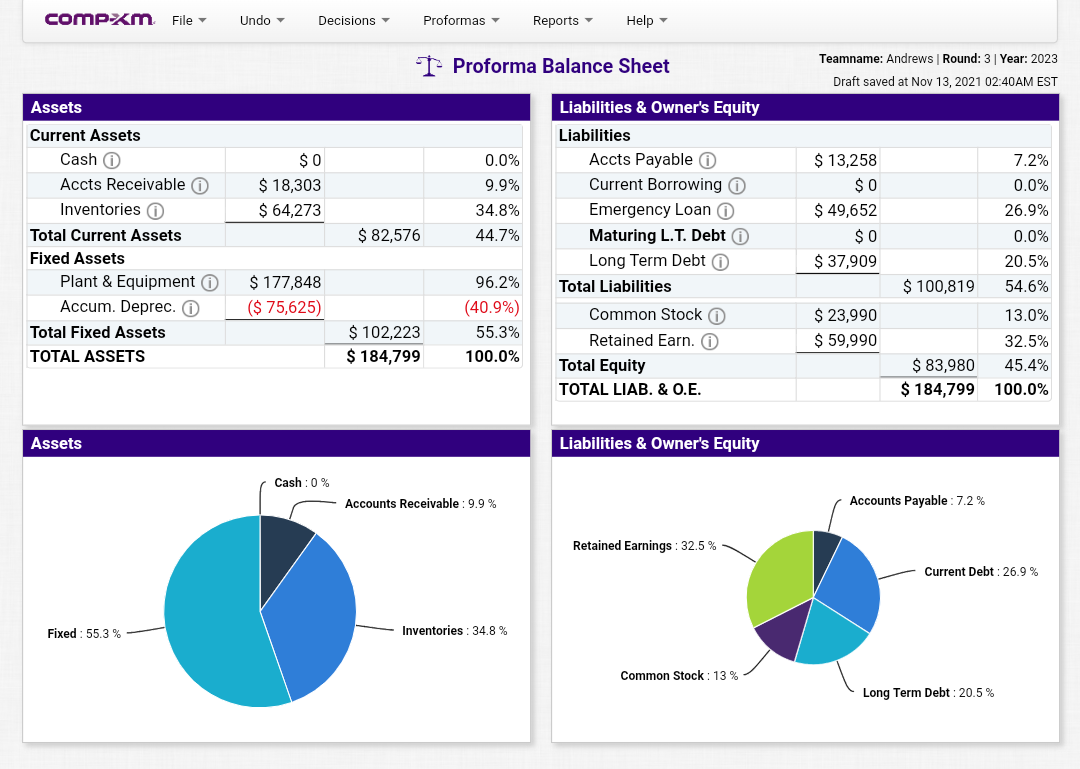

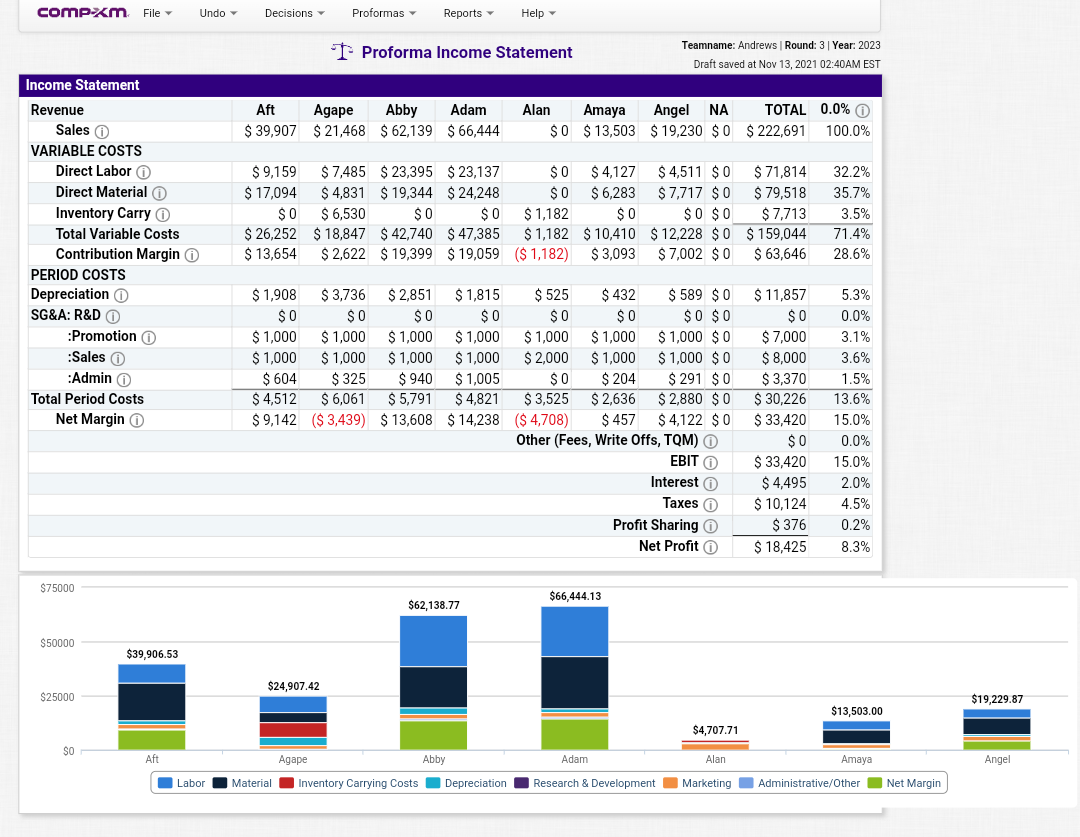

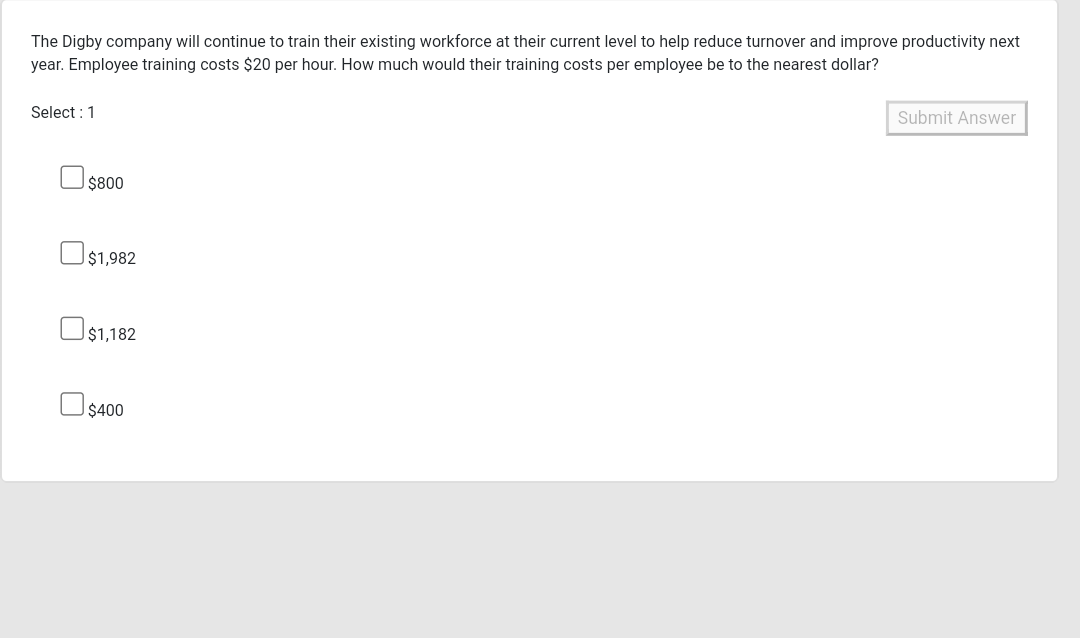

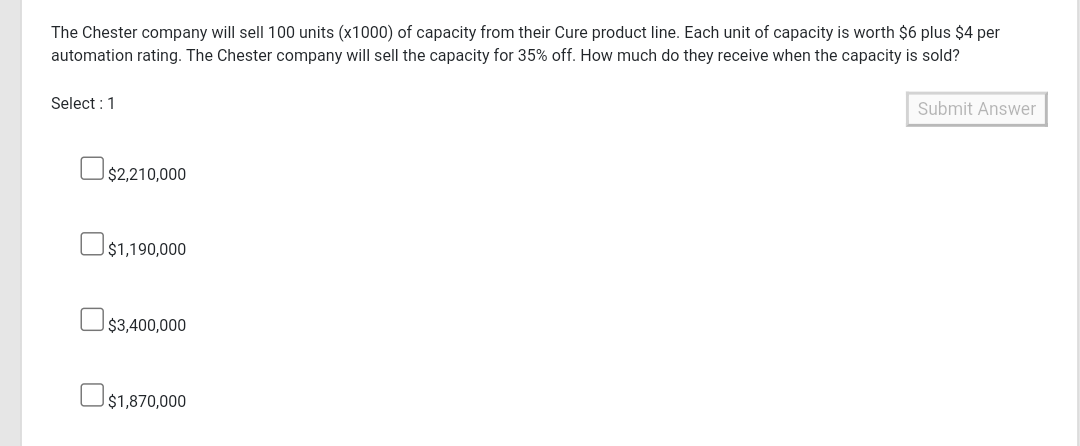

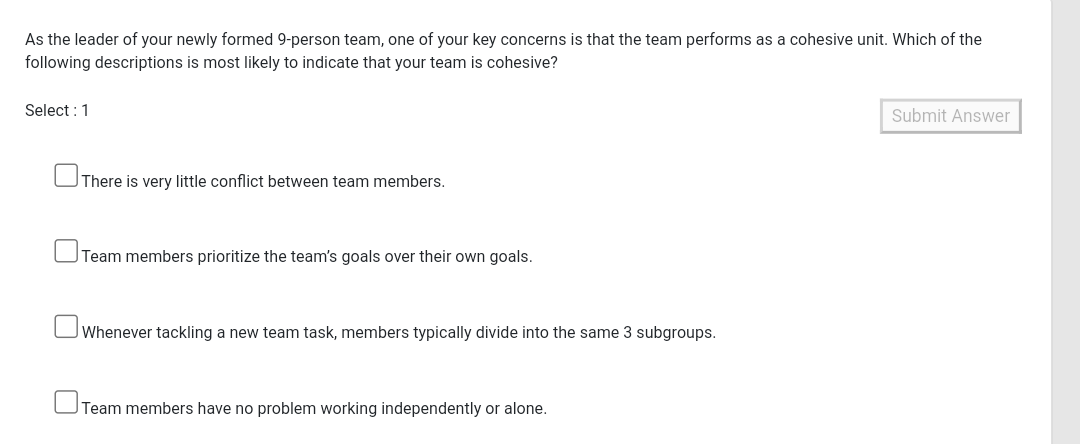

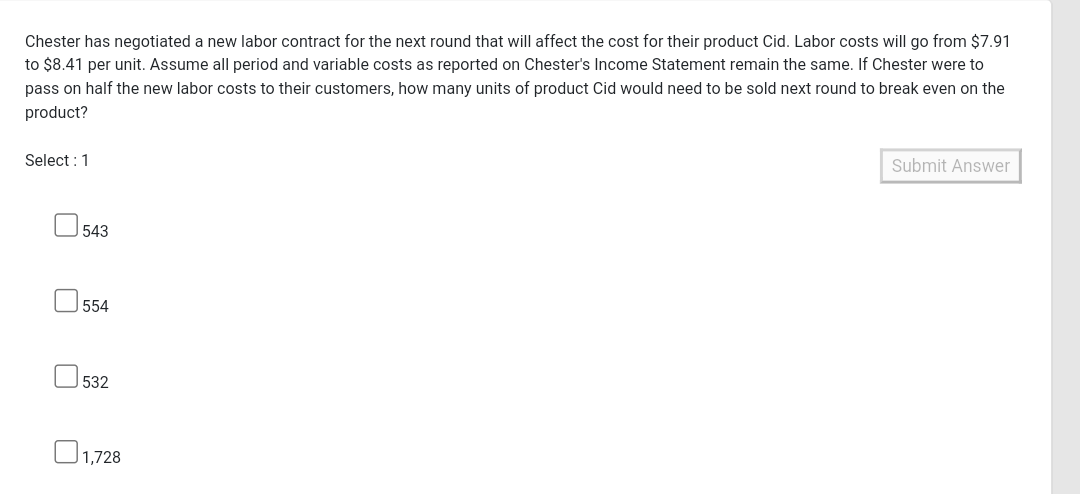

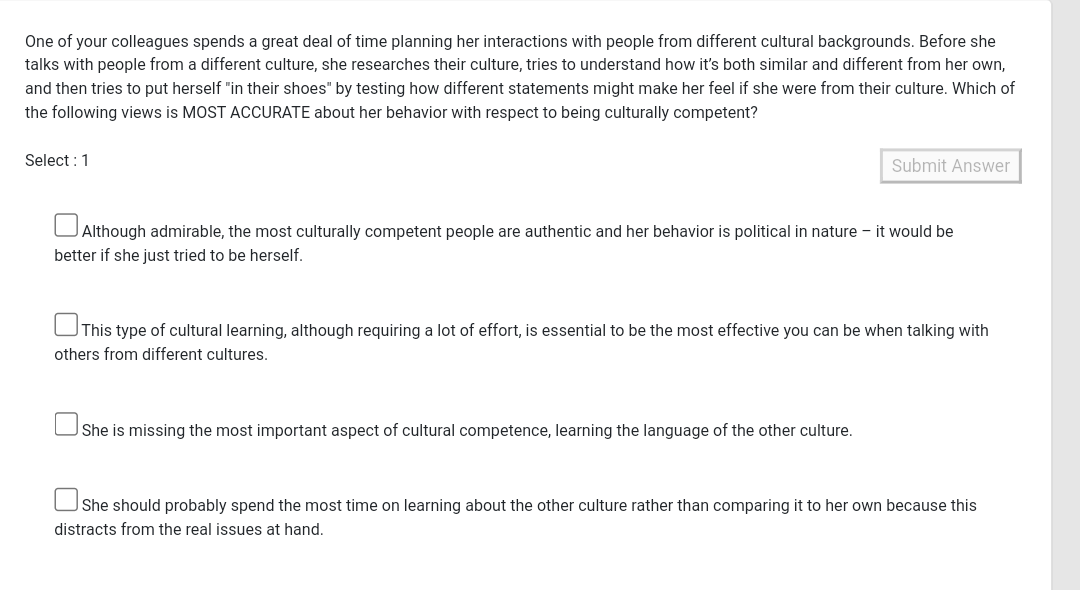

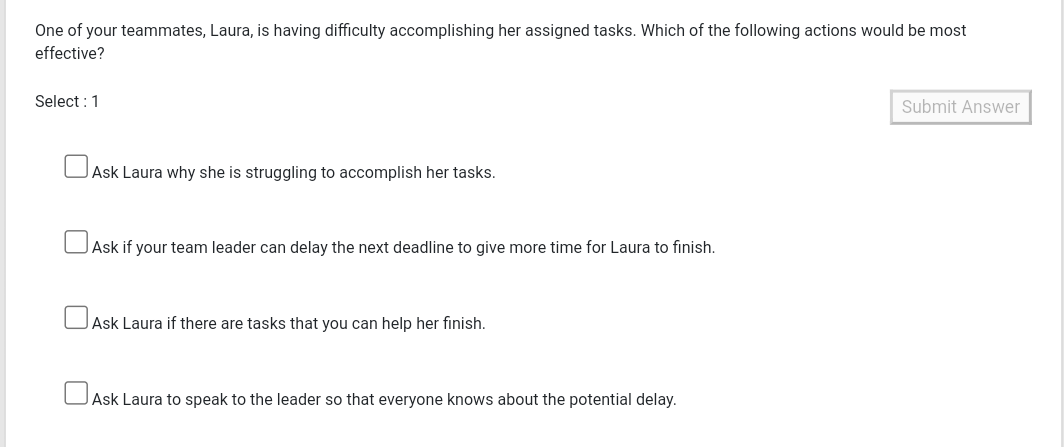

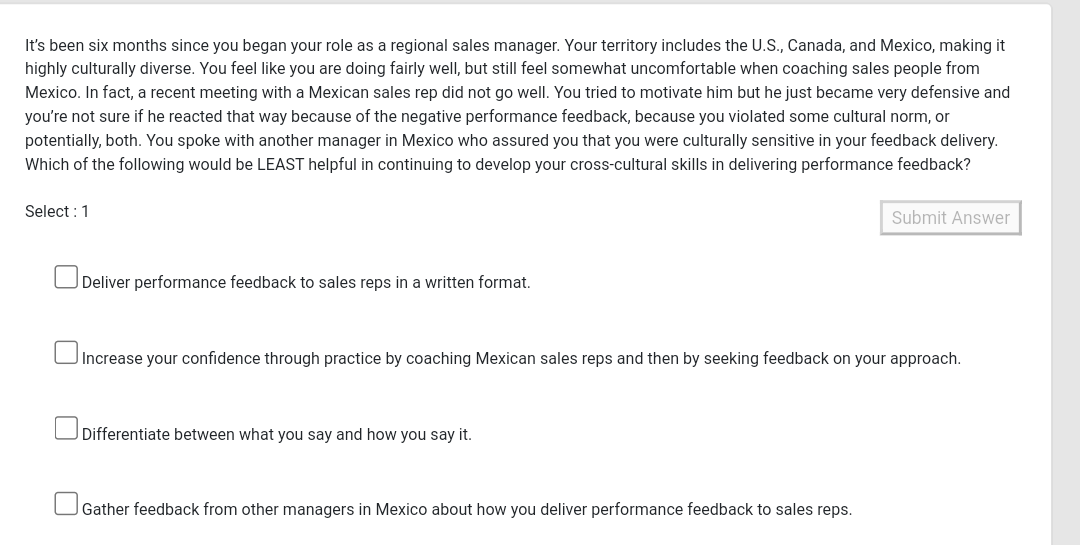

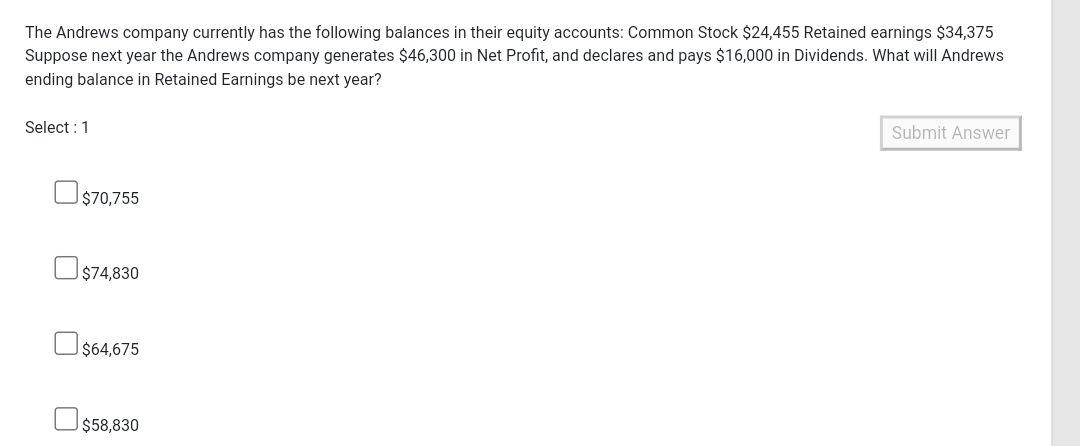

COMPxm File Undo Decisions Proformas Reports Help Recalculate lui Research & Development Teamname: Andrews Round: 3 Year: 2023 Draft saved at Nov 13, 2021 02:39AM EST Perceptual Map (at end of this year) o Revision Date 0 R&D Name Pfmn Size 0 MTBF O Age at Revision Cost o 20 Aft 14.5 8.0 25000 $0 18 Agape 16 6.5 13.0 22000 $0 14 Agape Abby 9.2 11.5 24000 $0 12 Adam 10 12.7 7.5 26000 $0 Size 8 KadaAft Alan 16.2 5.0 21000 $0 6 ATAR Amaya 4 Amaya 14.1 4.0 26000 $0 2 Angel 15.0 5.5 0 22000 $0 0 2 4 6 8 10 12 14 16 18 20 Performance NA 0.0 0.0 0 $0 Total $0 Material Cost Age Profile Aft 13:28 Agape Abby Adam 18:33 25 Alan Perceived Age in Years 1,4 12.77 - 14.5 15.37 13.88 $12.5 $15 $17.5 12 Amaya Angel 12 $0 $2.5 $5 04 $7.5 $10 Material Cost in dollars 22 O New Material Cost Old Material Cost Aft Agape + Abby Adam + Alan Amaya Angel COMPxm File Undo Decisions Proformas Reports Help Recalculate M Marketing Teamname: Andrews Round: 3 Year: 2023 Draft saved at Nov 13, 2021 02:39AM EST Price 0 Name Promo Budget Sales Budget Gross Revenue Benchmark Your Prediction Forecast Variable Contrib Less Costs Margin Promo/Sales Aft $ 31.00 $ 1000 $ 1000 2,351 0 $ 72,880 $ 47,838 $ 25,042 $ 23,042 Agape $ 28.00 $ 1000 $ 1000 767 0 $ 21,468 $ 13,053 $ 8,416 $ 6,416 Abby $ 27.00 $ 1000 $ 1000 3,881 0 $ 104,787 $ 71,492 $ 33,294 $ 31,294 Adam $ 35.00 $ 1000 $ 1000 2,780 0 $ 97,290 $ 69,055 $ 28,235 $ 26,235 ($ 3,000) Alan $ 30.00 $ 1000 $ 2000 0 0 $ 0 $0 $0 Amaya $ 34.00 us 1000 $ 1000 940 0 $ 31,961 $ 23,943 $ 8,018 $ 6,018 Angel $ 36.00 $ 1000 $ 1000 1,101 0 $ 39,646 $ 24,196 $ 15,449 $ 13,449 NA $0.0 $0 $0 0 $0 $0 $0 $0 $ 249,577 Total $7,000 $ 8,000 11,820 0 $ 368,032 $ 118,455 $ 103,455 A/R Lag (days) 30 A/P Lag (days) : 30 Revenue Forecast Unit Sales Forecast 150 6k $104,786 $97,290 3,881 100 $72,880 Revenue forecast (in 000's) 2,780 Unit Sales forecast (in 000's) 2,351 I-IL 50 $39,645 $31,961 $21,469 940 1,101 767 $3,000 0 0 Ok Aft Agape Abby Adam Alan Amaya Angel Aft Agape Abby Adam Alan Amaya Angel Variable Cost Marketing Margin After Marketing Thrift Core Nano Elite compxm File COMPxm Undo Decisions Proformas Reports Help Recalculate Production Teamname: Andrews Round: 3 Year: 2023 Draft saved at Nov 13, 2021 02:39AM EST Production Schedule Aft Agape Abby Adam Alan Amaya Angel NA Total Unit Sales Forecast 2,351 767 3,881 2,780 0 940 1,101 0 11,820 Inventory On Hand 0 2,669 222 17 70 100 138 0 3,216 Production Schedule 1300 1500 2100 1900 330 300 400 7,830 Production After Adj. 1,287 1,485 2,079 1,881 327 297 396 0 7,754 Margins 2nd Shift Production% 36.3% 5.6% 43.8% 76.3% 0.0% 0.0% 17.7% Labor Cost/Unit $7.07 $10.34 $10.05 $12.07 $10.10 $10.10 $8.09 Material Cost/Unit o $13.28 $6.68 $8.37 $12.77 $14.50 $15.37 $13.89 ooooo Total Unit Cost O $20.35 $17.02 $18.42 $24.84 $24.60 $25.47 $21.97 Contribution Margin 34.4% 39.2% 31.8% 29.0% 18.0% 25.1% 39.0% Physical Plant Total 1st Shift Capacity 0 954 1,420 1,460 1,078 340 360 340 0 5,952 Buy/Sell Capacity 0 0 0 0 0 0 0 0 Automation Rating 6.0 3.0 4.0 3.0 3.0 3.0 5.0 0.0 New Autom. Rating 6.0 3.0 4.0 3.0 3.0 3.0 5.0 Investment ($000) $0 $0 $0 $0 $0 $0 $0 o $o $0 2 C Workforce Last Year Needed This Year % 0 This Year 1st Shift 2nd Shift Overtime 0 Max Invest $ 53,820 Complement 994 1,184 100 % 994 892 102 21.3% A/P Lag 30 Price vs Unit Cost Production vs Capacity 4k $40 3k 2k $20 1k Ok 1 Alan $0 Aft Agape Abby Adam Amaya Angel Aft Agape Abby Adam Alan Amaya Angel Both Shifts Base Capacity Production Material Labor Margin COMPxm File Undo - Decisions Proformas Reports Help Recalculate Staffing Needed Complement Complement % 0 Teamname: Andrews Round: 3 Year: 2023 HR] Human Resources Draft saved at Nov 13, 2021 02:40AM EST Labor Negotiations Last Year This Year Current Labor Negotiation Negotiation Contract Demands Position Position 994 1,184 Starting Ceiling Hourly 100% 100% $28.15 $30.96 $28.15 $ 30.96 Wage 994 1,184 Benefits $ 2,500 $ 2,750 $ 2,500 $ 2,750 Profit 624 892 2.0% 2.2% 2.0% 2.2% Sharing % 370 292 Annual 5.0% 5.5% 5.0% 5.5% Raise 0.0% 0.0% Contract Expiration: 1-Oct-2025 7.0% 6.9% Complement 1st Shift Complemento 2nd Shift Complemento Overtime% Turnover Rate 225 272 0 0 New Employees Separated Employees Recruiting Spend Training Hours $2500 $ 2500 75 75 106.6% 109.9% $950 Productivity Index 0 Recruiting Cost O Separation Cost O Training Cost O $0 $1776 Total HR Admin Costs $2726 COMPxm File Undo Decisions Proformas Reports Help Recalculate Finance Teamname: Andrews Round: 3 Year: 2023 Draft saved at Nov 13, 2021 02:40AM EST Finances Liabilities & Owner's Equity Plant Improvements Total Investments ($000) Accounts Payable : 7.2% $ 0 Retained Earnings : 32.5% Sales of Plant & Equipment $ 0 Current Debt: 26.9% Common Stock Shares Outstanding (000) 2,324 Price Per Share on $ 1.00 Common Stock: 13% Earnings Per Share $ 7.93 Long Term Debt: 20.5% Max Stock Issue ($000) $ 465 Issue Stock ($000) O $ 0 $ 0 Max Stock Retire ($000) $ 116 Long Term Debt Retire Long Term Debt ($000) O Issue Long Term Debt ($000) Long Term Interest Rate Maximum Issue This Year $ 0 Retire Stock ($000) $ 0 14.1% $ 53,355 Dividend Per Share o $ 0.00 A/R Lag (days) Current Debt 30 Interest Rate 12.7% A/P Lag (days) 30 Due This Year $ 67,279 Borrow ($000) $ 0 Cash Positions December 31, 2022 $0 Outstanding Bonds Series Number Face Amount Current Yield 2022 Close 0 11.252027 $ 8,837 12.4% $ 90.07 11.9S2028 $ 7,072 13.0% $ 91.47 11.452031 $ 10,000 13.2% $ 86.69 12.782032 $ 12,000 13.7% $ 92.73 December 31, 2023 O ($ 49,652) COMPxm File Undo Decisions Proformas Reports Help Recalculate TQM Initiative Teamname: Andrews Round: 3 Year: 2023 Draft saved at Nov 13, 2021 02:40AM EST Process Management Initiatives Projected Impact Budget ($000) CPI Systems $ 0 Total Current Expenditures ($000): $0 Vendor/JITO $ 0 Worst Case Best Case Quality Initiative Training $ 0 Projected Cumulative Impacts Material Cost Reduction 7.6% 7.6% Channel Support Systems $ 0 Labor Cost Reduction 9.4% 9.4% Concurrent Engineering $ 0 Reduction R&D Cycle Time 39.5% 39.5% UNEP Green Programs $ 0 Reduction in Admin Costs 58.8% 58.8% Benchmarking $ 0 Demand increase 10.7% 10.7% Quality Function Deployment Effort $ 0 CCE/6 Sigma Training $ 0 GEMI TQEM Sustainability Initiatives $ 0 Reduction in Cost of Goods For the Year Just Ended Admin Cost Reductions For the Year Just Ended R&D Cycle Time Reductions For the Year Just Ended Demand Increase For the Year Just Ended Andrews 9.36 J 7.65 Andrews 58.75 Andrews 39.47 Andrews 10.65 Baldwin Baldwin 0 Baldwin 0 Baldwin 0 11.25 Chester Chester 0 Chester 32.13 Chester 4.56 12.92 Digby 0.33 O 1.4 Digby 3.25 Digby 0 Digby 1.16 0% 5% 10% 15% 0% 25% 50% 75% 0% 0% 20% 40% 60% 5% 10% 15% O Material Labor Admin Cost Reductions R&D Cycle Time Reduction Demand Increase COMPxm File Undo Decisions Proformas Reports Help I Proforma Balance Sheet Teamname: Andrews Round: 3 Year: 2023 Draft saved at Nov 13, 2021 02:40AM EST Assets $0 $ 18,303 $ 64,273 0.0% 9.9% 34.8% 44.7% Liabilities & Owner's Equity Liabilities Accts Payable Current Borrowing Emergency Loan O Maturing L.T. Debt Long Term Debt O Total Liabilities Current Assets Cash 0 Accts Receivable Inventories 0 Total Current Assets Fixed Assets Plant & Equipment Accum. Deprec. Total Fixed Assets TOTAL ASSETS $ 13,258 $0 $ 49,652 $0 $ 37,909 7.2% 0.0% 26.9% 0.0% 20.5% 54.6% $ 82,576 $ 100,819 $ 177,848 ($ 75,625) 96.2% (40.9%) 55.3% 100.0% $ 102,223 $ 184,799 $ 23,990 $ 59,990 Common Stock O Retained Earn. O Total Equity TOTAL LIAB. & O.E. 13.0% 32.5% $ 83,980 45.4% $ 184,799 100.0% Assets Liabilities & Owner's Equity Cash : 0% Accounts Receivable : 9.9% Accounts Payable : 7.2% Retained Earnings : 32.5% Current Debt: 26.9% Fixed : 55.3% Inventories: 34.8% Common Stock: 13% Long Term Debt: 20.5% comp-xm File Undo Decisions Proformas Reports Help 1 Proforma Income Statement Teamname: Andrews Round: 3 Year: 2023 Draft saved at Nov 13, 2021 02:40AM EST Aft Agape Abby Adam $ 39,907 $ 21,468 $ 62,139 $ 66,444 Alan Amaya Angel NA $0 $ 13,503 $ 19,230 $0 TOTAL 0.0% 0 $ 222,691 100.0% Income Statement Revenue Sales VARIABLE COSTS Direct Labor Direct Material Inventory Carry Total Variable Costs Contribution Margin PERIOD COSTS Depreciation SG&A: R&D O :Promotion :Sales :Admin Total Period Costs Net Margin $ 9,159 $ 7,485 $ 23,395 $ 23,137 SO $ 4,127 $ 4,511 $ 0 $ 71,814 $ 17,094 $ 4,831 $ 19,344 $ 24,248 $0 $ 6,283 $ 7,717 $0 $ 79,518 SO $ 6,530 $0 $0 $ 1,182 $0 $0 $0 $ 7,713 $26,252 $ 18,847 $ 42,740 $ 47,385 $ 1,182 $10,410 $ 12,228 $0 $ 159,044 $ 13,654 $ 2,622 $ 19,399 $ 19,059 ($ 1,182) $3,093 $ 7,002 $0 $ 63,646 32.2% 35.7% 3.5% 71.4% 28.6% $ 1,908 $ 3,736 $ 2,851 $ 1,815 $ 525 $ 432 $ 589 $0 $ 0 SO $0 $0 $ 0 $0 $0 $0 $1,000 $1,000 $ 1,000 $1,000 $ 1,000 $ 1,000 $1,000 $0 $ 1,000 $1,000 $1,000 $1,000 $ 2,000 $1,000 $ 1,000 $0 $ 604 $325 $940 $ 1,005 $ 0 $ 204 $ 291 $0 $ 4,512 $ 6,061 $5,791 $ 4,821 $ 3,525 $ 2,636 $ 2,880 $0 $ 9,142 ($ 3,439) $ 13,608 $ 14,238 ($ 4,708) $ 457 $ 4,122 $0 Other (Fees, Write Offs, TQM) O EBIT Interest o Taxes 0 Profit Sharing Net Profit $ 11,857 $0 $ 7,000 $ 8,000 $ 3,370 $ 30,226 $ 33,420 $0 $ 33,420 $ 4,495 $ 10,124 $ 376 $ 18,425 5.3% 0.0% 3.1% 3.6% 1.5% 13.6% 15.0% 0.0% 15.0% 2.0% 4.5% 0.2% 8.3% $75000 $66,444.13 $62,138.77 $50000 $39.906.53 $24,907.42 $25000 $19,229.87 $13,503.00 $4,707.71 $0 Aft Adam Alan Amaya Angel Agape Abby Inventory Carrying Costs Depreciation Labor Material Research & Development Marketing Administrative/Other Net Margin The Digby company will continue to train their existing workforce at their current level to help reduce turnover and improve productivity next year. Employee training costs $20 per hour. How much would their training costs per employee be to the nearest dollar? Select: 1 Submit Answer $800 $1,982 $1,182 $400 The Chester company will sell 100 units (x1000) of capacity from their Cure product line. Each unit of capacity is worth $6 plus $4 per automation rating. The Chester company will sell the capacity for 35% off. How much do they receive when the capacity is sold? Select: 1 Submit Answer $2,210,000 $1,190,000 $3,400,000 $1,870,000 As the leader of your newly formed 9-person team, one of your key concerns is that the team performs as a cohesive unit. Which of the following descriptions is most likely to indicate that your team is cohesive? Select : 1 Submit Answer There is very little conflict between team members. Team members prioritize the team's goals over their own goals. Whenever tackling a new team task, members typically divide into the same 3 subgroups. Team members have no problem working independently or alone. Chester has negotiated a new labor contract for the next round that will affect the cost for their product Cid. Labor costs will go from $7.91 to $8.41 per unit. Assume all period and variable costs as reported on Chester's Income Statement remain the same. If Chester were to pass on half the new labor costs to their customers, how many units of product Cid would need to be sold next round to break even on the product? Select : 1 Submit Answer 543 554 532 1,728 Of Chester Corporation's products, which earned the lowest Net Margin as a percentage of its sales? Select: 1 Submit Answer O coat Ocid Camp Cure Assuming no brokerage fees, calculate the amount of cash needed to retire Baldwin's 12.452028 bond early. Select: 1 Submit Answer $5,486,740 $5,825,802 $6,209,157 How much would it cost for Chester Corporation to repurchase all its outstanding shares if the price fell by 10%? Assume no brokerage fees. Select : 1 Submit Answer $171.1 million $190.1 million $80.0 million $88.9 million Suppose you were hired as a consultant for a company that wants to penetrate the Comp-XM market. This company wants to pursue a broad cost leader strategy. From last year's reports, which company would be the strongest competitor? Select : 1 Submit Answer Andrews Baldwin Chester Digby One of your colleagues spends a great deal of time planning her interactions with people from different cultural backgrounds. Before she talks with people from a different culture, she researches their culture, tries to understand how it's both similar and different from her own, and then tries to put herself "in their shoes" by testing how different statements might make her feel if she were from their culture. Which of the following views is MOST ACCURATE about her behavior with respect to being culturally competent? Select: 1 Submit Answer Although admirable, the most culturally competent people are authentic and her behavior is political in nature - it would be better if she just tried to be herself. This type of cultural learning, although requiring a lot of effort, is essential to be the most effective you can be when talking with others from different cultures. She is missing the most important aspect of cultural competence, learning the language of the other culture. She should probably spend the most time on learning about the other culture rather than comparing it to her own because this distracts from the real issues at hand. One of your teammates, Laura, is having difficulty accomplishing her assigned tasks. Which of the following actions would be most effective? Select : 1 Submit Answer Ask Laura why she is struggling to accomplish her tasks. Ask if your team leader can delay the next deadline to give more time for Laura to finish. Ask Laura if there are tasks that you can help her finish. Ask Laura to speak to the leader so that everyone knows about the potential delay. It's been six months since you began your role as a regional sales manager. Your territory includes the U.S., Canada, and Mexico, making it highly culturally diverse. You feel like you are doing fairly well, but still feel somewhat uncomfortable when coaching sales people from Mexico. In fact, a recent meeting with a Mexican sales rep did not go well. You tried to motivate him but he just became very defensive and you're not sure if he reacted that way because of the negative performance feedback, because you violated some cultural norm, or potentially, both. You spoke with another manager in Mexico who assured you that you were culturally sensitive in your feedback delivery. Which of the following would be LEAST helpful in continuing to develop your cross-cultural skills in delivering performance feedback? Select : 1 Submit Answer Deliver performance feedback to sales reps in a written format. Increase your confidence through practice by coaching Mexican sales reps and then by seeking feedback on your approach. Differentiate between what you say and how you say it. Gather feedback from other managers in Mexico about how you deliver performance feedback to sales reps. The Andrews company currently has the following balances in their equity accounts: Common Stock $24,455 Retained earnings $34,375 Suppose next year the Andrews company generates $46,300 in Net Profit, and declares and pays $16,000 in Dividends. What will Andrews ending balance in Retained Earnings be next year? Select: 1 Submit Answer $70,755 $74,830 $64,675 $58,830Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts