Question: Old MathJax webview will rate. please show calculations if possible. Hills Company's June 30 bank statement and the June ledger account for cash are summarized

Old MathJax webview

will rate. please show calculations if possible.

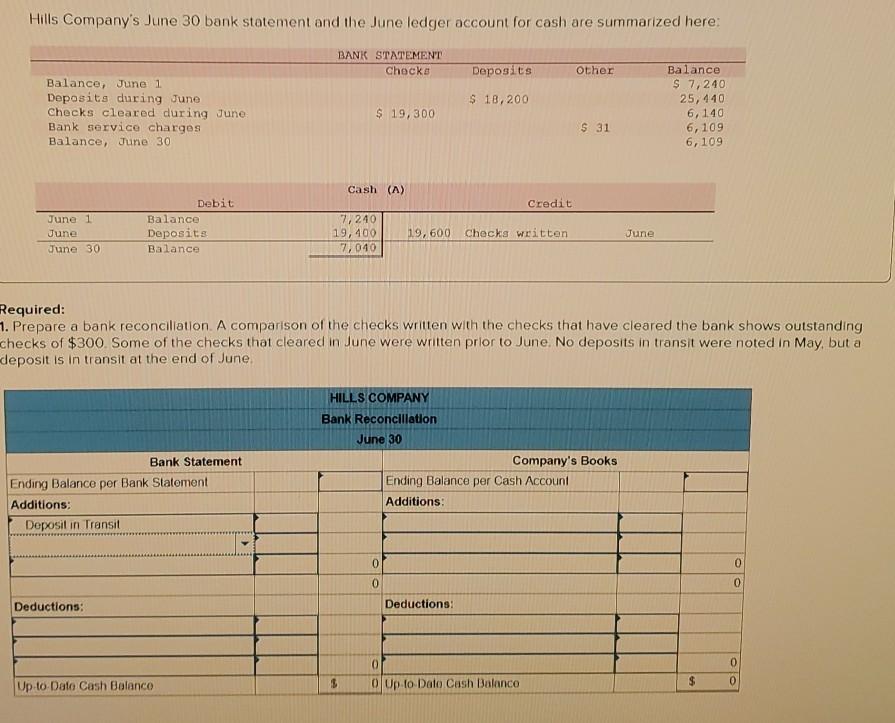

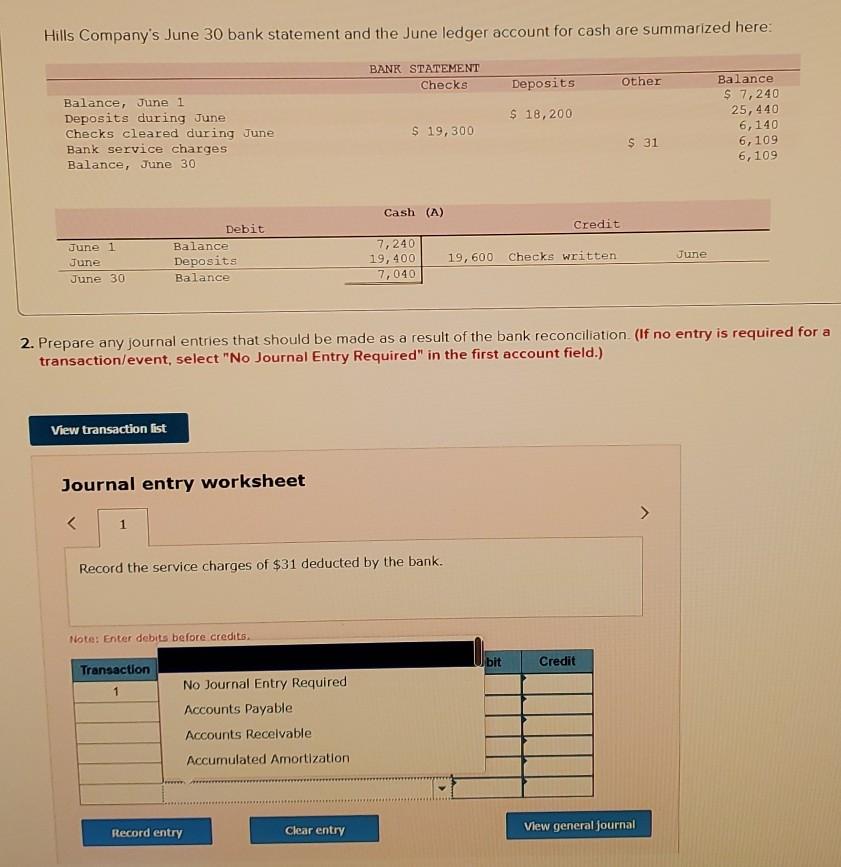

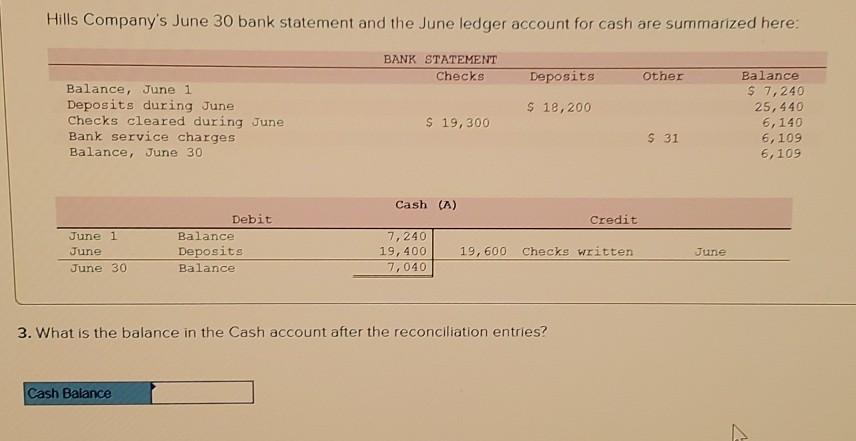

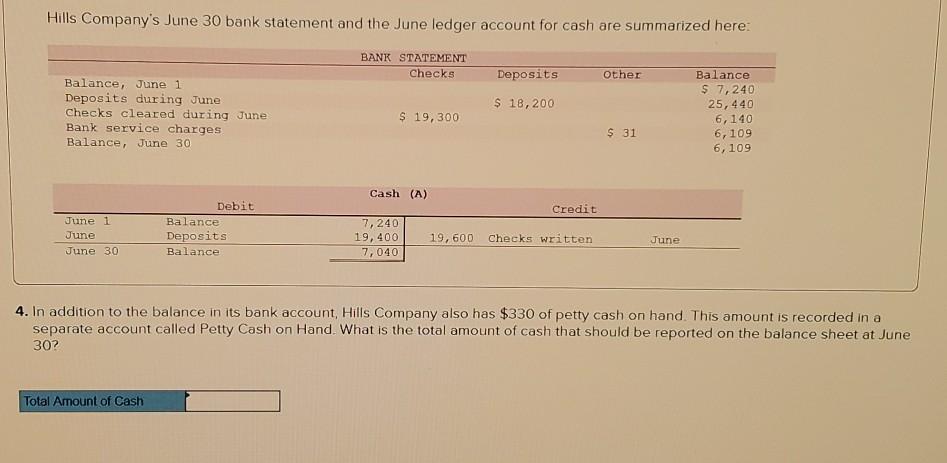

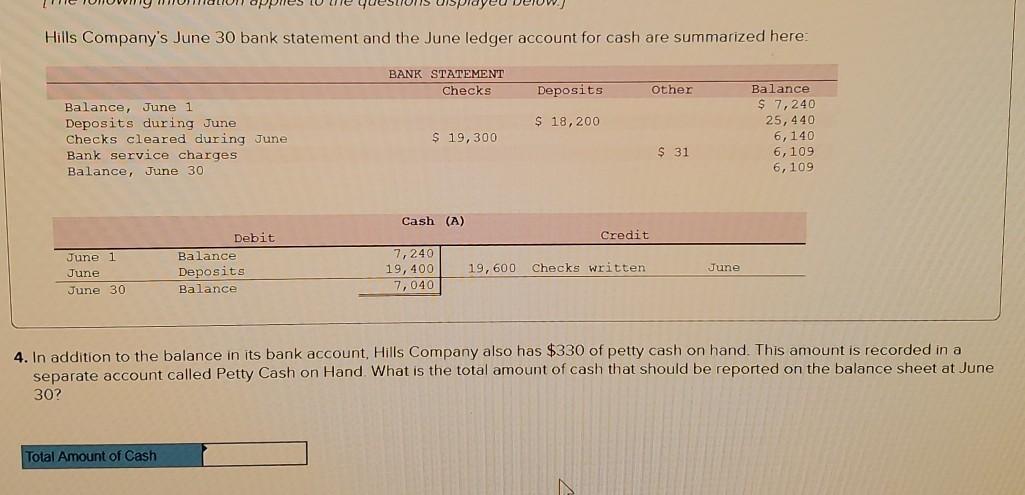

Hills Company's June 30 bank statement and the June ledger account for cash are summarized here: BANK STATEMENT Checko Deposits Other $ 18, 200 Balance, June 1 Deposits during June Checks cleared during Juno Bank service charges Balance, June 30 Balance S 7,240 25,140 6,140 6,109 6,109 $ 19,300 S 31 Cash (A) Credit June 1 June June 30 Debit Balance Deposits Balance 7,240 19,400 7,040 19,600 Checks written June Required: 1. Prepare a bank reconciliation. A comparison of the checks written with the checks that have cleared the bank shows outstanding checks of $300 Some of the checks that cleared in June were written prior to June. No deposits in transit were noted in May, but a deposit is in transit at the end of June HILLS COMPANY Bank Reconciliation June 30 Company's Books Ending Balance per Cash Account Additions: Bank Statement Ending Balance per Bank Statement Additions: Deposit in Transit 0 0 0 0 Deductions: Deductions: 0 O Up to Dato Cash Balance 0 0 $ Up to Dato Cash Balance Hills Company's June 30 bank statement and the June ledger account for cash are summarized here: BANK STATEMENT Checks Deposits Other $ 18, 200 Balance, June 1 Deposits during June Checks cleared during June Bank service charges Balance, June 30 Balance $ 7,240 25,440 6,140 6,109 6,109 $ 19,300 S 31 Cash (A) Credit Debit Balance Deposits Balance June 1 June June 30 7,240 19,400 7,040 June 19,600 Checks written 2. Prepare any journal entries that should be made as a result of the bank reconciliation (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet > 1 Record the service charges of $31 deducted by the bank. Note: Enter debits before credits bit Credit Transaction 1 No Journal Entry Required Accounts Payable Accounts Receivable Accumulated Amortization Record entry Clear entry View general Journal Hills Company's June 30 bank statement and the June ledger account for cash are summarized here: BANK STATEMENT Checks Deposits Other $ 18, 200 Balance, June 1 Deposits during June Checks cleared during June Bank service charges Balance, June 30 Balance $ 7,240 25,440 6,140 6, 109 6,109 $ 19, 300 S 31 Cash (A) Credit June 1 June June 30 Debit Balance Deposits Balance 7,240 19,400 7,040 19,600 Checks written June 3. What is the balance in the Cash account after the reconciliation entries? Cash Balance Hills Company's June 30 bank statement and the June ledger account for cash are summarized here: BANK STATEMENT Checks Deposits Other $ 18,200 Balance, June 1 Deposits during June Checks cleared during June Bank service charges Balance, June 30 $ 19,300 Balance $ 7,240 25, 440 6,140 6,109 6,109 $ 31 Cash (A) Credit June 1 June June 30 Debit Balance Deposits Balance 7, 240 19,400 7,040 19,600 Checks written June 4. In addition to the balance in its bank account, Hills Company also has $330 of petty cash on hand. This amount is recorded in a separate account called Petty Cash on Hand. What is the total amount of cash that should be reported on the balance sheet at June 30? Total Amount of Cash appie Hills Company's June 30 bank statement and the June ledger account for cash are summarized here: BANK STATEMENT Checks Deposits Other $ 18,200 Balance, June 1 Deposits during June Checks cleared during June Bank service charges Balance, June 30 Balance $ 7,240 25,440 6,140 6,109 6,109 $ 19,300 $ 31 Cash (A) Credit Debit Balance Deposits Balance June 1 June June 30 7,240 19,400 7,040 19,600 June Checks written 4. In addition to the balance in its bank account, Hills Company also has $330 of petty cash on hand. This amount is recorded in a separate account called Petty Cash on Hand. What is the total amount of cash that should be reported on the balance sheet at June 30? Total Amount of Cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts