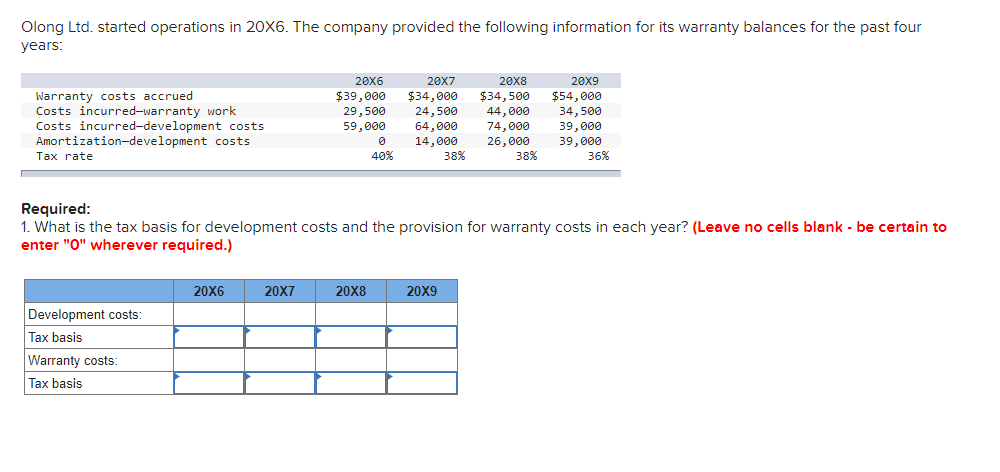

Question: Olong Ltd . started operations in 2 0 X 6 . The company provided the following information for its warranty balances for the past four

Olong Ltd started operations in X The company provided the following information for its warranty balances for the past four

years: XXXX

Warranty costs accrued $ $ $ $

Costs incurredwarranty work

Costs incurreddevelopment costs

Amortizationdevelopment costs

Tax rate

Required:

What is the tax basis for development costs and the provision for warranty costs in each year? Leave no cells blank be certain to

enter O wherever required.

What is the accounting basis for development costs and the provision for warranty costs in each year? Amounts to be deducted

should be indicated with a minus sign.

What is the deferred tax balance in each year? Amounts to be deducted should be indicated with a minus sign.

Is the deferred tax balance an asset or a liability?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock