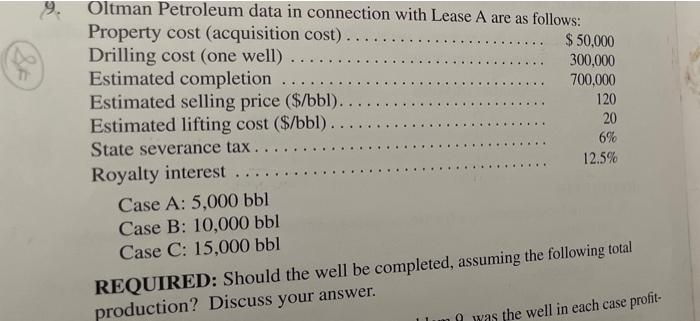

Question: --- Oltman Petroleum data in connection with Lease A are as follows: Property cost (acquisition cost). $ 50,000 Drilling cost (one well) 300,000 Estimated completion

--- Oltman Petroleum data in connection with Lease A are as follows: Property cost (acquisition cost). $ 50,000 Drilling cost (one well) 300,000 Estimated completion 700,000 Estimated selling price ($/bbl). 120 Estimated lifting cost ($/bbl). 20 State severance tax.. 12.5% Royalty interest Case A: 5,000 bbl Case B: 10,000 bbl Case C: 15,000 bbl 6% REQUIRED: Should the well be completed, assuming the following total production? Discuss your answer. was the well in each case profit

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock